Chartered Air Transportation Market

Chartered Air Transportation Market Size, Share, and Trends Analysis Report by Type (Passenger Chartered Air Transportation and Freight Chartered Air Transportation), Forecast Period (2023–2030) Update Available - Forecast 2025-2035

Chartered air transportation market is anticipated to grow at a considerable CAGR of 7.8% during the forecast period. The factors that are driving the market include the growing use of air transportation for quick travel and business travel purposes. Additionally, companies are offering new and innovative services to increase travelers’ interest in charter travel. For instance, in March 2023, Airble Aviation Inc., which debuted its online marketplace for charter flights, aviation tours, and empty legs in 2022, announced that it is still adding new partners. The firm, like Airbnb or VRBO, acts as a middleman, making it simpler for individuals to book these sorts of aircraft experiences. Airble is an online platform that enables passengers to compare and reserve private flights. Through the website and app, customers can book an entire aircraft and share seats with anyone they choose. Airble also tracks "empty legs," where aircraft are returning to their home base without passengers. Travelers can book these seats at reduced prices, with the added convenience of avoiding the queues and security delays associated with traditional air travel.

Segmental Outlook

The global chartered air transportation market is segmented by type. Based on type, the market is sub-segmented into passenger chartered air transportation and freight chartered air transportation.

The Passenger Chartered Air Transportation Segment Holds a Prominent Share in the Global Chartered Air Transportation Market

With passenger chartered air transportation, customers can customize their travel experience according to their specific needs and preferences. They can choose the aircraft type, departure and arrival times, and even the in-flight amenities. This level of personalization is not possible with commercial airlines. Additionally, customers have more flexibility in terms of flight schedules and routes. They can fly to smaller airports that are not served by commercial airlines and change their itinerary at short notice. Hence, the segment is growing.

Regional Outlook

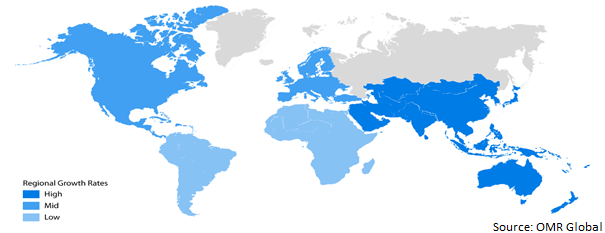

The global chartered air transportation market is segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the rest of the world (the Middle East and Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among the regions, the North American region is expected to generate the highest market share, followed by Asia-Pacific. The regional players with the largest fleet sizes are Deer Jet, Club One Air, and Australian Corporate Jet Centres. Charter service companies are expanding their fleets to meet the growing demand for on-demand flights. Service providers are introducing membership programs and new packages in order to improve their market share in the region. The market's tremendous potential has also enticed numerous charter service providers located in the US and Europe to extend their operations across Asia.

Global Chartered Air Transportation Market Growth, by Region (2023-2030)

The North American Region is Expected to Dominate the Global Chartered Air Transportation Market

The evolving aviation emission standards, as well as the diverse clientele's desire to customize their travel experience, have increased demand for newer-generation aircraft. Furthermore, the existence of many high-net-worth individuals (HNWIs) in North America has had a favorable influence on the market's demand-side dynamics. According to the Credit Suisse Research Institute's Global Wealth Report for 2019, the region had about 84,035 ultra-high-net-worth individuals. Aircraft charter operators are embracing cutting-edge innovation technologies to deliver a comprehensive portfolio of flight offers, ranging from fixed-price charter to bespoke membership programs, to give a personalized experience. For instance, XO Global LLC, a prominent charter service provider located in the US, offers turnkey solutions to give an asset-light alternative to full jet ownership and the inflexible, non-refundable jet card and fractional jet ownership models. To provide a distinct level of service even when reserving single tickets on shared flights, the firm has a fleet of 116 owned aircraft and 1,500 partner operator aircraft. Numerous other charter operators are competing for clients by establishing various programs that enhance convenience, dependability, and efficiency. Such improvements are expected to boost the commercial possibilities of North American charter jet service providers in the forecast period.

Market Players Outlook

The major companies serving the global chartered air transportation market include XO Global LLC, NetJets Services, Inc., VistaJet Group Holding Ltd., Directional Aviation, Jets.com, and others. These companies are considerably contributing to the market’s growth through the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, investments, and new product launches to stay competitive in the market. For instance, in March 2023, Aurora Anguilla Resort & Golf Club introduced its new Aurora Anguilla Public Air Charter Service, which provides visitors traveling to and from the property with an unparalleled private jet experience. Visitors can travel seamlessly with direct flights to Anguilla from New York or Florida for as little as $3,500 round trip from Westchester airport in New York and $2,500 per person from Fort Lauderdale.

The Report Covers-

- Market value data analysis for 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global chartered air transportation market. Based on the availability of data, information related to new product launches and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who stands where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Chartered Air Transportation Market by Type

4.1.1. Passenger Chartered Air Transportation

4.1.2. Freight Chartered Air Transportation

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Air Charter Service Group Ltd.

6.2. Air Transport Services Group, Inc. (ATSG)

6.3. Atlas Air Worldwide

6.4. Directional Aviation

6.5. Fly Victor Ltd.

6.6. GlobeAir AG

6.7. Jets.com

6.8. Jettly Inc.

6.9. JSX

6.10. Magellan Jets, LLC

6.11. NetJets Services, Inc.

6.12. Oxygen Aviation Ltd.

6.13. PT Garuda Indonesia (Persero) Tbk

6.14. VistaJet Group Holding Ltd.

6.15. Wheels Up Partners, LLC

6.16. XO Global LLC

1. GLOBAL CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY TYPE,2022-2030 ($ MILLION)

2. GLOBAL PASSENGER CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL FREIGHT CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

4. GLOBAL CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

5. NORTH AMERICAN CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY,2022-2030 ($ MILLION)

6. NORTH AMERICAN CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY TYPE,2022-2030 ($ MILLION)

7. EUROPEAN CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY,2022-2030 ($ MILLION)

8. EUROPEAN CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY TYPE,2022-2030 ($ MILLION)

9. ASIA-PACIFIC CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY,2022-2030 ($ MILLION)

10. ASIA-PACIFIC CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY TYPE,2022-2030 ($ MILLION)

11. REST OF THE WORLD CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY,2022-2030 ($ MILLION)

12. REST OF THE WORLD CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY TYPE,2022-2030 ($ MILLION)

1. GLOBAL CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY TYPE,2022 VS 2030 (%)

2. GLOBAL CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION,2022 VS 2030 (%)

3. GLOBAL PASSENGER CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION,2022 VS 2030 ($ MILLION)

4. GLOBAL FREIGHT CHARTERED AIR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION,2022 VS 2030 ($ MILLION)

5. GLOBAL CHARTERED AIR TRANSPORTATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. US CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

7. CANADA CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

8. UK CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

9. FRANCE CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

10. GERMANY CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

11. ITALY CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

12. SPAIN CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

13. REST OF EUROPE CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

14. INDIA CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

15. CHINA CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

16. JAPAN CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

17. SOUTH KOREA CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

18. REST OF ASIA-PACIFIC CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)

19. REST OF THE WORLD CHARTERED AIR TRANSPORTATION MARKET SIZE,2022-2030 ($ MILLION)