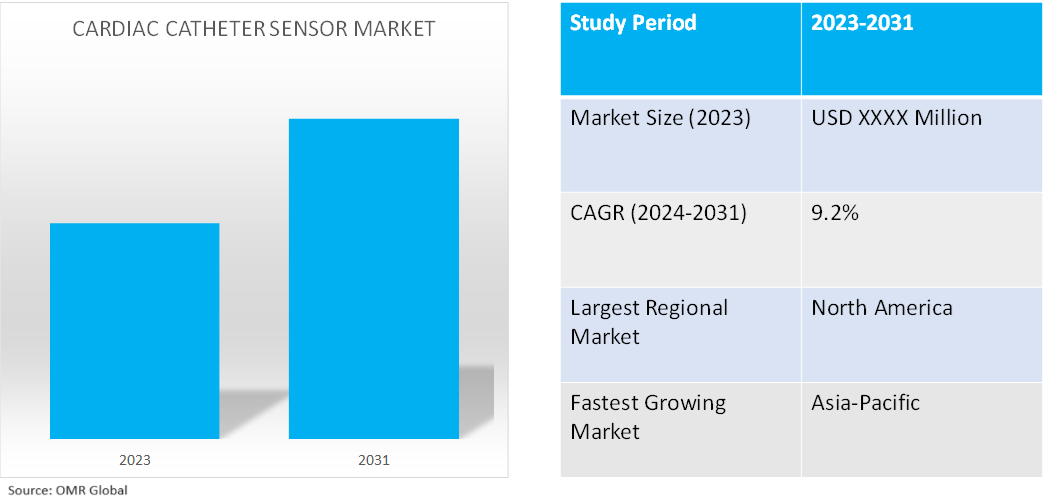

Cardiac Catheter Sensor Market

Cardiac Catheter Sensor Market Size, Share & Trends Analysis Report by Type (Pressure Sensors, Temperature Sensors, Biosensors, ECG Sensors, Image Sensors, and Other Sensors), by Application (Diagnostic, Surgical, Monitoring, and Imaging), and by End-User (Hospitals and Diagnostic Centers, Ambulatory Services Centers, and Others) Forecast Period (2024-2031)

Cardiac catheter sensor market is anticipated to grow at a significant CAGR of 9.2% during the forecast period (2024-2031). The market growth is attributed to the increasing incidence of cardiovascular disease and the high demand for less invasive procedures combined with improved medical imaging. The proper cardiac analysis has been enabled as a result of a sensor's capacity to handle vast amounts of data quickly, driving the growth of the market. According to the National Center for Biotechnology Information, in June 2023, in the US, more than 1,000,000 cardiac catheterization procedures are performed annually. With significant advances in the equipment used for cardiac catheterization, the improved skill of the operators, and newer techniques, the rates of these complications have been reduced significantly.

Market Dynamics

Increasing Adoption of Wireless and Remote Monitoring

Wireless communication and remote monitoring capabilities for cardiac sensors are growing increasingly important. This facilitates rapid responses and lessens the need for in-person visits by enabling real-time data transmission and monitoring. The heart of the system is a low-power cardiac pacemaker that can transmit data wirelessly and is used to monitor patients within a specific radius. The suggested technique is intended to be utilized in medical facilities during emergency scenarios, assisting in maintaining a steady heartbeat for the patient. Through a wireless sensor network, the status of every heartbeat is wirelessly sent to a monitoring station. When these values surpass the predetermined limitations, the patient monitor program that is run by the monitoring station sounds the alarms. The application gathers data from the wireless sensor network.

Advancements in Cardiac Catheter Sensor Technology

For accurate cardiac monitoring and diagnosis, sensor technology advancements including increased sensitivity, accuracy, and durability are essential. Better patient outcomes and treatment choices are supported by these developments. The successful integration of many sensors in the catheter is made possible by recent advancements in flexible and miniaturized sensors. This could aid in more precise monitoring and comprehension of the internal and exterior environments before and after surgery. With increasingly flexible in vivo sensing capabilities, recent rapid developments in sensor technology have expanded the integration and use of sensors in medical equipment. The rapidly expanding field of minimally invasive surgery has led to an increased focus on these special sensing capabilities, particularly for medical tools used in surgery or treatment.

Market Segmentation

- Based on the type, the market is segmented into pressure sensors, temperature sensors, biosensors, ECG sensors, image sensors, and other sensors.

- Based on the applications, the market is segmented into diagnostic, surgical, monitoring, and imaging.

- Based on the end-users, the market is segmented into hospitals and diagnostic centers, ambulatory services centers, and other (clinics).

Biosensors is Projected to Hold the Largest Segment

The primary factors supporting the growth include biosensors for cardiac biomarkers that rely on transduction mechanisms that have traditionally been the most widely utilized and researched electrochemical and optical approaches. Biosensors may be easily miniaturized and utilized for point-of-care analysis, which is performed at the patient's bedside by a portable gadget, as they are based on micro- and nanotechnologies. For instance, in July 2023, Biosense Webster, Inc., in cardiac arrhythmia treatment and part of Johnson & Johnson MedTech, announced the US launch of the OPTRELL™ Mapping Catheter with TRUEref™ Technology powered by the CARTO® 3 System. The OPTRELL™ Mapping Catheter is a high-density diagnostic catheter, with small electrodes arranged in a fixed array formation to provide high-definition electrophysiological mapping of complex cardiac arrhythmia cases like persistent atrial fibrillation (AFib), redo AFib ablation, atrial tachycardia, and ventricular tachycardia.

Hospitals And Diagnostic Centers to Hold a Considerable Market Share

The factors supporting segment growth include cardiac catheterization is performed in a hospital room equipped with specialized imaging and X-ray equipment. According to the American Hospital Association in 2023, there were around 6,129 hospitals in the US in 2022, of which 2,978 are nongovernment not-for-profit community hospitals and 944 are state and local government community hospitals. To more accurately identify heart abnormalities, a catheter is inserted into a blood artery and advanced to the heart during a cardiac catheterization operation. According to the Centers for Disease Control & Prevention (CDC), in May 2024, coronary heart disease will be the most common type of cardiovascular disease and more than 375,000 mortalities occurred in 2021 in the US Angioplasty, PCI, and cardiac catheterization are majorly recommended for the treatment of such problems, thus, an increase in cases of such diseases is expected to boost the hospital admission rate.

Regional Outlook

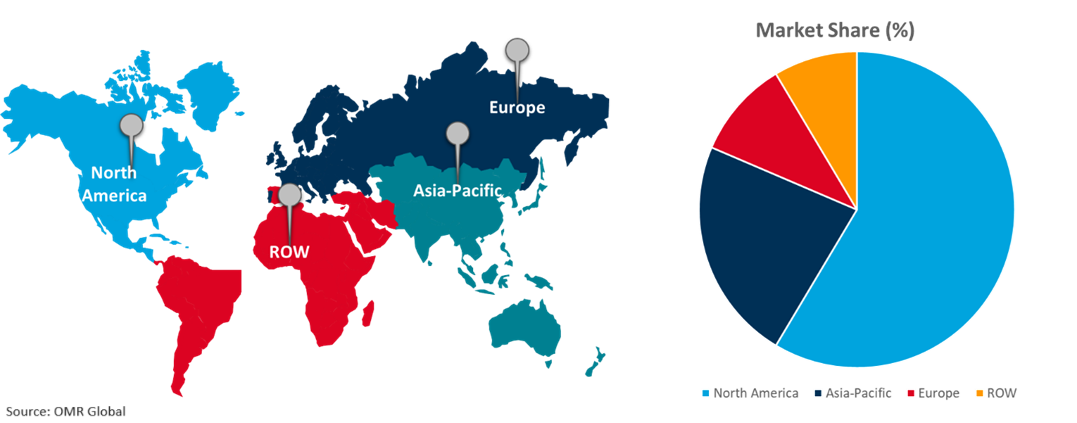

Global cardiac catheter sensor market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Cardiac Catheter Sensors in Asia-Pacific

The regional growth is attributed to the growing demand for cardiac catheters and guidewire equipment owing to the increased prevalence of heart disorders. Additionally, China and India have been the most affected countries owing to their high diabetes prevalence. According to the World Health Organization, in September 2023, cardiovascular diseases account for 3.9 million mortalities in the Southeast Asia Region every year, a quarter of all deaths from noncommunicable diseases (NCDs), with most of them being preventable.

Global Cardiac Catheter Sensor Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the presence of cardiac catheter sensors offered by companies such as Abbott Laboratories, Boston Scientific Corp. Medtronic plc, and others. The market growth is attributed to the growing use of guidewire technology and cardiac catheters in primary care settings, enhanced accessibility, and high healthcare spending in nations with effective payment policies, which might have contributed to this. The region's growth is expected to be further propelled by technological innovation and the increasing prevalence of atrial fibrillation (AF) chronic disease. National Center for Biotechnology Information, in August 2023, atrial fibrillation (AF) is the most common arrhythmia in the US, affecting approximately 2.7 million Americans. The prevalence of AF increases with age, with 5.0% of individuals over the age of 65 and 10.0% of those over the age of 80 having this condition. The incidence of AF is also increasing, with an estimated 160,000 new cases diagnosed each year.

The regional market players offer cardiac catheter sensors designed to be used with a heart mapping system, which allows physicians to view and precisely identify areas in the heart that require ablation. For instance, in May 2023, Abbott announced that the US (FDA) approved the company's TactiFlex Ablation Catheter, Sensor Enabled, the global first ablation catheter with a flexible tip and contact force technology. Used to perform an ablation procedure to treat atrial fibrillation (AFib), the most common abnormal heart rhythm, the TactiFlex catheter can result in reduced procedure times and better safety when compared to the company's previous-generation catheters.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global cardiac catheter sensor market include Abbott Laboratories, B. Braun Melsungen AG, Boston Scientific Corp., ICU Medical, Inc., and Medtronic plc among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In September 2022, GE Healthcare, a medical technology, diagnostics, and digital solutions innovator announced the launch of its first ‘Made in India’, ‘AI-powered’ Cath lab - Optima IGS 320 to advance cardiac care in India. Built at Wipro GE Healthcare’s new factory launched under the PLI (production linked incentive) scheme in Bengaluru, the Cath lab leverages the GE proprietary AutoRight technology.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the cardiac catheter sensor market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott Laboratories

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. B. Braun Melsungen AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Boston Scientific Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. ICU Medical, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Medtronic plc

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cardiac Catheter Sensor Market by Type

4.1.1. Pressure Sensors

4.1.2. Temperature Sensors

4.1.3. Biosensors

4.1.4. ECG Sensors

4.1.5. Image Sensors

4.1.6. Other Sensors

4.2. Global Cardiac Catheter Sensor Market by Application

4.2.1. Diagnostic

4.2.2. Surgical

4.2.3. Monitoring

4.2.4. Imaging

4.3. Global Cardiac Catheter Sensor Market by End-Users

4.3.1. Hospitals And Diagnostic Centers

4.3.2. Ambulatory Services Centers

4.3.3. Other (Clinics)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Becton, Dickinson, and Company

6.2. BIOTRONIK SE & Co. KG

6.3. Cardinal Health

6.4. Cook Group Inc.

6.5. Edwards Lifesciences

6.6. GE Healthcare

6.7. Integer Holdings Corp.

6.8. Johnson & Johnson Inc.

6.9. Koninklijke Philips N.V

6.10. LivaNova, Inc.

6.11. Merit Medical Systems

6.12. Penumbra, Inc.

6.13. Siemens Healthineers

6.14. Stryker Corp.

6.15. Teleflex Inc.

6.16. Terumo Corp.

6.17. ZOLL Medical Corp.

1. Global Cardiac Catheter Sensor Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Cardiac Catheter Pressure Sensors Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Cardiac Catheter Temperature Sensors Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Cardiac Catheter Biosensors Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Cardiac Catheter ECG Sensors Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Cardiac Catheter Image Sensors Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Cardiac Catheter Other Sensors Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Cardiac Catheter Sensor Market Research And Analysis By Application, 2023-2031 ($ Million)

9. Global Cardiac Catheter Sensor For Diagnostic Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Cardiac Catheter Sensor For Surgical Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Cardiac Catheter Sensor For Monitoring Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Cardiac Catheter Sensor For Imaging Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Cardiac Catheter Sensor Market Research And Analysis By End-Users, 2023-2031 ($ Million)

14. Global Cardiac Catheter Sensor For Hospitals And Diagnostic Centers Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Cardiac Catheter Sensor For Ambulatory Services Centers Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Cardiac Catheter Sensor For Other End-Users Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Cardiac Catheter Sensor Market Research And Analysis By Region, 2023-2031 ($ Million)

18. North American Cardiac Catheter Sensor Market Research And Analysis By Country, 2023-2031 ($ Million)

19. North American Cardiac Catheter Sensor Market Research And Analysis By Type, 2023-2031 ($ Million)

20. North American Cardiac Catheter Sensor Market Research And Analysis By Application, 2023-2031 ($ Million)

21. North American Cardiac Catheter Sensor Market Research And Analysis By End-Users, 2023-2031 ($ Million)

22. European Cardiac Catheter Sensor Market Research And Analysis By Country, 2023-2031 ($ Million)

23. European Cardiac Catheter Sensor Market Research And Analysis By Type, 2023-2031 ($ Million)

24. European Cardiac Catheter Sensor Market Research And Analysis By Application, 2023-2031 ($ Million)

25. European Cardiac Catheter Sensor Market Research And Analysis By End-Users, 2023-2031 ($ Million)

26. Asia-Pacific Cardiac Catheter Sensor Market Research And Analysis By Country, 2023-2031 ($ Million)

27. Asia-Pacific Cardiac Catheter Sensor Market Research And Analysis By Type, 2023-2031 ($ Million)

28. Asia-Pacific Cardiac Catheter Sensor Market Research And Analysis By Application, 2023-2031 ($ Million)

29. Asia-Pacific Cardiac Catheter Sensor Market Research And Analysis By End-Users, 2023-2031 ($ Million)

30. Rest Of The World Cardiac Catheter Sensor Market Research And Analysis By Region, 2023-2031 ($ Million)

31. Rest Of The World Cardiac Catheter Sensor Market Research And Analysis By Type, 2023-2031 ($ Million)

32. Rest Of The World Cardiac Catheter Sensor Market Research And Analysis By Application, 2023-2031 ($ Million)

33. Rest Of The World Cardiac Catheter Sensor Market Research And Analysis By End-Users, 2023-2031 ($ Million)

1. Global Cardiac Catheter Sensor Market Research And Analysis By Type, 2023 Vs 2031 (%)

2. Global Cardiac Catheter Pressure Sensors Market Share By Region, 2023 Vs 2031 (%)

3. Global Cardiac Catheter Temperature Sensors Market Share By Region, 2023 Vs 2031 (%)

4. Global Cardiac Catheter Biosensors Market Share By Region, 2023 Vs 2031 (%)

5. Global Cardiac Catheter ECG Sensors Market Share By Region, 2023 Vs 2031 (%)

6. Global Cardiac Catheter Image Sensors Market Share By Region, 2023 Vs 2031 (%)

7. Global Cardiac Catheter Other Sensors Market Share By Region, 2023 Vs 2031 (%)

8. Global Cardiac Catheter Sensor Market Research And Analysis By Application, 2023 Vs 2031 (%)

9. Global Cardiac Catheter Sensor For Diagnostic Market Share By Region, 2023 Vs 2031 (%)

10. Global Cardiac Catheter Sensor For Surgical Market Share By Region, 2023 Vs 2031 (%)

11. Global Cardiac Catheter Sensor For Monitoring Market Share By Region, 2023 Vs 2031 (%)

12. Global Cardiac Catheter Sensor For Imaging Market Share By Region, 2023 Vs 2031 (%)

13. Global Cardiac Catheter Sensor Market Research And Analysis By End-User, 2023 Vs 2031 (%)

14. Global Cardiac Catheter Sensor For Hospitals And Diagnostic Centers Market Share By Region, 2023 Vs 2031 (%)

15. Global Cardiac Catheter Sensor For Ambulatory Services Centers Market Share By Region, 2023 Vs 2031 (%)

16. Global Cardiac Catheter Sensor For Other End-Users Market Share By Region, 2023 Vs 2031 (%)

17. Global Cardiac Catheter Sensor Market Share By Region, 2023 Vs 2031 (%)

18. US Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

19. Canada Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

20. UK Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

21. France Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

22. Germany Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

23. Italy Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

24. Spain Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

25. Rest Of Europe Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

26. India Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

27. China Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

28. Japan Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

29. South Korea Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

30. Rest Of Asia-Pacific Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

31. Rest Of The World Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

32. Latin America Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)

33. Middle East And Africa Cardiac Catheter Sensor Market Size, 2023-2031 ($ Million)