Buckwheat Flour Market

Buckwheat Flour Market Size, Share & Trends Analysis Report by Type (Organic Buckwheat Flour and Normal Buckwheat Flour), by Application (Pancakes, Noodles, and Galettes), and by Distribution Channel (Online Retail, Hypermarkets and Supermarkets, Convenience Stores, and Others), Forecast Period (2024-2031)

Buckwheat flour market is anticipated to grow at a CAGR of 3.6% during the forecast period (2024-2031). Buckwheat, primarily grown in Asia, is popular for its adaptability to short seasons and acidic soils. Its flour, known for being gluten-free, is rich in flavonoid rutin, which strengthens blood vessels. The increasing demand for buckwheat flour is driven by its health benefits and versatility as a food ingredient.

Market Dynamics

Numerous Health Benefits

Buckwheat is a favorite because it has many proteins, fibers, and minerals. Buckwheat has anti-inflammatory qualities as well as acts as an antioxidant. Furthermore, its minerals which include magnesium, copper, manganese, and phosphorus contribute to other bodily functions such as muscle and nerve function, bone health, and antioxidant defense. On the other hand, compounds in buckwheat such as rutin and flavonoids are responsible for their antioxidant properties, which provide preventive health benefits against chronic diseases. Another benefit of gluten-free buckwheat is that people with gluten sensitivity or celiac disease get another safe option. In addition, it gives you many ways to use in recipes if you are cooking without gluten. In general, buckwheat is rich in nutrients like proteins, fiber, and other minerals while at the same time being free from gluten thus making it an important item in the diet of people conscious about their health status by taking healthy foods.

Growing Versatility of Buckwheat in Both Traditional & Modern Cuisine

The kitchen versatility of buckwheat can be deduced from the various ways in which it can be used in both traditional and contemporary recipes ranging from noodles and pancakes to salad and porridge among others, this flexibility allows for easy incorporation to different kinds of meals globally. The rising popularity of buckwheat is being driven by its adaptability and chefs and home cooks’ search for new avenues to exploit it in many kinds of dishes. The one-of-a-kind flavor profile and texture of buckwheat make it a perfect staple for some comfort food while serving as a nutritious element to salads and pastries. With increasing consumer interest in different and tasty foods, buckwheat continues to find its place in pretty much every possible food outlet today- be it traditional or modern-day style, meaning that it has remained popular while customer demand heats up.

Market Segmentation

- Based on type, the market is segmented into organic buckwheat flour and normal buckwheat flour.

- Based on application, the market is segmented into pancakes, noodles, and galettes.

- Based on distribution channels, the market is segmented into online retail, hypermarkets and supermarkets, convenience stores, and others.

Pancakes is Projected to Emerge as the Largest Segment

Pancakes is one of the largest segments in the buckwheat flour market. The unique, robust taste of buckwheat flour makes it a favored choice for pancake recipes due to its slightly nutty flavor and rich texture. Buckwheat flour pancakes have a very smooth finish and are full of delectable flavor. It is important to note that they are thought of as a healthier alternative in contrast to regular pancakes. This is because buckwheat which is used to make them has no gluten hence good for people who cannot tolerate it. Besides they have fiber, protein, and minerals, which are important to our health. Therefore, when taken together with other foods they help maintain balance and make sure someone does not feel hungry shortly after eating it; thus making those particular types of pancakes very good options for anyone who is seeking a good taste in their food during breakfast while at the same time maintaining a healthier lifestyle-friendly diet.

Organic Buckwheat Flour Segment to Hold a Considerable Market Share

Consumer preferences are driving sales in the buckwheat market segment, with organic buckwheat flour in the lead attributed to an increase in demand for organic products due to health, sustainability, and ethical sourcing concerns. Organic certification guarantees organic buckwheat flour is free from synthetic pesticides, fertilizers, or GMOs; thereby presenting a natural and good-for-you choice for those who mind their wellness. Its processes adhere to stringent guidelines for sustainable farming, striking a chord with those placing importance on taking care of nature. In addition to catering to particular dietary requirements, organic buckwheat flour is symbolic of holistic health consciousness and eco-friendliness, hence its market supremacy.

Regional Outlook

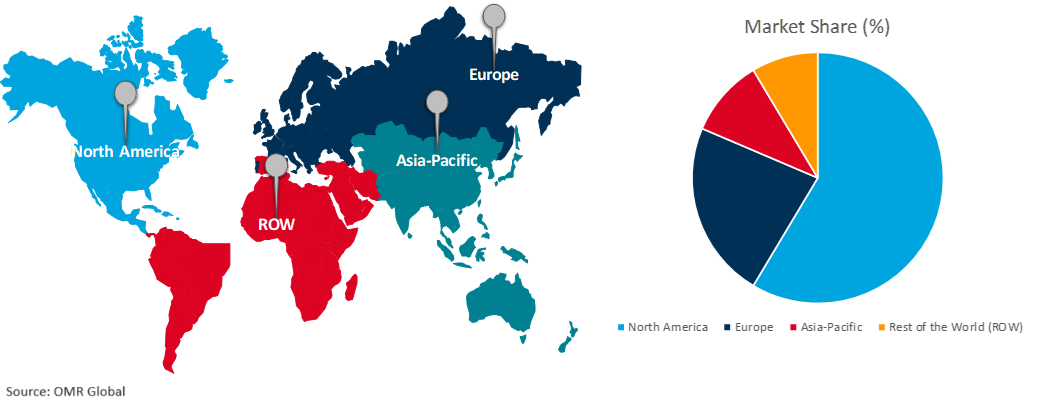

The global buckwheat flour market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Dominates the Buckwheat Flour Market

Asia-Pacific region is the leading market for buckwheat flour because people have been eating it traditionally, especially in China, Japan, and Korea. This has happened due to the long time usage combined with the fact that people in this area like eating nutritious and gluten-free grains which have made Buckwheat flour so famous among traditional Asian dishes. Increasing awareness of its health benefits; among them being gluten-free and full of nutrients; further fuels demand. Asia-Pacific remains the most populous continent with fast-paced urbanization growth coupled with shifted lifestyles as well as upward incomes contributing to having a bigger chunk by volume but smaller in value terms in the global buckwheat flour market.

Global Buckwheat Flour Market Growth by Region 2024-2031

North America Emerges as a Rapidly Growing Buckwheat Flour Industry

North America is the fastest-growing region in this market. There is more and more knowledge among customers about the health advantages of buckwheat flour, such as it being gluten-free, having a lot of fibers, and being very nutritious. Also, nutritional trends and health-oriented eating patterns have fostered the consumption of buckwheat flour in North America; thus, enhancing the need for plant-based food products that are a great alternative to conventional ones. Moreover, there is quick market growth in the region as health-conscious consumers benefit from increased availability of buckwheat flour items in ordinary stores and increasing specialty food markets.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global buckwheat flour market include Anthony's Goods, Bob's Red Mill Natural Foods Inc., Gerbs, Skvyrskyi Grain Processing Factory Ltd., and Birkett Mills Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in 2023, Hodgson Mill expanded its buckwheat flour line to include new organic stone-ground options, catering to health-conscious consumers seeking nutritious and minimally processed ingredients. This reflects the company's commitment to providing wholesome and sustainable food options.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global buckwheat flour market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Anthony's Goods

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bob's Red Mill Natural Foods Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. King Arthur Baking Company Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Skvyrskyi Grain Processing Factory Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. The Birkett Mills Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Buckwheat Flour Market by Type

4.1.1. Organic Buckwheat Flour

4.1.2. Normal Buckwheat Flour

4.2. Global Buckwheat Flour Market by Application

4.2.1. Pancakes

4.2.2. Noodles

4.2.3. Galettes

4.3. Global Buckwheat Flour Market by Distribution Channel

4.3.1. Online Retail

4.3.2. Hypermarkets and Supermarkets

4.3.3. Convenience Stores

4.3.4. Others (Food & Drink Specialty Stores)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Archer Daniels Midland (ADM)

6.2. Arrowhead Mills Inc.

6.3. Azure Standard

6.4. Barton Springs Mill

6.5. Bouchard Family Farms

6.6. Bulk Barn Foods Limited

6.7. Great River Organic Milling

6.8. Haldeman Mills

6.9. Himalayan Organics

6.10. Hodgson Mill Inc.

6.11. Minn-Dak Ag, LLC

6.12. Nature's Path Foods

6.13. NihKan- The Selfcare Arena

6.14. The Birkett Mills

6.15. The Hain Celestial Group Inc.

6.16. Wades Mill Inc.

6.17. Wilmar International Limited

1. GLOBAL BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ORGANIC BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL NORMAL BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL BUCKWHEAT FLOUR FOR PANCAKES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL BUCKWHEAT FLOUR FOR NOODLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BUCKWHEAT FLOUR FOR GALETTES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

9. GLOBAL BUCKWHEAT FLOUR VIA ONLINE RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL BUCKWHEAT FLOUR VIA HYPERMARKETS AND SUPERMARKETS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL BUCKWHEAT FLOUR VIA CONVENIENCE STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL BUCKWHEAT FLOUR VIA OTHER DISTRIBUTION CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

18. EUROPEAN BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. EUROPEAN BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

26. REST OF THE WORLD BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD BUCKWHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL BUCKWHEAT FLOUR MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL ORGANIC BUCKWHEAT FLOUR MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL NORMAL BUCKWHEAT FLOUR MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BUCKWHEAT FLOUR MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL BUCKWHEAT FLOUR FOR PANCAKES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL BUCKWHEAT FLOUR FOR NOODLES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL BUCKWHEAT FLOUR FOR GALETTES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL BUCKWHEAT FLOUR MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

9. GLOBAL BUCKWHEAT FLOUR VIA ONLINE RETAIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL BUCKWHEAT FLOUR VIA HYPERMARKETS AND SUPERMARKETS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL BUCKWHEAT FLOUR VIA CONVENIENCE STORES MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL BUCKWHEAT FLOUR VIA OTHER DISTRIBUTION CHANNEL MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL BUCKWHEAT FLOUR MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

16. UK BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA BUCKWHEAT FLOUR MARKET SIZE, 2023-2031 ($ MILLION)