Bundling Machine Market

Bundling Machine Market Size, Share & Trends Analysis Report by Type (Automatic Bundling Machines, Semi-Automatic Bundling Machines, and Manual Bundling Machines), by Application (Food & Beverage, Pharmaceuticals, Consumer Goods, Cosmetics and Personal Care, Paint & Chemicals, and Others) Forecast Period (2025-2035)

Industry Overview

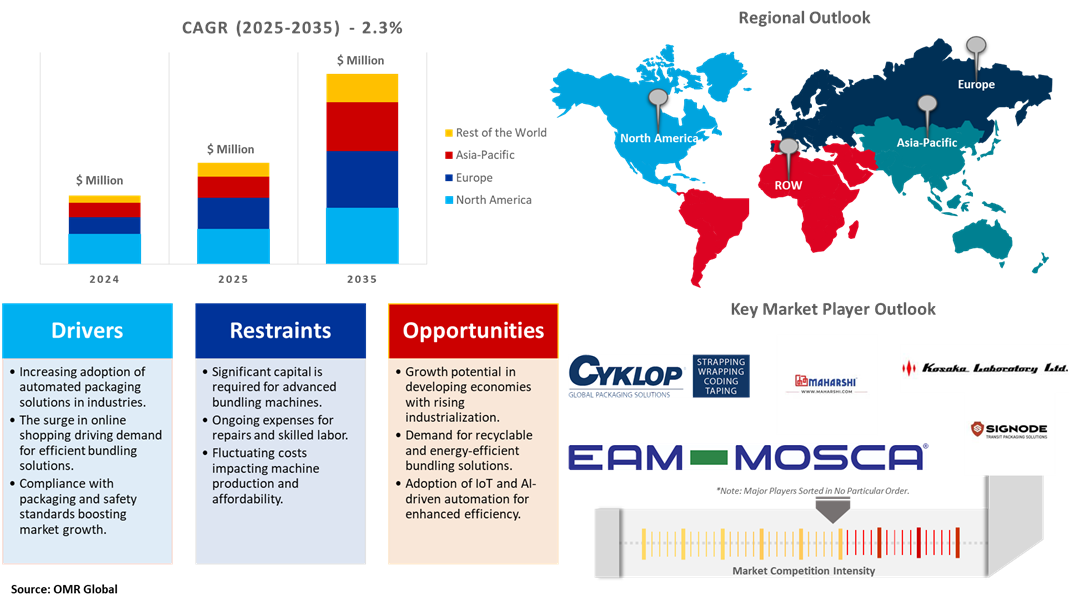

The bundling machine market was valued at $4,279 million in 2024 and is projected to reach $5,480 million in 2035, growing at a CAGR of 2.3% during the forecast period (2025-2035). The bundling machine market is expanding owing to the increasing automation of packaging processes in different industries such as food & beverage, pharmaceuticals, consumer goods, cosmetics, and personal care. The increase in e-commerce and retail sectors, the need for high-speed and efficient bundling solutions has also increased. Technological innovation and sustainable packaging trends are pushing the market growth forward.

Market Dynamics

Growing Adoption of IoT with Smart Automation in Bundling Machines

The shifting toward smart automation and IoT-enabled solutions drives the bundling machines market. The companies implement live monitoring systems that provide efficiency, reduce the time of downtime, and improve overall productivity levels. Advanced sensors and analytics driven by AI enable the bundling machines to sense packaging errors and adjust themselves for higher performance. Predictive maintenance features help businesses avoid unexpected breakdowns and, consequently, the repair costs are minimized. These smart technologies allow operators to work and monitor operations from anywhere, as the performance automatically be traced. Access to cloud-based solutions offers added advantages for optimizing processes and minimizing energy consumption. Automated bundling machines with IoT integration make the process more efficient by resulting in less manual intervention. Foods, beverages, pharmaceuticals, and consumer goods industries are quickly adopting these technologies owing to the wide demand for their high production level.

Increasing Flexibility and Customization in Packaging Solutions

The requirement for an adjustable packaging system has rapidly grown into a crucial issue for organizations to concentrate on in response to the growing demand for flexible and customized bundling. Manufacturers have begun designing machines that can quickly switch between several packing patterns in response to market demand. Multi-functional bundling machines are increasingly popular, where companies can easily change the configurations of their product without having to incur significant amounts of downtime. Such flexibility is critical for companies involved in seasonal products or limited-edition packaging. Advanced software and control systems allow rapid adjustments, shortened setup times, and improved operating efficiency. Uniqueness and customization of consumer packaging are drivers of innovation in bundling technology.

Market Segmentation

- Based on the type, the market is segmented into automatic bundling machines, semi-automatic bundling machines, and manual bundling machines.

- Based on the application, the market is segmented into food & beverage, pharmaceuticals, consumer goods, cosmetics and personal care, paint & chemicals, and others (printing & publishing).

Automatic Bundling Machines Segment to Lead the Market with the Largest Share

The market for bundling machines is growing as companies move toward fully automated systems to increase efficiency and decrease reliance on manual labor, automatic packaging devices are growing increasingly common. They offer speed, accuracy, and consistency all of that is critical in high-volume packing processes. The pharmaceutical, food and beverage, and consumer goods industries are incorporating automated bundling solutions at the fastest rate because of the rapidly increasing production volumes. There is also a significant demand for economical and space-efficient packaging solutions. Moreover, a growing number of sustainability initiatives encourage manufacturers to devise energy-efficient and eco-friendly bundling machines.

Food & Beverage: A Key Segment in Market Growth

The bundling machine market is expanding owing to the high demand for ready-to-eat and packaged foods has increased the demand for efficient solutions in bundling. Manufacturers require advanced machines to pack products at increased speed, for safety, and to meet strong hygiene regulations. Expansion of supermarkets, hypermarkets, and online grocery platforms further boosts demand for automated packaging systems. This focus on reduction in packaging waste and sustainability is a driving factor for to use of new bundling technologies. The increased desire of the consumers for multipack food and beverages is another contributing factor for growth in the market. Firms are upgrading their packaging process as a way to maintain efficiency while keeping it cost-effective.

Regional Outlook

The global bundling machine market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America)

Growing Adoption for Industrial Automation Solutions in Asia-Pacific

The rapid increase in manufacturing infrastructure investment in Asia Pacific has spurred demand for bundling machines. Favorable policies and benefits are offered by regional governments that aid industrial automation. Increasing the facilities of warehouse and logistics services has increased demand for efficient solutions of bundling. Technological advancement produces superior packing machines that is more cost-efficient and is usable for other firms. The growth in domestic and foreign trade has generally seen the proliferation of automated packaging technologies drive the growth of the market.

North America Region Dominates the Market with Major Share

The North America bundling machine market is characterized by a robust growth trend as the packaging industry increasingly adopts automation. The strong presence of e-commerce and retail sectors demands efficient high-speed bundling solutions. Strict packaging regulatory and quality requirements encourage manufacturers to adopt advanced machinery. This well-established industrial base in the area contributes to the ongoing advancement of packing equipment technologies. Organizations are being forced to invest in automated technologies to increase their efficiency owing to rising labor expenses. Growth of the food and beverage, pharmaceutical, and logistics industries further catalyzes expansion in the market.

Market Players Outlook

The major companies operating in the global bundling machine market include Cyklop International, EAM-Mosca Corp., Kosaka Laboratory Ltd., Maharshi Group, and Signode Industrial Group, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bundling machine market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Bundling Machine Market Sales Analysis – Type| Application ($ Million)

• Bundling Machine Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Bundling Machine Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Bundling Machine Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Bundling Machine Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Bundling Machine Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Bundling Machine Market Revenue and Share by Manufacturers

• Bundling Machine Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Cyklop International

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. EAM-Mosca Corp.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Kosaka Laboratory Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Maharshi Group

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Signode Industrial Group

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Bundling Machine Market Sales Analysis by Type ($ Million)

5.1. Automatic Bundling Machines

5.2. Semi-Automatic Bundling Machines

5.3. Manual Bundling Machines

6. Global Bundling Machine Market Sales Analysis by Application ($ Million)

6.1. Food & Beverage

6.2. Pharmaceuticals

6.3. Consumer Goods

6.4. Cosmetics and Personal Care

6.5. Paint & Chemicals

6.6. Others (Printing & Publishing)

7. Regional Analysis

7.1. North American Bundling Machine Market Sales Analysis – Type | Application |Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Bundling Machine Market Sales Analysis – Type | Application |Country ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Bundling Machine Market Sales Analysis – Type | Application |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Bundling Machine Market Sales Analysis – Type | Application |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. AB AUTOPACK

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Bandall

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. Bindtec Co., Ltd.

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. CAMPAK Inc.

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Chang Yong Machinery Co., Ltd.

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. Cyklop International

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. Cypack SAS

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. EAM-Mosca Corp.

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. Fujian Xinyun Machinery Development Co., Ltd.

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Hefei Huida Packing Machine Co., Ltd.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. Kosaka Laboratory Ltd.

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. LLY PACK (foshan) Co., Ltd.

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. Maharshi Group

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. minipack®-torre S.p.A.

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. SMI USA Inc.

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. PACKWAY INC.

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. Packwell Solutions

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. Romiter Machinery Co,.Ltd.

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Signode Industrial Group

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. Suzhou Sanao Electronics Co., Ltd.

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

8.21. tbs-pack GmbH

8.21.1. Quick Facts

8.21.2. Company Overview

8.21.3. Product Portfolio

8.21.4. Business Strategies

8.22. Tishma Technologies

8.22.1. Quick Facts

8.22.2. Company Overview

8.22.3. Product Portfolio

8.22.4. Business Strategies

8.23. Tissue Machinery Company S.p.A.

8.23.1. Quick Facts

8.23.2. Company Overview

8.23.3. Product Portfolio

8.23.4. Business Strategies

1. Global Bundling Machine Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Automatic Bundling Machines Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Semi-Automatic Bundling Machines Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Manual Bundling Machines Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Bundling Machine Market Research And Analysis By Application, 2024-2035 ($ Million)

6. Global Bundling Machine For Food & Beverage Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Bundling Machine For Pharmaceuticals Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Bundling Machine For Consumer Goods Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Bundling Machine For Cosmetics and Personal Care Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Bundling Machine For Paint & Chemicals Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Bundling Machine For Other Application Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Bundling Machine Market Research And Analysis By Region, 2024-2035 ($ Million)

13. North American Bundling Machine Market Research And Analysis By Country, 2024-2035 ($ Million)

14. North American Bundling Machine Market Research And Analysis By Type, 2024-2035 ($ Million)

15. North American Bundling Machine Market Research And Analysis By Application, 2024-2035 ($ Million)

16. European Bundling Machine Market Research And Analysis By Country, 2024-2035 ($ Million)

17. European Bundling Machine Market Research And Analysis By Type, 2024-2035 ($ Million)

18. European Bundling Machine Market Research And Analysis By Application, 2024-2035 ($ Million)

19. Asia-Pacific Bundling Machine Market Research And Analysis By Country, 2024-2035 ($ Million)

20. Asia-Pacific Bundling Machine Market Research And Analysis By Type, 2024-2035 ($ Million)

21. Asia-Pacific Bundling Machine Market Research And Analysis By Application, 2024-2035 ($ Million)

22. Rest Of The World Bundling Machine Market Research And Analysis By Region, 2024-2035 ($ Million)

23. Rest Of The World Bundling Machine Market Research And Analysis By Type, 2024-2035 ($ Million)

24. Rest Of The World Bundling Machine Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Bundling Machine Market Share By Type, 2024 Vs 2035 (%)

2. Global Automatic Bundling Machines Market Share By Region, 2024 Vs 2035 (%)

3. Global Semi-Automatic Bundling Machines Market Share By Region, 2024 Vs 2035 (%)

4. Global Manual Bundling Machines Market Share By Region, 2024 Vs 2035 (%)

5. Global Bundling Machine Market Share By Application, 2024 Vs 2035 (%)

6. Global Bundling Machine For Food & Beverage Market Share By Region, 2024 Vs 2035 (%)

7. Global Bundling Machine For Pharmaceuticals Market Share By Region, 2024 Vs 2035 (%)

8. Global Bundling Machine For Consumer Goods Market Share By Region, 2024 Vs 2035 (%)

9. Global Bundling Machine For Cosmetics and Personal Care Market Share By Region, 2024 Vs 2035 (%)

10. Global Bundling Machine For Paint & Chemicals Market Share By Region, 2024 Vs 2035 (%)

11. Global Bundling Machine For Other Application Market Share By Region, 2024 Vs 2035 (%)

12. Global Bundling Machine Market Share By Region, 2024 Vs 2035 (%)

13. US Bundling Machine Market Size, 2024-2035 ($ Million)

14. Canada Bundling Machine Market Size, 2024-2035 ($ Million)

15. UK Bundling Machine Market Size, 2024-2035 ($ Million)

16. France Bundling Machine Market Size, 2024-2035 ($ Million)

17. Germany Bundling Machine Market Size, 2024-2035 ($ Million)

18. Italy Bundling Machine Market Size, 2024-2035 ($ Million)

19. Spain Bundling Machine Market Size, 2024-2035 ($ Million)

20. Russia Bundling Machine Market Size, 2024-2035 ($ Million)

21. Rest Of Europe Bundling Machine Market Size, 2024-2035 ($ Million)

22. India Bundling Machine Market Size, 2024-2035 ($ Million)

23. China Bundling Machine Market Size, 2024-2035 ($ Million)

24. Japan Bundling Machine Market Size, 2024-2035 ($ Million)

25. South Korea Bundling Machine Market Size, 2024-2035 ($ Million)

26. Australia and New Zealand Bundling Machine Market Size, 2024-2035 ($ Million)

27. ASEAN Countries Bundling Machine Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific Bundling Machine Market Size, 2024-2035 ($ Million)

29. Latin America Bundling Machine Market Size, 2024-2035 ($ Million)

30. Middle East And Africa Bundling Machine Market Size, 2024-2035 ($ Million)

FAQS

The size of the Bundling Machine market in 2024 is estimated to be around $4,279 million.

North America holds the largest share in the Bundling Machine market.

Leading players in the Bundling Machine market include Cyklop International, EAM-Mosca Corp., Kosaka Laboratory Ltd., Maharshi Group, and Signode Industrial Group, among others.

Bundling Machine market is expected to grow at a CAGR of 2.3% from 2025 to 2035.

The Bundling Machine Market is growing due to rising demand for automation in packaging, especially in food, beverage, and pharmaceutical industries. Additionally, increasing e-commerce, logistics expansion.