Ceramic Substrate Market

Ceramic Substrate Market Size, Share & Trends Analysis Report, By Product Type (Alumina, Aluminum Nitride, Silicon Nitride, and Beryllium Oxide), and By End-User Industry (Consumer Electronics, Automotive, Telecom, Industrial, and Military & Avionics), Forecast Period 2022-2028 Update Available - Forecast 2025-2035

Ceramic substrate market is anticipated to grow at a considerable CAGR of 5.5% during the forecast period. The growing demand for ceramic substrates in the end-user industries such as consumer electronics, automotive, and telecommunication is the key factor driving the growth of the global ceramic substrate market. The increment in the utilization of these substrates as options in contrast to metals and combinations is further contributing to the market growth.

Synteris is developing 3D-printable ceramic packaging for power electronic modules to improve their thermal management, power density, performance, and lifetime. Existing power modules contain flat ceramic substrates that serve as both the electrically insulating component and thermal conductor that transfer the large heat outputs of these devices. Synteris proposes an additive manufacturing process that would replace the traditional insulating metalized substrate, with an additively manufactured ceramic packaging that acts as both an electrical insulator and heat exchanger for better thermal management. Such developments are anticipated to restrain the market growth.

After the pandemic, the global electronics industry has faced a dual impact. The production facilities of the electronics parts have been halted owing to the logistics slowdown and unavailability of the workforce across the globe. On the other hand, various e-commerce companies across the globe have discontinued the delivery of non-essential items (including most electronics products), which is affecting the electronics industry. COVID-19 has also disrupted the global supply chain of major electronic brands.

Segmental Outlook

The global ceramic substrate market is segmented by product type and end-user industry. The market segmentation based on the product type includes alumina, aluminum nitride, silicon nitride, and beryllium oxide. Based on the end-user industry, the market is segmented into consumer electronics, automotive, telecom, industrial, and military & avionics.

Based on end-user industry, the market is segmented into consumer electronics, automotive, telecom, industrial, military & avionics. Consumer electronics held a major market share based on the end-user industry. Ceramic substrate plays an essential role in the manufacturing of consumer electronics. Semiconductor manufacturers use ceramic substrates such as alumina and aluminum nitride owing to their properties such as hard and resistance to wear, strong acid and alkali at high temperatures, good thermal conductivity, extremely high bulk resistivity, very low dielectric constant, and loss tangent among others. Therefore, the growing consumer electronics industry is anticipated to drive the growth of this market segment.

Regional Outlooks

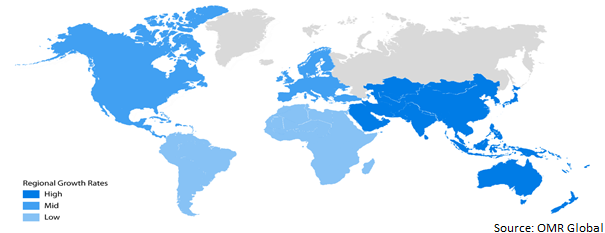

The global ceramic substrate market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America is expected to hold a considerable share in the global ceramic substrate market, owing to the presence of key market players in the region is making a considerable contribution to the market share. The developed automobile industry of the region is further expected to flourish with the growth of the ceramic substrate market in the region.

Global Ceramic Substrate Market Growth, by Region 2022-2028

Asia-Pacific to Exhibit Significant Growth in Ceramic substrate Market

Asia-Pacific is anticipated to exhibit significant growth in the market during the forecast period. The growing presence of end-user industries such as consumer electronics, automobile, and military among others across the region is a key factor driving the regional market. Rapid investment in the development of novel electronic products along with the availability of major market players such as Samsung Electronics Co. Ltd. are some other prominent factors contributing to the regional market growth. According to the Federation of Hong Kong Industries, China has the largest consumer electronics manufacturing bases across the globe. Japan is considered an advanced technological hub as it continuously invests in the R&D sector of the consumer electronics industry. The significant presence of the consumer electronics industry in the region is anticipated to support the growth of the ceramic substrate market in the region.

Market Players Outlook

The major companies serving the global ceramic substrate market include Kyocera Corp., Murata Manufacturing Co. Ltd., Coorstek Inc., Ceramtec, and Maruwa Co. Ltd. among others. The companies are focusing on technology advancements, expansions, mergers and acquisitions, partnerships, collaborations, and finding a new market or innovation in their core competency to expand individual market share. For instance, in May 2019, Aliaxis SA signed an agreement to divest its ceramic business to KYOCERA Fineceramic GmbH. The major motive behind the divest is to align its business offering with the market’s key players across the globe.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ceramic substrate market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Ceramic Substrate Market, By Product Type

4.1.1. Alumina

4.1.2. Aluminum Nitride

4.1.3. Silicon Nitride

4.1.4. Beryllium Oxide

4.2. Global Ceramic Substrate Market, By End-User Industry

4.2.1. Consumer Electronics

4.2.2. Automotive

4.2.3. Telecom

4.2.4. Industrial

4.2.5. Military & Avionics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ceramtec

6.2. Coorstek Inc.

6.3. Koa Corp.

6.4. Kyocera Corp.

6.5. Leatec Fine Ceramics

6.6. Maruwa Co. Ltd.

6.7. Murata Manufacturing Co. Ltd.

6.8. NEOTech

6.9. Nikko Company

6.10. Ortech Advanced Ceramics

6.11. Tong Hsing Electronics Industries

6.12. Yokowo Co. Ltd.

1. GLOBAL CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

2. GLOBAL ALUMINA CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ALUMINUM NITRIDE CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL SILICON NITRIDE CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL BERYLLIUM OXIDE CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

7. GLOBAL CERAMIC SUBSTRATE FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL CERAMIC SUBSTRATE FOR AUTOMOTIVE MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL CERAMIC SUBSTRATE FOR TELECOM MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL CERAMIC SUBSTRATE FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL CERAMIC SUBSTRATE FOR MILITARY & AVIONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. NORTH AMERICAN CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2021-2028 ($ MILLION)

15. NORTH AMERICAN CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

16. EUROPEAN CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. EUROPEAN CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2021-2028 ($ MILLION)

18. EUROPEAN CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

22. REST OF THE WORLD CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. REST OF THE WORLD CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2021-2028 ($ MILLION)

24. REST OF THE WORLD CERAMIC SUBSTRATE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

1. GLOBAL CERAMIC SUBSTRATE MARKET SHARE BY PRODUCT TYPES, 2021 VS 2028 (%)

2. GLOBAL ALUMINA CERAMIC SUBSTRATE MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL ALUMINUM NITRIDE CERAMIC SUBSTRATE MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL SILICON NITRIDE CERAMIC SUBSTRATE MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL BERYLLIUM OXIDE CERAMIC SUBSTRATE MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL CERAMIC SUBSTRATE MARKET SHARE BY END-USER INDUSTRY, 2021 VS 2028 (%)

7. GLOBAL CERAMIC SUBSTRATE FOR CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL CERAMIC SUBSTRATE FOR AUTOMOTIVE MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL CERAMIC SUBSTRATE FOR TELECOM MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL CERAMIC SUBSTRATE FOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL CERAMIC SUBSTRATE FOR MILITARY & AVIONICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL CERAMIC SUBSTRATE MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. US CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

15. UK CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF EUROPE CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

24. SOUTH KOREA CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF ASIA-PACIFIC CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD CERAMIC SUBSTRATE MARKET SIZE, 2021-2028 ($ MILLION)