Centrifugal Chillers Market

Centrifugal Chillers Market Size, Share & Trends Analysis Report by Type (Air Cooled, and Water Cooled), by Tonnage (Less than 1000, 1000-2000, and more than 2000), and by Industry (Food & Beverage, Pharmaceutical, Plastics, Chemicals & Petrochemicals, Data Centers, and Others) Forecast Period (2024-2031)

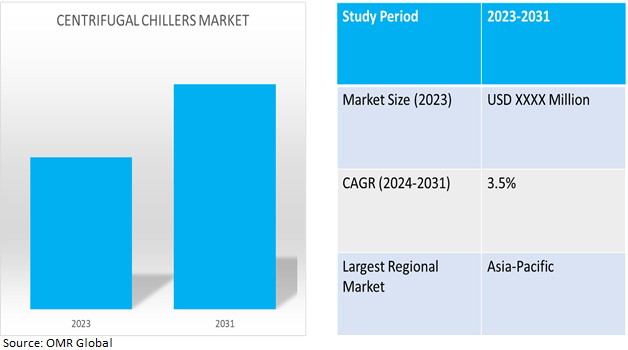

Centrifugal chillers market is anticipated to grow at a moderate CAGR of 3.5% during the forecast period (2024-2031). The market growth is driven by the rising demand of chillers in the end-user industries, such as hospitals, hotels, manufacturing plants and more. The market growth in the industrial sector is attributed to the lower energy usage and higher energy efficiencies offered by centrifugal chillers. The growing industrialization in the developing economies, due to supporting government policies is also expanding the need for thechillers. The benefits offered the chillers such as low procurement and maintenance cost, have also contributed to thedemand of chillers.

Market Dynamics

Increasing Adoption of Cold Chain Infrastructure

The growth in the centrifugal chillers market is instigated by the rising adoption of cold chain infrastructure, especially in agriculture, and the food & beverage industry to sustain food, and crops for a longer duration alongside reducing the use of preservatives, and processing. For instance, India's Integrated Cold Chain and Value Addition Infrastructure scheme promotes integrated and complete cold chain facilities without any break from the farm gate to the consumer, to reduce losses by improving efficiency in the collection of farmers' produce, storage, transportation, and minimal processing. Both horticultural and non-horticultural produce are eligible for support under this scheme. Under this scheme, as of December 31, 2022, a cold storage capacity of 8.38 lakh MT has been created.

In industrial environments, the purpose of a chiller is to provide precision temperature control to ensure safe, productive, and efficient working processes. The rising demand for centrifugal chillers is also driven by growth in manufacturing industries across domains including pharmaceuticals, food & beverage, chemicals, and others. For instance, as per the International Trade Administration, by 2025, 84.0% of German manufacturers plan to invest $10.5 billion annually into smart manufacturing technologies, including the automotive industry at approx. $1.2 billion per year, machinery & equipment and plant engineering and construction at $1.5 billion, the electronics and microelectronics industry at approximately $817.0 million per year, and the metalworking industry at $424.0 million per year. Further, 15 million employees are directly and indirectly involved in advanced manufacturing industries in Germany.

Segmental Outlook

Our in-depth analysis of the global centrifugal chillers market includes the following segments by type, tonnage, and industry.

- Based on type, the market is sub-segmented into air-cooled, and water-cooled.

- Based on tonnage, the market is sub-segmented into less than 1000, 1000-2000, and more than 2000.

- Based on industry, the market is sub-segmented into food & beverage, pharmaceutical, plastics, chemicals & petrochemicals, data centers, and others.

Water Cooled Centrifugal Chillers is the Most Prominent Centrifugal Chillers Type

Water cooled centrifugal chillers is the leading market segment as water cooled chillers are less energy-intensive as compared to air-cooled chillers. Also, water has a larger heat limit than air, making it inherently easier to cool down.

Above 2000 Ton is the Biggest Tonnage Sub-Segment

2000–6000-ton centrifugal chillers segment holds the largest market share, due to its wide application across industries, manufacturing plants, agricultural units, data centers, and commercial buildings requiring high-capacity chillers to maintain optimum temperatures in large premises.

Data Centers are Expected to Hold a Considerable Market Share

The demand for chillers has exponentially increased in the data center industry attributed to increasing demand for cloud storage, and the growth of the data center industry which is expected to further rise with the rising demand for data centers. For instance, in March 2024 Carrier launched a new line of high-performance chillers for data centers, aimed at reducing energy consumption and carbon emissions while lowering operating costs for operators. The units, which range in capacity from 400 kW to 2100kW. The units are built on Carrier screw compressors.

Regional Outlook

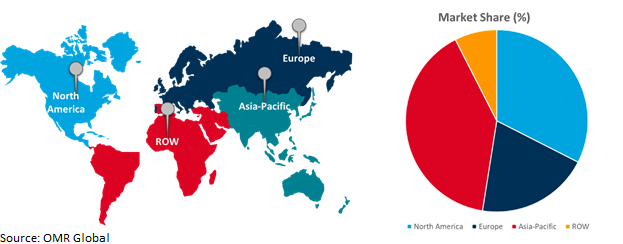

The global centrifugal chillers market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Centrifugal Chillers Market Growth by Region 2024-2031

Asia-pacific is Estimated to Demonstrate a Significant Market Growth

Asia-Pacific is predicted to demonstrate highest growth rate in the coming years attributed to the ongoing increase in expenditure made by regional companies to improve production capacity, rising consumption of centrifugal chiller in the manufacturing sector, and growth in cold chain infrastructure in the region. Also, this region is a manufacturing and service outsourcing location for big firms looking to increase market share. For instance, as per IBEF India, Indian manufacturing exports have registered highest highest-ever annual exports of $447.4 billion with 6.0% growth during 2022surpassing the previous year's (2021) exports of $422.0 billion. Also, it is estimated to add more than $500.0 billion annually to the global economy, by 2030.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global centrifugal chillers market include Honeywell International Inc. Carrier Corp., Linde plc., Daikin Industries Ltd., and Blue Star Ltd. among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in May 2022, Daikin Singapore and SP Group announced the formation of a new joint venture, after an earlier announcement by STMicroelectronics (ST) and SP to establish Singapore's largest industrial district cooling system for ST's Ang Mo Kio TechnoPark. The venture will construct a District Cooling System (DCS) with a cooling capacity of up to 36,000 Refrigerant Tons (RT). The project is anticipated to complete by 2025, and will assist ST achieve 20.0% yearly savings in cooling-related electricity usage and support ST's goal of becoming carbon neutral by 2027.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global centrifugal chillers market. Based on the availability of data, information related to new Type launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Blue Star Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Carrier Global Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Daikin Industries Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Honeywell International Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Linde plc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Centrifugal Chillers Market by Type

4.1.1. Air Cooled

4.1.2. Water Cooled

4.2. Global Centrifugal Chillers Market by Tonnage

4.2.1. Less than 1000

4.2.2. 1000 - 2000

4.2.3. More than 2000

4.3. Global Centrifugal Chillers Market by Industry

4.3.1. Food & Beverage

4.3.2. Pharmaceutical

4.3.3. Plastics

4.3.4. Chemicals & Petrochemicals

4.3.5. Data Centers

4.3.6. Others (Commercial, Rubber, etc.)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Air Liquide Advanced Technologies

6.2. Arctic Chiller Group

6.3. Arkema Group

6.4. Chemours

6.5. Hudson Technologies Inc.

6.6. Johnson Controls International plc

6.7. Klima Therm Ltd.

6.8. Mitsubishi Heavy Industries, Ltd.

6.9. Motivair Corp.

6.10. Orbia Advance Corporation S.A.B

6.11. Piovan S.p.A.

6.12. Reynold India Private Ltd.

6.13. Sinochem Group

6.14. SRF Ltd

6.15. Trane Technologies Company, LLC

1. GLOBAL CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL AIR COOLED CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL WATER COOLED CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY TONNAGE, 2023-2031 ($ MILLION)

5. GLOBAL LESS THAN 1000 TON CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL 1000-2000 TON CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL MORE THAN 2000 TON CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS FOR MORE THAN 2000 TON CHILLERS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

9. GLOBAL CENTRIFUGAL CHILLERS FOR FOOD AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CENTRIFUGAL CHILLERS ANALYSIS FOR PHARMACEUTICALS MARKET RESEARCH AND BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CENTRIFUGAL CHILLERS FOR PLASTIC MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CENTRIFUGAL CHILLERS FOR CHEMICALS & PETROCHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CENTRIFUGAL CHILLERS FOR DATA CENTER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL CENTRIFUGAL CHILLERS FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY TONNAGE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

19. EUROPEAN CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY TONNAGE, 2023-2031 ($ MILLION)

22. EUROPEAN CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY TONNAGE, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

27. REST OF THE WORLD CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY TONNAGE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD CENTRIFUGAL CHILLERS MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL CENTRIFUGAL CHILLERS MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL AIR COOLED CENTRIFUGAL CHILLERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL WATER COOLED CENTRIFUGAL CHILLERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CENTRIFUGAL CHILLERS MARKET SHARE BY TONNAGE, 2023 VS 2031 (%)

5. GLOBAL LESS THAN 1000 TON CENTRIFUGAL CHILLERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL 1000-2000 TON CENTRIFUGAL CHILLERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL MORE THAN 2000 TON CENTRIFUGAL CHILLERS MARKET SHARE BY INDUSTRY, 2023 VS 2031 (%)

8. GLOBAL CENTRIFUGAL CHILLERS FOR FOOD AND BEVERAGES MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CENTRIFUGAL CHILLERS FOR PHARMACEUTICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CENTRIFUGAL CHILLERS FOR PLASTIC MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CENTRIFUGAL CHILLERS FOR CHEMICALS AND PETROCHEMICALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CENTRIFUGAL CHILLERS FOR DATA CENTER MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CENTRIFUGAL CHILLERS FOR OTHER MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL CENTRIFUGAL CHILLERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

17. UK CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICA CENTRIFUGAL CHILLERS MARKET SIZE, 2023-2031 ($ MILLION)