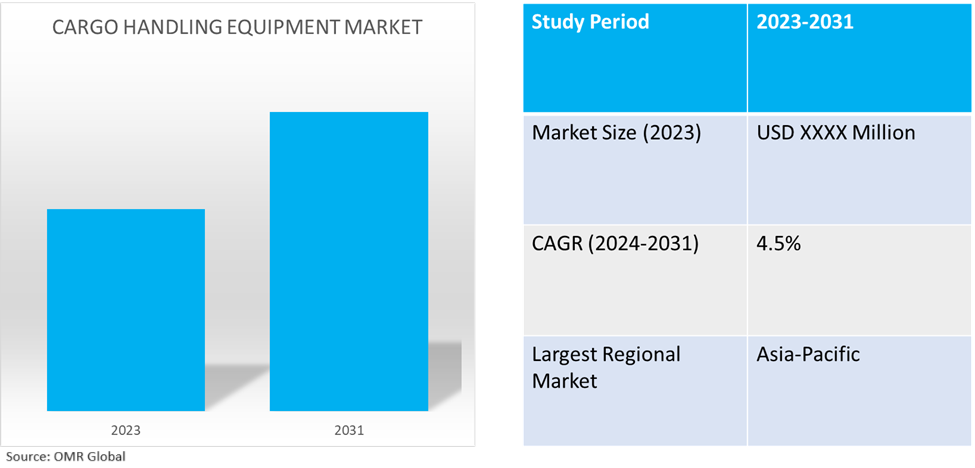

Cargo Handling Equipment Market

Cargo Handling Equipment Market Size, Share & Trends Analysis Report by Equipment Type (Industrial Trucks, Tow Tractors, Conveying Equipment, Stacker, Port Cranes, and Others), by Propulsion Equipment Type (Diesel, and Electric), and by Application (Air, Road & Rail, and Marine) Forecast Period (2024-2031)

Cargo handling equipment market is anticipated to grow at a CAGR of 4.5% during the forecast period (2024-2031). Cargo handling equipment market comprises of a variety of handling equipment including industrial trucks, cranes, stackers, pallets, among others, which streamline logistical and transport processes such as unloading cargo, transporting cargo, warehousing, picking, and sorting. The market growth is driven by the rising demand of cargo handling equipment from marine segment, increase in seaborne trade, e-commerce boom, and advancement in cargo equipment through integration of IoT devices, automation & robotics, and AI (artificial intelligence)) & ML (machine learning) among others.

Market Dynamics

Increase in Seaborne Trade to Create Demand for Cargo Handling Equipment

The global cargo equipment handling equipment market is highly dependent on international trade for its growth, which majorly comes from seaborne trade. According to the International Maritime Organization (IMO), up to 90.0% of the world's goods are transported through maritime trade. Further, the import and exports of goods through the marine has showcased exponential growth in recent years, especially post pandemic owing to e-commerce boom, government investment of port infrastructure, and increased consumer spending, which is projected to grow in future and benefit the cargo equipment handling market. As per the Indian Ministry of Ports, Shipping, and Waterways, cargo handling in national waterways has grown by more than 1700.0% to 126.1 million Metric Tons (MMT) in 2022–23 from 6.83 MMT in 2013–14. wherein, as reported by the United Nations Conference on Trade and Development (UNCTAD), in 2020, due to the fallout of the COVID-19, international maritime trade contracted by nearly 4.0%, which saw a rebound in 2022 with the global economy starting to recover and continued consumer spending, along with an easing in pandemic-related restrictions, causing maritime trade to grow by 3.2% reaching to a total of 11 billion tons, close to pre-pandemic levels.

Advancement in Cargo Handling Equipment

The development of a wide variety of cargo handling equipment with the integration of automation & robotics, IoT, and AI (artificial intelligence) & ML (machine learning) has increased the adoption of cargo handling equipment owing to increased efficiency, reduction in manpower consumption, and cost-effectivity. In March 2024, Konecranes introduced the Konecranes X-series industrial crane. It features a modern, compact design and safe, dependable technology that can be upgraded wirelessly to meet changing client needs. The X-series demonstrates ways Konecranes is influencing next-generation material handling for a safer, better, and more intelligent society by implementing sustainable design and material selections. Such product launches to meet user needs further promotes the adoption of cargo handling equipment.

Segmental Outlook

- Based on equipment type, the market is segmented into industrial trucks, tow tractors, conveying equipment, stackers, port cranes, and others (pallet jacks, loaders).

- Based on propulsion type, the market is segmented into diesel, and electric.

- Based on application, the market is segmented into air, road & rail, and marine.

Electric is the Most Prominent Propulsion Type

Electric cargo equipment such as industrial trucks, stackers, cranes, and tow tractors, among others are the preferred propulsion type owing to cost effectivity, eco-friendly features, and regulatory requirements. In January 2024, Kalmar, a division of Cargotec, received a substantial order from Wallenius Wilhelmsen, a leading Norwegian logistics service provider, to supply four heavy electric forklift trucks, two electric reachstackers, and three heavy terminal tractors to the company's US logistics network. The order, which includes the Kalmar Insight fleet performance monitoring solution, was placed during Cargotec's Q4 2023 order intake. The high adoption of electric cargo handling equipment by end-user industries is further contributing to the high share of this market segment.

Marine is the Biggest Application

Marine cargo accounts for 90.0% of global import-export volumes, creating a larger scope for purchase, replacement, and upgradation of cargo handling equipment. Further, the segment also has marine-specific cargo handling equipment such as container cranes, and twist lock among others, explaining the significance of the segment in cargo handling equipment revenue. For instance, in May 2024, SeaPort Manatee will add capacity to container and general cargo handling at their Tampa Bay, Florida, operations with two Konecranes Gottwald ESP.7 Mobile Harbor Cranes. After ordering the first crane in Q1 2024, the port swiftly chose to acquire a second optional crane at the start of Q2 to keep up with rapidly increasing demand. Both cranes will be delivered by the end of the year.

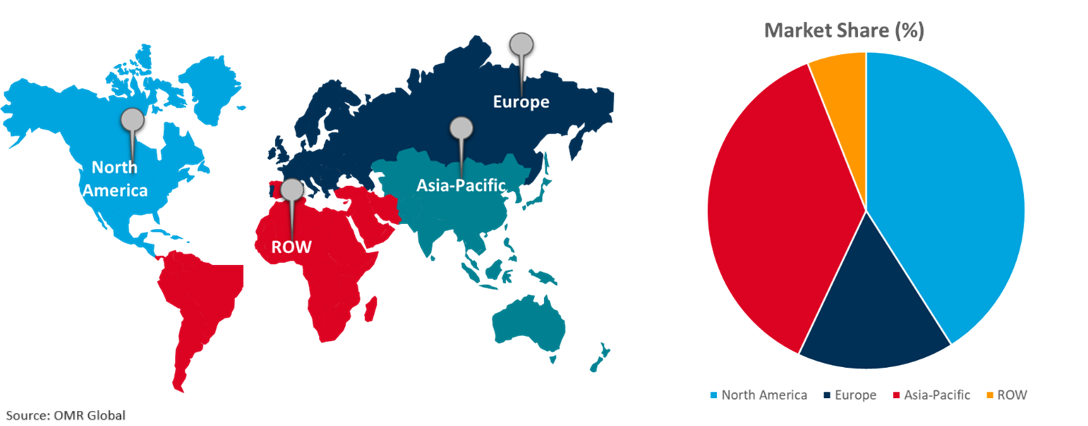

Regional Outlook

The global cargo handling equipment market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Cargo Handling Equipment Market Growth by Region 2024-2031

Asia-pacific is estimated to demonstrate a Significant Market Growth

The growing investments by regional governments in logistical infrastructure development is a key factor driving the regional market growth. The increasing seaborne trade in the region with significant presence of major cargo handling equipment manufacturers in the region such as Mitsubishi, Godrej, Toyota, among others is another contributor to the regional market growth. In August 2020, KION GROUP AG announced expansion of its operations in China and has commenced building of a new counterbalance truck manufacturing plant in Jinan, Shandong Province. The innovative project is intended to allow the global logistics equipment supplier to expand its product offering for industrial trucks in one of the world's most important material handling markets for around $109 million. The KION Group's new plant in eastern China is expected to create around 800 jobs by 2025. Such developments are further driving the regional market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global cargo handling equipment market include Cargotec Corp., Mitsubishi Heavy Industries, Ltd., and Liebherr-International Deutschland GmbH among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in October 2020, The Boards of Directors of Cargotec Corp. and Konecranes Plc entered into a combination agreement (referred to as the "Combination Agreement") and a merger plan to integrate the two businesses. This merger is anticipated to provide synergy to the company’s cargo handling equipment business.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cargo handling equipment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cargotec Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Liebherr-International Deutschland GmbH

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Mitsubishi Heavy Industries, Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cargo Handling Equipment Market by Equipment Type

4.1.1. Industrial Trucks

4.1.2. Tow Tractors

4.1.3. Conveying Equipment

4.1.4. Stacker

4.1.5. Port Cranes

4.1.6. Others (Stacker, Pallet Jacks, Loaders)

4.2. Global Cargo Handling Equipment Market by Propulsion Type

4.2.1. Diesel

4.2.2. Electric

4.3. Global Cargo Handling Equipment Market by Application

4.3.1. Air

4.3.2. Road & Rail

4.3.3. Marine

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Anhui Heli Co., Ltd.

6.2. Brunnhuber Cranes GmbH

6.3. CVS ferrari S.P.A.

6.4. Delite Systems Engineering (India) Pvt. Ltd.

6.5. Godrej & Boyce Manufacturing Co. Ltd

6.6. KION Group AG

6.7. Kornylak Corp.

6.8. Konecranes

6.9. McGrath Industries Ltd.

6.10. Oshkosh Aerotech LLC

6.11. SACO AIRPORT EQUIPMENT

6.12. Sany Heavy Industry Co Ltd

6.13. Shanghai Zhenhua Heavy Industries Co. Ltd

6.14. Terex Corp.

6.15. The Manitowoc Company, Inc.

6.16. Toyota Industries Corp

6.17. TREPEL Airport Equipment GmbH

1. GLOBAL CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL CARGO HANDLING INDUSTRIAL TRUCKS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CARGO HANDLING TOW TRACTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CARGO HANDLING CONVEYING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL CARGO HANDLING STACKER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CARGO HANDLING PORT CRANES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OTHER CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

9. GLOBAL DIESEL CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ELECTRIC CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

12. GLOBAL CARGO HANDLING EQUIPMENT FOR AERIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CARGO HANDLING EQUIPMENT FOR ROAD & RAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL CARGO HANDLING EQUIPMENT FOR MARINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT TYPE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. EUROPEAN CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. EUROPEAN CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT TYPE, 2023-2031 ($ MILLION)

22. EUROPEAN CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

23. EUROPEAN CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT TYPE, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT TYPE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD CARGO HANDLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL CARGO HANDLING EQUIPMENT MARKET SHARE BY EQUIPMENT TYPE, 2023 VS 2031 (%)

2. GLOBAL CARGO HANDLING INDUSTRIAL TRUCKS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CARGO HANDLING TOW TRACTORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CARGO HANDLING CONVEYING EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL CARGO HANDLING STACKER MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CARGO HANDLING PORT CRANES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OTHER CARGO HANDLING EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CARGO HANDLING EQUIPMENT MARKET SHARE BY PROPULSION TYPE, 2023 VS 2031 (%)

9. GLOBAL DIESEL CARGO HANDLING EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL ELECTRIC CARGO HANDLING EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CARGO HANDLING EQUIPMENT MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

12. GLOBAL CARGO HANDLING EQUIPMENT FOR AERIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CARGO HANDLING EQUIPMENT FOR ROAD & RAIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL CARGO HANDLING EQUIPMENT FOR MARINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL CARGO HANDLING EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

18. UK CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA CARGO HANDLING EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)