Carbon Credit Trading Platform Market

Carbon Credit Trading Platform Market Size, Share & Trends Analysis Report by Type (Voluntary, and Compliance/Regulated), and by System type (Cap and Trade, and Baseline and Credit), and by End-user (Industrial, Utilities, Energy, Petrochemical, Aviation and Others) Forecast Period (2024-2031)

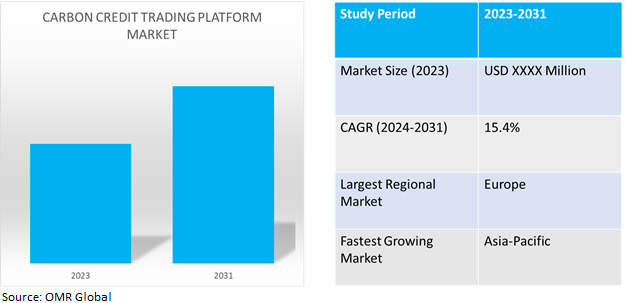

Carbon credit trading platform market is anticipated to grow at a significant CAGR of 15.4% during the forecast period (2024-2031). Carbon credit trading platforms are used by various industries aiming to reduce greenhouse gas emissions, enabling the trading of emission units (carbon credits), which are certificates representing emission reductions. Trading enables entities to reduce emissions at a lower cost and to be paid to do so by higher-cost emitters. Carbon credits are allotted to organizations based on government norms, wherein a single credit represents one ton of CO2e (or carbon dioxide equivalent) that the company is allowed to emit which can be traded to other companies as per carbon emission requirement.

Market Dynamics

Government Scrutiny and Regulations

In recent years governments globally have taken stringent measures to become carbon neutral which has positively impacted carbon trading platforms. For instance, according to the European Climate Law, the goal set out in the European Green Deal for Europe's economy and society is to become climate-neutral by 2050. The law also sets the intermediate target of reducing net greenhouse gas emissions by at least 55.0% by 2030, compared to 1990 levels. Climate neutrality by 2050 means achieving net zero greenhouse gas emissions for the EU countries, mainly by cutting emissions, investing in green technologies, and protecting the natural environment.

Moreover, the Danish parliament has recently approved a new corporate carbon tax which is reported to become the highest in Europe. Denmark has already set an ambitious target of cutting greenhouse gas emissions by 70.0% from 1990 levels by 2030.

Growing Implication of Cap Trade Systems by Governments

Since the 2015 Paris Agreement, market-based measures for carbon reduction have grown quickly, wherein, governments are using carbon tradingas a tactic to reduce emissions and compensate for excess carbon emissions caused by important industries. As per the United Nations Development Programme (UNDP) in 2023, 73 national and subnational jurisdictions account for 11.6billion tons of CO2e emissions, or around 23.0% of global greenhouse gas emissions, the EU, the UK, Sweden, and China are among them. Further, cap-and-trade schemes are one of the alternatives designed to create economic incentives for nations and companies to lessen their impact on the environment. For instance, in June 2021, China launched a national carbon Emissions Trading Scheme (ETS), expected to be the world’s largest carbon market, to curb climate change effects and to achieve the country’s goals of reaching peak emissions by 2030 and net zero emissions by 2060.

Market Segmentation

Our in-depth analysis of the global carbon credit trading platform market includes the following segments by type, system type, and end-user:

- Based on type, the market is bifurcated into voluntary, and compliance/ regulated

- Based on system type, the market is bifurcated into cap and trade, and baseline and credit.

- Based on end-user, the market is bifurcated into industrial, utilities, energy, petrochemical, aviation and others.

Compliance/Regulated to Remain as the Largest Segment

Based on the type, the regulated sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment are international treaties and agreements by governments to reduce carbon emissions and become carbon neutral. To support their agreements governments are imposing taxes, and trading systems acting positively for the carbon credit trading platform market.

Cap Trade Systems to Hold Substantial Share

Most governments are positive about adopting and implementing cap trade systems due to the system's feasibility in achieving emission reduction targets and financial benefits. Countries such as the UK, France, China, Denmark, and others have already imposed the system to achieve carbon neutrality, whereas the US and India are in the development stages for similar trade systems. Notably China, the US, and India are top emitters of carbon globally.

Utility to Emerge as the Largest Sub-segment

The utility industry provides basic everyday amenities, including natural gas, electricity, water, and power making it one of the biggest consumers of fossil fuels globally. The industry is highly dependent on coal-based fuels for its business making it one of the biggest carbon emitters globally which has led the industry to trade carbon credits to evade government action, taxes, and penalties and abide by emissions laws.

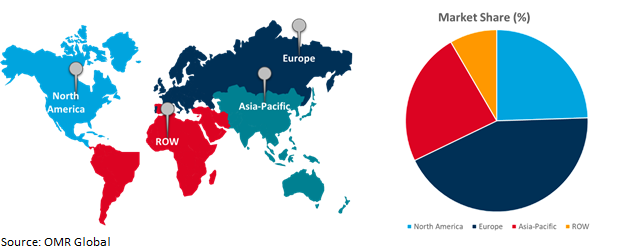

Regional Outlook

The globalcarbon credit trading platform market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia- Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Carbon Credit Trading Platform Market Growth by Region 2024-2031

Europe Holds Major Market Share in Carbon Credit Trading Platform Market

Among all the regions, Europe holds a significant share owing to pioneering efforts, stringent regulation, and one of the biggest carbon credit trading systems. The European Union has been one of the leading markets for carbon credit trading due to its plan to become carbon neutral by 2050 and other regulation abiding European Nations to reach emission reduction thresholds within stipulated years. For instance, the European emissions trading system is the world's first major carbon market and the largest one. It regulates about 40.0% of the total EU greenhouse gas emissions and covers about 10,000 power stations and manufacturing plants in the EU. To align it with the emission reduction targets of the European Green Deal, parliament approved an update of the scheme in April 2023. Reforms include cutting emissions in sectors covered by the emissions trading system to 62.0% by 2030, from 2005 levels.

Asia-Pacific Remains as the Fastest Growing Carbon Credit Trading Platform Market

- Asia is one of the biggest carbon-emitting regions globally with China on top and India on 3rd respectively, making it one of the biggest markets for carbon trading, wherein China introduced its trading platform in 2023, and India is in the development phase for a similar platform.

- China and India both being part of the Paris Agreement 2015 are rigorously working on reducing carbon emissions and becoming carbon neutral by 2050 through the implementation of taxing and trading systems respectively. Also, both countries are incentivizing domestic industries to lower carbon emissions and creating a market for carbon pricing.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global carbon credit trading platform market include Environmental Market Services Ltd (Carbon Trading Exchange), European Energy Exchange AG, NASDAQ Inc., and Climate Impact X Pte. Ltd, and CME Group Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2022 Carbonplace, the carbon credit settlement platform, and global carbon marketplace and exchange, Climate Impact X (CIX), have teamed up on a pilot to lower entry barriers for organizations seeking high-quality carbon credits on the voluntary carbon market while delivering a seamless experience for customers to discover, compare, buy, and retire credits.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global carbon credit trading platform market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Carbon Credit Trading Platform Market by Type

4.1.1. Voluntary

4.1.2. Compliance / Regulated

4.2. Global Carbon Credit Trading Platform Market by System Type

4.2.1. Cap and Trade

4.2.2. Baseline and Credit

4.3. Global Carbon Credit Trading Platform Market by End User

4.3.1. Industrial

4.3.2. Utilities

4.3.3. Energy

4.3.4. Petrochemical

4.3.5. Aviation

4.3.6. Other (Paper Industry)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AirCarbon Exchange

6.2. Aviation Carbon eXchange (ACE)

6.3. BetaCarbon Pty Ltd

6.4. Carbonplace UK Ltd.

6.5. Carbon Credit Capital, LLC.

6.6. CARBON EX Inc.

6.7. Climate Impact X Pte. Ltd

6.8. CLIMATETRADE

6.9. Climate Vault, Inc.

6.10. CME Group Inc.

6.11. Environmental Market Services Ltd. (Carbon Trading Exchange)

6.12. European Energy Exchange AG

6.13. Flow Carbon Inc.

6.14. Intercontinental Exchange, Inc.

6.15. Likvidi Technologies Ltd.

6.16. Nasdaq Inc.

6.17. South Pole

6.18. Toucan

6.19. United Nations Carbon Offset Platform

6.20. Xpansiv Ltd.

1. GLOBAL CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL VOLUNTARY CARBON CREDIT TRADING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL COMPLIANCE/REGULATED CARBON CREDIT TRADING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY SYSTEM TYPE, 2023-2031 ($ MILLION)

5. GLOBAL CAP AND TRADE BASED CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL BASELINE AND CREDITS BASED CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

8. GLOBAL CARBON CREDIT TRADING PLATFORM FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CARBON CREDIT TRADING PLATFORM REGION FOR UTILITIY MARKET RESEARCH AND ANALYSIS BY, 2023-2031 ($ MILLION)

10. GLOBAL CARBON CREDIT TRADING PLATFORM FOR PETROCHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CARBON CREDIT TRADING PLATFORM FOR AVIATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CARBON CREDIT TRADING PLATFORM FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY SYSTEM TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

18. EUROPEAN CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY SYSTEM TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY SYSTEM TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

26. REST OF THE WORLD CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY SYSTEM TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD CARBON CREDIT TRADING PLATFORM MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

1. GLOBAL CARBON CREDIT TRADING PLATFORM MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL VOLUNTARY ARBON CREDIT TRADING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL COMPLIANCE REGULATED CARBON CREDIT TRADING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CARBON CREDIT TRADING PLATFORM MARKET SHARE BY SYSTEM TYPE, 2023 VS 2031 (%)

5. GLOBAL CAP AND TRADE BASED CARBON CREDIT TRADING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL BASELINE AND CREDIT BASED CARBON CREDIT TRADING PLATFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CARBON CREDIT TRADING PLATFORM MARKET SHARE BY END USER, 2023 VS 2031 (%)

8. GLOBAL CARBON CREDIT TRADING PLATFORM FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CARBON CREDIT TRADING PLATFORM FOR UTILITY MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CARBON CREDIT TRADING PLATFORM FOR ENERGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CARBON CREDIT TRADING PLATFORM FOR PETROCHEMICAL MARKET SHARE BY REGION N, 2023 VS 2031 (%)

12. GLOBAL CARBON CREDIT TRADING PLATFORM FOR AVIATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CARBON CREDIT TRADING PLATFORM FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL CARBON CREDIT TRADING PLATFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

17. UK CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

29. THE MIDDLE EAST AND AFRICA CARBON CREDIT TRADING PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)