Cannabis Testing Market

Global Cannabis Testing Market Size, Share & Trends Analysis Report By Products (Instruments, Consumables, and Software), By Test Type (Potency Testing, Terpene Profiling, Heavy Metal Testing, Pesticide Screening, Microscopy Testing, Residual Solvent Screening, and Others)by End-User (Laboratories, Cannabis Cultivators/Growers, Cannabis Drug Manufacturers, and Others) Forecast Period (2021-2027) Update Available - Forecast 2025-2035

The global Cannabis testing market is anticipated to grow at a considerable CAGR of around 10.2 % during the forecast period. The rising need for cannabis cultivators for testing and quality control of hemp products is augmenting the growth of cannabis laboratories. Several organizations are providing accreditation to laboratories that perform analytical testing of cannabis products. Additionally, cannabis product testing is required for demonstrating the safety and efficacy of products and the increasing number of cannabis testing will force a number of laboratories that are providing cannabis testing services. For instance, In March 2020, Digipath, Inc. has received a Research and Development license to cultivate cannabis via an approval provided by Health Canada to the Company’s recently acquired VSSL Enterprises Ltd. The license will enable the company to cultivate cannabis at three field sites with 2000 plants, and one lab in that by tissue culture genetics can be grown. Thestrong government support for the legalization of medical marijuana in Latin America and Middle East and Africa is projected to offer new growth opportunity to the market during the forecast period

Impact of COVID-19 Pandemic on Global Cannabis Testing Market

The pharmaceutical and life science industry has been impacted by COVID-19 and also certain segments of instruments, consumables, and reagents are also impacted due to low demand. For instance, in April 2020, as per the article published by The Science Advisory Board across the globe overall 48% of labs were shut down or running at reduced capacity. Additionally, the labs that were fully or partially operating were majorly working on COVID-19 testing instead of carrying out the usual operation, due to the shutting down of research institutes and testing laboratories there was a decline in the number of tests performed in laboratories. For instance, in March 2020, as per the data revealed by MJBizDaily, cannabis labs that were federally regulated in Canada were supporting COVID-19 testing, that has affected the number of cannabis tests performed in labs.

Segmental Outlook

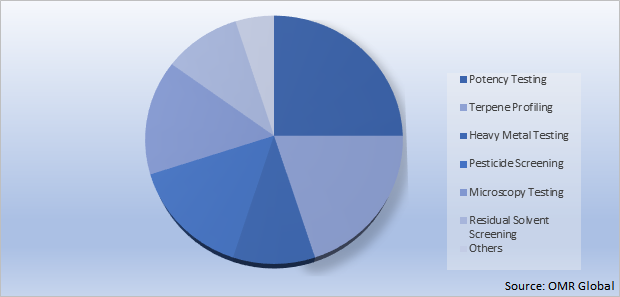

The global cannabis testing market is segmented based on the products, test type, and end-user. Based on the products, the market is segmented into instruments, consumables, and software. Based on the test type, the market is sub-segmented into potency testing, terpene profiling, heavy metal testing, pesticide screening, microscopy testing, residual solvent screening, and others. Based on the end-user, the market is sub-segmented into laboratories, cannabis cultivators/growers, cannabis drug manufacturers, and others. Among end-user segment, cannabis cultivators/growers sub-segment to expected to grow high due to enormous testing of cannabis products for their usage in both medicinal and recreational uses and also patient safety will further accelerate the expansion of the cannabis growers/cultivatorssub segment.

Global Cannabis Testing Market Share by Test Type, 2020 (%)

The Potency Testing Segment is Dominating in the Global Cannabis Testing Market.

Potency testing services are dominating due to the increase in usage of effective potencies testing techniques such as Gas Chromatography and High-Performance Liquid Chromatography (HPLC) for testing various samples and increasing demand for the potency of various cannabinoids particularly CBD (Cannabidiol) and Tetrahydrocannabinol (THC) in all the cultivated cannabis. In between 2015 and 2018 research was conducted by researchers at Suez Canal University in Egypt and the result given in 2019, researchers studied widely used cannabis analytical techniques and these techniques ranged from liquid chromatography (LC) to gas chromatography (GC) among others. For instance, In June 2019, Purpl Scientific launched its portable cannabis potency testing solution to across the globe. The potency testing solution named Puepl PRO, that solution brings unprecedented mobility, insight, and limitless lab-accurate THC and CBD tests.

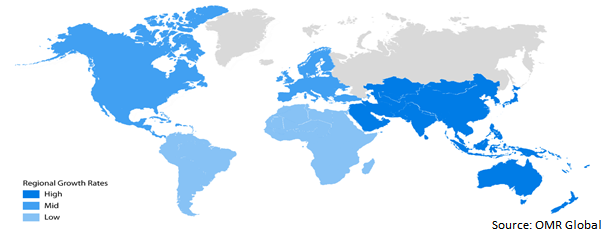

Regional Outlooks

The global cannabis testing market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). North America is dominating due to the will established biopharmaceutical industry and the presence of major players operating in the cannabis testing market.

Global Cannabis Testing Market Growth, by Region 2021-2027

The Asia-Pacific Region Holds the Major Share in the Global Cannabis Testing Market.

Cannabis to heal patients of several diseases such as chronic neuropathic pain, and any spinal injury and also help to deal with anorexia in HIV AIDS, that are a major challenge in this region. Additionally, growing awareness about drug testing and reduction in prices is a major factor that is propelling the cannabis testing market to grow in the region. Moreover, the increase in the biopharmaceutical industry, rising investments by pharmaceutical and biotechnology companies also growing life science research, and the growing number of cannabis testing laboratories that is coupled with the legalization of cannabis for medical use, and is expected to drive market growth in this in the Asia Pacific. For instance, in March 2021, the Chief Minister of Himachal Pradesh announced new policies to allow the cultivation of cannabis for medicinal and industrial use that will boost the local economy. Moreover, the state government of Tripura, has formed an expert panel to legalize cannabis cultivation.

Market Players Outlook

The major companies serving the global cannabis testing market are Agilent Technologies, Inc., CannaSafe, Merck KGaA, PerkinElmer Inc., Restek Corp., SC Laboratories Inc., Shimadzu Corp, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, In July 2020, Agilent Technologies Inc. launched a solution in fast-growing cannabis and hemp testing. Moreover, the cannabis and hemp potency kit and the cannabis pesticide and mycotoxin Kit, offer to test labs simple and effective solutions to help them get up and run quickly. Cannabis solutions are intended to be used for cannabis quality control and safety testing in laboratories.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cannabis testing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Cannabis Testing Market

• Recovery Scenario of Global Cannabis Testing Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Agilent Technologies, Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Merck KGaA

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. PerkinElmer Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Thermo Fisher Scientific

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. DigiPath, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Cannabis Testing Market by By-Products

4.1.1. Instruments

4.1.2. Consumables

4.1.3. Software

4.2. Global Cannabis Testing Market by Test Type

4.2.1. Potency Testing

4.2.2. Terpene Profiling

4.2.3. Heavy Metal Testing

4.2.4. Pesticide Screening

4.2.5. Microscopy Testing

4.2.6. Residual Solvent Screening

4.2.7. Others

4.3. Global Cannabis Testing Market by End-User

4.3.1. Laboratories

4.3.2. Cannabis Cultivators/Growers

4.3.3. Cannabis Drug Manufacturers

4.3.4. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AB SCIEX, LLC

6.2. Accelerated Technology Laboratories, Inc.

6.3. Anresco Laboratories

6.4. Aurora Cannabis Inc.

6.5. Aurum Labs

6.6. CannaSafe

6.7. Cw Analytical Laboratories

6.8. Digipath Inc.

6.9. Encore Labs LLC,

6.10. EVIO Inc.

6.11. GREEN LEAF LAB

6.12. LabLynx, Inc.

6.13. PhytoVista Laboratories

6.14. Pure Analytics LLC

6.15. Sartorius AG

6.16. SC Laboratories, Inc.

6.17. Steep Hill, Inc.

6.18. Saskatchewan Research Council (SRC)

6.19. Thermo Fisher Scientific Inc.

6.20. WATERS CORP.

1. GLOBAL CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

2. GLOBAL CANNABIS TESTING IN INSTRUMENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL CANNABIS TESTING IN CONSUMABLE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL CANNABIS TESTING IN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2020-2027 ($ MILLION)

6. GLOBAL POTENCY CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL TERPENE PROFILING CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL HEAVY METAL CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL PESTICIDE SCREENING CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL MICROSCOPY CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL RESIDUAL SOLVENT SCREENING CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)\

12. GLOBAL OTHER CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION

13. GLOBAL CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

14. GLOBAL CANNABIS TESTING FOR LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL CANNABIS TESTING FOR CANNABIS CULTIVATORS/GROWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL CANNABIS TESTING FOR CANNABIS DRUG MANUFACTURERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL CANNABIS TESTING FOR OTHER END-USERSMARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

18. GLOBAL CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

19. NORTH AMERICAN CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. NORTH AMERICAN CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

21. NORTH AMERICAN CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2020-2027 ($ MILLION)

22. NORTH AMERICAN CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

23. EUROPEAN CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. EUROPEAN CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

25. EUROPEAN CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2020-2027 ($ MILLION)

26. EUROPEAN CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

27. ASIA-PACIFIC CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2020-2027 ($ MILLION)

30. ASIA-PACIFIC CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

31. REST OF THE WORLD CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

32. REST OF THE WORLD CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

33. REST OF THE WORLD CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2020-2027 ($ MILLION)

34. REST OF THE WORLD CANNABIS TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL CANNABIS TESTING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL CANNABIS TESTING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL CANNABIS TESTING MARKET, 2021-2027 (%)

4. GLOBAL CANNABIS TESTING MARKET SHARE BYPRODUCTS, 2020 VS 2027 (%)

5. GLOBAL CANNABIS TESTING IN INSTRUMENTAL MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL CANNABIS TESTING IN CONSUMABLES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL CANNABIS TESTING IN SOFTWARE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL CANNABIS TESTING MARKET SHARE BY TEST TYPE, 2020 VS 2027 (%)

9. GLOBAL POTENCY CANNABIS TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL TERPENE PROFILING CANNABIS TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL HEAVY METAL CANNABIS TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL PESTICIDE SCREENING CANNABIS TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL MICROSCOPY CANNABIS TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL RESIDUAL SOLVENT SCREENING CANNABIS TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL OTHER CANNABIS TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL CANNABIS TESTING MARKET SHARE BY END-USER, 2020 VS 2027 (%)

17. GLOBAL CANNABIS TESTING FOR LABORATORIES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. GLOBAL CANNABIS TESTING FOR CANNABIS CULTIVATORS/GROWERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

19. GLOBAL CANNABIS TESTING FOR CANNABIS DRUG MANUFACTURERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

20. GLOBAL CANNABIS TESTING FOR OTHER END-USERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

21. GLOBAL CANNABIS TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

22. US CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

23. CANADA CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

24. UK CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

25. FRANCE CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

26. GERMANY CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

27. ITALY CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

28. SPAIN CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF EUROPE CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

30. INDIA CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

31. CHINA CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

32. JAPAN CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

33. SOUTH KOREA CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

34. REST OF ASIA-PACIFIC CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)

35. REST OF THE WORLD CANNABIS TESTING MARKET SIZE, 2020-2027 ($ MILLION)