Buoys and Beacon Market

Buoys and Beacon Market Size, Share & Trends Analysis Report by Material (Metal and Plastic) by End-user Industry (Maritime Transportation, Oil & Gas Industry, Fisheries & Aquaculture, and Defense & Security) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Buoys and beacon market is anticipated to grow at a CAGR of 3.2% during the forecast period. Buoys are floating aids that are anchored to the seabed. Boaters in- terpret what they mean by their shape, color, and the characteristics of lights and sound signals. Beacons are fixed to the earth's surface (not floating) and can be anything from big lighthouses to a sign nailed to some pilings.

![]()

Market Dynamics

Surge in Offshore Wind Energy Projects

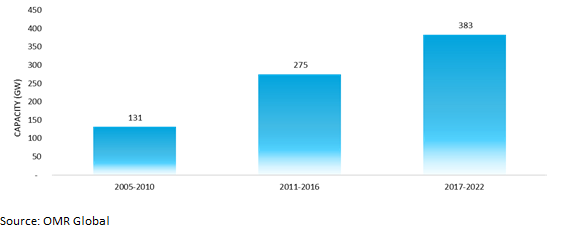

The expansion of offshore wind energy projects is driving demand within the buoys and beacons market significantly. With a growing importance on renewable energy sources to address climate change, offshore wind farms have become an integral part of this transition. According to the World Economic Forum(WEF), offshore wind energy is projected to generate 61 gigawatts of power by 2025, marking an increase of over 35 gigawatts since 2020, driven by the recent surge in the wind and solar energy sectors.

In offshore wind energy projects buoys and beacons provide essential navigational aids and safety markers. Given the challenging maritime conditions typically associated with offshore locations such as deep waters and strong currents-precise navigation is important for maintaining both maritime traffic safety and the integrity of wind farm infrastructure. Buoys and beacons are used to mark turbine locations, define exclusion zones, and guide vessel navigation around these installations. Additionally, they help in identifying hazards such as underwater cables and submerged structures, ensuring the safe operation and maintenance of offshore wind farms. As the global offshore wind energy sector continues to expand driven by renewable energy goals and technological advancements, the demand for buoys and beacons equipped with advanced features is expected to rise correspondingly, further propelling market growth in the buoy and beacon industry.

Renewable capacity growth by technology, 2005-2022

Source: International Energy Agency (IEA)

Growing Focus on Maritime Security

The rising importance of maritime security is one of the key drivers contributing to the demand for the buoys and beacons market. Governments and organizations globally are prioritizing maritime security due to various concerns, including piracy, smuggling, and terrorism. As reported by the International Maritime Bureau of the International Chamber of Commerce, there were 195 recorded incidents of piracy and armed robbery against ships globally in 2020, marking an increase of 33 compared to 2019. Buoys and beacons, equipped with advanced surveillance and communication technologies, are becoming essential components in these security efforts. These technologies enable efficient monitoring of maritime traffic, detection of suspicious activities, and prompt responses to security threats. They also can be utilized to safeguard critical maritime installations such as ports and offshore platforms. With the growing need for improved maritime security, there is an increasing demand for sophisticated buoys and beacons capable of contributing to comprehensive security solutions. This factor is collectively driving investment in the advancement and deployment of innovative buoy and beacon systems, consequently driving growth in the buoy and beacon market.

Market Segmentation

Our in-depth analysis of the global buoys and beacon market includes the following segments by material, and end-user industry:

- Based on material, the market is sub-segmented into metal and plastic

- Based on the end-user industry, the market is sub-segmented into maritime transportation, the oil & gas industry, fisheries & aquaculture, and defense & security.

The Plastic Buoys And Beacon Segment is Expected to Grow Significantly in the Forecast Period

Among materials, the plastic beacon and buoys market is expected to grow due to rising demand in maritime transportation, fishing, and offshore oil exploration sectors. Factors such as increased investments in marine infrastructure and coastal tourism activities further drive this growth. Technological advancements such as integrating solar panels and GPS systems enhance buoy functionality, offering improved safety and convenience. Additionally, there's a trend toward using eco-friendly materials in buoy manufacturing to align with global sustainability efforts and reduce environmental impact. For instance, in December 2023, an Italian startup launched a project for an intelligent buoy system aimed at filtering microplastics from the surfaces of seas and water basins.

Defense & Security Hold the Highest Share in the global Buoys and Beacon market

The defense and security sector's demand for buoys and beacons is increasing due to the need for reliable navigational aids, enhanced maritime security, and border surveillance. Governments invest in advanced systems with radar, sonar, and surveillance cameras to monitor maritime borders, detect vessels, and protect critical infrastructure. For instance, in May 2023, ship tracking data indicates that China positioned a buoy vessel in the West Philippine Sea, shortly after the Philippine Coast Guard (PCG) installed navigational buoys in the region's disputed waters. A report from China Global Television Network during the vessel's commissioning in 2020 stated that it primarily focuses on deploying buoys and conducting patrols and inspections in the South China Sea.

This growing demand drives manufacturers to innovate and develop more sophisticated buoy systems tailored to defense and security needs, leading to sector growth.

Regional Outlook

The global buoys and beacon market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia Pacific is the Fastest Growing Buoy and Beacon Market

- Increasing maritime trade and transportation activities, infrastructure, and development projects are contributing to market growth.

- Growing awareness of environmental conservation and the need for marine navigation aids

- Government initiatives to enhance maritime surveillance and monitoring capabilities

Global Buoys and Beacon Market Growth by Region 2024-2031

![]()

North America Holds Highest Share In Global Buoys and Beacon Market

North America is expected to maintain dominance in market share throughout the forecast period. This is attributed to increased R&D investments by regional companies specializing in buoy and beacon systems, along with a rising emphasis on maritime safety. The importance of maritime safety has grown significantly due to escalating maritime threats and the pivotal role of sea-based international trade. In North America, companies manufacturing maritime safety equipment prioritize advanced technology to detect various hazards in deep waters effectively. Some of the key companies in the region are Rolyan Buoys, Whitecap Industries Inc., and JFC Marine which are known for producing advanced maritime buoys that comply with or exceed US regulations. These advanced buoys and beacons cater not only to the shipping industry but also find applications in scientific research, marine and weather forecasting, protecting marine life, and planning for extreme weather events, among others. For instance, in May 2022, a laboratory based at the Woods Hole Oceanographic Institution in Massachusetts, USA, disclosed its collaboration with the French shipping company CMA CGM. Together, they have created innovative robotic buoy technology aimed at recording underwater whale sounds in real time. This initiative serves the purpose of tracking whale positions and mitigating the risk of collisions with ships, ultimately contributing to the protection of whale populations.

Market Players Outlook

![]()

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global buoys and beacon market are Meritaito Ltd., Xylem Inc., and Zeniya Aluminum Engineering, Ltd among others. With growing demand, market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global buoys and beacon market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Almarin

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Carmanah Technologies Corp

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Fugro N.V.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Buoys and Beacon Market by Material

4.1.1. Metal

4.1.2. Plastic

4.2. Global Buoys and Beacon Market by End-user Industry

4.2.1. Maritime Transportation

4.2.2. Oil & Gas Industry

4.2.3. Fisheries & Aquaculture

4.2.4. Defense & Security

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. FenderCare

6.2. Hydrosphere UK Ltd.

6.3. JFC Group

6.4. Mediterraneo Senales Maritimas

6.5. Meritaito Ltd

6.6. Mobilis SAS

6.7. Resinex

6.8. Ryokuseisha Corporation

6.9. Sealite Pty Ltd

6.10. Shandong Buoy and Pipe Industry Co., Ltd

6.11. SPX Technologies

6.12. Tideland Signal Corp

6.13. Vega Industries Ltd.

6.14. Xylem Inc.

6.15. Zeniya Aluminum Engineering, Ltd.

1. GLOBAL BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

2. GLOBAL COMMERCIAL BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL METAL BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL PLASTIC BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

6. GLOBAL BUOYS AND BEACON IN MARITIME TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BUOYS AND BEACON IN OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL BUOYS AND BEACON IN FISHERIES & AQUACULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL BUOYS AND BEACON IN DEFENSE & SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

13. NORTH AMERICAN BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

14. EUROPEAN BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

16. EUROPEAN BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

20. REST OF THE WORLD BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. REST OF THE WORLD BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

22. REST OF THE WORLD BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023 VS 2031 (%)

2. GLOBAL METAL BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL PLASTIC BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023 VS 2031 (%)

5. GLOBAL BUOYS AND BEACON IN MARITIME TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL BUOYS AND BEACON IN OIL & GAS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL BUOYS AND BEACON IN OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL BUOYS AND BEACON IN FISHERIES & AQUACULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL BUOYS AND BEACON IN DEFENSE & SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL BUOYS AND BEACON MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. US BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

13. UK BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)

25. THE MIDDLE EAST & AFRICA BUOYS AND BEACON MARKET SIZE, 2023-2031 ($ MILLION)