Cardless ATM Market

Cardless ATM Market Size, Share & Trends Analysis Report by Type (On-site and Off-site), by Technology (Near-field Communication (NFC), Quick Response (QR) Codes, and Biometric Verification), and by End User (Bank and Financial Institutions and Independent ATM Deployer), Forecast Period (2024-2031)

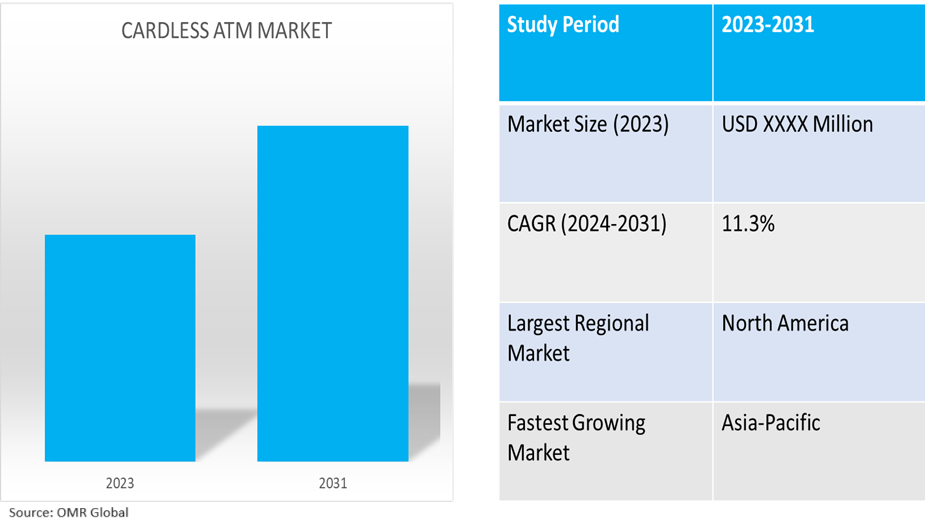

Cardless ATM market is anticipated to grow at a CAGR of 11.3% during the forecast period (2024-2031). Cardless ATMs are frequently being installed in bank locations to provide convenience for cash withdrawals, deposits, and transfers. The market for cardless ATMs has grown significantly in recent years due to the growing use of biometric verification, QR codes, and NFC (Near Field Communication). A few banks offer the option of cardless cash withdrawals through their ATM services. Over the coming years, it is anticipated that the growth will continue as more individuals use mobile payments and look for easier, quicker ways to access their money.

Market Dynamics

Increased Penetration of Smartphones to Drive the Cardless ATM Market

The increased penetration of smartphones is a key factor driving the growth of the cardless ATM market. With the widespread use of smartphones, consumers are increasingly looking for more convenient and secure ways to access their funds without the need for physical payment cards. Moreover, cardless ATM solutions leverage the security features of smartphones, such as biometric authentication, to provide added security and protection against fraud and cyber threats. This is particularly important given the increasing prevalence of cyber threats and the need for secure and reliable payment solutions. COVID-19 has accelerated the adoption of contactless payment solutions, including cardless ATMs, as consumers seek to minimize their physical interactions with payment devices. As a result, financial institutions and cardless ATM manufacturers have been investing in the development and deployment of cardless ATM solutions to meet the growing demand for contactless payment options.

Integration of Industry 4.0 Technologies into Cardless ATMs to Drive the Market

Globally, the Integration of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and big data into the manufacturing and production processes of cardless ATM manufacturing can bring significant benefits in terms of efficiency, connectivity, security, and customer experience. Industry 4.0 technologies can enable cardless ATM manufacturers to monitor the performance of their machines in real time, identifying potential issues before they occur and enabling predictive maintenance. The advanced technologies can enable cardless ATM manufacturers to automate and streamline production processes, reducing production time and costs while improving quality and helping financial institutions to better serve their customers and stay competitive in a rapidly evolving industry. Therefore, a rise in the Integration of Industry 4.0 technologies into the cardless ATM market will open new growth opportunities for the market's key players.

Market Segmentation

- Based on type, the market is segmented into on-site and off-site.

- Based on technology, the market is segmented into near-field communication (NFC), quick response (QR) codes, and biometric verification.

- Based on end users, the market is segmented into bank and financial institutions and independent ATM deployers.

Off-site ATM is Projected to Emerge as the Largest Segment

The off-site segment is expected to hold the largest share of the market. Off-site ATMs are becoming increasingly popular due to their convenience and accessibility. Off-site ATMs can be placed in locations that are easily accessible to customers, such as retail stores, airports, and transportation hubs. This makes it more convenient for customers to access cash without having to travel to a bank or financial institution. As technology continues to evolve and customer preferences shift, the demand for off-site cardless ATMs is likely to continue to grow during the forecast period.

Bank and Financial Institutions Segment to Hold a Considerable Market Share

Cardless ATMs can offer significant benefits for banks and financial institutions, helping them to provide better service to their customers while reducing costs and improving security. Offering cardless ATM services can help banks and financial institutions differentiate themselves from their competitors and attract new customers who are looking for more convenient and secure ways to access their accounts. Thus, the increasing use of cardless ATMs by banks and financial institutions segment is expected to increase the cardless ATM market demand during the forecast period.

Regional Outlook

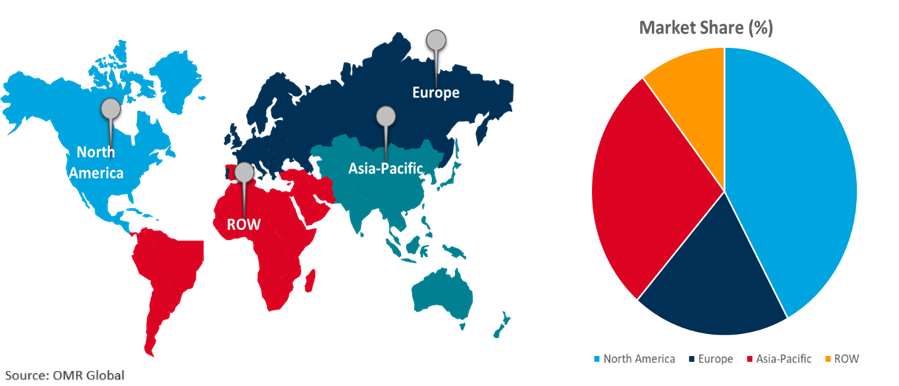

The global cardless ATM market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific to Register Fastest Market Growth

Asia-Pacific is the fastest-growing region globally in the cardless ATM market. China has also seen significant growth in cardless ATM adoption, driven by the popularity of mobile payment systems such as Alipay and WeChat Pay. Some Chinese banks, such as China Construction Bank and Agricultural Bank of China, have introduced cardless ATM services that allow customers to withdraw cash using their mobile phones. Other countries in the Asia-Pacific region, such as Japan, South Korea, and Australia, have also seen an increase in cardless ATM adoption in recent years, as more banks and financial institutions offer mobile banking services and seek to improve the customer experience. India and China are the largest markets for cardless ATMs in the Asia-Pacific region because of the high adoption rate of mobile banking and the popularity of mobile payment systems in these countries.

Global Cardless ATM Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share in terms of revenue in the cardless ATM market during the forecast period. The North American cardless ATM market is expected to experience significant growth in the coming years because of the increasing adoption of mobile banking, and rising concerns over ATM security. Large financial institutions in North America, such as Bank of America and Wells Fargo, have already implemented cardless ATM technology in many of their ATMs, making it available to their customers across the US and Canada. The US is the largest market for cardless ATMs in North America because of the high adoption rate of mobile banking among consumers and the presence of major financial institutions in the region. However, Canada is also expected to see significant growth in the cardless ATM market due to increasing demand for touchless banking solutions and the growing use of mobile banking among consumers.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Cardless ATM market include Citigroup Inc., JPMorgan Chase and Co., NCR Corp., and Wells Fargo, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2023, India's first UPI-ATM was launched as a White Label ATM (WLA) by Hitachi Payment Services in collaboration with the National Payments Corporation of India (NPCI) to enable seamless cash withdrawals, eliminating the need to carry physical ATM cards. It offers an experience that allows customers of certain banks to enjoy QR-based cashless withdrawals.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cardless ATM market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Citigroup Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. JPMorgan Chase and Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. NCR Atleos

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Wells Fargo

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cardless ATM Market by Type

4.1.1. On-site

4.1.2. Off-site

4.2. Global Cardless ATM Market by Technology

4.2.1. Near-field Communication (NFC)

4.2.2. Quick Response (QR) Codes

4.2.3. Biometric Verification

4.3. Global Cardless ATM Market by End User

4.3.1. Bank and Financial Institutions

4.3.2. Independent ATM Deployer

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Arab Bank

6.2. Banco Santander SA

6.3. Barclays Bank Plc.

6.4. Commonwealth Bank of Australia

6.5. CSB Bank Ltd.

6.6. Diebold Nixdorf Inc.

6.7. Fifth Third Bancorp

6.8. Fujitsu Ltd.

6.9. GRG Banking

6.10. HDFC Bank Ltd.

6.11. Hitachi Payment Services Pvt. Ltd.

6.12. HSBC Holdings Plc.

6.13. Hyosung Corporation

6.14. ICICI Bank Ltd.

6.15. Kotak Mahindra Bank Ltd.

6.16. State Bank of India

6.17. Turk Ekonomi Bank AS

1. GLOBAL CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL CARDLESS ON-SITE ATM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CARDLESS OFF-SITE ATM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

5. GLOBAL NEAR-FIELD COMMUNICATION (NFC) ENABLED CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL QUICK RESPONSE (QR) CODES ENABLED CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BIOMETRIC VERIFICATION ENABLED CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

9. GLOBAL CARDLESS ATM FROM BANK AND FINANCIAL INSTITUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CARDLESS ATM FROM INDEPENDENT ATM DEPLOYER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. EUROPEAN CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

19. EUROPEAN CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. REST OF THE WORLD CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

27. REST OF THE WORLD CARDLESS ATM MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL CARDLESS ATM MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL CARDLESS ON-SITE ATM MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CARDLESS OFF-SITE ATM MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CARDLESS ATM MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

5. GLOBAL NEAR-FIELD COMMUNICATION (NFC) ENABLED CARDLESS ATM MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL QUICK RESPONSE (QR) CODES ENABLED CARDLESS ATM MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL BIOMETRIC VERIFICATION ENABLED CARDLESS ATM MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CARDLESS ATM MARKET SHARE BY END-USER, 2023 VS 2031 (%)

9. GLOBAL CARDLESS ATM FROM BANK AND FINANCIAL INSTITUTIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CARDLESS ATM FROM INDEPENDENT ATM DEPLOYER MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CARDLESS ATM MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

14. UK CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA CARDLESS ATM MARKET SIZE, 2023-2031 ($ MILLION)