Bus Card Reader Market

Bus Card Reader Market Size, Share & Trends Analysis Report, By Type (Contact and Contactless), By Application (Public Transport Bus, Tourist Bus, School Bus, and Others) and Forecast, 2019-2025 Update Available - Forecast 2025-2035

The global bus card reader market is estimated to grow at a CAGR of 7.2% during the forecast period. The major factors contributing to the growth of the market include the growing implementation of smart card technology across public transport buses coupled with the increasing focus on the development of transportation infrastructure. Public bus transport buses are significantly used by the people of several areas, including urban, rural, and metro cites. With the increasing demand for bus transport services, both the government and private sectors are offering facilities to ease travel for passengers.

Some concerns among bus passengers and conductors have witnessed for the exact amount of money to be returned. Such kinds of problems occur in every bus every day that affect the harmony of society. Certain projects are being implemented to avoid the problems occur due to change in public bus transport services and facilitating the method of transaction. Therefore, Electronic Ticketing Machines (ETM) is utilized in public transport bus facilities for storing data and provide tickets digitally. By using ETM, the collection of fare conducts digitally with the support of smart cards which avoids direct money transactions.

A smart card is provided to the passenger which is rechargeable, and every card contains a unique id number in which cardholder details will be stored in a database. The concept of the smart card is implemented with the objective of receiving tickets in the public buses rather than cash payment. The conductor uses the smart card reader to swipe the smart card and later on, entering the traveling details of passengers, the ETM will generate electronic tickets. Afterward, the money will be transferred directly to the transport corporation account with the use of the Global Pocket Radio Service (GPRS). This practice allows a service provider to make the processing of transactions easier.

There are several bus stations that have implemented smart card readers to avoid boarding delays. For instance, Vancouver Translink’s 99 B Line bus route has employed proof-of-payment fare collection with all-door boarding since 2007. The busiest bus route in North America with 55,500 passengers on an average weekday and 160 boardings per revenue hour has 2–4-minute headways at peak and headways no longer than 7–8 minutes off-peak. Smart card readers are installed at each door of the route’s 60-foot articulated bus fleet, allowing passengers to board and tap their card at any door. Hence, growing digitalization in the transportation sector is expected to offer significant opportunities for market growth.

Segmentation

The global bus card reader market is segmented based on type and application. Based on type, the market is classified into contact and contactless. Based on the application, the market is classified into the public transport bus, tourist bus, school bus, and others.

Public Transport Bus has led a significant share in the application segment

There is increasing use of smart card readers in public transport bus service to increase the reliability and efficiency of public transport services. The utilization of an electronic smart card is emerging as a practical option for several bus operators. Some instances of broadly used contactless smart cards by public transport bus operators include London's Oyster card, Tokyo's Suica and Pasmo cards, Hong Kong's Octopus card, Nigeria's ETC Card, the Dutch OV-Chipkaart, Paris' Calypso/Navigo, and Lisbon's Lisboa Viva card. In 2014, all Transport for London buses ceased to accept cash on-board. Payment using the Oyster smart card had been an option since 2003, and by 2012 only 1% of bus riders were paying cash. An open payment system was implemented; buses began accepting payment via contactless credit and debit cards in 2012, which are used for one-third of all journeys today.

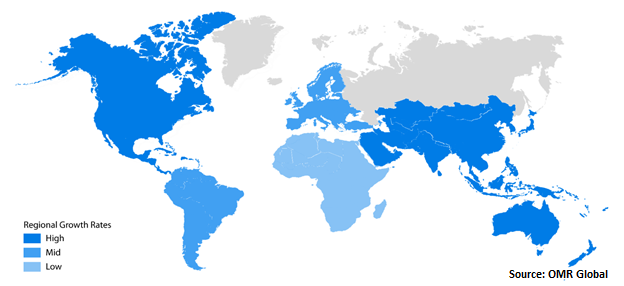

Regional Outlook

The global bus card reader market is segmented into four major regions, such as North America, Europe, Asia-Pacific, and rest of the world (RoW). North America is growing significantly in the market as scalable, equitable, and cost-effective measures for off-board fare collection and all-door boarding have been implemented by a number of transit agencies. Few cities in North America have used them to their full potential, usually implementing these tactics only on specific lines or services. Till 2017, Muni in San Francisco was the only transit agency in North America that has implemented all-door boarding and proof-of-payment fare collection on all its vehicles. There is increasing systemwide implementation of off-board fare collection and all-door boarding for major US bus systems, providing a large majority of the US bus riders with substantial time and reliability benefits.

Global Bus Card Reader Market Growth, by Region 2019-2025

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bus card reader market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Case Studies

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Verifone Holdings, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Shenzhen Cardlan Technology Co., Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Advanced Card Systems, Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. HID Global Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Identiv, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Bus Card Reader Market by Type

5.1.1. Contact

5.1.2. Contactless

5.2. Global Bus Card Reader Market by Application

5.2.1. Public Transport Bus

5.2.2. Tourist Bus

5.2.3. School Bus

5.2.4. Others (Airport Bus)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Advanced Card Systems, Ltd.

7.2. Baoruh Electronic Co., Ltd.

7.3. Calmell Group

7.4. Castles Technology Co., Ltd.

7.5. EP Intelligent Technology Co., Ltd.

7.6. FEIG ELECTRONIC GmbH

7.7. HID Global Corp.

7.8. Identiv, Inc.

7.9. MagTek, Inc.

7.10. NEC Corp.

7.11. NEXGO, Inc.

7.12. Nidec Sankyo America Corp.

7.13. Shenzhen Cardlan Technology Co., Ltd.

7.14. Shenzhen Decard Smartcard Tech Co., Ltd.

7.15. Shenzhen HCC Technology Co., Ltd.

7.16. Shenzhen Rakinda Technologies Co., Ltd.

7.17. Spectra Technovision (India) Pvt. Ltd.

7.18. STYL Solutions Pte. Ltd.

7.19. Thales Group

7.20. Universal Smart Cards, Ltd.

7.21. Verifone Holdings, Inc.

1. GLOBAL BUS CARD READER MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL CONTACT BUS CARD READER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL CONTACTLESS BUS CARD READER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL BUS CARD READER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

5. GLOBAL BUS CARD READER IN PUBLIC TRANSPORT BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL BUS CARD READER IN TOURIST BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL BUS CARD READER IN SCHOOL BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL BUS CARD READER IN OTHER BUS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL BUS CARD READER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN BUS CARD READER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN BUS CARD READER MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

12. NORTH AMERICAN BUS CARD READER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

13. EUROPEAN BUS CARD READER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. EUROPEAN BUS CARD READER MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

15. EUROPEAN BUS CARD READER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC BUS CARD READER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC BUS CARD READER MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC BUS CARD READER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. REST OF THE WORLD BUS CARD READER MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. REST OF THE WORLD BUS CARD READER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL BUS CARD READER MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL BUS CARD READER MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL BUS CARD READER MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)

6. UK BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD BUS CARD READER MARKET SIZE, 2018-2025 ($ MILLION)