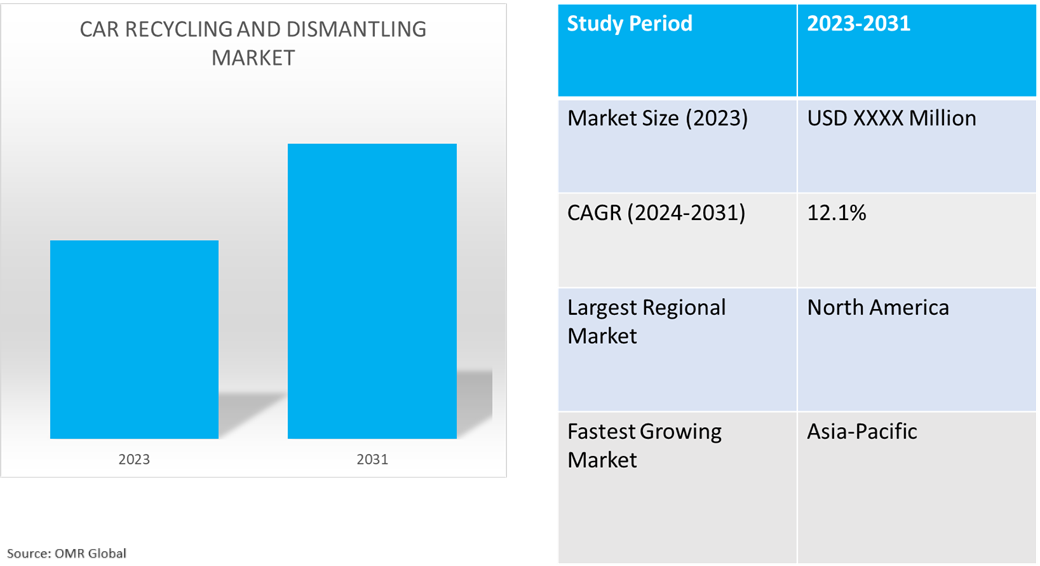

Car Recycling and Dismantling Market

Car Recycling and Dismantling Market Size, Share & Trends Analysis Report by Type (Disassembly and Recycling and Layered Utilization), and Application (Traditional Fuel Vehicle Recycling and Dismantling and New Energy Vehicle Recycling and Dismantling) Forecast Period (2024-2031)

Car recycling and dismantling market is anticipated to grow at a significant CAGR of 12.1% during the forecast period (2024-2031). The market growth is attributed to increasing economic and environmental benefits in recovering materials from End-Of-Life Vehicles (ELVs), and remanufacturing of Waste Steel Sheets (WSS) from ELVs into useful Mesh Steel Sheets (MSS) for metal forming applications drive the growth of the market. According to the World Steel Association AISBL, the average recycling rate for steel and iron in cars is about 90.0%. Each year, the steel industry recycles more than 14 million tons of steel from ELVs. This is equivalent to nearly 13.5 million automobiles. When comparing the amount of steel recycled from automobiles each year to the amount of steel used to produce new automobiles that same year, automobiles maintain a recycling rate of nearly 100.0%. By weight, the typical passenger car consists of about 65.0% steel and iron. The steel used in car bodies is made with about 25.0% recycled steel.

Market Dynamics

Increasing Demand for Automation and Robotics in the Dismantling Process

The increasing demand for efficiency and safety in the disassembly process by incorporating robotics and automated technologies is driving the market growth. Automated tools facilitate material separation, component removal, and pollution abatement. The disassembly process has become more efficient owing to technologies such as robotic arms (with cameras and sensors). These precisely identify and remove different auto parts. AI can also recognize and classify parts that are still functional, which helps the car sector with its recycling and reuse initiatives. The process of disassembling cars in wrecking yards is being altered by AI-powered robots. These robots use computer vision and machine learning algorithms to quickly detect and locate valuable components, such as electronics, engines, and gearboxes.

Growing Focus on Sustainability and Circular Economy

Growing focus on recycling and recovering materials from old cars, such as glass, plastic, and metals, to cut waste and promote a circular economy. Use of eco-friendly recycling and disassembly procedures, such as cautious handling of batteries and fluids, to reduce the negative effects on the environment. ELVs can also be an important source of secondary raw materials, such as metal and other materials, which if salvaged and/or reused/recycled, can be again fed into the economy thereby helping to close the loop of sustainable resource circulation and reducing the demand for virgin raw materials. According to the International Public Policy Association, estimates for India suggest that more than 8.7 million vehicles have reached the end-of-life phase by 2015, and this number is expected to rise to 21 million in 2025.

Market Segmentation

- Based on the type, the market is segmented into disassembly and recycling, and layered utilization.

- Based on the application, the market is segmented into traditional fuel vehicle recycling and dismantling and new energy vehicle recycling and dismantling.

Disassembly and Recycling Segment is Projected to Hold the Largest Market Share

The primary factors supporting the growth include increasing adoption of collecting, disassembly, processing, and repurposing of automotive components and end-of-life vehicles (ELVs) to minimize environmental effects and recover precious resources. Car recycling is the methodical deconstruction of old or abandoned automobiles to recover recyclable components and materials such as rubber, steel, aluminum, and copper. Following processing, sorting, and recycling, these materials are used to make automobile components, new cars, and other products, saving energy, cutting down on waste production, and conserving natural resources. As it encourages resource efficiency, sustainability, and environmental stewardship in the automobile industry, the car recycling and dismantling market is essential to the circular economy. According to the European Union, in June 2023, 5.7 million passenger cars, vans, and other light goods vehicles were scrapped in the EU in 2021. The total weight of passenger cars, vans, and other light goods vehicles scrapped in the EU in 2021 was 6.5 million tons 93.6 % of the parts and materials were reused and recovered, while 88.1 % were reused and recycled.

Traditional Fuel Vehicle Recycling and Dismantling to Hold a Considerable Market Share

The factors supporting segment growth include increasing demand for ELVs processing through disassembly, shredding, and landfill disposal. The 3R (Reduce, Reuse, and Recycle) approach is being used increasingly in the processing of ELVs, especially ELV parts, to support sustainable development. According to the National Center for Biotechnology Information (NCBI), in December 2021, currently, 1200 kt/year of waste steel sheet (WSS) from automotive bodies is generated in the US alone, which is expected to increase to ~125 kt/year by 2035 and 246 kt/year by 2050. Dismantling is the first stage of the ELV processing process. Oil, brake fluid, coolants, antifreeze, gasoline, and diesel are among the hazardous fluids that are removed and gathered in different tanks. Some can be recycled right away, while others require additional processing or even just basic filtration.

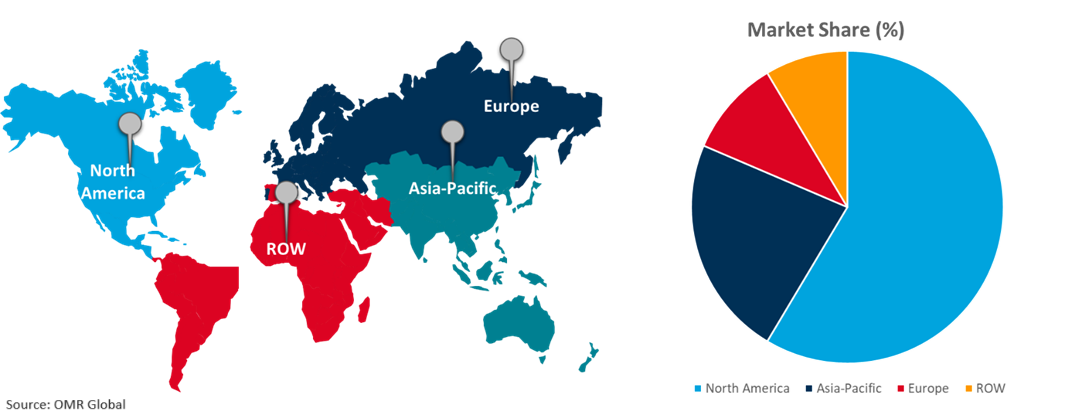

Regional Outlook

The global car recycling and dismantling market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Car Recycling and Dismantling in Asia-Pacific

The regional growth is attributed to the increasing demand for metals owing to the high quantity of metals required by manufacturers to create vehicle bodies and many other parts. According to the Economic Research Institute for ASEAN and East Asia, about 2.4 million motor vehicles have been discarded in the Association of Southeast Asian Nations (ASEAN) from 2015 to 2020. Growing Asia's global dominance in electric mobility has been driven by national efforts to implement specific policies and to remove barriers, as well as in some cases by initiatives to swap, recycle, and re-use electric vehicle batteries. According to the SLOCAT Transport and Climate Change Global Status Report, in August 2023, the electric car market in China, with 14.1 million units in 2022, was more than two times larger than the market in the European Union (5.7 million) and nearly five times that in the US (3 million).

Global Car Recycling and Dismantling Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the presence of car recycling and dismantling offering companies such as Fenix Parts, Inc., Metalico, Inc., SA Recycling LLC., and others. The market growth is attributed to the growing demand for the development of recycling solutions across all application categories increasing as the automobile industry adopts the circular economy concepts. Additionally, increasing demand for recycling electric cars is an increasingly important part of the EV battery materials supply chain. For instance, in March 2023, Ascend Elements announced the opening of its first commercial-scale lithium-ion battery recycling facility. Located in Covington, Georgia, the $50.0 million Base 1 facility is one of North America’s electric vehicle battery recycling facilities. The supply chain for EV battery materials has grown increasingly dependent on the recycling of lithium-ion batteries as the demand for electric vehicles rises.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the car recycling and dismantling market include BMW Group, European Metal Recycling Ltd., LKQ Corp., Radius Recycling, Inc. (Schnitzer Steel Industries, Inc.), and Toyota Tsusho Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In April 2023, BMW Group announced a new project with state funding that explores the circular economy in automotive manufacturing. The company is joining forces with representatives from the recycling industry, commodity processors, and the world of science to work on ways of improving the quality of secondary raw materials obtained from recycling end-of-life vehicles. The Federal Ministry for Economic Affairs and Climate Action in Germany under its ‘New Vehicle and System Technologies’ funding guidelines, the Car2Car project, secured a funding worth €6.4 million ($6.9 million). It focuses on materials such as aluminum, steel, glass, copper and plastic by the end of 2025.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global car recycling and dismantling market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BMW Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. European Metal Recycling Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. LKQ Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Radius Recycling, Inc. (Schnitzer Steel Industries, Inc.)

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Toyota Tsusho Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Car Recycling and Dismantling Market by Type

4.1.1. Disassembly and Recycling

4.1.2. Layered Utilization

4.2. Global Car Recycling and Dismantling Market by Application

4.2.1. Traditional Fuel Vehicle Recycling and Dismantling

4.2.2. New Energy Vehicle Recycling and Dismantling

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Scholz Recycling GMBH

6.2. Auto Recycling Nederland (ARN)

6.3. KEIAISHA CO., LTD.

6.4. Tata Motors Ltd.

6.5. CarTakeBack Ltd.

6.6. LIBERTY Steel Group

6.7. SA Recycling LLC

6.8. Alter Trading Corp.

6.9. Seda Environmental LLC

6.10. Fenix Parts, Inc.

6.11. GFL Environmental Inc.

6.12. Kuusakoski Recycling

6.13. Derichebourg Group

6.14. Hensel Recycling Group

6.15. Metalico, Inc.

6.16. Marubeni Tetsugen Co., Ltd.

6.17. Stena Metall AB

6.18. Rosmerta Recycling

1. Global Car Recycling and Dismantling Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Car Disassembly and Recycling Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Car Layered Utilization Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Car Recycling and Dismantling Market Research And Analysis By Application, 2023-2031 ($ Million)

5. Global Traditional Fuel Vehicle Recycling and Dismantling Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global New Energy Vehicle Recycling and Dismantling Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Car Recycling and Dismantling Market Research And Analysis By Region, 2023-2031 ($ Million)

8. North American Car Recycling and Dismantling Market Research And Analysis By Country, 2023-2031 ($ Million)

9. North American Car Recycling and Dismantling Market Research And Analysis By Type, 2023-2031 ($ Million)

10. North American Car Recycling and Dismantling Market Research And Analysis By Application, 2023-2031 ($ Million)

11. European Car Recycling and Dismantling Market Research And Analysis By Country, 2023-2031 ($ Million)

12. European Car Recycling and Dismantling Market Research And Analysis By Type, 2023-2031 ($ Million)

13. European Car Recycling and Dismantling Market Research And Analysis By Application, 2023-2031 ($ Million)

14. Asia-Pacific Car Recycling and Dismantling Market Research And Analysis By Country, 2023-2031 ($ Million)

15. Asia-Pacific Car Recycling and Dismantling Market Research And Analysis By Type, 2023-2031 ($ Million)

16. Asia-Pacific Car Recycling and Dismantling Market Research And Analysis By Application, 2023-2031 ($ Million)

17. Rest Of The World Car Recycling and Dismantling Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Rest Of The World Car Recycling and Dismantling Market Research And Analysis By Type, 2023-2031 ($ Million)

19. Rest Of The World Car Recycling and Dismantling Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Car Recycling and Dismantling Market Research And Analysis By Type, 2023 Vs 2031 (%)

2. Global Car Disassembly and Recycling Market Share By Region, 2023 Vs 2031 (%)

3. Global Car Layered Utilization Market Share By Region, 2023 Vs 2031 (%)

4. Global Car Recycling and Dismantling Market Research And Analysis By Application, 2023 Vs 2031 (%)

5. Global Traditional Fuel Vehicle Recycling and Dismantling Market Share By Region, 2023 Vs 2031 (%)

6. Global New Energy Vehicle Recycling and Dismantling Market Share By Region, 2023 Vs 2031 (%)

7. Global Car Recycling and Dismantling Market Share By Region, 2023 Vs 2031 (%)

8. US Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

9. Canada Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

10. UK Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

11. France Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

12. Germany Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

13. Italy Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

14. Spain Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

15. Rest Of Europe Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

16. India Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

17. China Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

18. Japan Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

19. South Korea Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

20. Rest Of Asia-Pacific Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

21. Rest Of The World Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

22. Latin America Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)

23. Middle East And Africa Car Recycling and Dismantling Market Size, 2023-2031 ($ Million)