Cell-based Assays Market

Cell-based Assays Market Size, Share & Trends Analysis Report by Product (Consumable, Instruments, and Software & Services), by Application (Drug Discovery, Basic Research, ADME Studies, and Predictive Toxicology), and by End-User (Contract Research Organizations, Academic and Government Institutions, and Pharmaceutical and Biotechnology Companies) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Cell-based assay market is anticipated to grow at a significant CAGR of 7.7% during the forecast period. The increasing number of chronic diseases such as cancer, diabetes, hypertension, and others owing to increasing chronic diseases that are raising demand growth for cell-based assays for new drug discoveries, is a key factor driving the market. For instance, according to the data by World Health Organization (WHO), in April 2021, approximately 17.9 million people annually lead to death which is followed by cancers (9.3 million), respiratory diseases (4.1 million), and diabetes (1.5 million). Each year estimated 15 million people die from chronic conditions between the ages of 30 and 69 years. Wherever the lack of skilled professionals and the increasing and high cost associated with the assays instruments are acting as a major restraining factor to the market growth. However, strict government regulations being implemented on the application of these instruments are creating a challenge in the growth of the market.

Segmental Outlook

The global cell-based assays market is segmented based on the product, application, and end-user. On the basis of product, the market is segmented into consumable that is further sub-segmented into (reagents, cell lines, microplates, probes & labels,) instruments, software, and services. Based on the application, the market is sub-segmented into drug discovery, basic research, ADME studies, and predictive toxicology. Based on the end-user, the market is segmented into pharmaceutical and biotechnology companies, academic and government institutions, and contract research organizations. Among the product segment Consumable segment is anticipated to hold a prominent share in the market attributed to consumables being widely used products and this are repeatedly been purchased by the pharmaceutical and biopharmaceutical companies for the increasing demand by its users. Moreover, as these consumables are majorly used in drug discovery the demand for it is been increasing owing to the growing number of drug discovery activities across the globe.

Among the application, the drug discovery sub-segment is predicted to hold a considerable share in the market due to the growing R&D investment by pharmaceutical & biotechnology companies. and also the functional cells derived in cell-based assays are used as diagnostic tools in research the development of new drugs that are supporting in drug discovery are such factors that are driving market growth further. Moreover, prominent players such as Merck KGaA, PerkinElmer Inc., and Thermo Fisher Scientific, among others operating in the market are heavily investing in the development of new platforms and services that are used in the discovery that is leading to positively impact cell-based assay market growth during the forecast period. For instance, in February 2021, Selvita launched a new cell-based phenotypic assay platform for drug discovery. This new platform test therapeutic potential in multiple areas, including neuroinflammatory and fibrotic diseases. The platform integrated with artificial intelligence analytical approaches is being used in drug discovery as secondary screening.

Regional Outlooks

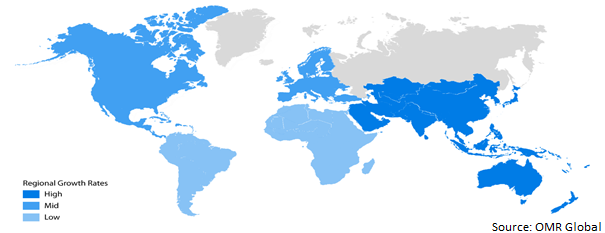

The global cell-based assays market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America. North America is anticipated to hold a prominent share in the market owing to a high number of advanced pharmaceutical & biotechnology companies presence in the region.

Global Cell-based Assays Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Cell-based Assays Market

Among all the regions, the Asia-Pacific region is expected to witness the fastest growth in the market due to the increasing medical tourism, disposable incomes, and developing healthcare infrastructure. According to the Government of India Ministry of Tourism, India ranked at 3rd across the globe with $6 billion of investment in medical tourism in 2019. Further, the increasing high investment in R&D activities by government and biopharmaceutical companies is a key factor driving cell-based assay market growth. The region is witnessing a considerable rise in the prevalence of chronic conditions, such as cancer, osteoarthritis, and hypertension among others, which will further creates a huge use and demand for market products for newer drug discoveries. For instance, in April 2022, CytoTronics raised seed funding of $9.3 million. The funding will be utilized to develop a platform that utilizes computer chip technology to conduct a suite of electrical and electrochemical cell-based assays. The platform will be able to handle discovery and phenotyping screening.

Market Players Outlook

The major companies serving the global cell-based assays market include Becton, Dickinson and Co., Corning Inc., Eurofins DiscoverX Products, LLC, General Electric Co., Merck KGaA, PerkinElmer Inc., Thermo Fisher Scientific, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, geographical expansions, partnerships, product launches, and collaborations, to stay competitive in the market. For instance, in March 2022, Promega Corp., and FUJIFILM Cellular Dynamics, Inc., collaborated to advance novel assay development for drug discovery. Through this collaboration, the company aims to merge bioluminescent reporter technology that is used to study cellular signaling and transcriptional activity in iPSCs. This technology will enable researchers to create novel assays and also the possibility of converting best-in-class assays into any type of iPSC-derived cell.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cell-based assays market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Corning Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Merck KGaA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. PerkinElmer Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Thermo Fisher Scientific

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cell-based Assays Market by Product

4.1.1. Consumable

4.1.1.1. Reagents

4.1.1.2. Cell Lines

4.1.1.3. Microplates

4.1.1.4. Probes & Labels

4.1.2. Instruments

4.1.3. Software & Services

4.2. Global Cell-based Assays Market by Application

4.2.1. Drug Discovery

4.2.2. Basic Research

4.2.3. ADME Studies

4.2.4. Predictive Toxicology

4.3. Global Cell-based Assays Market by End-User

4.3.1. Contract Research Organizations (CROs)

4.3.2. Academic and Government Institutions

4.3.3. Pharmaceutical and Biotechnology Companies

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AAT Bioquest, Inc.

6.2. Altis Biosystems, Inc.

6.3. Apical Scientific Sdn Bhd

6.4. Axion BioSystems Inc.

6.5. Beckman Coulter, Inc.

6.6. Becton, Dickinson and Co..

6.7. BioAgilytix

6.8. Cell Signaling Technology, Inc.

6.9. Charles River Laboratories

6.10. Eurofins DiscoverX Products, LLC

6.11. General Electric Co.

6.12. Genesis Biotechnology Group, LLC

6.13. lino Biotech AG

6.14. Lonza Group Ltd.

6.15. Platypus Technologies, LLC

6.16. Plexium, Inc.

6.17. Promega Corp.

1. GLOBAL CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL CONSUMABLE CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL INSTRUMENTS CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL SOFTWARE & SERVICES CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

6. GLOBAL CELL-BASED ASSAYS IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL CELL-BASED ASSAYS IN BASIC RESEARCH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL CELL-BASED ASSAYS IN ADME STUDIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL CELL-BASED ASSAYS IN PREDICTIVE TOXICOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

11. GLOBAL CELL-BASED ASSAYS FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL CELL-BASED ASSAYS FOR ACADEMIC AND GOVERNMENT INSTITUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL CELL-BASED ASSAYS FOR CONTRACT RESEARCH ORGANIZATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. NORTH AMERICAN CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

17. NORTH AMERICAN CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. NORTH AMERICAN CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

19. EUROPEAN CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. EUROPEAN CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

21. EUROPEAN CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. EUROPEAN CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

27. REST OF THE WORLD CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. REST OF THE WORLD CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

29. REST OF THE WORLD CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

30. REST OF THE WORLD CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL CELL-BASED ASSAYS MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL CONSUMABLE CELL-BASED ASSAYS MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL INSTRUMENTS CELL-BASED ASSAYS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL SOFTWARE & SERVICES CELL-BASED ASSAYS MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL SERVICE CELL-BASED ASSAYS MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL CELL-BASED ASSAYS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

7. GLOBAL CELL-BASED ASSAYS IN DRUG DISCOVERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL CELL-BASED ASSAYS IN BASIC RESEARCH MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL CELL-BASED ASSAYS IN ADME STUDIES MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL CELL-BASED ASSAYS IN PREDICTIVE TOXICOLOGY MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL CELL-BASED ASSAYS MARKET SHARE BY END-USER, 2021 VS 2028 (%)

12. GLOBAL CELL-BASED ASSAYS FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL CELL-BASED ASSAYS FOR ACADEMIC AND GOVERNMENT INSTITUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL CELL-BASED ASSAYS FOR CONTRACT RESEARCH ORGANIZATIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL CELL-BASED ASSAYS MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. US CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

18. UK CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD CELL-BASED ASSAYS MARKET SIZE, 2021-2028 ($ MILLION)