Cashew Nuts Market

Global Cashew Nuts Market Size, Share & Trends Analysis Report, By Form (Raw and Roasted), By Distribution Channel (Online and Offline) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The global cashew nuts market is estimated to grow at a CAGR of 4.6% during the forecast period. Rising demand for roasted cashew nuts and potential awareness regarding the health benefits of cashew nuts are some key factors accelerating the market growth. Cashews are rich in fiber and low in sugar and contain plant protein and heart-healthy fats. Cashew nuts are also a potential source of some essential nutrients such as manganese, copper, and magnesium that are important for energy production, bone health, brain health, and immunity. Apart from these benefits, cashews are rich in polyphenols and carotenoids, which are two antioxidants categories that may support reduce inflammation and provide protection from conditions such as cancer and CVD.

Cashew nuts contain heart-healthy monounsaturated fats, which include palmitoleic and oleic acids. These are regarded as essential fatty acids linked with reduced levels of unhealthy low-density lipoproteins (LDL) cholesterol and higher levels of healthy high-density lipoprotein (HDL) cholesterol. Therefore, the consumption of cashews in the form of monounsaturated fats is resulting in a reduced risk of CVD. Cashew nuts are an excellent source of protein which is one of three macronutrients used by the body for energy and is especially important to rebuild muscle tissue and developing new cellular compounds.

Rising inclination towards healthier diets is resulting in increased consumption of cashew nuts to meet their protein and other well-balanced nutritional profile. Every ounce of cashews (nearly 16 to 18 nuts) contains 5 grams of protein, 13 grams of fat (most of this fat contains heart-healthy monounsaturated fats), and 160 calories. This makes cashew nuts less calorie dense compared to other nuts including macadamia nuts, which consists of 200 calories, however, only 2 grams of protein per ounce. Therefore, the consumption of cashew nuts is a potential snack option for people who are following a high-protein or low-calorie diet. Owing to these health benefits, cashew nuts are significantly consumed as a healthier snacking option, particularly among the millennial population.

Market Segmentation

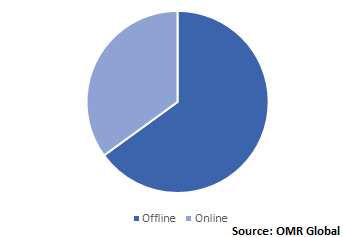

The market is segmented based on form and distribution channel. Based on the form, the market is classified into raw and roasted. Based on the distribution channel, the market is classified into online and offline.

Online Distribution Channel to Witness Significant Share During the Forecast Period

The online distribution channel is expected to grow at a significant CAGR during the forecast period owing to the rising preference towards online shopping owing to the ease of convenience and busy lifestyle of consumers. Amidst COVID-19, several players have started expanding their online presence to retain their share in the market. For instance, in May 2020, PepsiCo, Inc. launched two direct-to-consumer websites, including Snacks.com and PantryShop.com. These websites allow shoppers to order a range of food and beverage brands from PepsiCo. With the increasing consumers' inclination towards online platforms for their food and beverage requirements during the COVID-19 pandemic, these websites will offer shoppers easy and fast access to PepsiCo’s products.

Global Cashew Nuts Market Share by Distribution Channel, 2019 (%)

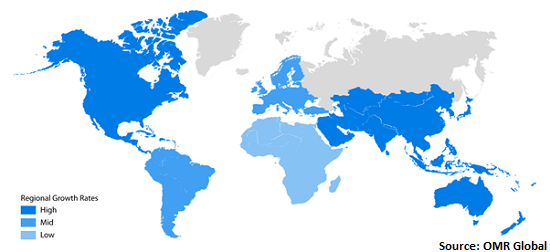

Regional Outlook

Geographically, in 2019, Europe cashew nuts market is significantly driven by the rising consumption of healthier snacks and significant availability of the working-age population in the region. As per the Organization for Economic Cooperation and Development (OECD), the percentage of the working-age population in Germany, France, Italy, the UK, and Sweden was 65.0%, 62.1%, 64.0%, 63.8%, and 62.4%, respectively. This population highly consume healthier snacks with an appropriate nutritional profile. As a result, the demand for cashew nuts is growing significantly in the region. Moreover, Asia-Pacific cashew nuts market is significantly driven by the increased demand for roasted cashew nuts in the country and raising awareness regarding the health benefits associated with cashew nuts.

Global Cashew Nuts Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include PepsiCo, Inc., Blue Diamond Growers, Haldiram Foods International Pvt Ltd., the Kraft Heinz Co., and Olam International. The players are focused on increasing their range of products to widen their consumer base. For instance, in September 2019, the flagship brand of Greendot Health Foods Pvt Ltd, Cornitos, revealed flavored nuts and seeds within its Pop N Crunch range. This new range comprises Roasted Salted Pumpkin Seeds, Premium Cashews, California Almonds, Party Nut Mix, Sunflower seeds, Premium Salted Peanuts, and Coated Green Peas. These nuts and seeds are handpicked and processed with the use of advanced technology employing imported roasting lines that provide them a crunchy bite and a uniform roast. These nuts and seeds are packed in re-sealable nitrogen-filled pouches, which provide good shelf life.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cashew nuts market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. PepsiCo, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Blue Diamond Growers

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Haldiram Foods International Pvt Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. The Kraft Heinz Co.

1.1.1.1. Overview

1.1.1.2. Financial Analysis

1.1.1.3. SWOT Analysis

1.1.1.4. Recent Developments

3.3.5. Olam International

1.1.1.5. Overview

1.1.1.6. Financial Analysis

1.1.1.7. SWOT Analysis

1.1.1.8. Recent Developments

2. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

3. Market Segmentation

3.1. Global Cashew Nuts Market by Form

3.1.1. Raw

3.1.2. Roasted

3.2. Global Cashew Nuts Market by Distribution Channel

3.2.1. Offline

3.2.2. Online

4. Regional Analysis

4.1. North America

4.1.1. United States

4.1.2. Canada

4.2. Europe

4.2.1. UK

4.2.2. Germany

4.2.3. Italy

4.2.4. Spain

4.2.5. France

4.2.6. Rest of Europe

4.3. Asia-Pacific

4.3.1. China

4.3.2. India

4.3.3. Japan

4.3.4. Rest of Asia-Pacific

4.4. Rest of the World

5. Company Profiles

5.1. Aperitivos Flaper S.A.

5.2. Blue Diamond Growers

5.3. Haldiram Foods International Pvt. Ltd.

5.4. Herbert Kluth GmbH & Co.KG

5.5. Lorenz Bahlsen Snack-World GmbH & Co KG

5.6. Ludlow Nut Co. Ltd.

5.7. Napa Nuts

5.8. Natco Foods Ltd.

5.9. Nilon’s Enterprises Pvt. Ltd.

5.10. Olam International

5.11. PepsiCo, Inc.

5.12. Pioneer Non Fried Foods Pvt Ltd.

5.13. Rajguru Foods (Delight Nuts)

5.14. Sun Valley Ltd.

5.15. The Kraft Heinz Co.

5.16. Three Squirrels

5.17. Ültje GmbH (Intersnack Group GmbH & Co. KG)

5.18. V. Besana S.p.A.

1. GLOBAL CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

2. GLOBAL RAW CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL ROASTED CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

5. GLOBAL CASHEW NUTS FROM OFFLINE DISTRIBUTION CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL CASHEW NUTS FROM ONLINE DISTRIBUTION CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

10. NORTH AMERICAN CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

11. EUROPEAN CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. EUROPEAN CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

13. EUROPEAN CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

14. ASIA-PACIFIC CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

17. REST OF THE WORLD CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

18. REST OF THE WORLD CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL CASHEW NUTS MARKET SHARE BY FORM, 2019 VS 2026 (%)

2. GLOBAL CASHEW NUTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

3. GLOBAL CASHEW NUTS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD CASHEW NUTS MARKET SIZE, 2019-2026 ($ MILLION)