BRICS e-commerce logistics Market

BRICS E-Commerce Logistics Market Size, Share & Trends Analysis Report By Products (Baby Products, Personal Care Products, Books, Home Furnishing Products, Apparel Products, Electronics Products, Automotive Products, and Others) By Services (Transportation Services, Warehouse Services, and Others) By Location (Urban, Semi-Urban, and Rural) Forecast, 2021-2027 Update Available - Forecast 2025-2035

The BRICS e-commerce logistics market is projected to have a considerable CAGR of 13.7% during the forecast period. The major factors contributing to the growth of the market include the rising inclination of enterprises towards e-commerce platforms and the rising number of start-ups entering the B2B e-commerce space. The increasing e-commerce market is one of the major reasons for augmenting the logistic market of e-commerce during the forecast period. With the Introduction of prominent e-commerce companies such as Alibaba, Amazon is expected to provide a substantial growth rate to the e-commerce and its logistic market in the China region. After setting up business in developed economies, the e-commerce companies targeted the most emerging and lucrative market. As most of the countries such as Brazil, Russia, China, and India are providing a positive growth rate, the e-commerce companies are targeting these countries significantly. Moreover, increasing internet penetration and the growing trend of online shopping are the factors that are boosting the BRICS e-commerce logistics market.

However, undeveloped infrastructure and unstable price of petrol and diesel, high costs for reverse logistics, lack of adequate data, logistics infrastructure, trust, regulations, cross-border customs clearance, are the major concerns hampering the market growth. Moreover, technological advancements in e-commerce logistics are expected to create lucrative opportunities in the market during the forecast period.

COVID-19 Impact on BRICS E-Commerce Logistics Market

The COVID-19 pandemic has resulted in fueling the growth of the e-commerce logistics sector in BRICS countries. However, due to the frequent imposition of lockdown, the dependency on e-commerce platform for the purchase of essential goods has increased considerably. According to a new report from the World Economic Forum, the lockdown has led to a 25% rise in consumer e-commerce deliveries in 2020. Further, extended lockdowns in several countries have resulted in disrupting the supply chain and new production, however, despite these, growth in the e-commerce market has witnessed during the lockdown.

Segmental Outlook

BRICS e-commerce logistics market is segmented based on products, service, and location. Based on products, the BRICS e-commerce logistics market is segmented into personal care, home furnishing, apparel, electronics, automotive, and others. Among these, electronics products are estimated to have a significant market share amongst all products segment due to the increasing use of electronic devices such as smartphone and other devices. Similarly, based on services, the market is categorized into transport services, warehouse services, and others. Whereas, based on location, the BRICS e-commerce market is divided into urban, semi-urban, and rural.

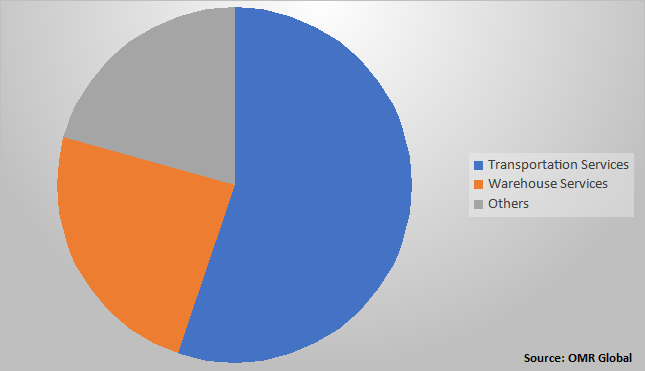

BRICS E-Commerce logistics Market Share by Services, 2020 (%)

The transportation services segment holds the major share in the BRICS e-commerce logistics market

Based on services, the transportation segment is projected to hold the largest market share during the forecast period. Transportation services play a vital role in e-commerce logistics. The e-commerce companies distribute their products to the customers by their network or taking the support of outsourcing companies such as DHL Express and BlueDart Express. By moving goods from locations where they are sourced to locations where they are demanded, transportation provides the essential service of linking a company to its suppliers and customers. It is an essential activity in the logistics function, supporting the economic utilities of place and time. Thus, further growth in the e-commerce sector will drive the need for transportation for logistics distribution.

Regional Outlook

The BRICS e-commerce logistics market is classified into regions include Brazil, Russia, India, China, and South Africa. Among these, e-commerce logistics in Brazil is showing a significant growth rate. Brazil is not only the biggest however also the most developed e-commerce markets in Latin America. With over 42% share, Brazil has the strongest cross-border consumer market in Latin America. High internet penetration in the country and the significant rise in e-consumers, both retail and transport market witnessed skyrocketing incline in the number of daily transactions by consumers. Whereas in Russia, online shopping is growing at an alarming level, in 2018, Russian customers ordered 350m parcels and packages from online outlets. Due to which the logistics market has also increased, which led to the growth in the market. In China, the e-commerce market is three times the size of any market. According to Alibaba, Cainiao Network and its logistics partners delivered 25.1 billion packages in 2019. the massive pool of consumers and high internet penetration and technological development in e-commerce logistics are the prominent factors driving the growth of the market.

Market Players Outlook

The key players in the BRICS e-commerce logistics market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market are Alibaba Group Holding Ltd, Amazon.com, Inc., DHL International GmbH, eBay Inc., JD.com, Inc, Walmart Inc., among others. These market players adopt different marketing strategies such as mergers & acquisitions, R&D, product launches, and geographical expansions to generate more revenue and to remain competitive in the market. For instance, In July 2018, Singapore Post Limited signed a logistics and warehousing contract with a premium global bicycle brand for specialized Bicycle components. The tie-up for three-year specialized regional warehousing operations from Hong Kong to SingPost’s regional logistics facility. SingPost will handle warehousing and sea freight for Specialized bicycles and equipment. This will improve the geographical position of the company due to which the revenue generated by the company will increase which in turn affects the market positively.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the BRICS e-commerce logistics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the BRICS E-Commerce logistics Industry

• Recovery Scenario of BRICS E-Commerce logistics Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. BRICS E-Commerce Logistics Market, By Products

5.1.1. Baby Products

5.1.2. Personal Care Products

5.1.3. Books

5.1.4. Home Furnishing Products

5.1.5. Apparel Products

5.1.6. Electronics Products

5.1.7. Automotive Products

5.1.8. Others

5.2. BRICS E-Commerce Logistics Market, By Service

5.2.1. Transportation Services

5.2.2. Warehouse Services

5.2.3. Others

5.3. BRICS E-Commerce Logistics Market, Location

5.3.1. Urban

5.3.2. Rural

5.3.3. Semi-Urban

6. Regional Analysis

6.1. Brazil

6.2. Russia

6.3. India

6.4. China

6.5. South Africa

7. Company Profiles

7.1. Alibaba Group Holding Ltd

7.2. Amazon.com, Inc

7.3. Cargo X

7.4. Clues Network Pvt. Ltd

7.5. CNova N.V

7.6. DHL International GmbH

7.7. eBay Inc.

7.8. FedEx Corp

7.9. Flipkart Pvt Ltd

7.10. HomeShop18

7.11. JD.com, Inc

7.12. Konga.com

7.13. Takealot Online (Pty) Ltd.

7.14. VIA Transportation Inc.

7.15. Vipshop Holdings Limited

7.16. Walmart Inc.

7.17. WBS Logistic Ltd.

7.18. Zando

1. BRICS E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. BRICS E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCTS 2020-2027 ($ MILLION)

3. BRICS E-COMMERCE LOGISTICS FOR BABY PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

4. BRICS E-COMMERCE LOGISTICS FOR PERSONAL CARE PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

5. BRICS E-COMMERCE LOGISTICS FOR BOOKS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

6. BRICS E-COMMERCE LOGISTICS FOR HOME FURNISHING PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

7. BRICS E-COMMERCE LOGISTICS FOR APPAREL PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

8. BRICS E-COMMERCE LOGISTICS FOR ELECTRONICS PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

9. BRICS E-COMMERCE LOGISTICS FOR AUTOMOTIVE PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

10. BRICS E-COMMERCE LOGISTICS FOR OTHER PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

11. BRICS E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICE, 2020-2027 ($ MILLION)

12. BRICS TRANSPORTATION SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. BRICS WAREHOUSE SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. BRICS OTHER E-COMMERCE LOGISTICS SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. BRICS E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATIONS, 2020-2027 ($ MILLION)

16. BRICS URBANE-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. BRICS RURALE-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. BRICS SEMI-URBANE-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON BRICS E-COMMERCE LOGISTICS MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON BRICS E-COMMERCE LOGISTICS MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF BRICS E-COMMERCE LOGISTICS MARKET, 2020-2027 (%)

4. BRICS E-COMMERCE LOGISTICS MARKET SHARE BY PRODUCTS,2020 VS 2027 (%)

5. BRICS E-COMMERCE LOGISTICS MARKET SHARE BY SERVICES, 2020 VS 2027 (%)

6. BRICS E-COMMERCE LOGISTICS MARKET SHARE BY LOCATIONS, 2020 VS 2027 (%)

7. BRICS E-COMMERCE LOGISTICS MARKET SIZE 2020-2027 ($MILLIONS)

8. BRAZIL E-COMMERCE LOGISTICS MARKET SIZE 2020-2027 ($MILLIONS)

9. RUSSIA E-COMMERCE LOGISTICS MARKET SIZE 2020-2027 ($MILLIONS)

10. INDIA E-COMMERCE LOGISTICS MARKET SIZE 2020-2027 ($MILLIONS)

11. CHINA E-COMMERCE LOGISTICS MARKET SIZE 2020-2027 ($MILLIONS)

12. SOUTH AFRICA E-COMMERCE LOGISTICS MARKET SIZE 2020-2027 ($MILLIONS)