Carob Powder Market

Carob Powder Market Size, Share & Trends Analysis Report by Application (Food and beverages and Pharmaceuticals)Forecast Period (2024-2031)

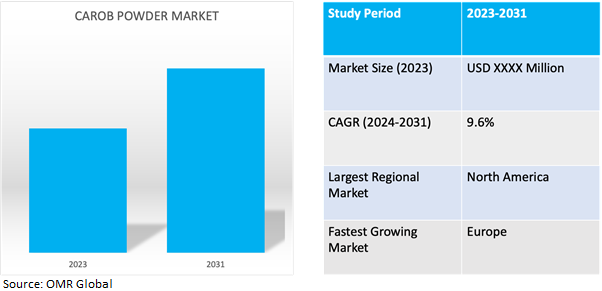

Carob powder market is anticipated to grow at a considerable CAGR of 9.6% during the forecast period (2024-2031).Carob Powderalso called carob flour, is a cocoa powder alternative that is made from dried, roasted carob tree pods and looks a lot like cocoa powder.

Market Dynamics

Carob Powder's Versatility Fuels Growth Amidst the Expanding Food and Beverage Industry

As consumer preferences evolve and demand for innovative food and beverage options increases, manufacturers are constantly introducing new products to meet these changing needs. Within this context, carob powder finds applications in various food and beverage products, including baked goods, confectionery, beverages, and snacks. Its versatility as an ingredient allows manufacturers to incorporate it into a wide range of products, catering to different tastes and preferences. For instance, in 2021, Clif Bar & Company introduced a fresh range of energy bars incorporating carob powder as a prominent component.

Carob Powder: Meeting the Rising Demand for Functional Foods in Consumer Health Trends

The rising trend of having functional food among millennial population, Carob powder, with its rich nutrient profile, including antioxidants, fibre, and other essential nutrients, fits into this trend perfectly. It is often marketed as a functional ingredient due to its potential health benefits, such as digestive support and blood sugar regulation. As consumers become more health-conscious, the demand for functional foods like those containing carob powder continues to rise. For instance, in 2021, Nada Moo unveiled a novel collection of vegan ice creams infused with Mediterranean and Middle Eastern influences, highlighting carob powder as a central ingredient.

Market Segmentation

Our in-depth analysis of the global carob powder market includes the following segments by application:

- Based on application, the market is sub-segmented into food and beverages and pharmaceuticals.

Food and Beverages Sub-segment to Hold a Considerable Market Share

The food and beverages sub-segment holds a considerable market share in the global carob powder market due to its wide utilisation as a versatile ingredient in a diverse range of food and beverage applications that serves as a suitable substitute for cocoa powder in various recipes, including baked goods, confectionery, beverages, and snacks and also the rising consumer demand for healthier and natural alternatives in food and beverages fuels the adoption of carob powder, that is renowned for its low-fat content, absence of caffeine, and high fibre content. The increasing popularity of vegan and plant-based diets contributes to the growth of carob powder consumption in food and beverage products, as it aligns with the preferences of this consumer segment.For instance, In October 2021, Barry Callebaut, a renowned provider of chocolate and cocoa goods, unveiled a fresh assortment of chocolate products incorporating carob. This range encompasses chocolate bars, drops, and chunks crafted using carob powder, strategically catering to the escalating market interest in vegan and plant-based chocolate options.

Regional Outlook

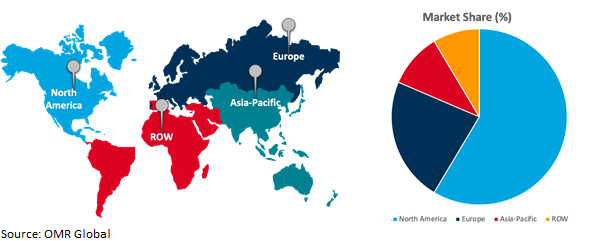

The globalcarob powdermarket is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries to invest in carob powder manufacturing

Europe is experiencing rapid growth in the global carob powder market due to the rising consumer trend towards healthier lifestyles and dietary choices.. Consumers in Europe are increasingly seeking alternatives to traditional ingredients such as carob powder, with the low-fat content, absence of caffeine, and high-fibre content, to meet preferences effectively. The growing popularity of vegan and plant-based diets in Europe further accelerates the demand for carob powder, as it serves as a suitable substitute for cocoa powder in various culinary applications. Additionally, the region's well-established food and beverage industry is continuously innovating to meet consumer demands, leading to the incorporation of carob powder into a wide range of products.In 2023, Carob World, a Portuguese company renowned for its successful product lines such as "Mediterranean Temptations" and "Mediterranean Secret's," introduced its latest offering includes Carob World Carob Powder. This standalone carob powder product marks a significant addition to the company's portfolio. Marketed as gluten-free and boasting high protein and fibre content, the powder also touts richness in essential vitamins.

Global Carob Powder Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to a heightened awareness of health considerations. Moreover, the rising adoption of vegan and plant-based diets in North America amplifies the market demand for carob powder as a suitable substitute for cocoa powder in various culinary applications. The well-established food and beverage industry infrastructure, coupled with continuous product innovation and effective marketing strategies, further bolsters the market's growth trajectory.For instance, in 2023, the acquisition of Missy J's Carob & Sweet Treats was confirmed by Azure Standard, a leading distributor in the United States specializing in wholesome home, health, and garden products.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global carob powdermarket includeIngredion, Tate & Lyle plc, The Hain Celestial Group, Inc., Nestle., THE AUSTRALIAN CAROB CO., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in 2022, The Carob Kitchen partnered with a prominent vegan bakery chain to develop innovative carob-infused desserts, highlighting the adaptability of this ingredient.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global carob powdermarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Ingredion

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Tate & Lyle plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. The Hain Celestial Group, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Carob Powder Market by Application

4.1.1. Food and beverages

4.1.2. Pharmaceuticals

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. AEP Colloids

6.2. Alpine Herb Company Inc.

6.3. Altrafine Gums

6.4. Auroduna Americas (EURODUNA Rohstoffe GmbH)

6.5. THE AUSTRALIAN CAROB CO.

6.6. Bob's Red Mill Natural Foods, Inc.

6.7. BulkFoods.com

6.8. Carob S.A.

6.9. Chatfield's (Panos Brands)

6.10. Mondelez Global Direct Inc.

6.11. Country Life Natural Foods

6.12. Cretacarob

6.13. CyberColloids

6.14. EurlOuasdi International (Carob Algeria)

6.15. Forest Whole Foods (Forest Whole Foods Ltd.)

6.16. Frontier Co-op

6.17. Healthworks

6.18. INDUSTRIAS RALDA S.A.

6.19. Ingredients UK

6.20. Jedwards International, Inc.

1. GLOBAL CAROB POWDER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

2. GLOBAL CAROB POWDER FOR FOOD AND BEVERAGESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBALCAROB POWDERFOR PHARMACEUTICALSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CAROB POWDERMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. NORTH AMERICAN CAROB POWDERMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

6. NORTH AMERICAN CAROB POWDERMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

7. EUROPEAN CAROB POWDERMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

8. EUROPEAN CAROB POWDERMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. ASIA-PACIFIC CAROB POWDERMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

10. ASIA-PACIFICCAROB POWDERMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

11. REST OF THE WORLD CAROB POWDERMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. REST OF THE WORLD CAROB POWDERMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL CAROB POWDERMARKET SHAREBY APPLICATION, 2023 VS 2031 (%)

2. GLOBAL CAROB POWDERFOR FOOD AND BEVERAGESMARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBALCAROB POWDERFOR PHARMACEUTICALSMARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CAROB POWDERMARKETSHARE BY REGION, 2023 VS 2031 (%)

5. US CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

6. CANADA CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

7. UK CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

8. FRANCE CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

9. GERMANY CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

10. ITALY CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

11. SPAIN CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

12. REST OF EUROPE CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

13. INDIA CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

14. CHINA CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

15. JAPAN CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

16. SOUTH KOREA CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF ASIA-PACIFIC CAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

18. LATIN AMERICACAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)

19. MIDDLE EAST AND AFRICACAROB POWDERMARKET SIZE, 2023-2031 ($ MILLION)