Breathalyzer Market

Global Breathalyzer Market Size, Share & Trends Analysis Report By Application (Alcohol Detection, Drug abuse detection, and Others) By Technology (Fuel Cell, Semiconductor oxide sensor, and Others) By End-User (Healthcare facilities, Law enforcement & Military, and Others) Forecast 2021-2027

The global breathalyzer market is anticipated to grow at a CAGR of around 8.5% during the forecast period. The factors that are augmenting the growth of the market include the increasing demand for breathalyzers in various end-users such as law enforcement agencies, consumers, transport, and others to minimize alcohol abuse. Furthermore, the increasing prevalence of diseases such as asthma, chronic obstructive pulmonary disease (COPD), a lung disease that further includes chronic bronchitis and emphysema, and other medical conditions is the reason due to which the demand for quick, accurate, and easy methods such as breathalyzer is increasing. Moreover, the alcohol and drug abuse, and stringent government regulations, and adoption of a breathalyzer in the detection of various diseases is also the factors that are boosting the market growth. The introduction of advanced technologies in breathalyzers such as fuel cells, semiconductor oxide sensors, and infrared spectroscopy are making them highly recommendable in the healthcare sector and law enforcement & military sector for the detection of diseases. Due to which their use and demand are growing, thus driving the growth of the market.

However, the accuracy in the results related to the breathalyzer is the prime concern that may hinder the market growth. As sometimes these devices are failed to detect the difference between the alcohol and chemical compound. The introduction of an accurate and easy-to-use breathalyzer and investments in R&D for novel breathalyzers from major players are expected to offer lucrative opportunities in the market during the forecast period.

Impact of COVID-19 on Global Breathalyzer Market

The global breathalyzer market was positively impacted by the outbreak of the COVID-19 pandemic. The increased coronavirus infected cases have accelerated the demand for the non-invasive, rapid, inexpensive testing device such as a breathalyzer. Furthermore, various healthcare institutes were extensively using novel breathalyzers to detect the occurrence of COVID-19 disease among people. Due to these, the demand and adoption of breathalyzer as an initial scaling tool were high, this led to the growth in the breathalyzer market during the forecast period.

Segmental Outlook

The global breathalyzer market is segmented based on application, technology, and end-user. Based on application, the global breathalyzer market is segmented into alcohol detection, drug abuse detection, and medical application. The alcohol detection segment held a significant share in the market in 2020, and it is projected to grow more at a faster rate during the forecast period. Whereas the medical application segment is likely to witness lucrative growth during the forecast period. On the basis of technology, the market is classified into fuel cell technology, semiconductor oxide sensor technology, infrared (IR) spectroscopy, and others. Among these, the fuel cell technology segment is projected to dominate the market and it is further expected to maintain its dominance during the forecast period owing to the increasing demand for hand-held analyzers coupled with fuel cell technology and various advantages associated with them. Similarly, based on end-user, it is divided into healthcare facilities, law enforcement & military, government & private workplace, and others (transport).

Global Breathalyzer Market Share by End-User, 2020 (%)

Law Enforcement & Military Segment is Projected to Hold Significant Share in Global Breathalyzer Market.

Among all the end-users of the breathalyzers, the law enforcement & military is the largest end-user of the breathalyzers. The segment dominated the market in 2020, and it is further projected to witness healthy growth during the forecast period. The use of breathalyzers in law enforcement & the military is increasing to achieve the highest standard of accuracy and reliability in alcohol testing. The increasing alcohol abuse and cases of drink and drive globally is the major factor due to which the demand for a breathalyzer is increasing. In the military, the breathalyzers are used to monitor the health of personnel, deglamorize alcohol, and track its use. Increasing alcohol use and drug abuse have forced many laws enforcement and militaries to adopt breathalyzers as an essential part of their system, which in turn is driving the market growth.

Regional Outlook

Geographically, the global breathalyzer market is analyzed based on regions which include, North America Asia-Pacific, Europe, and the Rest of the World. In North America, the US and Canada are the two major economies that are contributing to the growth of the region. The factors that are augmenting the growth of the market in North America include the rising number of drunk and drive cases in the US and increasing consumption of alcohol among the population. Moreover, North America has dominated the market due to the adoption and implementation of rigorous laws by the government in the region. Europe is accounted as the second-largest market in the global breathalyzer market. In Europe Germany is the major economy contributing to the market growth owing to rising popularity and growing demand for personal breathalyzers.

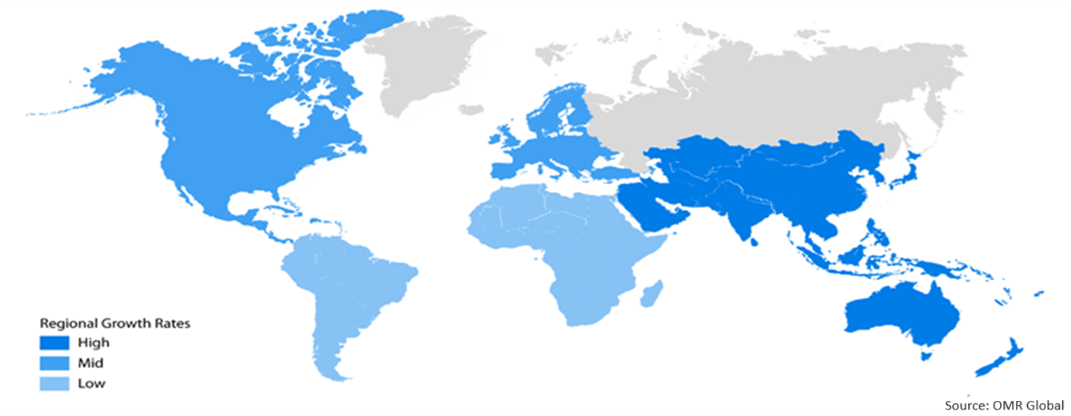

Global Breathalyzer Market Growth, By Region 2021-2027

Asia-Pacific is projected to be the fastest-growing region in the global breathalyzer market

Geographically, Asia-Pacific is projected to grow at the fastest rate during the forecast period. factor such as rising use of drugs and alcohol testing equipment in various verticals such as transport and construction sectors, healthcare sectors, law enforcement & military among others is driving the growth of the market. The increasing alcohol consumption and stringent regulations imposed by the government have increased the adoption of breathalyzers in the region. Developing nations in Asia-Pacific such as China, India, Japan, are the major economies contributing near the growth of the market during the forecast period. Growing awareness for drug testing, increasing traffic accidents, and reduction in breathalyzer costs are the major drivers for the market growth in these economies.

Market Players Outlook

The key players in the Breathalyzer market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include AK GlobalTech Corp., Alcohol Countermeasure Systems Corp., Andatech Private Ltd., BACtrack, Inc., C4 development, Drägerwerk AG & Co. KGaA, EnviteC-Wismar GmbH, Intoximeter, Inc., Lifeloc Technologies Inc., MPD, Inc., PAS Systems International, Quest Products, Inc., among Others. To remain competitive in the market, these market players are adopting several market strategies including product launch and approvals, merger and acquisition, partnership collaboration, business, and capacity expansion, and others. For instance, in September 2018, Alcohol Countermeasure Systems Corp launched WipeAlyser, a portable optical reader for the DrugWipe oral fluid drug screening tester. WipeAlyser records on-site information about the test subject, drugs detected with the date and time stamp, and (GPS) location for future printout or data storage.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Breathalyzer market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Breathalyzer Industry

• Recovery Scenario of Global Breathalyzer Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Breathalyzer Market, By Application

5.1.1. Alcohol detection

5.1.2. Drug abuse detection

5.1.3. Medical applications

5.2. Global Breathalyzer Market, By Technology

5.2.1. Fuel Cell Technology

5.2.2. Semiconductor Oxide Sensor Technology

5.2.3. Infrared (IR) Spectroscopy

5.2.4. Other Technologies

5.3. Global Breathalyzer Market, By End-User

5.3.1. Healthcare Facilities

5.3.2. Law enforcement & Military

5.3.3. Government & Private Workplace

5.3.4. Others (Transport)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East& Africa

7. Company Profiles

7.1. Advanced Safety Devices, LLC

7.2. Abbott Laboratories

7.3. AK GlobalTech Corp.

7.4. Akers Biosciences, Inc (MyMD Pharmaceuticals, Inc)

7.5. Alcohol Countermeasure Systems (ACS)Corp

7.6. Alcohol Monitoring Systems, Inc.

7.7. Alcolizer Pty. Ltd

7.8. Alcopro, Inc.

7.9. Andatech Private Ltd.

7.10. BACtrack Breathalyzers / KHN Solutions Inc.

7.11. BedfontScientific Ltd.

7.12. C4 development Ltd.

7.13. Drägerwerk AG & Co. KGaA

7.14. Honeywell International Inc.

7.15. Hound Labs, Inc.

7.16. Guth Laboratories, Inc.

7.17. Intoximeter, Inc.

7.18. Lifeloc Technologies Inc.

7.19. Lion Laboratories Ltd.

7.20. MPD, Inc.

7.21. PAS Systems International, Inc.

7.22. Thermo Fisher Scientific

7.23. Quest Products, Inc.

1. GLOBAL BREATHALYZER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

2. GLOBAL BREATHALYZER IN ALCOHOL DETECTION, MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL BREATHALYZER IN DRUG ABUSE DETECTION, MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL BREATHALYZER IN MEDICAL APPLICATIONS, MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL BREATHALYZER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

6. GLOBAL FUEL CELL TECHNOLOGY IN BREATHALYZER, MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL SEMICONDUCTOR OXIDE SENSOR TECHNOLOGY IN BREATHALYZER, MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL INFRARED (IR) SPECTROSCOPY IN BREATHALYZER, MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL OTHER TECHNOLOGIES IN BREATHALYZER, MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL BREATHALYZER MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

11. GLOBAL BREATHALYZER IN HEALTHCARE FACILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL BREATHALYZER IN LAW ENFORCEMENT & MILITARY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL BREATHALYZER IN GOVERNMENT & PRIVATE WORKPLACE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

14. GLOBAL BREATHALYZER IN OTHERS END-USER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN BREATHALYZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. NORTH AMERICAN BREATHALYZER MARKET RESEARCH AND ANALYSIS BY APPLICATION,2020-2027 ($ MILLION)

17. NORTH AMERICAN BREATHALYZER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

18. NORTH AMERICAN BREATHALYZER MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

19. EUROPEAN BREATHALYZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. EUROPEAN BREATHALYZER MARKET RESEARCH AND ANALYSIS BY APPLICATION,2020-2027 ($ MILLION)

21. EUROPEAN BREATHALYZER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

22. EUROPEAN BREATHALYZER MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION

23. ASIA-PACIFIC BREATHALYZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC BREATHALYZER MARKET RESEARCH AND ANALYSIS BY APPLICATION,2020-2027 ($ MILLION)

25. ASIA-PACIFIC BREATHALYZER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY,2020-2027 ($ MILLION)

26. ASIA-PACIFIC BREATHALYZER MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

27. REST OF THE WORLD BREATHALYZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

28. REST OF THE WORLD BREATHALYZER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

29. REST OF THE WORLD BREATHALYZER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY,2020-2027 ($ MILLION)

30. REST OF THE WORLD BREATHALYZER MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL BREATHALYZER MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL BREATHALYZER MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF GLOBAL BREATHALYZER MARKET, 2020-2027 (%)

4. GLOBAL BREATHALYZER MARKET SHARE BY APPLICATION,2020 VS 2027 (%)

5. GLOBAL BREATHALYZER MARKET SHARE BY TECHNOLOGY, 2020 VS 2027 (%)

6. GLOBAL BREATHALYZER MARKET SHARE BY TYPE OF END-USER, 2020 VS 2027 (%)

7. GLOBAL BREATHALYZER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL BREATHALYZER IN ALCOHOL DETECTION, MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL BREATHALYZER IN DRUG ABUSE DETECTION, MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL BREATHALYZER IN MEDICAL APPLICATIONS, MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL FUEL CELL TECHNOLOGY IN BREATHALYZER, MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL SEMICONDUCTOR OXIDE SENSOR TECHNOLOGY IN BREATHALYZER, MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL INFRARED (IR) SPECTROSCOPY IN BREATHALYZER, MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL OTHER TECHNOLOGIES IN BREATHALYZER, MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL BREATHALYZER IN HEALTHCARE FACILITIES MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL BREATHALYZER IN LAW ENFORCEMENT & MILITARY MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL BREATHALYZER IN GOVERNMENT & PRIVATE WORKPLACE MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

18. GLOBAL BREATHALYZER IN OTHERS END-USER MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

19. US BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

20. CANADA BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

21. UK BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

22. FRANCE BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

23. GERMANY BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

24. ITALY BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

25. SPAIN BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF EUROPE BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

27. INDIA BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

28. CHINA BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

29. JAPAN BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

30. ASEAN BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

31. SOUTH KOREA BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

32. REST OF ASIA-PACIFIC BREATHALYZER MARKET SIZE, 2020-2027 ($ MILLION)

33. REST OF THE WORLD BREATHALYZER MARKET SIZE, 2021-2027($ MILLION