Breast Imaging Market

Global Breast Imaging Market Size, Share & Trends Analysis Report by Ionizing Breast Technologies (Analog Mammography, 3D Breast Tomosynthesis, Cone Beam Computed Tomography (CB-CT), Positron Emission Mammography (PEM), and Molecular Breast Imaging), By Non-Ionizing Breast Technologies (Breast MRI, Breast Ultrasound, Optical Imaging, and Breast Thermography), By Screening Method (Symptomatic Imaging and Asymptomatic Imaging), Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The global breast imaging market is anticipated to grow at a considerable CAGR of 6.3% during the forecast period. The market was valued at $3.7 billion in 2019 and is anticipated to reach $5.6 billion in 2026. Breast imaging is the process of reproduction of the breast’s form. It supports medical professionals to identify breast abnormalities and diagnose them with imaging technologies. There are various breast imaging techniques used for the diagnostic procedure such as mammography, breast tomosynthesis, MRI, ultrasound, and galactography. The global breast imaging market is growing at a significant rate due to various factors such as increasing incidences and prevalence of breast cancer and the growing geriatric population across the globe. As per the WHO (World Health Organization), around 2.1 million cases were registered globally related to breast cancer in 2018 which is expected to reach more than 2.4 million cases in 2025. Asia-Pacific had the highest cases of breast cancer with 911,000 cases, whereas 522,000 and 262,000 cases were registered in Europe and North America, respectively, in 2018. The growth in breast cancer is significantly generating the demand for breast imaging across the globe.

In addition, increasing investment and funding in research and development activities of breast cancer diagnostics and government initiatives to raise awareness among the people to propel the growth of the market. For instance, as per the National Cancer Institute research, around $574.9 million were funded in research of breast cancer. Certain factors act as barriers to market growth such as the high cost of imaging systems, side effects related to imaging, strict government regulations, and lack of awareness among women about breast cancer in developing countries. However, emerging technologies for breast imaging, increasing demand for breast imaging from the Asia-Pacific region, improving healthcare infrastructure, and increasing spending on healthcare create future opportunities for the growth of the market.

Segmental Outlook

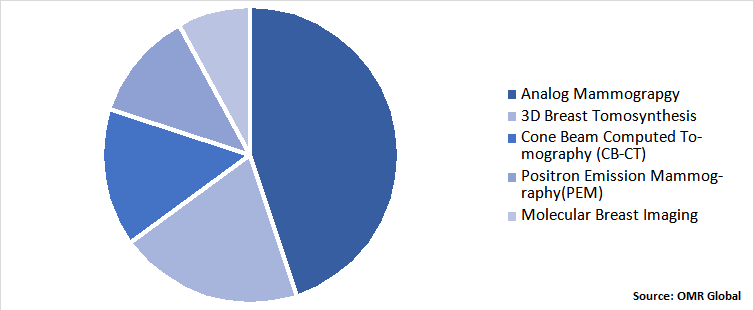

The global breast imaging market is analyzed by segmenting the market into ionizing breast imaging technologies and non-ionizing breast imaging technologies. Based on ionizing breast imaging technologies, the market is further segmented into analog mammography, 3D breast tomosynthesis, cone beam computed tomography (CB-CT), positron emission mammography (PEM), and molecular breast imaging. Whereas, based on non-ionizing breast imaging technologies, the market is categorized into breast MRI, breast ultrasound, optical imaging, and breast thermography. Moreover, the market is also segmented based on the breast imaging method into symptomatic and asymptomatic imaging.

Global Breast Imaging Market Share by Ionizing Breast Technologies, 2020 (%)

Analog Mammography holds a significant share in the Market

The analog mammography held the major share in 2020 and is also anticipated to grow during the forecast period. Analog Mammography uses low-dose radiation to deliver high-quality X-rays and is capable of detecting tissue variations as small as 1-2mm in size. The X-ray beams are captured on film cassettes, and the result is an image depicting the breast from various perspectives and is then hung on a viewing screen. The factors such as raising awareness and various programs on breast screening have been contributing to the rapid market growth. When opposed to unscreened populations, these screening systems have been found to save lives. For instance, the National Breast Cancer Screening Programme in the Netherland was created for people aged 50 to 75 years. Women in this age group are invited for mammography once every two years as part of the initiative. Similarly, as per Breast Screen Australia, women aged 50-74 in Australia are required to get free mammography every two years as part of the government’s nationwide screening scheme.

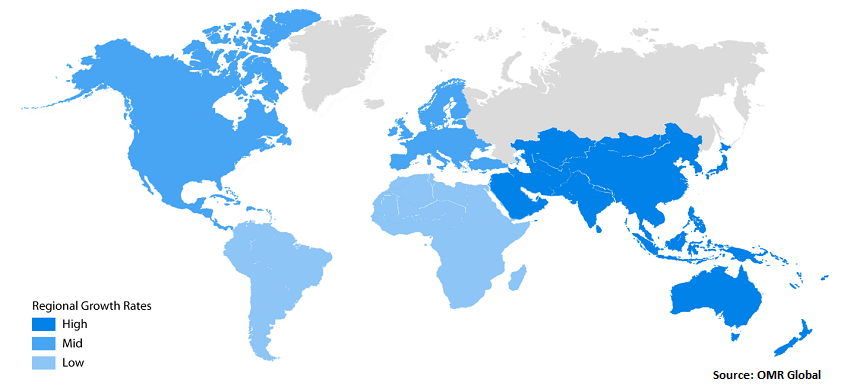

Regional Outlooks

The global breast imaging market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America holds a dominant position in the global breast imaging market, followed by Europe. The growth is mainly driven by the demand for such technology for the treatment of breast cancer, and the presence of developed technology and healthcare infrastructure. For instance, as per the American Cancer Society, in 2021, it an estimated that around 281,550 new cases of invasive breast cancer are expected to be diagnosed in women in the US. Apart from it, around 49,290 new cases of non-invasive breast cancer in the US. Europe covers noteworthy market share with high initiatives in the field of research & development and spreading awareness among people.

Global Breast Imaging Market Growth, by Region 2021-2027

Asia-Pacific is projected to have a considerable share in the global breast imaging market

Asia-Pacific is anticipated to hold a considerable market share in the global breast imaging market during the forecast period. This is due to the increasing prevalence of breast cancer which is creating demand for imaging technologies. For instance, according to the Organization for Economic Cooperation and Development (OECD), in 2018, around 839,000 women were diagnosed with breast cancer, and 286,000 mortalities occurred in the Asia-Pacific region. Moreover, the increasing awareness related to breast cancer, rising government focus on disease diagnosis and treatment, and the increasing disposable income in emerging economies are some of the major factors for the growth of the market. Moreover, the developed economies such as Japan, Australia, and South Korea have a well-developed breast cancer diagnosis infrastructure with high disposable income & a high geriatric population base, driving the market growth.

Market Players Outlook

Several players are operating in the global breast imaging market. Hologic, Inc., Koninklijke Philips N.V., Canon Medical Systems Corp., Carestream Health, and Siemens Healthcare Ltd. are some of the major players operating in the global breast imaging market. These players focus on providing novel and technically advanced breast imaging solutions for different end-users such as hospitals and clinics to gain a considerable market share. Furthermore, mergers and acquisitions, partnerships, collaborations, and product launches are some crucial strategies that are being adopted by the market players to stay competitive. For instance, in May 2019, Bracco imaging S.P.A has acquired Blue Earth Diagnostics, a molecular imaging company for around $450 million. Blue Earth Diagnosis working as a subsidiary of Bracco Imaging.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global breast imaging market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Siemens AG

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Koninklijke Philips N.V.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. FUJIFILM Holdings Corp.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. General Electric Co.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Hologic Inc

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Breast Imaging Market by Type

5.1.1. Ionizing Technologies

5.1.1.1. Analog Mammography

5.1.1.2. 3D Breast Tomosynthesis

5.1.1.3. Cone Beam Computed Tomography (CB-CT)

5.1.1.4. Positron Emission Mammography (PEM)

5.1.1.5. Molecular Breast Imaging

5.1.2. Non-Ionizing Technologies

5.1.2.1. Breast MRI

5.1.2.2. Breast Ultrasound

5.1.2.3. Optical Imaging

5.1.2.4. Breast Thermography

5.2. Global Breast Imaging Market by Screening Method

5.2.1. Symptomatic Imaging

5.2.2. Asymptomatic Imaging

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ADANI Systems Inc.

7.2. Aurora Healthcare US Corp.

7.3. Agfa-Gevaert Group.

7.4. Bracco Imaging S.p.A.

7.5. Carestream Health, Inc.

7.6. CMR Naviscan Corp.

7.7. Cook Group Inc.

7.8. Dilon Medical Technologies, Inc.

7.9. FUJIFILM Holdings Corp.

7.10. General Electric Co. (GE Healthcare)

7.11. Hitachi Medical System

7.12. Hologic Inc.

7.13. Konica Minolta Inc.

7.14. Koning Corp.

7.15. Micrima Ltd.

7.16. Koninklijke Philips N.V. (Philips healthcare)

7.17. Planmeca Group

7.18. Shimadzu Corp.

7.19. Siemens Healthcare GmbH

7.20. SonoCiné, Inc.

1. GLOBAL BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY IONIZING TECHNOLOGIES, 2020-2027 ($ MILLION)

2. GLOBAL ANALOG MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL 3D BREAST TOMOSYNTHESIS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL CONE BEAM COMPUTED TOMOGRAPHY (CB-CT) MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL POSITRON EMISSION MAMMOGRAPHY (PEM) MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL MOLECULAR BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY NON-IONIZING TECHNOLOGIES, 2020-2027 ($ MILLION)

8. GLOBAL BREAST MRI MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL BREAST ULTRASOUND MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL OPTICAL IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL BREAST THERMOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY SCREENING METHODS, 2020-2027 ($ MILLION)

13. GLOBAL SYMPTOMATIC IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL ASYMPTOMATIC IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. NORTH AMERICAN BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. NORTH AMERICAN BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY IONIZING TECHNOLOGIES, 2020-2027 ($ MILLION)

17. NORTH AMERICAN BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY NON-IONIZING TECHNOLOGIES, 2020-2027 ($ MILLION)

18. NORTH AMERICAN BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY SCREENING METHODS, 2020-2027 ($ MILLION)

19. EUROPEAN BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. EUROPEAN BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY IONIZING TECHNOLOGIES, 2020-2027 ($ MILLION)

21. EUROPEAN BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY NON-IONIZING TECHNOLOGIES, 2020-2027 ($ MILLION)

22. EUROPEAN BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY SCREENING METHODS, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY IONIZING TECHNOLOGIES, 2020-2027 ($ MILLION)

25. ASIA-PACIFIC BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY NON-IONIZING TECHNOLOGIES, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY SCREENING METHODS, 2020-2027 ($ MILLION)

27. REST OF THE WORLD BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

28. REST OF THE WORLD BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY IONIZING TECHNOLOGIES, 2020-2027 ($ MILLION)

29. REST OF THE WORLD BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY NON-IONIZING TECHNOLOGIES, 2020-2027 ($ MILLION)

30. REST OF THE WORLD BREAST IMAGING MARKET RESEARCH AND ANALYSIS BY SCREENING METHODS, 2020-2027 ($ MILLION)

1. GLOBAL BREAST IMAGING MARKET SHARE BY IONIZING TECHNOLOGIES, 2020 VS 2027 (%)

2. GLOBAL BREAST IMAGING MARKET SHARE BY NON-IONIZING TECHNOLOGIES, 2020 VS 2027 (%)

3. GLOBAL BREAST IMAGING MARKET SHARE BY SCREENING METHODS, 2020 VS 2027 (%)

4. GLOBAL BREAST IMAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

5. GLOBAL ANALOG MAMMOGRAPHY IMAGING MARKET SHARE BY REGION, 2020 VS 2027 (%)

6. GLOBAL 3D BREAST TOMOSYNTHESIS IMAGING MARKET SHARE BY REGION, 2020 VS 2027 (%)

7. GLOBAL CONE BEAM COMPUTED TOMOGRAPHY (CB-CT) IMAGING MARKET SHARE BY REGION, 2020 VS 2027 (%)

8. GLOBAL POSITRON EMISSION MAMMOGRAPHY (PEM) IMAGING MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL MOLECULAR BREAST IMAGING MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL BREAST MRI IMAGING MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. GLOBAL BREAST ULTRASOUND IMAGING MARKET SHARE BY REGION, 2020 VS 2027 (%)

12. GLOBAL OPTICAL IMAGING MARKET SHARE BY REGION, 2020 VS 2027 (%)

13. GLOBAL BREAST THERMOGRAPHY IMAGING MARKET SHARE BY REGION, 2020 VS 2027 (%)

14. GLOBAL SYMPTOMATIC IMAGING MARKET SHARE BY REGION, 2020 VS 2027 (%)

15. GLOBAL ASYMPTOMATIC IMAGING MARKET SHARE BY REGION, 2020 VS 2027 (%)

16. US BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

17. CANADA BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

18. UK BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

19. FRANCE BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

20. GERMANY BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

21. ITALY BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

22. SPAIN BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

23. REST OF EUROPE BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

24. INDIA BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

25. CHINA BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

26. JAPAN BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

27. SOUTH KOREA BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF ASIA-PACIFIC BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF THE WORLD BREAST IMAGING MARKET SIZE, 2020-2027 ($ MILLION)