Chemoinformatics Market

Chemoinformatics Market Size, Share & Trends Analysis Report by Application (Drug Discovery, Chemical Analysis, Molecular Modeling, Regulatory Compliance, and Others), by Product Type (Software, and Services), and by End-User (Pharmaceutical Companies, Biotechnology Companies, Contract Research Organizations (CROs), and Academic & Research Institutes) Forecast Period (2024-2031)

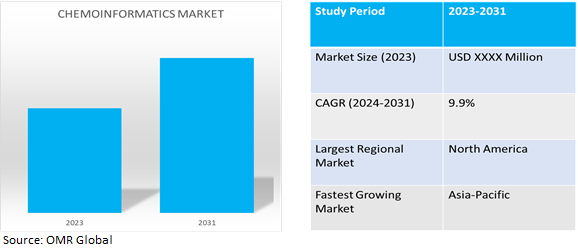

Chemoinformatics market is anticipated to grow at a considerable CAGR of 9.9% during the forecast period (2024-2031). The global chemoinformatics market uses computational techniques, algorithms, and software tools to analyze and model chemical data for drug discovery, materials science, and other applications in pharmaceutical, biotechnology, and chemical industries. Factors driving the market growth include increasing drug discovery activities, increasing R&D expenditure in life sciences. the adoption of AI and machine learning, growing demand for personalized medicine, expanding applications in materials science, drug repurposing and virtual screening, and regulatory initiatives and drug safety requirements. Chemoinformatics tools facilitate the identification of existing drugs with potential therapeutic benefits, and support toxicity prediction, ADME modeling, and pharmacokinetic profiling. These tools help in the identification and optimization of drug candidates with improved safety profiles and reduced adverse effects.

Market Dynamics

Increasing demand for market growth and revenue projection

The small-molecule drug discovery is expected to grow owing to the increasing adoption of Machine Learning (ML) driven chemoinformatics tools. This is anticipated to xontribute significantly to the market growth. According to the National Center of Biotechnology Information, in July 2023, chemoinformatics plays an essential role in biology, chemistry, and biochemistry. The market revenue for small-molecule drug discovery is projected to reach across $163.76 billion by 2032. ML algorithms have introduced a data-driven approach that allows computers to analyze complex patterns and relations in chemical structures and biological activity data, leading to improved accuracy and efficiency in predicting drug-target interactions and toxicological responses. This review provides insights into the current state of research, the integration of ML-driven chemoinformatics tools in drug discovery, and the future possibilities of small-molecule drug discovery and design.

Anticipated Expenses for Drug Discovery

The development cost of a new drug is significantly influenced by factors such as pre-clinical research, clinical trials, regulatory approvals, and post-marketing surveillance. According to the Congressional Budget Office, in April 2021, the pharmaceutical industry allocated $83.0 billion for R&D expenses, including drug exploration, testing, and clinical trials. However, developing new drugs is costly and uncertain, with only 12.0% gaining FDA approval. The average R&D cost per new drug ranges from less than $1.0 billion to over $2.0 billion, including capital costs and unsuccessful drugs. The process often takes over a decade.

Market Segmentation

Our in-depth analysis of the global chemoinformatics market includes the following segments by application, product type, and end-user:

- Based on application, the market is sub-segmented into drug discovery, chemical analysis, molecular modeling, regulatory compliance, and others(drug validation).

- Based on product type, the market is bifurcated into software and services.

- Based on end-users, the market is augmented into pharmaceutical companies, biotechnology companies, Contract Research Organizations (CROs), and academic & research institutes.

Chemical Analysis is Projected to Emerge as the Largest Segment

Based on the application, the global chemoinformatics market is sub-segmented into drug discovery, chemical analysis, molecular modeling, regulatory compliance, and others. Among these, the chemical analysis sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing accuracy and precision in chemical analysis. It is essential for producing reliable information for various chemoinformatics applications, such as virtual screening and Structure-Activity Relationship (SAR) modeling. Major advances in spectroscopy, spectrometry, and chromatography have improved the efficacy of chemical analysis. The sector is essential to ensuring the efficacy and safety of pharmaceutical products in addition to supporting the procedures involved in drug discovery, formulation, and development.

Biotechnology Companies Sub-segment to Hold a Considerable Market Share

Biotechnology companies offer innovative molecular design solutions, utilizing chemoinformatics tools, enabling researchers to design and optimize novel drug candidates, thereby driving demand for these technologies in early-stage drug discovery. For instance, in October 2023, Pfizer Inc. signed an agreement to extend access to Cadence Molecular Sciences' products and programming toolkits for advanced molecular design, which aids in early-stage drug discovery innovation.

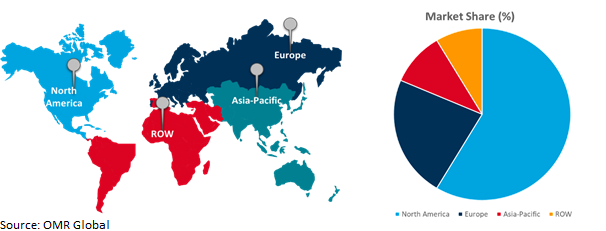

Regional Outlook

The global chemoinformatics market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Rise of Biotech Start-ups in Asia-Pacific

India's biotech startups are expanding owing to the use of chemoinformatics tools, which streamline R&D processes, accelerate drug discovery, and optimize biotechnological processes, driving market growth. According to the Asian Biotechnology and Development Review, in November 2023, the Indian Bioeconomy Report 2023 highlights significant economic contributions from sectors such as diagnostics, biopharma, enzymes, and bioindustries. The diagnostic sector identified a 1.5-fold increase since 2018, with a yearly output of $10.8 billion. Biotech startups increased by 23.0% in 2022.

Global Chemoinformatics Market Growth by Region 2024-2031

North America Holds Major Market Share

Increased funding in biotechnology sectors accelerates drug discovery, with new platforms and key players enhancing numerous techniques and advanced technologies for target identification and lead optimization. For instance, in July 2022, Dotmatics released its small molecule drug discovery solution, an integrated platform for R&D, promoting collaboration, productivity, and data management. The platform, based on 15+ years of experience, reduces operational inefficiencies and accelerates progress toward life-improving drug therapies. It additionally introduced its biology solution for antibody discovery, offering comprehensive offerings for chemistry and biology.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global chemoinformatics market include Agilent Technologies Inc., Collaborative Drug Discovery, Inc., Dassault Systèmes S.E., PerkinElmer Inc., and Schrödinger, LLC among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2022, Agilent Technologies acquired Virtual Control's advanced AI technology, ACIES, to improve productivity, efficiency, and accuracy in gas chromatography and mass spectrometry platforms. It integrates ACIES into its MassHunter software package for LC/MS and GC/MS instruments, automating data analysis and streamlining laboratory workflows.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global chemoinformatics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Agilent Technologies, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. DassaultSystèmes S.E.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. PerkinElmer Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global ChemoinformaticsMarket by Application

4.1.1. Drug Discovery

4.1.2. Chemical Analysis

4.1.3. Molecular Modeling

4.1.4. Regulatory Compliance

4.1.5. Others(Drug Validation)

4.2. Global Chemoinformatics Market by Product Type

4.2.1. Software

4.2.2. Services

4.3. Global ChemoinformaticsMarket by End-User

4.3.1. Pharmaceutical Companies

4.3.2. Biotechnology Companies

4.3.3. Contract Research Organizations (CROs)

4.3.4. Academic & Research Institutes

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Advanced Chemistry Development, Inc. (ACD/ Labs)

6.2. Bio-Rad Laboratories, Inc.

6.3. BioSolveIT GmbH

6.4. Cadence Design Systems, Inc.

6.5. CambridgeSoft Corp.

6.6. Certara, Inc.

6.7. ChemaxonKft.

6.8. Chemical Computing Group ULC

6.9. Collaborative Drug Discovery, Inc. (CDD VAULT)

6.10. Jubilant Biosys Ltd.

6.11. KODE S.r.l.

6.12. Molecular Discovery Ltd

6.13. Schrödinger, LLC

6.14. Scilligence

6.15. Vox Biomedical

1. GLOBAL CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

2. GLOBAL CHEMOINFORMATICS MARKET IN DRUG DISCOVERY RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CHEMOINFORMATICS MARKET IN CHEMICAL ANALYSIS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CHEMOINFORMATICS MARKET IN MOLECULAR MODELING RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL CHEMOINFORMATICS MARKET IN REGULATORY COMPLIANCE RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CHEMOINFORMATICS MARKET IN OTHER RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

8. GLOBAL CHEMOINFORMATICS MARKET SOFTWARE RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CHEMOINFORMATICS MARKET SERVICES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

11. GLOBAL CHEMOINFORMATICS FOR PHARMACEUTICAL COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CHEMOINFORMATICS FOR BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CHEMOINFORMATICS FOR CONTRACT RESEARCH ORGANIZATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL CHEMOINFORMATICS FOR ACADEMIC & RESEARCH INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN CHEMOINFORMATICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN CHEMOINFORMATICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN CHEMOINFORMATICS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN CHEMOINFORMATICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. EUROPEAN CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. EUROPEAN CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. EUROPEAN CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

23. EUROPEAN CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFICCHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

28. REST OF THE WORLD CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD CHEMOINFORMATICSMARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL CHEMOINFORMATICSMARKETSHARE BY APPLICATION, 2023 VS 2031 (%)

2. GLOBAL CHEMOINFORMATICS MARKET IN DRUG DISCOVERY SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CHEMOINFORMATICS MARKET IN CHEMICAL ANALYSIS SERVICES SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CHEMOINFORMATICS MARKET IN MOLECULAR MODELING SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL CHEMOINFORMATICS MARKET INREGULATORY COMPLIANCE SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CHEMOINFORMATICS MARKET IN OTHER APPLICATION SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CHEMOINFORMATICSMARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

8. GLOBAL CHEMOINFORMATICS MARKET SOFTWARE SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CHEMOINFORMATICS MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CHEMOINFORMATICSMARKET SHARE BY END-USER, 2023 VS 2031 (%)

11. GLOBAL CHEMOINFORMATICS FOR PHARMACEUTICAL COMPANIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CHEMOINFORMATICS FOR BIOTECHNOLOGY COMPANIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CHEMOINFORMATICS FOR CONTRACT RESEARCH ORGANIZATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL CHEMOINFORMATICS FOR ACADEMIC & RESEARCH INSTITUTES MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL CHEMOINFORMATICSMARKETSHARE BY REGION, 2023 VS 2031 (%)

16. US CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

18. UK CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA CHEMOINFORMATICSMARKET SIZE, 2023-2031 ($ MILLION)