Cancer Screening Market

Global Cancer Screening Market Size, Share, and Trends Analysis Report, by Screening Type (Diagnostic Imaging Tests, Biopsy & Cytology Tests, Tumor Biomarkers, and Others), and By Application (Breast Cancer, Lung Cancer, Cervical Cancer, Kidney Cancer, Liver Cancer, Pancreatic Cancer, Ovarian Cancer, and Others), Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global cancer screening market is anticipated to grow at a CAGR of 10.0% during the forecast period. The rising prevalence of cancer is the major factor behind the rising demand for cancer screening globally. The awareness programs initiated by governments across the globe for early diagnosis and treatment of cancer are also supporting the growth of the market. For instance, in November 2018, the European Commission announced the availability of the European Commission Initiative on Breast Cancer (ECIBC) recommendations about breast cancer imaging and diagnosis. The ECIBC develops the European Breast Guidelines, evidence-based references to provide women and healthcare providers with bright, objective, and individualistic guidance on breast cancer screening and diagnosis.

However, the high cost associated with the cancer screening types may hamper the growth of the market in developing countries due to the lower disposable income. This report will further analyze all the primary and secondary factors that are directly or indirectly influencing the growth of the cancer screening market during the forecast period.

Diagnosis and treatment of several patients with different disorders were postponed during the COVID-19 crisis as hospital beds were reserved for COVID-19 patients. Due to this reason the market players had reported a significant decline during the COVID-19 pandemic. However, as the situation got normalized the market had bounced back to its pre-COVID-19 pandemic level.

Segmental Outlook

The global cancer screening market is segmented based on the screening type and application. Based on the screening type, the market is segmented into diagnostic imaging tests, biopsy & cytology tests, tumor biomarkers, and others. Among these screening types, diagnostic imaging tests hold the major share in the market, as it is an initial level for the test performed on any patients having cancer symptoms. Moreover, it is a more economical type of screening test as compared to other screening types.

Based on the application, the market is sub-segmented into breast cancer, lung cancer, cervical cancer, kidney cancer, liver cancer, pancreatic cancer, ovarian cancer, and others. Breast cancer holds a considerable share in the market as it is the most frequent cancer among women across the globe. According to the Breast Cancer Foundation Organization, in 2020, there were over 684,996 mortality from breast cancer. Survival rates of breast cancer are high if the cancer is diagnosed at an early stage, however 80% of the breast cancers are diagnosed at an advanced stage. Thus, various foundations are supporting breast cancer-specific initiatives including The Breast Cancer Research Foundation. In October 2020, The Breast Cancer Foundation announced that it is funding $40 million for breast cancer research from 2020-to 2021. Additionally, BCRF’s 40% grants are for Metastatic breast cancer which funded 88 projects in 2020. These factors are driving the growth of this segment in the market.

Regional Outlooks

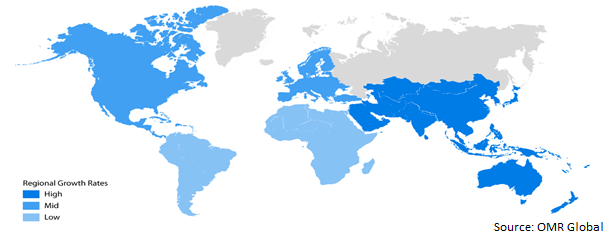

The global cancer screening market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, and Others), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Cancer Screening Market Growth by Region, 2022-2028

The North American Region Holds the Major Share in the Global Cancer Screening Market

The North American region holds the major share in the global cancer screening market due to significantly high healthcare spending. The US spends almost 17.7% of GDP on healthcare expenditure, whereas Canada spends 15.2% of GDP on healthcare as per Organization for Economic Co-operation and Development (OECD, 2019). Moreover, the market is also growing due to the rising prevalence of cancer cases in this region. According to Globocan, 2.5 million new cancer cases were registered in this region in 2020 with 699.3 thousand mortalities caused. Prostate cancer was the most prevalent type of cancer with a share of 17.5% of the total new cancer cases registered in 2020.

Market Players Outlook

The major companies serving the global cancer screening market include Abbott Laboratories Inc., F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., GE Healthcare, Hologic Inc., Illumina Inc., Bio-Rad Laboratories Inc., Agilent Technologies Inc., and Cancer Diagnostic Inc., among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance-

• In January 2021, C4 Imaging LLC announced that Soray Medical, Inc. received the US Food and Drug Administration (FDA) 510(k) clearance for the use of C4 Imaging’s Sirius positive-signal MRI (Magnetic Resonance Imaging) markers with Isoray’s Cesium-131 brachytherapy seeds.

• In April 2021, Hologic inc. announced the acquisition of Mobidiag, a molecular diagnostics company with multiplex technology, for $795 million.

• In May 2021, GE Healthcare acquired Zionexa for its PET imaging agent used in the biopsy of metastatic breast cancer.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cancer screening market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Cancer Screening Market

• Recovery Scenario of Global Cancer Screening Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Abbott Laboratories Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Agilent Technologies Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. F. Hoffmann-La Roche Ltd.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. GE Healthcare

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Thermo Fisher Scientific Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Cancer Screening Market by Screening Type

4.1.1. Diagnostic Imaging Tests

4.1.2. Biopsy & Cytology Tests

4.1.3. Tumor Biomarkers

4.1.4. Others

4.2. Global Cancer Screening Market by Application

4.2.1. Breast Cancer

4.2.2. Lung Cancer

4.2.3. Cervical Cancer

4.2.4. Kidney Cancer

4.2.5. Liver Cancer

4.2.6. Pancreatic Cancer

4.2.7. Ovarian Cancer

4.2.8. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Becton, Dickinson, and Co.

6.2. Bio-Rad Laboratories Inc.

6.3. Cancer Diagnostic Inc.

6.4. DiaSorin S.p.A.

6.5. Epigenomics AG

6.6. Hologic Inc.

6.7. Illumina Inc.

6.8. MedGenome Labs Ltd.

6.9. Positive Biosciences Ltd.

6.10. QIAGEN GmbH

6.11. Siemens Healthineers AG

6.12. Techlab, Inc.

6.13. VolitionRX Ltd.

6.14. 20/20 GeneSystems

1. GLOBAL CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY SCREENING TYPE, 2021-2028 ($ MILLION)

2. GLOBAL DIAGNOSTIC IMAGING TESTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL BIOPSY & CYTOLOGY TESTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL TUMOR BIOMARKERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL OTHER SCREENING TYPE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

7. GLOBAL BREAST CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL LUNG CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL CERVICAL CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL KIDNEY CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL LIVER CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

12. GLOBAL PANCREATIC CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL OVARIAN CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

14. GLOBAL OTHER CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY SCREENING TYPE, 2021-2028 ($ MILLION)

17. NORTH AMERICAN CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. EUROPEAN CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. EUROPEAN CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY SCREENING TYPE, 2021-2028 ($ MILLION)

20. EUROPEAN CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY SCREENING TYPE, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

24. REST OF THE WORLD CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. REST OF THE WORLD CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY SCREENING TYPE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL CANCER SCREENING MARKET SHARE BY SCREENING TYPE, 2021 VS 2028 (%)

2. GLOBAL DIAGNOSTIC IMAGING TESTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL BIOPSY & CYTOLOGY TESTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL TUMOR BIOMARKERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL OTHER CANCER SCREENING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL CANCER SCREENING MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

7. GLOBAL BREAST CANCER SCREENING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL LUNG CANCER SCREENING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL CERVICAL CANCER SCREENING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL LIVER CANCER SCREENING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL PANCREATIC CANCER SCREENING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL OVARIAN CANCER SCREENING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL OTHER CANCER SCREENING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL CANCER SCREENING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. US CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

17. UK CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF EUROPE CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF ASIA-PACIFIC CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD CANCER SCREENING MARKET SIZE, 2021-2028 ($ MILLION)