Cashmere Clothing Market

Cashmere Clothing Market Size, Share & Trends Analysis Report by Product (Sweaters & Coats, Pants & Trousers, Tees & Polo and Others), by End-User (Men and Women), and by Distribution Channel (Online and Offline) Forecast Period (2024-2031)

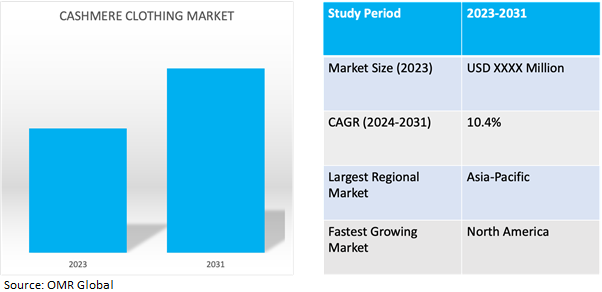

Cashmere clothing market is anticipated to grow at a CAGR of 10.4% during the forecast period (2024-2031). Cashmere clothing refers to garments made from cashmere wool, which comes from the soft undercoat of cashmere goats. It's known for its luxurious feel, warmth, and lightweight texture. Cashmere is highly prized for its softness and insulating properties, making it a popular choice for sweaters, scarves, shawls, hats, gloves, and other cold-weather apparel. It's considered a high-end material due to its rarity and the labour-intensive process involved in harvesting and processing the wool.

Market Dynamics

High Consumer Demand in the Cashmere Clothing Market

Consumer demand for cashmere clothing is driven by its luxurious appeal, softness, and elegance. Fashion trends heavily influence the demand for cashmere apparel, with consumers seeking stylish and high-quality garments. Cashmere's perceived value as a premium material further enhances its allure, leading consumers to willingly pay premium prices. Seasonal variations also impact demand, with higher interest during colder months for warmth and insulation, while lightweight cashmere accessories remain popular year-round for their versatility. For instance, in September 2022, Gigi Hadid debuted her exclusive direct-to-consumer cashmere brand, named Guest In Residence.

Understand Cashmere Clothing Supply Chain: From Raw Wool to Seamless Apparel Innovations

The cashmere clothing supply chain begins with the sourcing of raw cashmere wool from regions like China and Mongolia. Factors such as weather conditions and animal husbandry practices influence the quantity and quality of cashmere produced. Processing and spinning facilities transform raw wool into yarn suitable for weaving or knitting, leveraging technological advancements for efficiency and quality. Manufacturing centres then utilize this yarn to create various cashmere garments, with production often concentrated in countries with lower labour costs. Finished products are distributed through wholesale and retail channels, relying on efficient logistics to meet consumer demand. For instance, in September 2022, UNIQLO, a renowned clothing apparel company, unveiled its latest advancement: 3D cashmere knits. These articles of clothing, made from pure cashmere, demonstrate the utilization of WHOLEGARMENT Japanese knitting technology, leading to the creation of seamless attire. This introduction represents a strategic reaction to the growing desire for premium cashmere among female consumers, showcasing UNIQLO's dedication to adapting to changing consumer needs.

Market Segmentation

Our in-depth analysis of the global cashmere clothing market includes the following segments by product, end-user, and distribution channel:

- Based on product, the market is sub-segmented into sweaters & coats, pants & trousers, tees & polo and others (scarves).

- Based on end-user, the market is sub-segmented into men and women.

- Based on distribution channel, the market is sub-segmented into online and offline.

Sweaters and Coats is Projected to Emerge as the Largest Segment

Based on the product, the sweaters & coats sub-segment is expected to hold the largest share of the market driven by the increasing demand for luxury and high-quality winter wear. Cashmere sweaters and coats offer exceptional warmth, softness, and elegance, making them highly desirable among consumers seeking premium winter apparel. North American consumers are willing to invest in luxurious and durable clothing items like cashmere sweaters and coats. Fashion trends also play a significant role, with designers and influencers often promoting cashmere garments as must-have items for their timeless appeal and versatility.

Offline Sub-segment to Hold a Considerable Market Share

The offline sub-segment maintains a significant market share in the global cashmere clothing market due to its ability to provide customers with a tactile shopping experience. This personalized approach, facilitated by knowledgeable sales staff, is particularly valued in the luxury apparel sector. Additionally, offline retail channels cater to an affluent clientele who appreciate the exclusivity and prestige associated with shopping in upscale boutiques and department stores. Despite the rise of online shopping, the offline sub-segment continues to thrive, offering a unique and immersive shopping experience that resonates with discerning consumers seeking high-quality cashmere clothing.

Regional Outlook

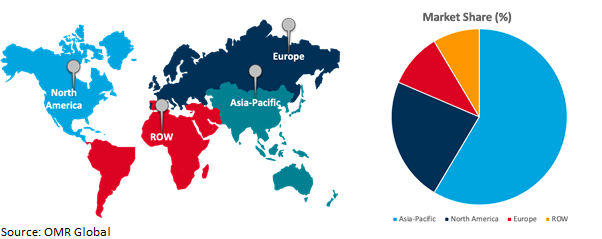

The global cashmere clothing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America's Surging Demand for Luxury Cashmere

North America is experiencing rapid growth due to rising demand for luxury apparel in the region, driven by increasing disposable incomes and a growing appreciation for high-quality, premium garments among consumers. Additionally, the influence of fashion trends and celebrity endorsements has heightened interest in cashmere clothing, particularly among younger demographics. Moreover, the shift towards sustainable and ethically sourced fashion has led consumers to favour natural fibres like cashmere, further boosting its popularity in North America. Furthermore, the ease of accessibility through online retail channels has made cashmere clothing more available to a wider audience in the region. For instance, in September 2022, NAADAM launched a new retail location in Georgetown, United States, showcasing a varied selection of apparel including sweaters, hoodies, sleepwear, outerwear, and an assortment of accessories, all meticulously crafted from exquisite cashmere wool.

Global Cashmere Clothing Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share due to major producers of cashmere wool, notably China and Mongolia, renowned for their high-quality fibres. With a burgeoning consumer base and rising incomes, particularly in countries such as China, India, and Japan, there's a growing demand for luxury apparel, including cashmere garments. The region's rich cultural heritage values craftsmanship and natural materials, further fueling the popularity of cashmere clothing. Additionally, Asia-Pacific benefits from a well-established textile and garment manufacturing sector, facilitating efficient production and distribution of cashmere clothing both within the region and for export globally. For instance, In March 2023, Toteme, the Swedish brand founded by online fashion influencer Elin Kling and former art director Karl Lindman, is focusing on expanding its presence in Asia. With a successful business surpassing €100 million in revenue and established retail locations in Stockholm, New York, and Shanghai, Toteme has opened its first stores in Seoul, South Korea.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global cashmere clothing market include Clinton Hill Cashmere Company, ERDOS Cashmere Group, Huzhou Zhenbei Cashmere Products Co., Ltd., Mongolia Cashmere Manufacturer, TSE Cashmere, and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2023, Zegna and The Elder Statesman collaborated to introduce the Oasi Cashmere collection, leveraging their respective strengths in fabric craftsmanship. This partnership resulted in a series of opulent cashmere garments that prioritized both style and sustainability. The collection integrated innovative eco-friendly methods throughout the production process, with a focus on ensuring complete traceability of the cashmere garments.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cashmere clothing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cashmere Clothing Market by Product

4.1.1. Sweaters & Coats

4.1.2. Pants & Trousers

4.1.3. Tees & Polo

4.1.4. Others (Scarves)

4.2. Global Cashmere Clothing Market by End-User

4.2.1. Men

4.2.2. Women

4.3. Global Cashmere Clothing Market by Distribution Channel

4.3.1. Online

4.3.2. Offline

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Alyki - Felice De Palma & Co.

6.2. Birdie Cashmere, Ltd. (BIRDIE LONDON)

6.3. Brunello Cucinelli SpA

6.4. Clinton Hill Cashmere Company

6.5. Dolce & Gabbana S.r.l.

6.6. ERDOS Cashmere Group

6.7. Ermenegildo Zegna

6.8. Giorgio Armani S.p.A.

6.9. Gobi Corp.

6.10. Hermes International S.A.

6.11. Huzhou Zhenbei Cashmere Products Co., Ltd.

6.12. Kering S.A.

6.13. King Deer Group

6.14. Kinross Cashmere

6.15. Loro Piana S.P.A.

6.16. Malo Spa

6.17. Mongolia Cashmere Manufacturer

6.18. NatureKnit

6.19. NakedCashmere

6.20. Pringle of Scotland Limited

6.21. Ralph Lauren Corp.

6.22. Repeat Fashion B.V.

6.23. Sofia Cashmere

6.24. The Ballantyne (Corso Italia S.P.A.)

6.25. TSE Cashmere

6.26. White + Warren

1. GLOBAL CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL CASHMERE SWEATERS & COATS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CASHMERE PANTS & TROUSERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CASHMERE TEES & POLO MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHERS CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

7. GLOBAL CASHMERE CLOTHING FOR MEN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CASHMERE CLOTHING FOR WOMEN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

10. GLOBAL ONLINE CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL OFFLINE CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. NORTH AMERICAN CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

17. EUROPEAN CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

19. EUROPEAN CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. EUROPEAN CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

25. REST OF THE WORLD CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

27. REST OF THE WORLD CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

28. REST OF THE WORLD CASHMERE CLOTHING MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL CASHMERE CLOTHING MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL CASHMERE SWEATERS & COATS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CASHMERE PANTS & TROUSERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CASHMERE TEES & POLO MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL OTHERS CASHMERE CLOTHING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CASHMERE CLOTHING MARKET SHARE BY END-USER, 2023 VS 2031 (%)

7. GLOBAL CASHMERE CLOTHING FOR MEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CASHMERE CLOTHING FOR WOMEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CASHMERE CLOTHING MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

10. GLOBAL ONLINE CASHMERE CLOTHING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL OFFLINE CASHMERE CLOTHING MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CASHMERE CLOTHING MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

15. UK CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA CASHMERE CLOTHING MARKET SIZE, 2023-2031 ($ MILLION)