Ceiling Tiles Market

Ceiling Tiles Market Size, Share & Trends Analysis Report by Raw Material (Mineral Wool, Metal, Gypsum and Others (Composites, Plastics, and Wood)), by Property (Acoustic and Non-Acoustic), and by Application (Residential, Commercial, Industrial, and Institutional), Forecast Period (2024-2031)

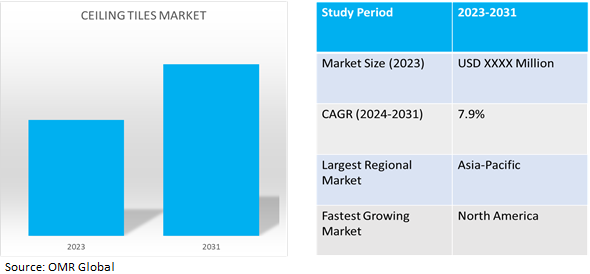

Ceiling tiles market is anticipated to grow at a CAGR of 7.9% during the forecast period (2024-2031).The growth is expected to be driven by rising commercial construction activities like office complexes, institutional buildings, and healthcare facilities across the world. The market is likely to grow substantially with increasing disposable income in emerging economies, increasing demand for thermal and acoustic insulation, and changing consumer behavior toward the aesthetics of office and home buildings. In addition, the usage of innovative and sustainable construction solutions involving eco-friendly materials for floors, ceilings, and walls, is expected to benefit the market dynamics over the forecast period. The ceiling tiles are manufactured using various raw materials such as metals, mineral fiber, fiberglass, gypsum, wood, and plastic. Some of them have harmful effects on the environment which acts as a restraint in the growth of the ceiling tiles industry.

Market Dynamics

Rising Number Of Renovations And Retrofitting Activities

Renovations and retrofitting activities have gained traction in both commercial and residential sectors, establishing themselves as a fundamental market driver. Ceiling tiles serve as an economical yet effective option for these renovations. Especially in older buildings where insulation and acoustics are poor, the incorporation of modern tile variants can significantly improve these aspects. The increased awareness among consumers about sustainability and energy efficiency has also led many to opt for ceiling tiles as a greener option during renovations. Furthermore, retrofitting activities are often subsidized or incentivized by government initiatives aimed at improving energy efficiency in buildings, making the installation of these tiles an even more attractive option for property owners. As such, the rising trend in renovations and retrofitting activities using ceiling tiles plays a vital role in market expansion.

Sustainable, Energy-efficient, and Indoor Air Quality-focused Ceiling Tiles to Create Opportunities

The global ceiling tiles market is experiencing significant growth opportunities driven by sustainability, energy efficiency, and indoor air quality considerations. With increasing global emphasis on sustainability and environmental responsibility, the construction sector is shifting toward sustainable building practices. Sustainable ceiling tiles, made from recycled materials or renewable resources, have a lower environmental impact compared to traditional alternatives. These can hence conserve natural resources and reduce waste. Energy efficiency is another crucial aspect driving demand, as building owners seek to reduce energy consumption and carbon footprints. Ceiling tiles with enhanced thermal insulation properties can contribute to energy savings. Several supporting government policies promoting sustainable construction practices and increasing preference for eco-friendly products are driving the market. Manufacturers who would seize the opportunity to provide sustainable ceiling tiles can meet customer needs. They can also differentiate themselves in the market and contribute to a more sustainable future.

Market Segmentation

Our in-depth analysis of the global ceiling tiles market includes the following segments by raw material, property, and application:

- Based on raw materials, the market is segmented into mineral wool, metal, gypsum, and others (composites, plastics, and wood).

- Based on property, the market is segmented into acoustic and non-acoustic.

- Based on application, the market is segmented into residential, commercial, industrial, and institutional.

The Commercial is Projected to Emerge as the Largest Segment

The commercial segment is expected to hold the largest share of the market. Commercial buildings, including offices, retail stores, hotels, restaurants, healthcare facilities, and educational institutions, require functional and visually appealing ceilings. Ceiling tiles serve as an essential element in these spaces, offering a range of benefits such as aesthetics, acoustics, thermal insulation, and energy efficiency. A significant increase in commercial construction projects such as office complexes, shopping malls, hotels, and educational facilities is estimated to drive the market during the forecast period.

Mineral Wool Segment to Hold a Considerable Market Share

Mineral wool ceiling tiles are made from a combination of natural or synthetic fibers and minerals such as clay, perlite, or fiberglass. These tiles are designed to provide acoustic control and are known for their excellent sound absorption properties. Mineral wool ceiling tiles are lightweight, easy to install, and are available in various textures, as well as patterns. These offer high thermal insulation compared to tiles made up of other materials. Several benefits associated with these tiles are key factors bolstering their sales across the globe. The superior performance attributes of the products such as thermal and acoustic insulation, lightweight, and recyclability have resulted in increased penetration of the product in the application industries.

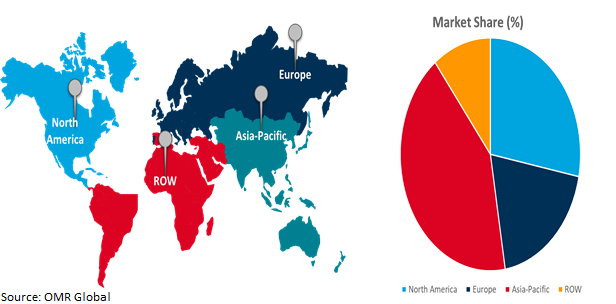

Regional Outlook

The global ceiling tiles market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America is Fastest Growing Market

Robust growth of the commercial construction sector is a key factor propelling ceiling tile sales in the US. In addition, increasing renovation and retrofitting activities in the country would boost sales. The country has stringent building codes and regulations that govern construction practices, including requirements for fire safety, acoustics, and energy efficiency. These are also expected to benefit the demand for high-quality ceiling tiles in the market.

Global Ceiling Tiles Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share with growing investments in residential and commercial construction in countries, such as India, China, the Philippines, Vietnam, and Indonesia, the market for ceiling tiles is expected to increase in the coming years. Currently, China has numerous airport construction projects, which are either in the development or planning stage. These include Beijing Capital International Airport, Chengdu Shuangliu International Airport, Guangzhou Baiyun International Airport, etc. Furthermore, the government rolled out massive construction plans for the movement of 250.0 million people to its new megacities, over the next 10 years. In India, the government’s investment target of $120.5 billion, for developing 27 industrial clusters, is expected to boost commercial construction in the country. The Indonesian government announced its plans to invest about $450.0 billion in the construction sector, by 2021, which is expected to boost residential construction in the country.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global ceiling tiles market include AWI Licensing LLC, Knauf Digital GmbH, New Ceiling Tiles, LLC., and Saint-Gobain Group, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in August 2023, SAS International introduced 'Truline Systems' as a new brand and website for their subsidiary Apollo Park, well known for producing partitioning, access panels, and doors. Looking ‘Back to the Future’, Truline Systems harks back to the strong heritage of the original business, reinstating its presence in the market with a contemporary collection of acoustic and glazed products.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ceiling tiles market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AWI Licensing LLC

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Knauf Digital GmbH

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. New Ceiling Tiles, LLC.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Saint-Gobain Group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Ceiling TilesMarket by Raw Material

4.1.1. Mineral Wool

4.1.2. Metal

4.1.3. Gypsum

4.1.4. Others (Composites, Plastics, and Wood)

4.2. Global Ceiling TilesMarket by Property

4.2.1. Acoustic

4.2.2. Non-Acoustic

4.3. Global Ceiling TilesMarket by Application

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Institutional

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. BYUCKSAN ENGINEERING GROUP

6.2. CYMAT Technologies Ltd.

6.3. FabriTRAK Systems Inc

6.4. Foshan Ron Building Material Trading Co. Ltd

6.5. Haining Shamrock Import & Export Co. Ltd

6.6. HIL.in.

6.7. Hunter Douglas India Pvt Ltd.

6.8. Imerys S.A.

6.9. LATICRETE International, Inc.

6.10. Legacy Cast Stone and Composites LLC

6.11. Mada Gypsum Company.

6.12. OdenwaldFaserplattenwerk GmbH

6.13. Poly Molding LLC

6.14. ROCKWOOL A/S

6.15. SAS International

6.16. Schlüter-Systems KG

6.17. Shandong Huamei Building Materials Co., Ltd.

6.18. Superior Materials Holdings, LLC

6.19. Techno Ceiling Products

6.20. USG Corp.

1. GLOBAL CEILING TILES MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2023-2031 ($ MILLION)

2. GLOBAL MINERAL WOOLCEILING TILES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBALMETALCEILING TILES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBALGYPSUMCEILING TILES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBALCEILING TILES MARKET RESEARCH AND ANALYSIS BY PROPERTY, 2023-2031 ($ MILLION)

6. GLOBAL ACOUSTICCEILING TILES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBALNON-ACOUSTIC CEILING TILES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CEILING TILES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL CEILING TILES FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CEILING TILES FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CEILING TILES FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CEILING TILES FOR INSTITUTIONAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CEILING TILESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CEILING TILESMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CEILING TILESMARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2023-2031 ($ MILLION)

16. NORTH AMERICAN CEILING TILESMARKET RESEARCH AND ANALYSIS BY PROPERTY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN CEILING TILESMARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

18. EUROPEAN CEILING TILESMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN CEILING TILESMARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2023-2031 ($ MILLION)

20. EUROPEAN CEILING TILESMARKET RESEARCH AND ANALYSIS BY PROPERTY, 2023-2031 ($ MILLION)

21. EUROPEAN CEILING TILESMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC CEILING TILESMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFICCEILING TILESMARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2023-2031 ($ MILLION)

24. ASIA-PACIFICCEILING TILESMARKET RESEARCH AND ANALYSIS BY PROPERTY, 2023-2031 ($ MILLION)

25. ASIA-PACIFICCEILING TILESMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD CEILING TILESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD CEILING TILESMARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2023-2031 ($ MILLION)

28. REST OF THE WORLD CEILING TILESMARKET RESEARCH AND ANALYSIS BY PROPERTY, 2023-2031 ($ MILLION)

29. REST OF THE WORLD CEILING TILESMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBALCEILING TILES MARKET SHARE BY RAW MATERIAL, 2023 VS 2031 (%)

2. GLOBAL MINERAL WOOLCEILING TILES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBALMETAL CEILING TILES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBALGYPSUM CEILING TILES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBALCEILING TILES MARKET SHARE BY PROPERTY, 2023 VS 2031 (%)

6. GLOBAL ACOUSTICCEILING TILES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBALNON-ACOUSTIC CEILING TILES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CEILING TILES MARKETSHARE BY APPLICATION, 2023 VS 2031 (%)

9. GLOBAL CEILING TILES FOR RESIDENTIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CEILING TILES FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CEILING TILES FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CEILING TILES FOR INSTITUTIONAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CEILING TILES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US CEILING TILESMARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA CEILING TILESMARKET SIZE, 2023-2031 ($ MILLION)

16. UK CEILING TILES MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE CEILING TILES MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY CEILING TILES MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY CEILING TILES MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN CEILING TILES MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE CEILING TILES MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA CEILING TILES MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA CEILING TILES MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN CEILING TILES MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA CEILING TILES MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC CEILING TILES MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICACEILING TILESMARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICACEILING TILESMARKET SIZE, 2023-2031 ($ MILLION)