Canned Tuna Market

Canned Tuna Market Size, Share & Trends Analysis Report by Product Type (Skipjack and Yellowfin), and by Distribution Channel (Hypermarket & Supermarket, Specialty Stores, and Online) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Canned tuna market is anticipated to grow at a considerable CAGR of 4.5% during the forecast period. The canned tuna industry is predicted to be significantly impacted by changing customer tastes for seafood in various cuisines due to its abundance in vital proteins, vitamins, and minerals. Many brands are now offering tuna that has been responsibly caught and produced, which appeals to environmentally conscious consumers. Wild Planet Tuna, American Tuna, and Ocean Naturals are some brands that offer sustainable caught tuna in can forms. More consumers are becoming aware of the impact that their food choices have on the environment, and they are seeking out products that are responsibly sourced and produced.

According to the statistics provided by the FAO Fisheries and Aquaculture Department, Thailand, Ecuador, China, Indonesia, and Philippines were the largest exporter of canned and processed tuna. Additionally, the European Union, the US and Japan are the largest consumers of canned tuna. As more people lead busy lifestyles and look for quick and easy meal solutions, canned tuna is likely to remain a popular choice. Canned tuna offered health benefits has made it a preferred food product for athletes. For instance, in May 2023, SolTuna had become the official supplier of canned tuna for the Pacific Games. The $60,000 deal equates to approximately 1,400 cartons of tuna at the Games. This is expected to help feed 5,000 athletes and officials and 3,000 Games workers during Solomon Islands 2023.

In March 2023, Dutch brand Seasogood has launched its plant-based canned tuna alternatives on the Spanish market. The tuna will be available in four flavors: natural, tomato, olive oil, and lemon & black pepper. The launch is significant as Spain is a major consumer of seafood. Such launches are anticipated to restrain the growth of the global canned tuna market.

Segmental Outlook

The global canned tuna market is segmented based on product type and distribution channel. Based on product type, the market is bifurcated into skipjack and yellowfin. Based on distribution channel, the market is sub-segmented into hypermarket & supermarket, specialty stores, and online.

Hypermarket & Supermarket Sub-Segment to Hold a Prominent Share of the Global Canned Tuna Market

Among the distribution channel, the hypermarket and supermarket sub-segment is expected to hold a significant market share over the past few years. The large scale promotion of major canned tuna product through offline retail stores such as hypermarkets & supermarkets is a key contributor to the high share of this market segment. Moreover, several companies are opening new brick & mortar stores across the globe to expand their customer base. For instance, Target Brands, Inc. opened over 25 new stores across the US in 2020. The growing number of offline stores to drive the market segment.

Regional Outlooks

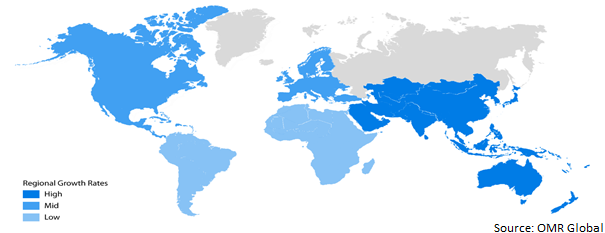

The global canned tuna market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Central and South America is set to witness the highest CAGR during the forecast period. Skipjack tuna fishing in Brazil has traditionally carried using the one-by-one method, with operating bases in Rio-de-Janeiro, Santa Catarina, and Rio Grande do Sul, which is also the locations of the biggest tuna canneries and export businesses in the nation.

Global Canned Tuna Market Growth, by Region 2023-2030

European Region is Expected to Hold a Considerable Share of the Global Canned Tuna Market

Among all the regions, the European region is expected to hold a considerable share of the canned tuna market across the globe. The regional market share is driven by the increasing adoption of simple, ready-to-eat, and convenient seafood choices by consumers across the globe. According to European Union (EU) journal, in 2021, tuna was the most consumed fish in the EU. Each person in the region on an average consumes 2.78 kilograms of tuna, most of which is canned. Some of the biggest consumers of tinned tuna in the area includes Italy, Spain, and the UK. These trends are further contributing to the regional market.

Market Players Outlook

The major companies serving the global canned tuna market include Frinsa del Noroeste S.A., Thai Union Group PCL, Bumble Bee Foods LLC, Century Pacific Food Inc., and Jealsa Corp. among others. The market players are contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in October 2021, Bumble Bee Foods LLC extended its Bumble Bee Prime line of gourmet canned tuna and salmon products. The Prime Solid White Albacore in Water is wild-caught tuna made from firm, white, premium albacore tuna, water, and sea salt. It contains 30-32 grams of protein per serving.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global canned tuna market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Jealsa Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Ocean Brands

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Thai Union Group Plc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Canned Tuna Market by Product Type

4.1.1. Skipjack

4.1.2. Yellowfin

4.2. Global Canned Tuna Market by Distribution Channel

4.2.1. Hypermarket & Supermarket

4.2.2. Specialty Stores

4.2.3. Online

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. American Tuna Inc.

6.2. Bumble Bee Foods LLC

6.3. Century Pacific Food Inc.

6.4. Frinsa del Noroeste S.A.

6.5. Grupo Calvo

6.6. Jealsa Corp.

6.7. Ocean Brands

6.8. PT. Aneka Tuna Indonesia

6.9. Thai Union Group PLC

6.10. Wild Planet Foods Inc.

1. GLOBAL CANNED TUNA MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

2. GLOBAL CANNED SKIPJACK MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL CANNED YELLOWFIN MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL CANNED TUNA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

5. GLOBAL CANNED TUNA IN HYPERMARKET & SUPERMARKET MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL CANNED TUNA IN SPECIALTY STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL CANNED TUNA IN ONLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL CANNED TUNA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. NORTH AMERICAN CANNED TUNA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

10. NORTH AMERICAN CANNED TUNA MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

11. NORTH AMERICAN CANNED TUNA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

12. EUROPEAN CANNED TUNA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

13. EUROPEAN CANNED TUNA MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

14. EUROPEAN CANNED TUNA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

15. ASIA-PACIFIC CANNED TUNA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC CANNED TUNA MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC CANNED TUNA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

18. REST OF THE WORLD CANNED TUNA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. REST OF THE WORLD CANNED TUNA MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

20. REST OF THE WORLD CANNED TUNA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

1. GLOBAL CANNED TUNA MARKET SHARE BY PRODUCT TYPE, 2022 VS 2030 (%)

2. GLOBAL CANNED SKIPJACK MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL CANNED YELLOWFIN MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL CANNED TUNA MARKET SHARE BY DISTRIBUTION CHANNEL, 2022 VS 2030 (%)

5. GLOBAL CANNED TUNA IN HYPERMARKET & SUPERMARKET MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL CANNED TUNA IN SPECIALTY STORES MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL CANNED TUNA IN ONLINE MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL CANNED TUNA MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. US CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

10. CANADA CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

11. UK CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

12. FRANCE CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

13. GERMANY CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

14. ITALY CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

15. SPAIN CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

16. REST OF EUROPE CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

17. INDIA CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

18. CHINA CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

19. JAPAN CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

20. SOUTH KOREA CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF ASIA-PACIFIC CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF THE WORLD CANNED TUNA MARKET SIZE, 2022-2030 ($ MILLION)