Cheese Market

Cheese Market Size, Share & Trends Analysis Report by Source (Animal-Based, and Plant-Based), by Type (Mozzarella Cheese, Cheddar Cheese, Parmesan Cheese, and Others) by Distribution Channel (Supermarkets, Hypermarkets, Convenience Stores, and Others) Forecast Period (2024-2031)

Cheese market is anticipated to grow at a significant CAGR of 7.0% during the forecast period (2024-2031). The market growth is attributed to shifting consumer preferences and desires for unusual and different flavors in food products, and an increase in the demand for plant-based cheese products. The introduction of novel and distinctive cheese varieties, and the internationalization of culinary trends further aid the market growth. According to the Agricultural Marketing Resource Center, in May 2024, the European Union was the major producer of cheese in the international market. European countries have produced on average around 13.7 billion pounds of cheese every year. The US and Japan are the two largest importers of cheese, importing 455 thousand pounds and 454 thousand pounds, respectively, every year.

Market Dynamics

Increasing Demand for Artisanal and Specialty Cheeses

Specialty cheese has grown increasingly common because of consumers' preferences moving toward the flavor of premium, artisanal goods and their increased understanding and delight in the variety of flavors and textures available in cheese. The profound impact of European customs is usually understood to allude to the ways of the Portuguese, Spanish, and Italian settlers who overran South and Central America. Subsequently, depending on their traditional expertise, immigrants from Asia and various European nations contributed to these fermentation methods. The regions of Brazil gave rise to distinct types of artisanal cheese, such as matured and fresh cheeses made from the milk of cows, goats, sheep, buffalo, or a combination of these animals.

Increasing Innovations in Flavors and Textures in Cheese

Cheese texture can be altered according to micellar casein's functional properties. From soft, and spreadable to stiff, and sliceable, manufacturers can create a variety of textures by adjusting the concentration and processing parameters. Every year, the market offers exciting new kinds and flavor combinations for cheese customers ready to venture beyond the mainstream. Developing novel flavor combinations by mixing common cheeses with unusual ingredients is a common approach to new product development. Science and technology aimed at enhancing flavor, texture, and taste are the main drivers of innovation in the cheese market as customers' interest in complex flavor profiles grows. When it comes to making low-fat and dairy-free cheeses, technology is very crucial.

Market Segmentation

- Based on the source, the market is segmented into animal-based and plant-based.

- Based on the type, the market is segmented into mozzarella cheese, cheddar cheese, parmesan cheese, and others (American cheese, blue cheese).

- Based on the distribution channel, the market is segmented into supermarkets, hypermarkets, convenience stores, and others (specialty stores).

Plant-Based is Anticipated to Exhibit Significant Growth

The primary factors supporting the growth include the growing popularity of plant-based diets and the benefits of consuming fewer animal products in terms of health and the environment. The growing adoption of healthier food options among consumers is driving the demand for plant-based cheese product alternatives. According to the Plant-Based Foods Association, Plant-based cheese sales reached $230.0 million in 2022. Household penetration of plant-based cheese stands at 5.0%, the repeat buying rate is an exceptionally strong 49.9%. In comparison, household penetration for animal-based cheese fell by 0.3%. Plant-based cheese products appeal to mainstream consumers by mimicking the taste, texture, and functionality of conventional animal products. Companies from startups to large food manufacturers generated that growth through significant innovation and investment in their plant-based cheese portfolios. For instance, in December 2022, Royal DSM introduced a new portfolio for plant-based cheese, which brings together DSM’s range of solutions and expertise to solve some of the category’s challenges in taste, texture, and health. The portfolio includes dairy-type flavors and concentrates from DSM’s acquisition of First Choice Ingredients as well as texture, nutrition, and color solutions that enable producers to deliver authentic, dairy-like taste experiences.

Mozzarella Cheese Segment Holds a Considerable Market Share

The factors supporting segment growth include increasing demand for mozzarella owing to the growing popularity of convenience food products. It is also widely used in many other types of cooking, such as American, Italian, and fusion foods, which makes it a flexible component for both conventional and contemporary recipes. Aside from this, the market's growth is supported for the near future by the quick-service restaurant (QSR) industry's continuing expansion. Market players invest in new technology that allows better flexibility and innovation opportunities to meet demands from customers, who need their mozzarella to brown, melt, or stretch in a certain way. For instance, in March 2024, Arla Foods invests €210 million ($227.0 million) to secure a position as a key mozzarella producer with highly advanced production technology at the Taw Valley dairy in southwestern England. With the new production capabilities, Arla Foods to meet increasingly specific demands from key customers and keep pace in the fast-moving space of global mozzarella.

Regional Outlook

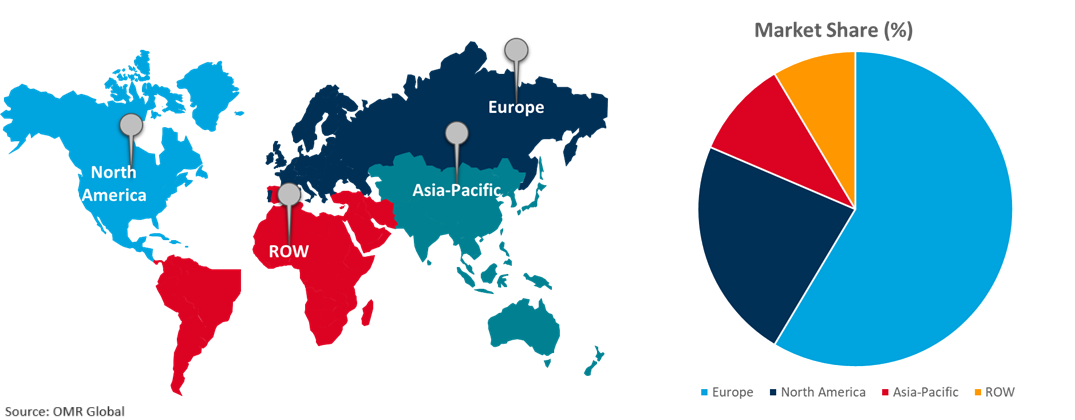

The global cheese market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Cheese in North America

The regional growth is attributed to the increasing consumption of cheese in fast food, informal eateries, and a wide range of exquisite cuisine products. Specialty and artisanal cheese demand have surged, a reflection of shifting consumer tastes for distinctive and superior goods. According to the International Dairy Foods Association, in November 2023, the US per capita consumption of all dairy products reached 653 pounds per person in 2022. Cheese consumption set an all-time high in 2022 to reach nearly 42 pounds per person, a half-a-pound per-person increase over the previous year. In the past decade alone, domestic per capita consumption of cheese is up 17.1%.

Global Cheese Market Growth by Region 2024-2031

Europe Holds Major Market Share

Europe holds a significant share owing to the presence of Cheese offering companies such as Arla Foods Group, BEL Group, Royal Friesland Campina N.V., and others. The regional market growth is attributed to the development of several enhanced cheese varieties and the growing impact of Western cuisine among French consumers, an increase in cheese production was noted across the majority of EU Member States. Production was expanded across most countries, with notable increases, particularly in Belgium, Denmark, and Poland. According to the European Dairy Association, the production of cheese in 2023 was 10.795 (million tons (MT)) and is expected to reach 10.880 (MT) in 2024 and consumption of cheese in 2023 was 9.605 (MT) and reached 9.710 (MT) in 2024. Global food player invests in new biotech startups to collaborate and create a new and disruptive generation of plant-based cheese. For instance, in April 2024, Bel and Climax Foods, Inc. announced a partnership to innovate plant-based cheeses indistinguishable from dairy cheeses, Powered by AI. This collaboration epitomizes our co-innovation strategy by combining their distinctive technological data science and AI platforms and expertise with Bel’s. The new plant-based cheeses aim to be nutritious, affordable, low carbon footprint, and be indistinguishable from their dairy counterparts.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order

The major companies serving the cheese market include Arla Foods Group, BEL Group, Fonterra Co-operative Group Ltd., Royal Friesland Campina N.V., and The Kraft Heinz Company among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In August 2023, Agrocorp’s brand, HerbYvore introduced plant-based cheese. The end-to-end innovation support rendered by this private-public research partnership has enabled the successful development and commercialization of HerbYvore such as Cheese, which includes dairy-free alternatives to cheddar, mozzarella, and parmesan.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cheese market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Arla Foods Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BEL Group

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Fonterra Co-Operative Group Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Royal Friesland Campina N.V.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. The Kraft Heinz Company

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cheese Market by Source

4.1.1. Animal-Based

4.1.2. Plant-Based

4.2. Global Cheese Market by Type

4.2.1. Mozzarella Cheese

4.2.2. Cheddar Cheese

4.2.3. Parmesan Cheese

4.2.4. Others (American Cheese, Blue Cheese)

4.3. Global Cheese Market by Distribution Channel

4.3.1. Supermarkets

4.3.2. Hypermarkets

4.3.3. Convenience Stores

4.3.4. Others (Specialty Stores)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Aarkay Food Products Ltd.

6.2. Amul

6.3. Associated Milk Producers Inc.

6.4. Bega Cheese (The Bega Group)

6.5. Bletsoe Cheese

6.6. Brunkow Cheese Factory

6.7. Cady Cheese Factory Land O'Lakes Inc.

6.8. Dairy Farmers of America Inc.

6.9. Glanbia Kraft and Burnett Dairy

6.10. Hook's Cheese Company

6.11. Kanegrade Ltd.

6.12. Kerry Group Plc

6.13. Lactalis Group

6.14. Meiji Holdings

6.15. Milchkontor GmbH

6.16. Mondelez International Group

6.17. Mother Dairy

6.18. Parag Milk Foods

6.19. Saputo Inc.

6.20. Savencia SA

1. Global Cheese Market Research And Analysis By Source, 2023-2031 ($ Million)

2. Global Animal-Based Cheese Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Plant-Based Cheese Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Cheese Market Research And Analysis By Type, 2023-2031 ($ Million)

5. Global Mozzarella Cheese Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Cheddar Cheese Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Parmesan Cheese Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Other Type of Cheese Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Cheese Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

10. Global Cheese Market In Supermarket Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Cheese Market In Hypermarket Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Cheese Market In Convenience Stores Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Cheese In Others Distribution Channel Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Cheese Market Research And Analysis By Region, 2023-2031 ($ Million)

15. North American Cheese Market Research And Analysis By Country, 2023-2031 ($ Million)

16. North American Cheese Market Research And Analysis By Source, 2023-2031 ($ Million)

17. North American Cheese Market Research And Analysis By Type, 2023-2031 ($ Million)

18. North American Cheese Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

19. European Cheese Market Research And Analysis By Country, 2023-2031 ($ Million)

20. European Cheese Market Research And Analysis By Source, 2023-2031 ($ Million)

21. European Cheese Market Research And Analysis By Type, 2023-2031 ($ Million)

22. European Cheese Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

23. Asia-Pacific Cheese Market Research And Analysis By Country, 2023-2031 ($ Million)

24. Asia-Pacific Cheese Market Research And Analysis By Source, 2023-2031 ($ Million)

25. Asia-Pacific Cheese Market Research And Analysis By Type, 2023-2031 ($ Million)

26. Asia-Pacific Cheese Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

27. Rest Of The World Cheese Market Research And Analysis By Region, 2023-2031 ($ Million)

28. Rest Of The World Cheese Market Research And Analysis By Source, 2023-2031 ($ Million)

29. Rest Of The World Cheese Market Research And Analysis By Type, 2023-2031 ($ Million)

30. Rest Of The World Cheese Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

1. Global Cheese Market Share By Source, 2023 Vs 2031 (%)

2. Global Animal-Based Cheese Market Share By Region, 2023 Vs 2031 (%)

3. Global Plant-Based Cheese Market Share By Region, 2023 Vs 2031 (%)

4. Global Cheese Market Share By Type, 2023 Vs 2031 (%)

5. Global Mozzarella Cheese Market Share By Region, 2023 Vs 2031 (%)

6. Global Cheddar Cheese Market Share By Region, 2023 Vs 2031 (%)

7. Global Parmesan Cheese Market Share By Region, 2023 Vs 2031 (%)

8. Global Other Type of Cheese Market Share By Region, 2023 Vs 2031 (%)

9. Global Cheese Market Share By Distribution Channel, 2023 Vs 2031 (%)

10. Global Cheese Market In Supermarket Market Share By Region, 2023 Vs 2031 (%)

11. Global Cheese Market In Hypermarkets Market Share By Region, 2023 Vs 2031 (%)

12. Global Cheese Market In Convenience Stores Market Share By Region, 2023 Vs 2031 (%)

13. Global Cheese Market In Other Distribution Channel Market Share By Region, 2023 Vs 2031 (%)

14. Global Cheese Market Share By Region, 2023 Vs 2031 (%)

15. US Cheese Market Size, 2023-2031 ($ Million)

16. Canada Cheese Market Size, 2023-2031 ($ Million)

17. UK Cheese Market Size, 2023-2031 ($ Million)

18. France Cheese Market Size, 2023-2031 ($ Million)

19. Germany Cheese Market Size, 2023-2031 ($ Million)

20. Italy Cheese Market Size, 2023-2031 ($ Million)

21. Spain Cheese Market Size, 2023-2031 ($ Million)

22. Rest Of Europe Cheese Market Size, 2023-2031 ($ Million)

23. India Cheese Market Size, 2023-2031 ($ Million)

24. China Cheese Market Size, 2023-2031 ($ Million)

25. Japan Cheese Market Size, 2023-2031 ($ Million)

26. South Korea Cheese Market Size, 2023-2031 ($ Million)

27. Rest Of Asia-Pacific Cheese Market Size, 2023-2031 ($ Million)

28. Rest Of The World Cheese Market Size, 2023-2031 ($ Million)

29. Latin America Cheese Market Size, 2023-2031 ($ Million)

30. Middle East And Africa Cheese Market Size, 2023-2031 ($ Million)