Cargo Shipping Market

Global Cargo Shipping Market Size, Share & Trends Analysis Report, by Industry Type (Metal & Non-Metal, Fossil Fuel, Food & Beverage, Electronics, Automotive, Chemical & Pharmaceuticals, Machinery, Textile, Others), By Vessel Type (Oil Tankers, Bulk Carriers, General Cargo Ships, Container Ships, Other) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The cargo shipping market is estimated to augment at a modest growth rate during the forecast period. Cargo shipping is the process of transporting commodities, goods, and cargo by the water route. The cargo shipping can be domestic or international however most of the cargo ships are operating at the international routes. Cargo ships are preferred over air and land routes due to very low cost and ability to transport goods in bulk. As per the United Nations, around 80% of the international global trade is done through cargo ships each year.

Rise in the global trade, increasing import and export of the liquid, dry, general, and container cargo trade in Asia Pacific & the Middle East countries are some of the major factors for the growth of the cargo shipping market. Moreover, the rapid growth of the end-user industries is also propelling the market growth. In addition, the establishment of the new ports and extension of the existing ports are also motivating market growth. For instance, Sweden's new freight port Stockholm Norvik Port became operational in May 2020. Russia is expected to invest $4.13 billion to connect Asia with the Arctic Ocean by modifying its port in Indiga and Arkhangelsk. The country has spent $5 million to prepare for the construction of a deepwater year-round port.

As per the United Nations, in 2018 global maritime trade reached around 11 billion tons which were around 2.7% higher than in 2017. However, in 2017, the global maritime trade volume expanded around 4.7%. The United Nations also predicted that during 2019-2024, the CAGR in the maritime transportation volume is expected to be 3.5% however the potential scenario is before the COVID-19 pandemic. After the pandemic, the volume is expected to be far lower than the earlier predicted. As an estimate, the departure of all ships in the first week of April decreased by 20% as compared to 2019, whereas the decrease in container ship was around 29% for the same period. Moreover, trade tension between the US and China is also a major concern for global international trade.

Market Segmentation

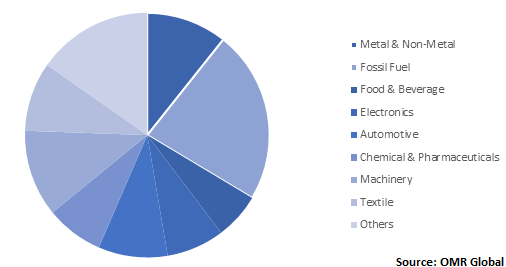

The cargo shipping market is segmented on the basis of industry type and vessel type. By industry type, the market is segmented into metal & non-metal, fossil fuel, food & beverage, electronics, automotive, chemical & pharmaceuticals, machinery, textile, and others. Metal and non-metal segment include raw ore material as well as processed materials, fossil fuel segment include crude oil, natural gas, coal, and other fossil fuels. As per the United Nations, global trade of crude oil in 2018 was 1.9 billion tons which were a 1% higher YoY basis. However, a considerable drop in fossil cargo shipping is expected in 2020 as due to COVID-19 pandemic and lockdowns, the demand for petroleum products and electricity (generated from coal) has plummeted significantly globally.

The food and beverage segment includes grains, cereals, oil & oilseeds, and other crop products, packaged & processed food and alcoholic, & non-alcoholic beverages. The electronics industry include consumer electronics products, as well as electrical & electronics components. The automotive segment includes vehicles exported through cargo ships, along with auto-ancillary and aftermarket products. Chemicals and pharmaceuticals segment include petrochemicals, and other chemicals along with their raw material, whereas pharmaceuticals include finished drugs, excipients, and API (Active Pharmaceutical Ingredients) trade.

Global Cargo Shipping Market Share by Industry Type, 2019 (%)

By vessel type, the market is segmented into oil tankers, bulk carriers, general cargo ships, container ships, and others. Bulk carrier is expected to hold a major market share during the forecast period all across the globe.

Regional Outlook

By geography, the global cargo shipping market is studied on the basis of North America, Europe, Asia-Pacific, and the Rest of the World (RoW). Asia-Pacific is expected to hold a significant market in the global cargo shipping market. China has seven out of the ten busiest container ports all across the globe. Other than China; Japan, India, South Korea, Taiwan, Vietnam, Australia, and ASEAN countries will significantly contribute to market growth. It is due to the further development of ports and increasing market demand and supportive government export policies. Moreover, the free trade agreement between the countries is also one of the factors driving international trade and so cargo shipping market. Free trade agreement of ASEAN countries with China, India, Japan, and South Korea has been a major factor boosting the trade between Asia-Pacific countries.

Global Cargo Shipping Market Growth, by Region 2020-2026

Market Players Outlook

The cargo shipping market is the consolidated market as few market players are operating in the industry all across the globe. It is due to the high cost associated with the ship and its operations. Some of the key players operating in the market include A.P. Møller – Mærsk A/S, Mediterranean Shipping Company S.A., China Ocean Shipping Co. (COSCO), Hapag-Lloyd AG, and Ocean Network Express Holdings Ltd. Major strategies adopted by the players include a focus on a high-quality product, cost-effectiveness, expansions, strategic partnerships, and collaborations with manufacturing companies. For instance, in April 2020 Mærsk A/S acquired Performance Team, U.S.-based warehousing, and distribution company for $545 million. After the acquisition, the company’s warehouse locations will increase to 46 from 22 with an increasing 800,000 square meter of warehouse capacity.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Cargo Shipping market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. A.P. Møller – Mærsk A/S

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Mediterranean Shipping Company S.A.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. China Ocean Shipping Co. (COSCO)

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Hapag-Lloyd AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Ocean Network Express Holdings Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Cargo Shipping Market by Industry Type

5.1.1. Metal & Non-Metal

5.1.2. Fossil Fuel

5.1.3. Food & Beverage

5.1.4. Electronics

5.1.5. Automotive

5.1.6. Chemical & Pharmaceuticals

5.1.7. Machinery

5.1.8. Textile

5.1.9. Other (Plastic, Toys, Sports)

5.2. Global Cargo Shipping Market by Vessel Type

5.2.1. Oil Tankers

5.2.2. Bulk Carriers

5.2.3. General Cargo Ships

5.2.4. Container Ships

5.2.5. Other (Gas Carrier, Chemical Tanker, Offshore Vessels)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Rest of North America

6.2. Europe

6.2.1. UK

6.2.2. Italy

6.2.3. France

6.2.4. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Middle East & Africa

6.4.2. Latin America

7. Company Profiles

7.1. A.P. Møller – Mærsk A/S

7.2. Arkas Container Transport S.A

7.3. China Ocean Shipping Co. (COSCO)

7.4. CMA CGM S.A.

7.5. Evergreen Marine Corp.

7.6. Hapag-Lloyd AG

7.7. Hyundai Merchant Marine Co. Ltd.

7.8. Islamic Republic of Iran Shipping Lines

7.9. Korea Marine Transport Co., Ltd.

7.10. Mediterranean Shipping Company S.A.

7.11. Ocean Network Express Holdings Ltd.

7.12. Orient Overseas Container Line Ltd.

7.13. Pacific International Lines Pte. Ltd.

7.14. Sea Consortium Pte. Ltd.

7.15. Shandong Shipping Corp.

7.16. T.S. Lines LTD.

7.17. Wan Hai Lines Ltd.

7.18. Yang Ming Marine Transport Corp.

7.19. Zhonggu Logistics Corp.

7.20. Zim Integrated Shipping Services Ltd.

1. GLOBAL CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY INDUSTRY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL METAL & NON-METAL MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

3. GLOBAL FOSSIL FUEL MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

4. GLOBAL FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

5. GLOBAL ELECTRONICS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

6. GLOBAL AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

7. GLOBAL CHEMICAL & PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

8. GLOBAL MACHINERY MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

9. GLOBAL TEXTILE MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

10. GLOBAL OTHER MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

11. GLOBAL CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

12. GLOBAL OIL TANKERS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

13. GLOBAL BULK CARRIERS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

14. GLOBAL GENERAL CARGO SHIPS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

15. GLOBAL CONTAINER SHIPS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

16. GLOBAL OTHER MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

17. NORTH AMERICAN CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. NORTH AMERICAN CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY INDUSTRY TYPE, 2019-2026 ($ MILLION)

19. NORTH AMERICAN CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

20. EUROPEAN CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY INDUSTRY TYPE, 2019-2026 ($ MILLION)

22. EUROPEAN CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

23. ASIA PACIFIC CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. ASIA PACIFIC CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY INDUSTRY TYPE, 2019-2026 ($ MILLION)

25. ASIA PACIFIC CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

26. REST OF THE WORLD CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY INDUSTRY TYPE, 2019-2026 ($ MILLION)

27. REST OF THE WORLD CARGO SHIPPING MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2019-2026 ($ MILLION)

1. GLOBAL CARGO SHIPPING MARKET SHARE BY INDUSTRY TYPE, 2019 VS 2026 (%)

2. GLOBAL CARGO SHIPPING MARKET SHARE BY VESSEL TYPE, 2019 VS 2026 (%)

3. GLOBAL CARGO SHIPPING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

6. UK CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

11. REST OF EUROPE CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

16. MIDDLE EAST & AFRICA CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)

17. LATIN AMERICA CARGO SHIPPING MARKET SIZE, 2019-2026 ($ MILLION)