Cable Tie Market

Cable Tie Market Size, Share & Trends Analysis Report by Material Type (Nylon, Metal, and Others), by Product Type (Releasable, Non-Releasable, Beaded, Push Mount, Mounting Holes, Heat Stabilized, and Others), and by Application (Electronics and Electricals, Automobile, Consumer Goods, Construction, and Others) Forecast Period (2024-2031)

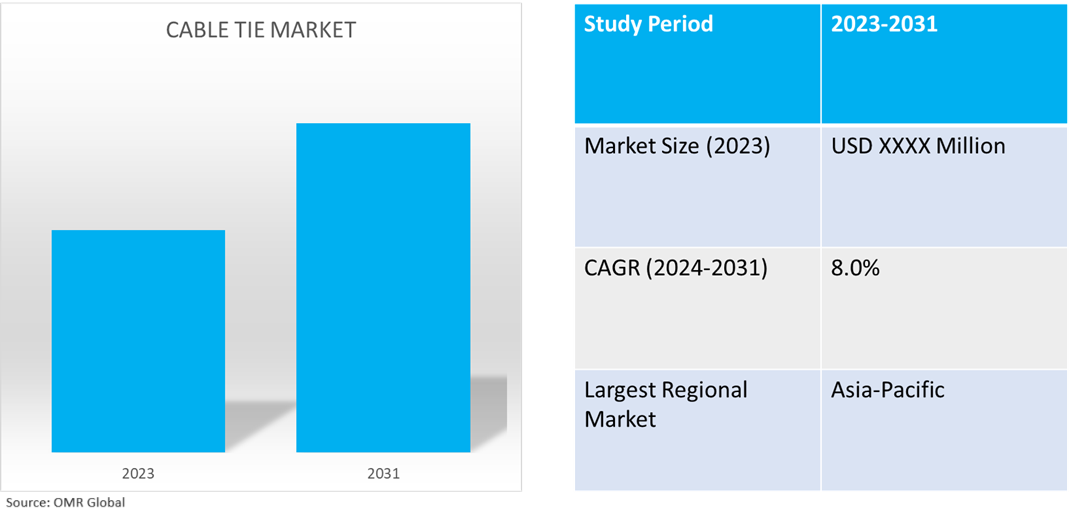

Cable tie market is anticipated to grow at a CAGR of 8.0% during the forecast period (2024-2031). The cable tie market involves the production and distribution of versatile fastening solutions used to secure and organize cables, wires, and other items. The market growth can be attributed to factors such as the expansion of infrastructure projects, a rise in maintenance, repair, and operations activities, and growing demand from other end-user industries such as automotive and electronics. Additionally, the market is expected to be positively influenced by an industrial shift towards eco-friendly or sustainable cable ties, demand for specialty chemical ties, and advancements in cable tie material technology.

Market Dynamics

Expansion in Infrastructure Projects

The demand for cable is expected to be significantly influenced by the global expansion of infrastructure projects. Construction sites use cable ties extensively for cable and wire management, reducing the risk of tripping or entanglement. Additionally, they are used to secure tools and equipment for scaffolding structures, making the tools easily accessible and preventing them from falling. Conclusively, with increasing global requirements and investment in infrastructure projects, the cable tie market is expected to benefit. According to the Global Infrastructure Facility (GIF) Annual Highlights Report, during FY22, the GIF expanded its support to 25 new project activities in 21 countries, securing $19.0 million in approved funding. These projects are projected to generate over $6.0 billion in total private infrastructure investment. Furthermore, five GIF-supported projects achieved commercial close, three of which also reached financial close, resulting in an anticipated $4.8 billion in private investment mobilized. As a result, the GIF's cumulative portfolio now consists of 138 project activities in 62 countries, with 16 commercial closes, of which 9 have reached financial close, mobilizing over $6.9 billion in private capital.

Innovation in the Cable Ties

The cable tie market is continuously experiencing innovation and development in materials, products, and applications. The market has introduced a variety of new products that promote innovation while also providing extended support and application to end-user industries. These products include UV-resistant cable ties for harsh environments, as well as specialty cable ties for specific applications, among others. Conclusively, this innovation is expected to sustain and enhance the market relevance in the future. For instance, ABB's Ty-Rap and TyGenic cable ties are the industry's first two-piece cable ties that are both antimicrobial and detectable. They are over 99.0% effective against a broad spectrum of microorganisms and can be detected by X-ray, visual, and metal detection systems. These cable ties help protect against costly contamination and waste in food and beverage, pharmaceutical processing, healthcare, and hygiene-critical locations.

Segmental Outlook

- Based on material type, the market is segmented into nylon, metal, and others (fluoropolymer).

- Based on product type, the market is segmented into releasable, non-releasable, beaded, push mount, mounting holes, heat stabilized, and others (reusable and UV resistant).

- Based on application, the market is segmented into electronics and electrical, automobiles, consumer goods, construction, and others (agriculture).

Nylon Holds Major Share Based on Material Type Segment

Nylon is preferred in cable ties owing to its exceptional strength-to-weight ratio, ensuring reliable fastening without added bulk or weight. Further, the segmental preference and growth can be attributed to the diverse application capabilities of nylon, high industrial usage, and increasing demand for lightweight, durable cable tie materials that can withstand harsh environments.

Electronics & Electricals Holds Major Share Based on Application

Electronics and electrical are expected to dominate cable tie applications owing to the sector's inclination towards lightweight, non-conductive materials such as nylon, ensuring safety and reliability. Further, the segmental growth can be attributed to rising demand for electronics and electrical devices, stringent regulatory requirements for safety management, and increasing global trade for electronic devices.

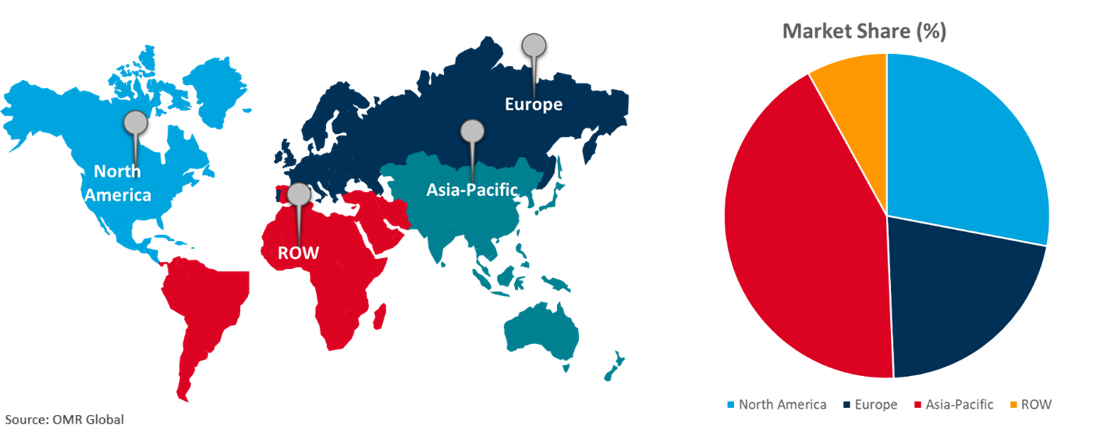

Regional Outlook

The global cable tie market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Cable Tie Market Growth by Region 2024-2031

Asia-Pacific is Estimated to Dominate the Global Cable Tie Market

Asia-Pacific is projected to dominate the cable tie market during the forecast period, attributed to the increasing investment in infrastructure projects in the region and the growing demand for cable ties from various end-user industries such as automobiles and electronics, among others. Further, rapid industrialization in countries such as India, Vietnam, and Myanmar, among others, ample trade of commodities, and wide & cost-effective availability for cable tie materials are expected to contribute to regional growth. For instance, according to IBEF India, in the Indian Interim Budget 2024-25, the capital investment outlay for infrastructure has been increased by 11.1% to $133.86 billion, which would be 3.4% of GDP. In the Interim Budget 2023-24, a capital outlay of $30.72 billion has been allocated for the Railways, marking a 5.8% increase over the previous year. Currently, 2,476 projects are in the development phase, amounting to an estimated investment of $1.9 trillion. Nearly half of the under-development projects are in the transportation sector, with 3,906 projects falling under the roads and bridges sub-sector.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global cable tie market include 3M Co., ABB Ltd., and Panduit Corp. among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in November 2022, Panduit launched a range of harsh environment and UV-resistant cable ties, the PLT4S-M6120, manufactured in resilient nylon 612 with a guaranteed 20-year life cycle. Panduit’s PLT4S-M6120 cable ties are resistant to chemical corrosion, making them ideal for harsh outdoor applications.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cable tie market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. ABB Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Panduit Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cable Tie Market by Material Type

4.1.1. Nylon

4.1.2. Metal

4.1.3. Others (Fluoropolymer)

4.2. Global Cable Tie Market by Product Type

4.2.1. Releasable

4.2.2. Non-Releasable

4.2.3. Beaded

4.2.4. Push Mount

4.2.5. Mounting holes

4.2.6. Identification

4.2.7. Heat Stabilized

4.2.8. Others (Reusable and UV Resistant)

4.3. Global Cable Tie Market by Application

4.3.1. Electronics and Electricals

4.3.2. Automobile

4.3.3. Consumer Goods

4.3.4. Construction

4.3.5. Others (Agriculture)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Advanced Cable Ties, Inc.

6.2. Acme Seals Group

6.3. All-States Inc.

6.4. Avery Dennison Corp.

6.5. BAND-IT-IDEX, Inc.

6.6. Changhong Plastics Group Imperial Plastics Co., Ltd.

6.7. HellermannTyton Pvt. Ltd.

6.8. Hoods Corp.

6.9. H.W.Eckhardt Corp.

6.10. Kai Suh Suh Enterprise Co., Ltd. (KSS)

6.11. Nelco Products

6.12. NORMA Group

6.13. Novoflex Industries Pvt. Ltd.

6.14. Partex Marking Systems

6.15. SapiSelco s.r.l.

6.16. Surelock Plastics Pvt. Ltd.

6.17. YueQing Bontley Electric Co., Ltd.