Caprolactam Market

Caprolactam Market Size, Share & Trends Analysis Report by Raw Materials (Phenol, Cyclohexane, and Toluene), by Product (Nylon 6 Resins and Nylon 6 Fibers),by Application (Engineering Resins and Films, Industrial Yarns, Textiles and Carpets, and Others)Forecast Period (2024-2031)

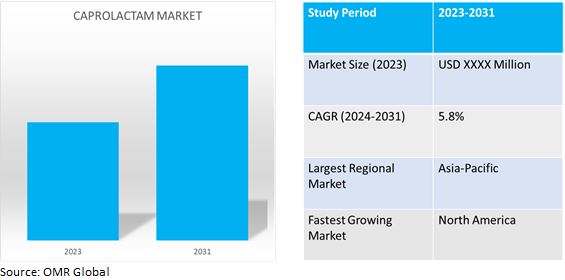

Caprolactam market is anticipated to grow at a considerable CAGR of 5.8% during the forecast period (2024-2031). Caprolactum is a type of an organic compound which is used in the manufacturing of nylon 6 fibre and resins. As a result of its superior elasticity, tensile strength, chemical and oil resistance and low moisture absorbency nylon 6 resin and nylon 6 fibres have augmented their demand in the textile and automotive industry.

Market Dynamics

Growing textile industry

There has been a growing demand for high-quality textiles that are used in the manufacturing of clothing, sports wears, and carpets, among other things in the textile industry. The domestic apparel & textile industry in India contributes approx. 2.3 % to the country’s GDP, 13.0% to industrial production and 12.0% to exports. India has a 4.0% share of the global trade in textiles and apparel. Additionally, in India, 100 percent foreign direct investment (FDI) is allowed in textiles, which is expected to propel regional market growth over the forecast period. Caprolactam is used extensively in the textile industry due to its high tensile strength and superior abrasion and chemical resistance. Thus, the growing textile industry is anticipated to drive the growth of the global market.

Surging demand for sustainable and bio-based products

Surging demand for sustainable & bio based cloths is promoting manufacturers to different strategic moves to produce bio-based caprolactam. For instance, in May 2018, Genomatica and Aquafil have declared the formation of Project EFFECTIVE. This is a multi-company collaboration to create more sustainable plastics and fibers for commercial usage by utilizing bio-based technologies and renewable feedstocks. One of the main goal of Project EFFECTIVE is to produce more sustainable nylon from bio-based caprolactam. Thus, the surging demand for sustainable and bio-based products is anticipated to drive the market growth rate

Market Segmentation

Our in-depth analysis of the global caprolactam market includes the following segments by raw materials, product, application and end-use industry:

- Based on raw material, the market is sub-segmented into phenol, cyclohexane, and toluene.

- Based on product, the market is bifurcated into nylon 6 resins and nylon 6 fibers.

- Based on application, the market is augmented into engineering resins and films, industrial yarns, and textiles and carpets.

Nylon 6 Fibers is Projected to Emerge as the Largest Segment

Based on the product, the global caprolactam market is sub-segmented into nylon 6 resins and nylon 6 fibers. Among these, the nylon 6 fibers sub-segment is expected to hold the largest share of the market. It is expected to grow at a healthy CAGR during the forecast period. Nylon 6 fibers are manufactured using caprolactam derived from ammonia, sulfuric acid, and a few other chemicals. In addition to toothbrushes, raincoats, sportswear, bedsheets, curtains, racket strings, threads, ropes, and sleeping bags, Nylon 6 fibers are utilized in a variety of applications.

Textile Sub-segment to Hold a Considerable Market Share

The textile segment holds a considerable market share and is expected to grow at a considerable CAGR during the forecast period. Textile yarn is widely utilized in a variety of applications, including clothing and home furnishings. In the coming years, the increasing demand for textile yarn and the usage of nylon 6 fibers in bedspreads, carpets, upholstery, and curtains are anticipated to drive the growth of this market segment.

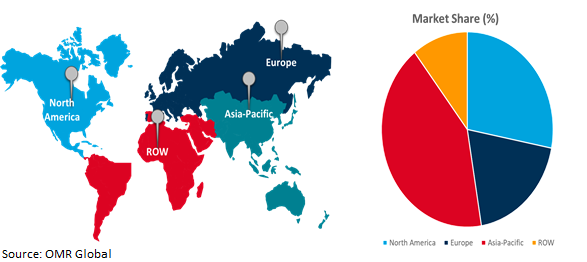

Regional Outlook

The global caprolactam market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America). The North American region is anticipated to experience substantial growth in the global market over the forecast period due to the region's strong manufacturing base and advanced technological capabilities, particularly in industries such as automotive, aerospace, and electronics, which are significant consumers of caprolactam-derived products. Additionally, the increasing investments in infrastructure development, particularly in the construction sector, are expected to drive demand for nylon 6-based materials such as carpets, flooring, and insulation.

Global Caprolactam Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share in the global caprolactam market due to the presence of emerging economies such as China, South Korea, and India, which collectively drive significant demand for caprolactam-based products across various industries. Rapid industrialization, urbanization, and infrastructure development in these countries have spurred demand for nylon 6, a major derivative of caprolactam, in sectors such as automotive manufacturing, textiles, and electronics. Moreover, Asia Pacific region benefits from a robust manufacturing base and extensive supply chain networks, enabling efficient production and distribution of caprolactam and its derivatives.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global caprolactam market includeBASF SE, China Petrochemical Development Corp., Fibrant, and UBE Corp., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in December 2023, NACAG, an organization in the chemical industry, has taken a significant step towards mitigating N2O emissions in caprolactam production. The company has embraced abetment technology, and the first measures have been taken in Thailand. NACAG has expanded its scope by offering technical cooperation and financial mechanisms to caprolactam production.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global caprolactam market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BASF SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. China Petrochemical Development Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Fibrant

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. UBE Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Caprolactam Market by Raw Materials

4.1.1. Phenol

4.1.2. Cyclohexane

4.1.3. Toluene

4.2. Global Caprolactam Market by Product

4.2.1. Nylon 6 Resins

4.2.2. Nylon 6 Fibers

4.3. Global Caprolactam Market by Application

4.3.1. Engineering Resins and Films

4.3.2. Industrial Yarns

4.3.3. Textiles and Carpets

4.3.4. Other Applications

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. AdvanSix Inc.

6.2. Alpek S.A.B. de CV

6.3. Capro Co.

6.4. China Petroleum & Chemical Corp (Sinopec)

6.5. Domo Chemicals

6.6. Fertilisers And Chemicals Travancore Ltd (FACT)

6.7. Fujian Jinjiang Petrochemical

6.8. GrupaAzot

6.9. Gujarat State Fertilizers & Chemicals Ltd

6.10. Highsun Group

6.11. Juhua Group Corp.

6.12. Lanxess

6.13. Luxi Chemical Group Co. Ltd.

6.14. PJSC Kuibyshevazot

6.15. Shandong Haili Chemical Industry Co. Ltd

6.16. Spolana Sumitomo Chemical Co. Ltd.

6.17. Sumitomo Chemical Co. Ltd

6.18. The Aquafil Group

6.19. Toray Industries Inc.

6.20. Xuyang Group

6.21. Zhejiang Hengyi Group Co. Ltd

1. GLOBAL CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2023-2031 ($ MILLION)

2. GLOBAL PHENOL CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CYCLOHEXANE CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL TOLUENE CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

6. GLOBAL NYLON 6 RESINS CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL NYLON 6 FIBERS CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL CAPROLACTAM MARKET FOR ENGINEERING RESINS AND FILMS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CAPROLACTAM MARKET FOR INDUSTRIAL YARNS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CAPROLACTAM MARKET FOR TEXTILES AND CARPETS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

16. NORTH AMERICAN CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. EUROPEAN CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2023-2031 ($ MILLION)

19. EUROPEAN CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. EUROPEAN CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2023-2031 ($ MILLION)

27. REST OF THE WORLD CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

28. REST OF THE WORLD CAPROLACTAM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL CAPROLACTAM MARKET SHARE BY RAW MATERIALS, 2023 VS 2031 (%)

2. GLOBAL PHENOL CAPROLACTAM MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CYCLOHEXANE CAPROLACTAM MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL TOLUENE CAPROLACTAM MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL CAPROLACTAM MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

6. GLOBAL NYLON 6 RESINS CAPROLACTAM MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL NYLON 6 FIBERS CAPROLACTAM MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CAPROLACTAM MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CAPROLACTAM FOR ENGINEERING RESINS AND FILMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CAPROLACTAM FOR INDUSTRIAL YARNS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CAPROLACTAM FOR TEXTILES AND CARPETS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CAPROLACTAM MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

15. UK CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICACAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA CAPROLACTAM MARKET SIZE, 2023-2031 ($ MILLION)