Building Automation System Market

Building Automation System Market Size, Share & Trends Analysis Report by Component (Hardware, Software, Services), End-User (Residential, Commercial, Industrial), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

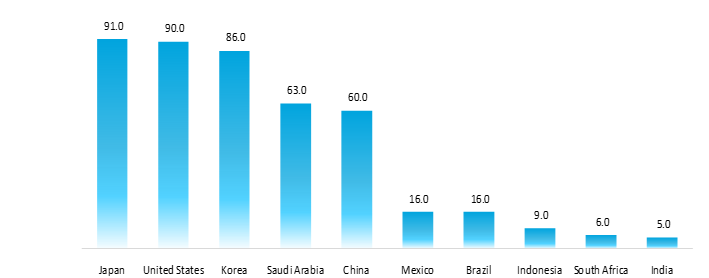

Building automation system market is anticipated to grow at a significant CAGR of 10.8% during the forecast period. The growing adoption of building automation systems across the globe is a key factor driving the growth of the global building automation system market. Building automation systems exhibit functions such as control of the building's environment and operating systems and monitoring the system performance, based on which the systems produce sound alerts as required. It centrally controls the building's heating, ventilation, and air conditioning (HVAC), electrical, lighting, shading, access control, security systems, and other interrelated systems. The growing demand for air conditioners across the globe due to the rising temperatures during summer has further created demand for the building automation systems market. There are mounting concerns in the Asia-Pacific region, where air-conditioning systems are becoming more prevalent, affordable, and essential than ever before.

Countries with the Highest Share of Households Equipped with AC, 2020 (%)

Source: www.iea.org

Segmental Outlook

The global building automation system market is segmented based on components and end-user. Based on components, the market is segmented into hardware, software, and services. Based on end-user industry, the market is segmented into residential, commercial, and industrial.

Building Automation Software segment to Exhibit Highest Growth

The increasing number of software applications in building automation is a key factor driving the growth of this market segment. New software launches are contributing to the growth of this market segment. For instance, in June 2022, Siemens Smart Infrastructure launched Building X, a new smart building suite that is open, interoperable, and fully cloud based. The suite is the first next generation offering built on the design principles of Siemens Xcelerator, an open digital Smart Building Suite business platform to accelerate digital transformation and value creation across industry, transportation, grids, and buildings.

Regional Outlook

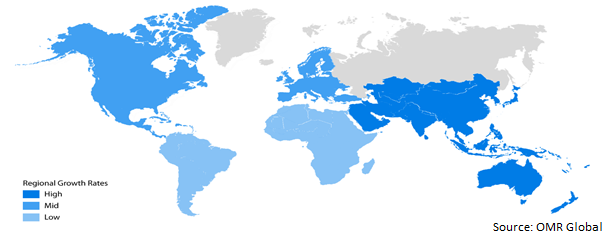

The global building automation system market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, Asia-Pacific is estimated to be the fastest-growing region owing to the growing adoption of smart buildings in emerging economies such as India & China. Government initiatives, such as smart city projects, have further strengthened the place of the region in the building automation system market.

In August 2022, KT, South Korea's largest telecommunications company, plans to launch a suite of smart building services in cooperation with its subsidiary, KT Estate. The new ICT-based integrated service consists of "Smart Building Sensing" and "Smart Building BEMS". Currently, public buildings with a floor space of 10,000 square meters or more are required to set up a BEMS. The regulation is scheduled to be extended in 2025 to private buildings with a floor space of 1,000 square meters or more and public buildings with a floor space of 500 square meters or more. Such regulations that promote the adoption of building automation systems across the region are further contributing to the regional market growth.

Global Building Automation System Market Growth, by Region 2023-2030

The North American region held a Considerable Share in the Global Building Automation System Market

North America held a considerable share of the global building automation system market. The high adoption rate of smart technologies, and the presence of wide and maintained IT infrastructure are the key contributors to the high share of the regional market. Companies are introducing sustainable technologies to improve the building ecosystem in the region. For instance, in September 2021, Turntide Technologies, (“Turntide”), a developer of electrification and sustainable operations technologies rolled out its new Turntide for Buildings, a full-stack intelligent building solution. Turntide combines its Smart Motor SystemTM with automation software, connected edge equipment, and cloud insights to improve energy efficiency and streamline building operations while reducing downtime and maintenance costs.

Turntide for Buildings gives owners, managers, and operators the visibility they need to control and maintain systems such as HVAC and lighting, indoor air quality, and energy efficiency. It collects data from an ecosystem of connected equipment including the Smart Motor System and edge equipment such as smart thermostats, IAQ sensors, and gateway devices, to provide a dashboard of cloud insights and control capabilities that enables more efficient oversight and management across a portfolio of locations.

Market Players Outlook

The major companies serving the global building automation system market include Honeywell International Inc., Schneider Electric SE, Trane Technologies, Johnson Controls, Inc. Emerson Electric Co., Siemens AG, and Baldor Electric (ABB Ltd.) among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2023, ABB Ltd. unveiled its smart building management systems (BMS) for the Middle East region. The ABB Cylon Smart Building Management Systems portfolio of products covers scalable automation and energy control for a wide variety of commercial or industrial buildings, regardless of size. The BMS enables buildings to automate functions and reduce energy costs with energy control and management. It also allows real-time monitoring and control of the building facility.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global building automation system market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Honeywell International Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Schneider Electric SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Trane Technologies

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Siemens AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Johnson Controls, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Building Automation Systems Market by Component

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. Global Building Automation Systems Market by End-User

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ABB Ltd.

6.2. Bajaj Electricals

6.3. Building LogiX

6.4. Carrier Corp.

6.5. Cisco Systems Inc.

6.6. Control4 Plc

6.7. Delta Controls Inc.

6.8. Distech Controls Inc.

6.9. Emerson Electric Co.

6.10. General Electric

6.11. Hitachi Ltd.

6.12. Huawei Technologies Corp.

6.13. Hubbell Inc.

6.14. Lennox International Inc.

6.15. Lutron Electronics Co. Ltd.

6.16. Mitsubishi Electric Corp.

6.17. Oracle Corp.

6.18. Robert Bosch GmbH.

6.19. SAP SE

6.20. United Technologies Corp.

1. GLOBAL BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

2. GLOBAL BUILDING AUTOMATION SYSTEMS HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL BUILDING AUTOMATION SYSTEMS SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL BUILDING AUTOMATION SYSTEMS SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

6. GLOBAL BUILDING AUTOMATION SYSTEMS FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL BUILDING AUTOMATION SYSTEMS FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL BUILDING AUTOMATION SYSTEMS FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. NORTH AMERICAN BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

11. NORTH AMERICAN BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

12. NORTH AMERICAN BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

13. EUROPEAN BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

14. EUROPEAN BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

15. EUROPEAN BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

19. REST OF THE WORLD BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

20. REST OF THE WORLD BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

21. REST OF THE WORLD BUILDING AUTOMATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL BUILDING AUTOMATION SYSTEMS MARKET SHARE BY COMPONENT, 2022 VS 2030(%)

2. GLOBAL BUILDING AUTOMATION SYSTEMS MARKET SHARE BY END-USER, 2022 VS 2030(%)

3. GLOBAL BUILDING AUTOMATION SYSTEMS HARDWARE MARKET SHARE BY REGION, 2022 VS 2030(%)

4. GLOBAL RIGID BUILDING AUTOMATION SYSTEMS SOFTWARE MARKET SHARE BY REGION, 2022 VS 2030(%)

5. GLOBAL RIGID BUILDING AUTOMATION SYSTEMS SERVICE MARKET SHARE BY REGION, 2022 VS 2030(%)

6. GLOBAL BUILDING AUTOMATION SYSTEMS FOR RESIDENTIAL MARKET SHARE BY REGION, 2022 VS 2030(%)

7. GLOBAL BUILDING AUTOMATION SYSTEMS FOR COMMERCIAL MARKET SHARE BY REGION, 2022 VS 2030(%)

8. GLOBAL BUILDING AUTOMATION SYSTEMS FOR INDUSTRIAL MARKET SHARE BY REGION, 2022 VS 2030(%)

9. GLOBAL BUILDING AUTOMATION SYSTEMS MARKET SHARE BY REGION, 2022 VS 2030(%)

10. US BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

11. CANADA BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

12. UK BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

13. FRANCE BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

14. GERMANY BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

15. ITALY BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

16. SPAIN BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

17. REST OF EUROPE BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

18. INDIA BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

19. CHINA BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

20. JAPAN BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

21. SOUTH KOREA BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF ASIA-PACIFIC BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

23. LATIN AMERICA BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

24. MIDDLE EAST AND AFRICA BUILDING AUTOMATION SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)