Central Nervous System (CNS) Biomarker Market

Global Central Nervous System (CNS) Biomarker Market Size, Share & Trends Analysis Report By Application (Drug Discovery & Development, Personalized Medicine, Disease Risk Assessment, and Other), By Type (Safety Biomarker, Efficacy Biomarker, Predictive Biomarker, Prognostic Biomarker, and Validation Biomarker), By End-User (Diagnostic Labs, Hospitals & Clinics, and, Research Centers) Forecast, 2021-2027 Update Available - Forecast 2025-2035

The global CNS biomarker market is growing at a CAGR of 15.5% during the forecast period. The major factors that are augmenting the growth of the market are the rise in the number of patients suffering from Alzheimer's disease, significant R&D in the neurological biomarkers, rising demand for effective therapeutics options, and an increase in focus on the clinical trial of biomarkers. Moreover, the rise in patients with Parkinson's disease has also led to the growth of the market. According to the Centers for Disease Control and Prevention (CDC), Parkinson's disease is rated as the 14th cause of death in the US. Moreover, according to Parkinson’s Foundation, around 1.2 million people in the US are estimated to live by 2030. In addition to this, the rise in chronic neurological illness, approval of generic products by government organizations, and rise in pharmaceutical industries are other factors that are estimated to fuel the growth of the market in the forecast period.

Moreover, growing awareness in the developing countries for the disorders where there is a huge rise in population can further grow the market. In addition to this, the studies have linked noise pollution to central nervous disorders as there is increased anxiety, depression, high blood pressure, heart disease, and stroke. Many drug manufacturers collaborate with other manufacturers to improve product quality and market growth. As per the reports of the World Health Organization (WHO), around 1 out of 6 people suffer from neurological disorders across the globe and the number of patients accounts for more than 1 billion. Moreover, as of September 2020, according to WHO, around 50 million people had dementia and Alzheimer's disease contribute to 60–70% of cases. However, the high cost of CNS biomarker tests and diagnostic, and several adverse health effects due to the failure of CNS are the constraints estimated to challenge the growth of the market. Conversely, the rapid increase of new technologies and innovations in the research institutes is the opportunity estimated for the global market players.

Impact of COVID-19 on the CNS Biomarker Market

The CNS biomarker market is hardly hit by the COVID-19 pandemic since December 2019. The outbreak of COVID-19 in the major economies has disrupted the manufacturing and supply of drugs and products such as anesthesia across the globe which resulted in a decrease in market share. This was mainly due to the lockdowns imposed by the governments of several countries due to which many industries were not being operated and also due to the delay in diagnosis. In the early stages of the pandemic, the rate of patient screening and diagnosis was greatly hampered due to restrictions such as lockdowns to prevent the disease from spreading. According to the American Cancer Society in 2021, delays in cancer screening, diagnosis, and treatment would almost certainly result in a short-term decrease in cancer diagnoses, followed by an increase in late-stage diagnoses and unnecessary cancer deaths due to limited healthcare coverage. Only the emergency cases were allowed to be diagnosed in several countries as the priority was given to the patients suffering from COVID-19.

Segmental Outlook

The market is segmented based on application, type, and end-user. By application, the market is segmented into drug discovery & development, personalized medicine, disease risk assessment, and others. Further, based on the type segment, the market is segmented into safety biomarker, efficacy biomarker, predictive biomarker, prognostic biomarker, and validation biomarker. Moreover, based on the end-user segment, the market is segmented into diagnostic labs, hospitals and clinics, and research centers.

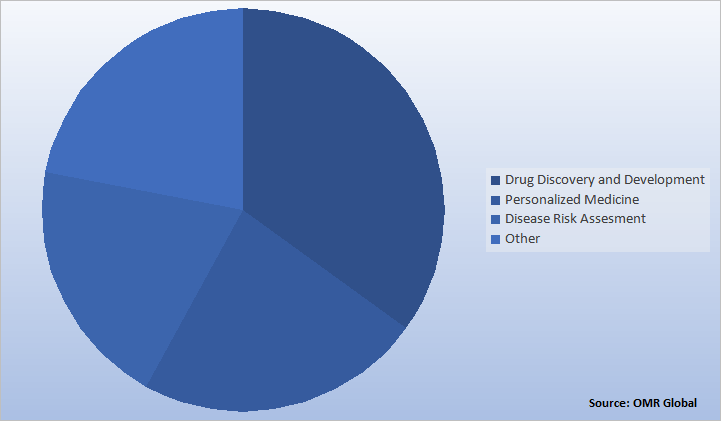

Global Central Nervous System (CNS) Biomarkers Market Share by Application, 2020 (%)

Drug Discovery and Development Segment to Hold a Lucrative Share in the Global CNS Biomarker market

Amongst the application segment of the global CNS biomarker market, the drug discovery and development segment hold a significant market share in 2020. The market growth is driven by growing R&D expenditure in the pharmaceutical industry. The drug discovery and development researchers include Johnson & Johnson service Ltd., Novartis AG, F. Hoffmann-La Roche Ltd, Biogen Inc., and many more. Further, significant researches on new drugs are expected to contribute to market growth. For instance, in 2019, CDER approved two new treatments for adult patients, a chronic and often debilitating disease of the central nervous system and FDA approved monoclonal antibody for the treatment of episodic cluster headache which is very painful.

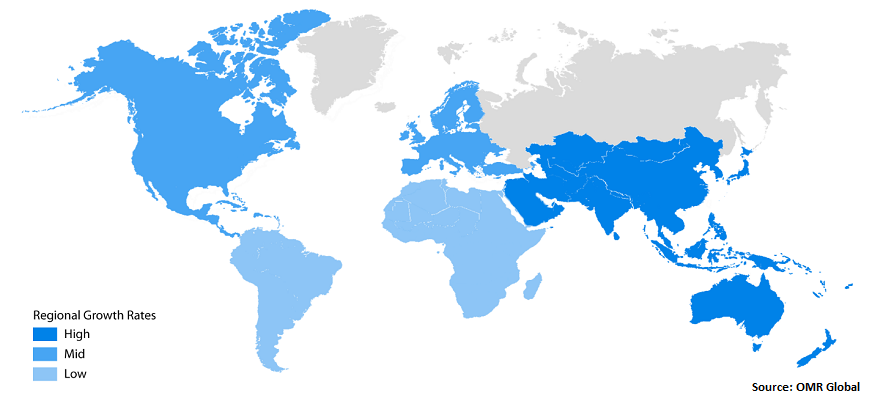

Regional Outlook

The global CNS biomarkers market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is bifurcated into North America (the US and Canada), Europe (Germany, Spain, Italy, France, the UK, and the Rest of Europe), Asia-Pacific (India, China, Japan, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East and Africa, and Latin America). North America is estimated to be the leading region in the global market. The increase in modern technologies and the presence of prominent players in the region are some of the major factors driving the growth of the market in the North American region.

Global Central Nervous System (CNS) Biomarkers Market Growth, by Region 2021-2027

Asia-Pacific is projected to highest Contributor to the growth of the Global CNS Biomarker market

Asia-Pacific is anticipated to be the fastest-growing region in the global CNS biomarker market owing to improved healthcare spending and a rise in the number of Alzheimer's disease patients. The emerging economies such as South Korea, China, Japan, and India where there will be an increase in population and cohesive government policies will further grow the market. Furthermore, improving healthcare infrastructure and more research investments assist in the development of new CNS biomarkers. For instance, in April 2021, according to research published in the Journal of Translational Psychiatry, new electroencephalography (EEG)-mediated approach to uncover biomarkers for neuropsychiatric diseases was identified in China.

Market Players Outlook

Key players of the CNS biomarkers market are Eli Lilly and Company, Otsuka America Pharmaceutical Inc., Aposense, Banyan Biomarkers, Inc., Novartis AG, F. Hoffmann-La Roche Ltd, Fujirebio, Bio-Rad Laboratories, Inc., Pfizer Inc., Avacta Group PLC, and AppliedNeurosolutions, Inc. To survive in the market these players adopt different marketing strategies such as a merger, acquisitions, product launch, and geographical expansion so on. For Instance, in 2020, Eli Lilly and Company acquired Prevail Therapeutics in an $880 million deal. Prevail is a biotechnology company developing AAV9-based gene therapies for patients with neurodegenerative diseases.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global CNS biomarkers market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global CNS Biomarkers Industry

• Recovery Scenario of Global CNS Biomarkers Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Banyan Biomarkers, Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Bio-Rad Laboratories, Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Eli Lilly & Co.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. F. Hoffmann-La Roche Ltd

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Thermo Fisher Scientific, Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global CNS Biomarker Market By Application

5.1.1. Drug Discovery & Development

5.1.2. Personalized Medicine

5.1.3. Disease Risk Assessment

5.1.4. Other

5.2. Global CNS Biomarker Market By Type

5.2.1. Safety Biomarker

5.2.2. Efficacy Biomarker

5.2.3. Predictive Biomarker

5.2.4. Prognostic Biomarker

5.2.5. Validation Biomarker

5.3. Global CNS Biomarker Market By End User

5.3.1. Diagnostic Labs

5.3.2. Hospitals and Clinics

5.3.3. Research Centers

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AbbVie Inc

7.2. Adlyfe Inc.

7.3. ADxNeuroSciences NV

7.4. Altoida, Inc.

7.5. Aposense Ltd.

7.6. Applied NeuroSolutions, Inc.

7.7. AstraZeneca Plc

7.8. Avacta Group PLC

7.9. Biogen Inc.

7.10. Fujirebio Diagnostics, Inc. (Innogenetics)

7.11. GlaxoSmithKline plc

7.12. Iron Horse Diagnostics, Inc.

7.13. Johnson & Johnson Services, Inc.

7.14. Merck KGaA

7.15. Metabolon, Inc.

7.16. Neuraltus Pharmaceuticals, Inc.

7.17. Novartis AG

7.18. Otsuka America Pharmaceutical, Inc.

7.19. Pfizer Inc.

7.20. Takeda Pharmaceutical Company Ltd.

1. GLOBAL CNS BIOMARKER MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

3. GLOBAL CNS BIOMARKER IN DRUG DISCOVERY & DEVELOPMENT MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

4. GLOBAL CNS BIOMARKER IN PERSONALIZED MEDICAL MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

5. GLOBAL CNS BIOMARKER IN DISEASE RISK ASSESSMENT MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

6. GLOBAL CNS BIOMARKER IN OTHER APPLICATION MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

7. GLOBAL CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

8. GLOBAL SAFETY BIOMARKER MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

9. GLOBAL EFFICACY BIOMARKER MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

10. GLOBAL PREDICTIVE BIOMARKER MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

11. GLOBAL PROGNOSTIC BIOMARKER MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

12. GLOBAL VALIDATION BIOMARKER MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

13. GLOBAL CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION

14. GLOBAL CNS BIOMARKER IN DIAGNOSTIC LABS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

15. GLOBAL CNS BIOMARKER IN HOSPITALS &CLINICS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

16. GLOBAL CNS BIOMARKER IN RESEARCH CENTERS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

17. GLOBAL CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

18. NORTH AMERICAN CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY APPLICATION 2020-2027 ($ MILLION)

19. NORTH AMERICAN CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

20. NORTH AMERICAN CNS BIOMARKER MARKET RESEARCH AND ANALYSIS, BY END-USER, 2020-2027 ($ MILLION)

21. NORTH AMERICAN CNS BIOMARKER MARKET RESEARCH AND ANALYSIS, BY COUNTRY, 2020-2027 ($ MILLION)

22. EUROPEAN CNS BIOMARKER MARKET RESEARCH AND ANALYSIS, BY APPLICATION 2020-2027 ($ MILLION)

23. EUROPEAN CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

24. EUROPEAN CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

25. EUROPEAN CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

27. ASIA-PACIFIC CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

30. REST OF THE WORLD CNS BIOMARKER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

31. REST OF THE WORLD CNS BIOMARKER MARKET RESEARCH AND ANALYSIS, BY TYPE, 2020-2027 ($ MILLION)

32. REST OF THE WORLD CNS BIOMARKER MARKET RESEARCH AND ANALYSIS, BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL CNS BIOMARKER MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL CNS BIOMARKER MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL CNS BIOMARKER MARKET, 2021-2027 (%)

4. GLOBAL CNS BIOMARKER MARKET SHARE BY APPLICATION 2020 VS 2027 (IN %)

5. GLOBAL CNS BIOMARKER MARKET SHARE BY TYPE, 2020 VS 2027 (IN %)

6. GLOBAL CNS BIOMARKER MARKET SHARE BY END-USER, 2020 VS 2027 (IN %)

7. GLOBAL CNS BIOMARKER MARKET SHARE BY APPLICATION, 2020 VS 2027 (IN %)

8. GLOBAL CNS BIOMARKER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (IN %)

9. GLOBAL CNS BIOMARKER IN DRUG DISCOVERY & DEVELOPMENT MARKET SHARE BY REGION, 2020 VS 2027(%)

10. GLOBAL CNS BIOMARKER IN PERSONALIZED MEDICAL MARKET SHARE BY REGION, 2020 VS 2027(%)

11. GLOBAL CNS BIOMARKER IN DISEASE RISK ASSESSMENT MARKET SHARE BY REGION, 2020 VS 2027(%)

12. GLOBAL CNS BIOMARKER IN OTHER APPLICATION MARKET SHARE BY REGION, 2020 VS 2027(%)

13. GLOBAL SAFETY BIOMARKER MARKET SHARE BY REGION, 2020 VS 2027(%)

14. GLOBAL EFFICACY BIOMARKER MARKET SHARE BY REGION, 2020 VS 2027(%)

15. GLOBAL PREDICTIVE BIOMARKER MARKET SHARE BY REGION, 2020 VS 2027(%)

16. GLOBAL PROGNOSTIC BIOMARKER MARKET SHARE BY REGION, 2020 VS 2027(%)

17. GLOBAL VALIDATION BIOMARKER MARKET SHARE BY REGION, 2020 VS 2027(%)

18. GLOBAL CNS BIOMARKER IN DIAGNOSTIC LABS MARKET SHARE BY REGION, 2020 VS 2027(%)

19. GLOBAL CNS BIOMARKER IN HOSPITALS & CLINICS MARKET SHARE BY REGION, 2020 VS 2027(%)

20. GLOBAL CNS BIOMARKER IN RESEARCH CENTERS MARKET SHARE BY REGION, 2020 VS 2027(%)

21. UNITED STATES CNS BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

22. CANADA CNS BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

23. UK CNS BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

24. GERMANY CNS BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

25. FRANCE CNS BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

26. ITALY CNS BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

27. ROE CNS BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

28. CHINA CNS BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

29. INDIA CNS BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

30. JAPAN CNS BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

31. REST OF ASIA PACIFIC CNS BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

32. REST OF WORLD CNS BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)