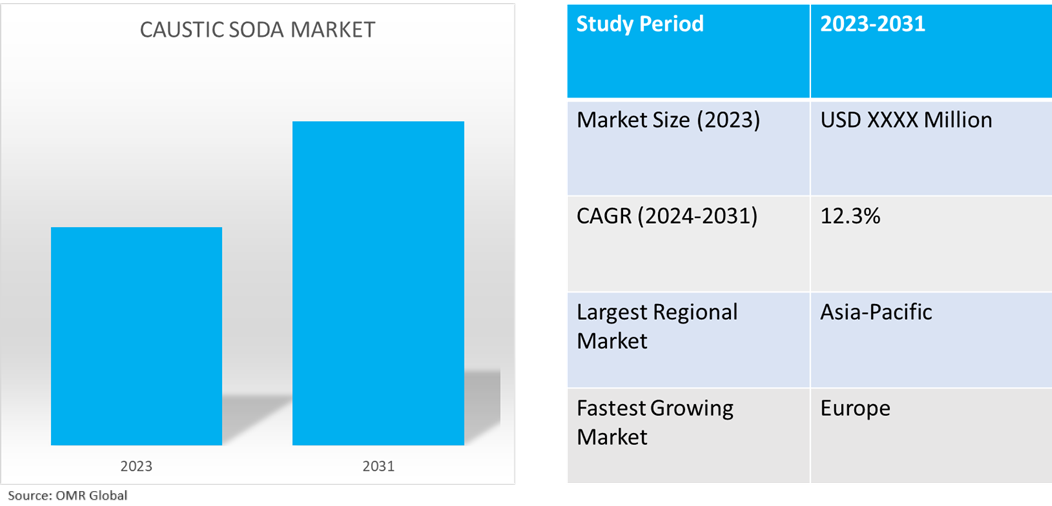

Caustic Soda Market

Caustic Soda Market Size, Share & Trends Analysis Report by Production Process (Membrane Cell Process, Diaphragm Cell Process, and Mercury Cell Process), by Form (Solid, Liquid, and Flake), and by Application (Pulp and Paper, Textiles, Soaps and Detergents, Petroleum Products, Alumina, Chemical Production, Water Treatment and Others) Forecast Period (2024-2031)

Caustic soda market is anticipated to grow at a significant CAGR of 12.3% during the forecast period (2024-2031). The industry growth is attributed to pivotal factors such as increasing demand for caustic soda in industrial applications owing to its strong alkaline nature. It is integral to the manufacture of petroleum products, pulp and paper, alumina, textiles, soaps, and detergents, along with its application in chemical processing, water treatment, and petroleum processing. According to the Department of Health, around 56.0% of sodium hydroxide produced is used by industry, with 25.0% of NaOH used in the paper industry. Some other uses include fuel cell production, curing food, removing skin from vegetables for canning, bleach, drain cleaner, oven cleaner, soaps, detergent, paper making, paper recycling, aluminum ore processing, oxide coating, processing cotton fabric, pickling, pain relievers, anticoagulants to prevent blood clots, cholesterol reducing medications, and water treatment.

Market Dynamics

Increasing Demand in Industrial Production, and Increasing Consumption in Emerging Markets

Major consuming sectors for caustic soda are textiles, alumina, inorganics, pulp & paper, and others. According to the Centre for Science and Environment (CSE), the world production of caustic soda is estimated to be around 45 million tons per year. In the US, the largest users of caustic soda are the organic chemical industry 30.0% and the inorganic chemical industry 20.0%. The pulp and paper industry uses about 20.0% of the US caustic soda production for pulping wood chips, and other processes. In Europe, the chemical industry is the major consumer of caustic soda followed by the paper industry. Other user is the aluminum industry.

Increasing Innovations in Production Technologies

Innovative methods such as the membrane cell process have emerged as cleaner and more efficient alternatives, reducing the environmental impact and optimizing the production process. These advancements have significantly improved energy efficiency, resulting in lower production costs. Additionally, modern production lines deliver better product quality control and have minimized the need for manual labor. This ultimately leads to enhanced efficiency and cost-effectiveness for manufacturers. The manufacturers are turning to advanced optimization techniques, to further enhance the efficiency of caustic soda production. These methods utilize algorithms and mathematical models to analyze process data and identify opportunities for improvement.

Market Segmentation

- Based on the production process, the market is segmented into the membrane cell process, diaphragm cell process, and mercury cell process.

- Based on the form, the market is segmented into solid, liquid, and flake.

- Based on the application, the market is segmented into pulp and paper, textiles, soaps and detergents, petroleum products, alumina, chemical production, water treatment, and others (food processing, pharmaceuticals).

Solid Segment is projected to hold the Largest Market Share

The primary factor supporting the growth of solid caustic soda is its application in the manufacturing of numerous products, including pulp and paper, textiles, soaps, detergents, and various chemicals. Solid caustic soda is a powerful alkaline chemical that rapidly absorbs moisture from the air. It plays a crucial role in defining the market for this product. As of this property, solid caustic soda dissolves in water very easily and releases heat as it dissolves. As for its corrosive qualities, it is an essential ingredient of many industrial processes, especially those that produce paper and textiles, where it is used in the pulping and bleaching stages, respectively.

Pulp and Paper Segment to Hold a Considerable Market Share

The factors supporting segment growth include increasing demand for caustic soda to break the lignin bonds of wood being processed into pulp for papermaking. Caustic soda is primarily used in the chemical processing or cooking of pulp, particularly kraft pulp, in the manufacturing of pulp and paper. Most pulp-bleaching methods, including sulfite, sulfate, and soda, involve the use of caustic soda. Moreover, pulp is mostly used in the creation of writing and printing paper. Production of pulp and paper is the primary usage for caustic soda. The global market for caustic soda is anticipated to develop as a result of rising pulp and paper consumption.

Regional Outlook

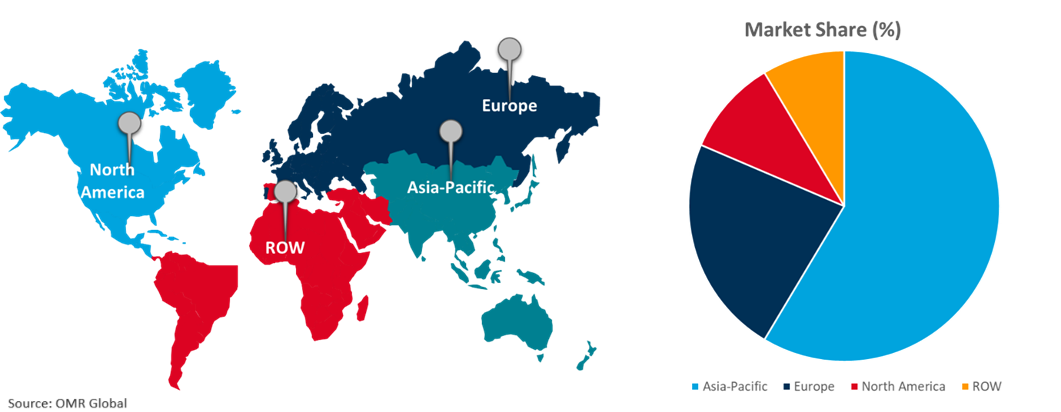

The global caustic soda market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Caustic Sodas in Europe

- The regional growth is attributed to increasing demand for caustic soda from various applications such as pulp and paper, chemicals and soap, and detergents. According to the Euro Chlor, in June 2023, caustic soda production reached 293,686 tons. Germany is one of the biggest chemical manufacturing sectors in the continent, with an estimated 27.0% of the overall revenue generated by the European chemical industry. In terms of spending, investments, exports, and sales of chemicals, the German chemical sector is significant. More chemicals are still exported by local businesses than by any other country in Europe.

Global Caustic Soda Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the presence of caustic soda offering companies such as Aditya Birla Chemicals (India) Ltd. (Grasim Industries Ltd.), Gujarat Alkalies and Chemicals Ltd.(GACL)., Hanwha Group, Shin-Etsu Chemical Co., Ltd, Tata Chemicals Ltd. and others. The market growth is attributed to the increasing demand for caustic soda in the textile industry for processes such as scouring, mercerization, and dyeing, integral parts of the textile manufacturing process. Additionally, the increasing adoption of caustic soda in alumina and inorganics drives the growth of the market in the region. According to the Alkali Manufacturers Association of India, in 2023, the Installed Capacity of caustic soda as of 31 March 2023 was 5.56 million MTPA (Million Tons Per Annum). The production during the year 2022-23 was 4.4 million MT (Million Tons). The capacity utilization was 80.0% during 2022-23. The exports increased by 34.0%, to 458 KT (Kilo Tins) during the year. Market players are increasing their domestic caustic soda production volume, to further strengthen their presence in the chemicals industry. For instance, in April 2022, Hanwha Group made a strategic decision to increase its production of caustic soda. Hanwha Solutions is currently producing 840,000 tons of caustic soda per year. Hanwha Solutions invested $282.0 million (KRW 338.0 billion) to increase the production of caustic soda by an additional 270,000 tons.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the caustic soda market include Dow Chemical Company, Formosa Plastics Corp., Occidental Petroleum Corp.(OxyChem), Olin Corp., and Westlake Chemical Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In December 2023, Asahi Kasei introduced a demonstration trial on rental service for chlor-alkali electrolysis cells in Europe. The membrane process for chlor-alkali electrolysis produces chlorine, hydrogen, and caustic soda by electrolyzing brine using ion-exchange membranes. It eliminates the need to use environmentally hazardous mercury or asbestos as process materials and enables greater energy efficiency.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global caustic soda market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Dow Chemical Company

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Formosa Plastics Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Occidental Petroleum Corp. (OxyChem)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Olin Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Westlake Chemical Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Caustic Soda Market by Production Process

4.1.1. Membrane Cell Process

4.1.2. Diaphragm Cell Process

4.1.3. Mercury Cell Process

4.2. Global Caustic Soda Market by Form

4.2.1. Solid

4.2.2. Liquid

4.2.3. Flake

4.3. Global Caustic Soda Market by Application

4.3.1. Pulp And Paper

4.3.2. Textiles

4.3.3. Soaps And Detergents

4.3.4. Petroleum Products

4.3.5. Alumina

4.3.6. Chemical Production

4.3.7. Water Treatment

4.3.8. Others (Food Processing, Pharmaceuticals)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Aditya Birla Chemicals (India) Ltd. (Grasim Industries Ltd.)

6.2. AGC Group

6.3. BASF SE

6.4. Covestro AG

6.5. Diversey, Inc.

6.6. FMC Corp.

6.7. Gujarat Alkalies and Chemicals Ltd. (GACL)

6.8. Hanwha Solutions Corp.

6.9. INEOS Group Ltd.

6.10. JSC KAUSTIK

6.11. Kemira Oyj

6.12. LG Chem Ltd.

6.13. Mitsui Chemicals, Inc.

6.14. Nouryon Chemicals Holding B.V

6.15. SABIC (Saudi Basic Industries Corp.)

6.16. Shin-Etsu Chemical Co., Ltd.

6.17. Sinochem Holdings

6.18. Solvay S.A.

6.19. Tata Chemicals Ltd.

6.20. TOAGOSEI CO., LTD.

6.21. Tosoh Corp.

1. Global Caustic Soda Market Research And Analysis By Production Process, 2023-2031 ($ Million)

2. Global Caustic Soda By Membrane Cell Process Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Caustic Soda By Diaphragm Cell Process Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Caustic Soda By Mercury Cell Process Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Caustic Soda Market Research And Analysis By Form, 2023-2031 ($ Million)

6. Global Solid Caustic Soda Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Liquid Caustic Soda Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Flake Caustic Soda Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Caustic Soda Market Research And Analysis By Application, 2023-2031 ($ Million)

10. Global Caustic Soda For Pulp And Paper Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Caustic Soda For Textiles Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Caustic Soda For Soaps And Detergents Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Caustic Soda For Petroleum Products Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Caustic Soda For Alumina Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Caustic Soda For Chemical Production Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Caustic Soda For Water Treatment Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Caustic Soda For Other Application Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Global Caustic Soda Market Research And Analysis By Region, 2023-2031 ($ Million)

19. North American Caustic Soda Market Research And Analysis By Country, 2023-2031 ($ Million)

20. North American Caustic Soda Market Research And Analysis By Production Process, 2023-2031 ($ Million)

21. North American Caustic Soda Market Research And Analysis By Form, 2023-2031 ($ Million)

22. North American Caustic Soda Market Research And Analysis By Application, 2023-2031 ($ Million)

23. European Caustic Soda Market Research And Analysis By Country, 2023-2031 ($ Million)

24. European Caustic Soda Market Research And Analysis By Production Process, 2023-2031 ($ Million)

25. European Caustic Soda Market Research And Analysis By Form, 2023-2031 ($ Million)

26. European Caustic Soda Market Research And Analysis By Application, 2023-2031 ($ Million)

27. Asia-Pacific Caustic Soda Market Research And Analysis By Country, 2023-2031 ($ Million)

28. Asia-Pacific Caustic Soda Market Research And Analysis By Production Process, 2023-2031 ($ Million)

29. Asia-Pacific Caustic Soda Market Research And Analysis By Form, 2023-2031 ($ Million)

30. Asia-Pacific Caustic Soda Market Research And Analysis By Application, 2023-2031 ($ Million)

31. Rest Of The World Caustic Soda Market Research And Analysis By Country, 2023-2031 ($ Million)

32. Rest Of The World Caustic Soda Market Research And Analysis By Production Process, 2023-2031 ($ Million)

33. Rest Of The World Caustic Soda Market Research And Analysis By Form, 2023-2031 ($ Million)

34. Rest Of The World Caustic Soda Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Caustic Soda Market Research And Analysis By Production Process, 2023 Vs 2031 (%)

2. Global Caustic Soda By Membrane Cell Process Market Share By Region, 2023 Vs 2031 (%)

3. Global Caustic Soda By Diaphragm Cell Process Market Share By Region, 2023 Vs 2031 (%)

4. Global Caustic Soda By Mercury Cell Process Market Share By Region, 2023 Vs 2031 (%)

5. Global Caustic Soda Market Research And Analysis By Form, 2023 Vs 2031 (%)

6. Global Solid Caustic Soda Market Share By Region, 2023 Vs 2031 (%)

7. Global Liquid Caustic Soda Market Share By Region, 2023 Vs 2031 (%)

8. Global Flake Caustic Soda Market Share By Region, 2023 Vs 2031 (%)

9. Global Caustic Soda Market Research And Analysis By Application, 2023 Vs 2031 (%)

10. Global Caustic Soda For Pulp And Paper Market Share By Region, 2023 Vs 2031 (%)

11. Global Caustic Soda For Textiles Market Share By Region, 2023 Vs 2031 (%)

12. Global Caustic Soda For Soaps And Detergents Market Share By Region, 2023 Vs 2031 (%)

13. Global Caustic Soda For Petroleum Products Market Share By Region, 2023 Vs 2031 (%)

14. Global Caustic Soda For Alumina Market Share By Region, 2023 Vs 2031 (%)

15. Global Caustic Soda For Chemical Production Market Share By Region, 2023 Vs 2031 (%)

16. Global Caustic Soda For Water Treatment Market Share By Region, 2023 Vs 2031 (%)

17. Global Caustic Soda For Other Application Market Share By Region, 2023 Vs 2031 (%)

18. Global Caustic Soda Market Share By Region, 2023 Vs 2031 (%)

19. US Caustic Soda Market Size, 2023-2031 ($ Million)

20. Canada Caustic Soda Market Size, 2023-2031 ($ Million)

21. UK Caustic Soda Market Size, 2023-2031 ($ Million)

22. France Caustic Soda Market Size, 2023-2031 ($ Million)

23. Germany Caustic Soda Market Size, 2023-2031 ($ Million)

24. Italy Caustic Soda Market Size, 2023-2031 ($ Million)

25. Spain Caustic Soda Market Size, 2023-2031 ($ Million)

26. Rest Of Europe Caustic Soda Market Size, 2023-2031 ($ Million)

27. India Caustic Soda Market Size, 2023-2031 ($ Million)

28. China Caustic Soda Market Size, 2023-2031 ($ Million)

29. Japan Caustic Soda Market Size, 2023-2031 ($ Million)

30. South Korea Caustic Soda Market Size, 2023-2031 ($ Million)

31. Rest Of Asia-Pacific Caustic Soda Market Size, 2023-2031 ($ Million)

32. Rest Of The World Caustic Soda Market Size, 2023-2031 ($ Million)

33. Latin America Caustic Soda Market Size, 2023-2031 ($ Million)

34. Middle East And Africa Caustic Soda Market Size, 2023-2031 ($ Million)