Cell Counting Market

Global Cell Counting Market Size, Share & Trends Analysis Report by Product Type (Instruments and Consumables), By Application (Medical Applications, Research, and Industrial), By End-User (Pharmaceuticals & Biotechnology companies, Research Institutes & CRO, and Hospitals and Diagnostic Laboratories) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global market for cell counting is projected to have considerable CAGR of around 7.4% during the forecast period. The growth of the cell counting market is attributed to the various factors including rising prevalence of chronic and infectious diseases across the globe, increasing investment in the cell based research activities, and others. The cancer is the most prevalent chronic diseases across the globe that further contribute in the growth of the global cell counting market. As per the World Health Organization (WHO), cancer is the second largest cause of mortality across the globe and it accounted around 9.6 million mortalities across the globe in 2018. Therefore, there is an rising demand for effective cancer treatment solution across the globe. Cell Counting is a preferred method in cancer biology for microenvironment study, tumor analysis, and drug discovery. The growing incidences of such chronic diseases has further marked the attention of government organizations to offers investments to the research institutes and biotechnology companies in the development of advanced therapeutics.

Segmental Outlook

The global cell counting market is segmented based on product type, application and end-user. Based on the product type, the market is further classified into instruments and consumables. The instruments segment is projected to grow at a significant CAGR during the forecast period owing to the rising application of hematology analyzers. Based on application the global market for cell counting is further classified into medical applications, research, and industrial. The research segment is projected to have considerable share owing to the significant investment in the cell based research activities across the globe. On the basis of end-user the market is further segregated into pharmaceuticals & biotechnology companies, research institutes & CRO, hospitals and diagnostic laboratories.

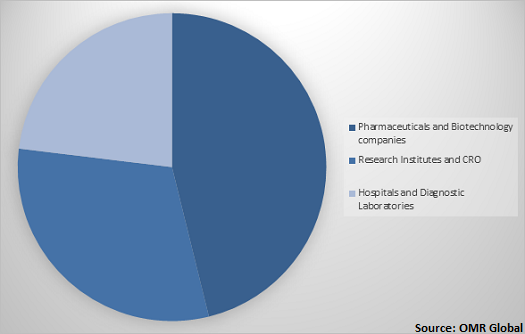

Global cell counting Market Share by End-User, 2019(%)

Global cell counting market to be driven by pharmaceutical and biotechnology companies

Among end-user, the pharmaceutical and biotechnology companies segment held a considerable share in the market. The growing focus on R&D activities in the regenerative medicine field for the treatment of cancer and diabetes is the major factor for its dominance in the cell counting technologies in biotechnology and biotechnology companies. Cell counting equipment such as hematology analyzers, Spectrophotometers, flow cytometers are being extensively used by the biotechnology and biopharmaceutical companies in the production of biosimilars such as monoclonal antibodies, regenerative medicine, vaccine production, and drug development, among others. Cell counting technology are used in biotechnological companies to study the effects of new drugs, cosmetics and chemicals on survival and growth in a several variety of cell types, including kidney-derived cell cultures, liver and kidney-derived cell cultures.

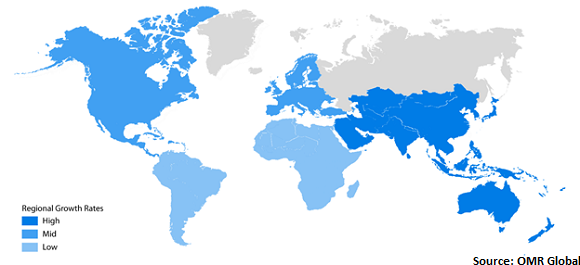

Regional Outlook

Geographically, the global cell counting market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is projected to grow at a considerable CAGR in the cell counting market during the forecast period. The growing need for advanced healthcare facilities in emerging economies such as China, India and partnerships among the market players for the development of innovative products are some other factors that are considerably driving the market growth.

Global cell counting Market Growth, by Region 2020-2026

North America to hold a considerable share in the global cell counting market

Geographically, North America is projected to hold a significant share in the global cell counting market during the forecast period. North America has well-developed healthcare infrastructure, owing to which, the market players are investing in the development of advanced products and solutions for the cell counting market. Moreover, growing prevalence of chronic diseases such as diabetes and cardiovascular diseases due to sedentary lifestyle and unhealthy dietary habits. Therefore the research institutes are developing effective treatment solutions for these diseases. Moreover, rising government initiative for drug discovery and development with growing usage of cell counting solution in drug discovery & development of regenerative medicines among pharmaceutical companies is further driving the growth of cell counting market in the region. For instance, the New York Stem Cell Foundation has invested over $200 million in stem cell research Since its establishment in 2005.

Market Players Outlook

The key players in the cell counting market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Becton, Dickinson and Co., Bio-Rad Laboratories Inc., Danahar Corp., Merck KGaA, Thermo Fisher Scientific Inc. and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cell counting market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Becton, Dickinson and Co.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bio-Rad Laboratories Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Danahar Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Merck KGaA

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Thermo Fisher Scientific Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Cell Counting Market by Product Type

5.1.1. Instruments

5.1.2. Consumables

5.2. Global Cell Counting Market by Application

5.2.1. Medical Applications

5.2.2. Research

5.2.3. Industrial

5.3. Global Cell Counting Market by End-User

5.3.1. Pharmaceuticals and Biotechnology companies

5.3.2. Research Institutes and CRO

5.3.3. Hospitals and Diagnostic Laboratories

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. Agilent Technologies, Inc.

7.3. Becton, Dickinson and Co.

7.4. Bio-Rad Laboratories Inc.

7.5. Boule Diagnostics AB

7.6. Corning Inc.

7.7. Danahar Corp.

7.8. F. Hoffmann-La Roche Ltd.

7.9. HORIBA Group

7.10. Luminex Corp.

7.11. Logos Biosystems, Inc.

7.12. Merck KGaA

7.13. Nexcelom Bioscience LLC

7.14. Olympus Corp.

7.15. Perkinelmer, Inc.

7.16. Sysmex Corp.

7.17. Siemens Healthineers AG

7.18. Tip Biosystems Pte Ltd.

7.19. Thermo Fisher Scientific Inc.

7.20. Tecan Trading AG

1. GLOBAL CELL COUNTING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL INSTRUMENTS FOR CELL COUNTING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL CONSUMABLES FOR CELL COUNTING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL CELL COUNTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

5. GLOBAL CELL COUNTING IN MEDICAL APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL CELL COUNTING IN RESEARCH MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL CELL COUNTING IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL CELL COUNTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

9. GLOBAL CELL COUNTING IN PHARMACEUTICALS AND BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL CELL COUNTING IN RESEARCH INSTITUTES AND CRO MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL CELL COUNTING IN HOSPITALS AND DIAGNOSTIC LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL CELL COUNTING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN CELL COUNTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN CELL COUNTING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

15. NORTH AMERICAN CELL COUNTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

16. NORTH AMERICAN CELL COUNTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

17. EUROPEAN CELL COUNTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPEAN CELL COUNTING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

19. EUROPEAN CELL COUNTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. EUROPEAN CELL COUNTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC CELL COUNTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC CELL COUNTING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC CELL COUNTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC CELL COUNTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

25. REST OF THE WORLD CELL COUNTING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

26. REST OF THE WORLD CELL COUNTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

27. REST OF THE WORLD CELL COUNTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL CELL COUNTING MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL CELL COUNTING MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL CELL COUNTING MARKET SHARE BY END-USER, 2019 VS 2026 (%)

4. GLOBAL CELL COUNTING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)

7. UK CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD CELL COUNTING MARKET SIZE, 2019-2026 ($ MILLION)