Ceramic Capacitor Market

Global Ceramic Capacitor Market Size, Share & Trends Analysis Report by Product Type (Multilayer Ceramic Chip Capacitor (MLCC), Ceramic Disc Capacitor, Feed through Ceramic Capacitor, and Ceramic Power Capacitor), and by Application (Automotive, IT & Telecommunications, Consumer Electronics, and Others) Forecast Period (2021-2027) Update Available - Forecast 2025-2035

The ceramic capacitor market is anticipated to grow at a significant CAGR of 7.2% during the forecast period. Rising demand and establishment of advance technologies such as AI, IoT, 5G connectivity and others, are expected to fuel the use of ceramic capacitor globally. In addition, the growing demand of 5G-enabled smartphones will further spur the use of electronic circuits. As the high-end smartphones are equipped with around 800 to 1,000 capacitors, the increase in number of components along with reduction in thickness of recent smartphones, there is a significant need for slimmer components. For instance, in 2019, Murata Manufacturing Co., Ltd. developed GRM011R60J104M, the world’s first multi-layer ceramic capacitor to feature a maximum capacitance of 0.1µF in 008004-inch size (0.25×0.125mm) and in 2021, Samsung Electro-Mechanics revealed that it has developed the 0.65mm ultra-slim 3-socket MLCC, which is 18% thinner than previous products, and began to make it available for global smartphone companies.

Impact of COVID-19 Pandemic on Ceramic Capacitor Market

The automotive industry had been impacted due to the outbreak of COVID-19. The automotive industry faced a sharp decline in demand and investment which had immensely reduced the demand for ceramic capacitors. According to a reports published by International Labour Organization in 2020, China is known as the world’s main provider of intermediate inputs for manufacturing companies abroad, the turn down in output and exports from China is having a straight impact on the automotive industry. Additionally, as a impact of COVID-19, in 2021, Murata Manufacturing Co. Ltd. temporarily closed a plant in Japan that creates electronic component of smart phones, computers, and cars, among other products, to combat COVID-19.

Segmental Outlook

The global ceramic capacitor market is segmented based on the product type and application. Based on the product type, the market is segmented into MLCC, ceramic disc capacitor, feedthrough ceramic capacitor, and ceramic power capacitor. Based on the application, the market is sub-segmented into the automotive, IT & telecommunications, consumer electronics and others. The others application segment comprises of healthcare, aviation, and energy & power. The above-mentioned segments can be customized as per the requirements.

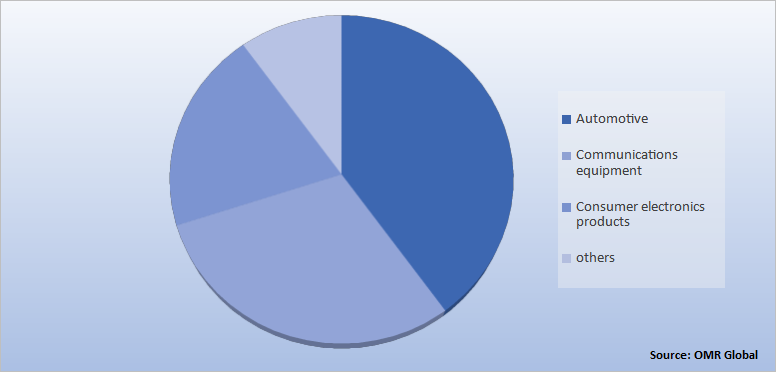

Global Ceramic Capacitor Market Share by Application, 2020 (%)

The Ceramic Capacitor in Automotive segment holds the Major Share in the Ceramic Capacitor Market

Based on the application, theautomotive segment is anticipated to hold the prominent share in 2020. The growing production in automotive industry is demanding a shift of consumers to high-performance and high-functionality automobiles which is in turn adding to the growth of ceramic capacitor market. As a result, advanced driver assistance systems (ADAS) the number of processors incorporated in one automobile has been increased which has severely increased ceramic capacitor usage. For instance, in 2021, Murata Manufacturing Co., Ltd. developed and started mass production of the "GCM155D70E106ME36", the world's first multilayer ceramic capacitor available in the 0402-inch size (1.0 × 0.5 mm) for powertrain and safety applications in automobiles and featuring a maximum electrostatic capacitance of 10 µF.

Regional Outlooks

The ceramic capacitor market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for region or country level as per the requirement.

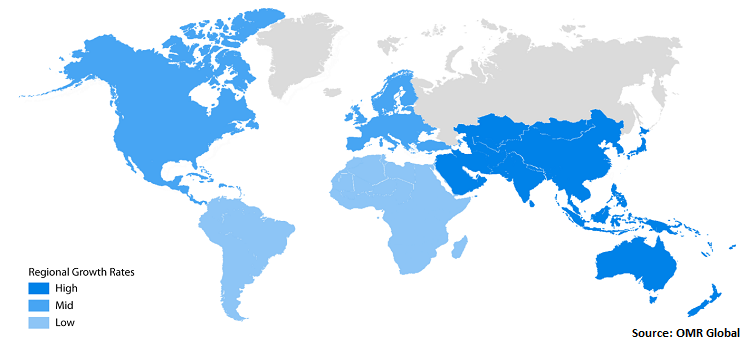

Global Ceramic Capacitor Market Growth, by Region 2021-2027

The Asia-Pacific Region Is Anticipated to Hold the Major Share in The Ceramic Capacitor Market

China is expected to be the largest Ceramic Capacitor market. China is a large producer and a leader in electronic components and electronic ceramic products. China currently has the highest market contribution and large number of competitive manufacturing base. for instance, according to European Passive Components Institute in 2019, South Korean technology giant Samsung Electronics Co Ltd was altering its strategy in China as it has closed one of its smartphone manufacturing plants in Tianjin and plans to invest $2.4 billion to build new battery and capacitor plants in the city, to raise its business in China. Additionally, according to XINHUANET.com in 2020, China revealed a development plan for its new energy vehicles (NEV) industry from 2021 to 2035 that targets to accelerate the country's move into an automotive powerhouse.

Market Players Outlook

The major companies serving the global ceramic capacitor market include KEMET, KYOCERA Corp., Murata Electronics North America, Samsung Electro-Mechanics Co., Ltd., Samwha Capacitor Group, TDK Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in 2021, Vishay Antitechnology, Inc. introduced a new series of surface-mount AC line rated ceramic disc safety capacitors that are the industry’s first such devices to offer a Y1 rating of 500 VAC and 1500 VDC. The Vishay BCcomponents SMDY1 series devices offer industry-high capacitance to 4.7 nF. Designed to withstand harsh, high humidity environments, the capacitors will be utilized for EMI / RFI filtering in power supplies, solar inverters, smart meters, and LED drivers.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the ceramic capacitor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Ceramic Capacitor Market

• Recovery Scenario of Global Ceramic Capacitor Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. KEMET

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. KYOCERA Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Murata Electronics North America, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Samsung Electro-Mechanics Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Samwha Capacitor Group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Ceramic Capacitor Market by Product Type

4.1.1. Multilayer Ceramic Chip Capacitor (MLCC)

4.1.2. Ceramic Disc Capacitor

4.1.3. Feedthrough Ceramic Capacitor

4.1.4. Ceramic Power Capacitor

4.2. Global Ceramic Capacitor Market by Application

4.2.1. Automotive

4.2.2. IT &Telecommunication

4.2.3. Consumer electronics

4.2.4. Others (Healthcare, Aviation, and Energy&Power)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AFM Microelectronics Inc.

6.2. Chaozhou Three-circle (Group) Co.

6.3. Darfon Innovation Corp.

6.4. Eyang Technology Development Co., Ltd.

6.5. Fujian Torch Electron Technology Co., Ltd

6.6. Holy Stone Enterprise Co. Ltd

6.7. Johanson Dielectrics

6.8. Murata Electronics North America, Inc

6.9. NIC Components Corp.

6.10. Panasonic Corp.

6.11. TAIYO YUDEN Group

6.12. TDK Corpo.

6.13. TE Connectivity Ltd.

6.14. Vishay Intertechnology, Inc.

6.15. Walsin Technology Corp.

6.16. Yageo Corp.

6.17. ZONKAS ELECTRONIC CO., LTD.

1. GLOBAL CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

2. GLOBAL MULTILAYER CERAMIC CHIP CAPACITOR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL CERAMIC DISC CAPACITOR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL FEEDTHROUGH CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL CERAMIC POWER CAPACITOR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

7. GLOBAL CERAMIC CAPACITOR IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL CERAMIC CAPACITOR IN IT & TELECOMMUNICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL CERAMIC CAPACITOR IN CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL CERAMIC CAPACITOR IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

14. NORTH AMERICAN CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

15. EUROPEAN CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. EUROPEAN CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

17. EUROPEAN CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

21. REST OF THE WORLD CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. REST OF THE WORLD CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

23. REST OF THE WORLD CERAMIC CAPACITOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL CERAMIC CAPACITOR MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL CERAMIC CAPACITOR MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL CERAMIC CAPACITOR MARKET, 2021-2027 (%)

4. GLOBAL CERAMIC CAPACITOR MARKET SHARE BY PRODUCT TYPE, 2020 VS 2027 (%)

5. GLOBAL MULTILAYER CERAMIC CHIP CAPACITOR MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL CERAMIC DISC CAPACITOR MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL FEED THROUGH CERAMIC CAPACITOR MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL CERAMIC POWER CAPACITOR MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL CERAMIC CAPACITOR MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

10. GLOBAL CERAMIC CAPACITOR IN AUTOMOTIVE MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL CERAMIC CAPACITOR IN TELECOMMUNICATIONS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL CERAMIC CAPACITOR IN CONSUMER ELECTRONICS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL CERAMIC CAPACITOR IN OTHER MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL CERAMIC CAPACITOR MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. US CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

16. CANADA CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

17. UK CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

18. FRANCE CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

19. GERMANY CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

20. ITALY CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

21. SPAIN CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF EUROPE CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

23. INDIA CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

24. CHINA CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

25. JAPAN CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

26. SOUTH KOREA CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF ASIA-PACIFIC CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF THE WORLD CERAMIC CAPACITOR MARKET SIZE, 2020-2027 ($ MILLION)