Cardiovascular Devices Market

Global Cardiovascular Devices Market Size, Share & Trends Analysis Report by Type (Diagnostic and Monitoring Devices (MRI, Electrocardiogram (ECG), Remote Cardiac Monitoring, Cardiac CT, and Others) and Surgical Devices (Stents, Catheters, Cardiac Assist Devices, Cardiac Rhythm Management Device, and Others)) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global cardiovascular devices market is growing at a significant CAGR of around 6.1% during the forecast period (2020-2026). The market is driven by the growing healthcare spending, rising geriatric population, and rising prevalence of cardiovascular diseases (CVD) across the globe. The heart diseases are considered one of the leading cause of mortalities across the globe. According to the World Health Organization (WHO), around one million of mortalities occurs due to the CVD globally, accounting for around 17.9% million lives each year. Such rise in mortalities possesses a burden on healthcare sector of every country to improve their diagnostic and treatment facilities. This includes the introduction of technologically advanced diagnostic devices and advanced surgical instruments.

The market players are regularly enhancing their capabilities in the cardiovascular devices market. This includes the launch of portable, easy to use, and minimal size devices for the diagnosis and treatment of CVD. A range of wearable devices are introduced in the market that can monitor heart conditions of the person. These technologically advanced devices are spurring the global cardiovascular devices market growth. Moreover, the fast-moving lifestyle with a huge workplace stress and unhealthy dietary habits will further lead to the increase in CVD cases globally, which in turn, will drive the market growth during the forecast period. However, the high cost of instruments and stringent regulatory policies will affect the market growth during the forecast period.

Segmental Outlook

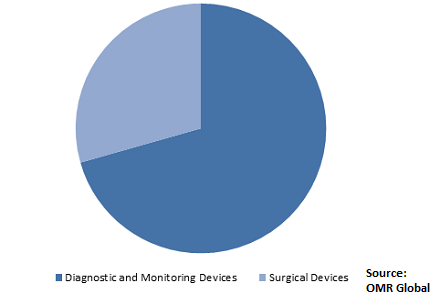

The cardiovascular devices market is bifurcated on the basis of type of devices into diagnostic and monitoring devices and surgical devices. The cardiovascular devices market based on diagnostic and monitoring devices is further segmented into MRI, electrocardiogram (ECG), remote cardiac monitoring, cardiac CT, and others. ECG drives the global cardiovascular diagnostics and monitoring devices market. The ECG is widely recommended to the CVD patients in order to keep a track of the disease. Moreover, the integration of advanced technologies, such as AI, in ECG will further augment the market growth during the forecast period. Whereas the cardiovascular devices market based on surgical devices is further segmented into stents, catheters, cardiac assist devices, cardiac rhythm management device, and others. The stents contribute significantly in the global cardiovascular surgical devices market.

Global Cardiovascular Devices Market Share by Type, 2019 (%)

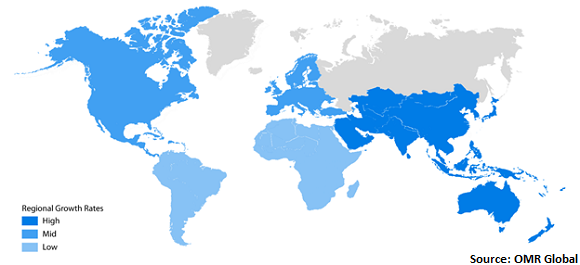

Regional Outlook

The global cardiovascular devices market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America holds a significant share in the global cardiovascular devices market. The US plays the critical role in geographic contribution of North America in global cardiovascular devices market, attributing to the rising prevalence of heart diseases. As per the American Heart Association (AHA), around half of the all the US adults, accounting for 116.4 million, are suffering from some type of CVD in 2018, which is expected to increase to 130 million by 2035. Such continuous rise in CVD statistics in the US poses the need for advanced diagnostic and treatment devices that can go according with the fast-moving lifestyle. Therefore, the demand for wearable heart monitoring devices is high in the US. Moreover, the presence of key market players in the region, such as Abbott Laboratories and Boston Scientific Corp., is another factor offering growth to the cardiovascular devices market in North America.

Global Cardiovascular Devices Market Growth, by Region 2020-2026

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is estimated to project a considerable CAGR in the global cardiovascular devices market. Countries in Asia-Pacific that are contributing to the market growth include China, India, and Japan. There are various factors that are driving the market in Asia-Pacific, such as improving healthcare infrastructure, rising geriatric population, and associated prevalence of chronic disease in them. The United Nations Population Division estimated that India’s population aged 50 years and above will reach 34% by 2050. Furthermore, Chinese government is projecting that the country's population, aged 60 years and above, will reach 255 million by 2020. According to WHO, CVD causes nearly one-third of the total mortalities in China and the number is anticipated to get doubled by 2020. Moreover, AHA predicted that CVD patients are expected to increase by 23% between 2010 and 2030 and there will be more than 7.7 million fatalities because of CVD in China. These statistics indicated the need for technologically advanced cardiovascular devices in the region.

Market Players Outlook

The key players in the cardiovascular devices market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global cardiovascular devices market include Abbott Laboratories, Boston Scientific Corp., Edwards Lifesciences Corp., Medtronic PLC, Terumo Corp., Becton, Dickinson and Co., Getinge AB, VitalConnect, Inc., and Johnson & Johnson Services, Inc. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market. For instance, in February 2020, VitalConnect, Inc. launched wearable biosensor technology for the detection of arrhythmia via its remote patient monitoring portfolio. The company partnered with the CorVitals, Inc. for the offering of the device to physicians, which enables the monitor, diagnosis, and treatment of patients with various heart conditions.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cardiovascular devices market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Abbott Laboratories

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Boston Scientific Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Edwards Lifesciences Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Medtronic PLC

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Terumo Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Cardiovascular Devices Market by Type

5.1.1. Diagnostic and Monitoring Devices

5.1.1.1. MRI

5.1.1.2. Electrocardiogram (ECG)

5.1.1.3. Remote Cardiac Monitoring

5.1.1.4. Cardiac CT

5.1.1.5. Others (PET scan)

5.1.2. Surgical Devices

5.1.2.1. Stents

5.1.2.2. Catheters

5.1.2.3. Cardiac Assist Devices

5.1.2.4. Cardiac Rhythm Management Device

5.1.2.5. Others (Heart Valves and Grafts)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. B. Braun Melsungen AG

7.3. Becton, Dickinson and Co.

7.4. Biotronik, Inc.

7.5. Boston Scientific Corp.

7.6. Cardinal Health Inc.

7.7. Cook Medical, Inc.

7.8. Edwards Lifesciences Corp.

7.9. Fresenius SE & Co. KGaA

7.10. GE Healthcare (General Electric Co.)

7.11. Getinge AB

7.12. Johnson & Johnson Services, Inc.

7.13. Koninklijke Philips N.V.

7.14. Lepu Mdicial Technology (Beijing) Co., Ltd.

7.15. Medtronic PLC

7.16. Siemens AG

7.17. Smith & Nephew PLC

7.18. Stryker Corp.

7.19. Terumo Corp.

7.20. VitalConnect, Inc.

7.21. W. L. Gore & Associates, Inc.

7.22. ZOLL Medical Corp.

1. GLOBAL CARDIOVASCULAR DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL DIAGNOSTIC AND MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL SURGERY DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL CARDIOVASCULAR DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

5. NORTH AMERICAN CARDIOVASCULAR DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

6. NORTH AMERICAN CARDIOVASCULAR DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

7. EUROPEAN CARDIOVASCULAR DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

8. EUROPEAN CARDIOVASCULAR DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

9. ASIA-PACIFIC CARDIOVASCULAR DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. ASIA-PACIFIC CARDIOVASCULAR DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

11. REST OF THE WORLD CARDIOVASCULAR DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

1. GLOBAL CARDIOVASCULAR DEVICES MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL CARDIOVASCULAR DEVICES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)

5. UK CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD CARDIOVASCULAR DEVICES MARKET SIZE, 2019-2026 ($ MILLION)