Chlor Alkali Market

Chlor-Alkali Market Size, Share & Trends Analysis Report by Product (Chlorine, Caustic Soda, and Soda Ash), and by Application (PVC, Paper & Pulp, Gas, Chemicals, Textile, and Others) Forecast Period (2024-2031)

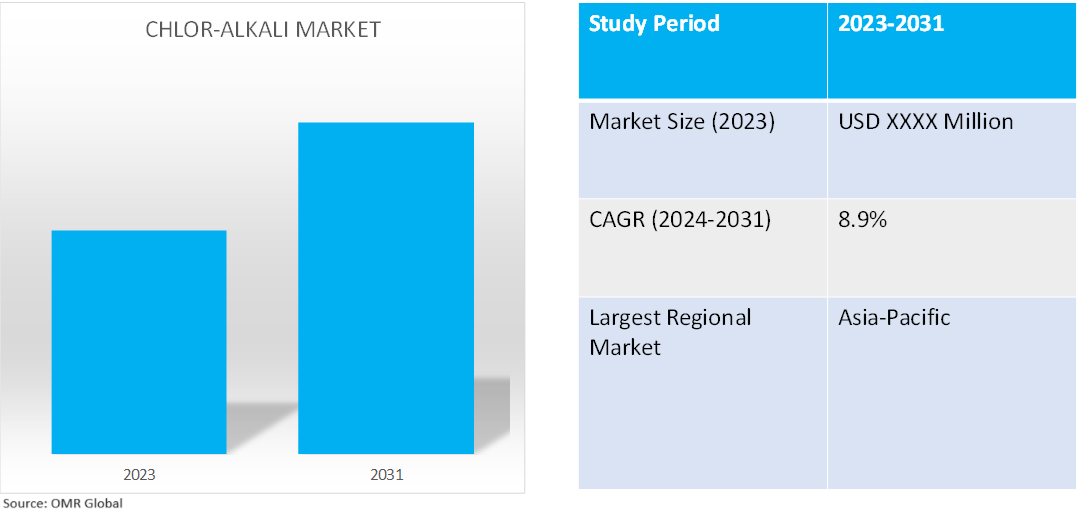

Chlor-alkali market is anticipated to grow at a significant CAGR of 8.9% during the forecast period (2024-2031). The industry growth is attributed to increasing demand for chlor-alkali based products such as soda ash, caustic soda, and chlorine that are found useful in several industrial applications. Major bulk chemical industries use these items as raw materials, and they are used in many industrial and manufacturing value chains. Additionally, increasing applications for the products include plastics, alumina, paper and pulp, and a variety of other end-use sectors (such as construction and automotive) driving the growth of the market. According to the World Chlorine Council, Globally, there are currently some 500 chlor-alkali producers and over 650 sites with a total production capacity of 58 million metric tonnes of chlorine and 62 million metric tonnes of its co-product, caustic soda (sodium hydroxide) per year.

Market Dynamics

Increasing Adoption of Greener Production Technologies

Membrane cell technology subjugates the technology used in the manufacturing of chlor-alkali. The mercury cell process is still used in several production plants, nevertheless. Owing to the extreme toxicity of mercury, policymakers have been forced to impose strict environmental laws on procedures involving the element. Consequently, producers are shifting from mercury cell technologies to more environmentally friendly ones like membrane cells. Owing to growing environmental concerns, several Indian plants have recently changed their technologies.

Growing Expansion of the Water Treatment Industry

The demand for chlor-alkali products is increasing as a result of the water treatment industry's significant expansion. This is mainly because the production of sodium hypochlorite in water treatment facilities depends on chlor-alkali, an essential component. This disinfectant is commonly used to treat wastewater and drinking water. Considering its well-known and dependable disinfecting abilities, sodium hypochlorite is a necessary component for ensuring the security and quality of water. In addition, rising industrialization and population growth have raised water pollution levels, which is driving up demand for water treatment products. Moreover, a variety of goods, including paper, textiles, detergents, and plastics, are made using chlor-alkali. Thus, the growing market for chlor-alkali will also be aided by the rising demand for these goods.

Market Segmentation

- Based on the product, the market is segmented into chlorine, caustic soda, and soda ash.

- Based on the applications, the market is segmented into PVC, paper & pulp, gas, chemicals, textile, and others (water treatment, food processing, and glass manufacture).

Caustic Soda is Projected to Hold the Largest Segment

The primary factors supporting the growth include caustic soda use is expected to rise in tandem with the growing use of aluminum in the automotive sector. As a result of the organic chemistry industry's widespread use of caustic soda. In the textile sector, textile is the second-fastest-growing category utilized for mercerization, dyeing, and scouring. One of the earliest industrial applications of caustic soda was in the soap and detergent industry. The use of caustic in detergent and soap applications has been hindered by the robust availability of substitutes. Roughly, half of the global demand for caustic soda came from pulp and paper, inorganics, water treatment, and other industries. Additionally, increasing demand for high-purity caustic soda with low chlorate levels for food and sensitive applications, complying with the highest food safety standards. For instance, in December 2023, Dow introduced two caustic soda products Caustic DEC and TRACELIGHT DEC, part of Dow’s Decarbia portfolio of reduced-carbon solutions, with up to 90.0% lower carbon dioxide. Customers can now benefit from high-quality caustic soda solutions for a variety of industrial and food applications with externally verified sustainability benefits.

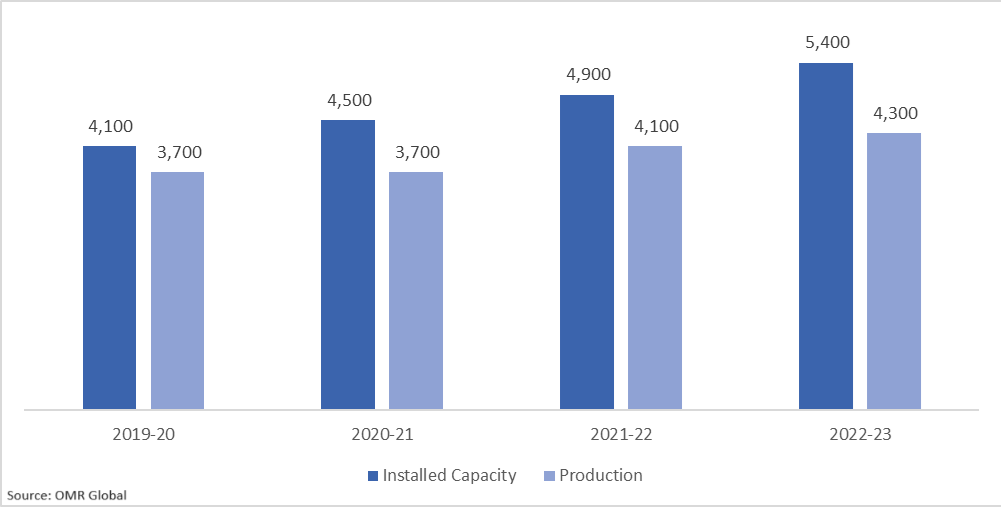

Caustic Soda Installed Capacity and Production 2019-2023 (KMT)

Source: Alkali Manufacturers Association of India

PVC to Hold a Considerable Market Share

The factors supporting segment growth include PVC is mostly used in applications for wire and cables, profiles, and pipe and fittings. Additionally, the demand for PVC is an increase in building and construction activities and an increase in industrialization globally. Consequently, this is increasing the need for chlor-alkali. To ensure full compliance with existing and potential future restrictions related to such legacy additives, innovative solutions are required. For instance, in June 2024, Vynova announced the introduction of a research & development programme to further advance PVC recycling and help the PVC value chain accelerate towards circularity. Vynova’s innovation efforts focus on technologies to remove heavy metals from dissolved rigid post-consumer PVC waste such as used window profiles or pipes.

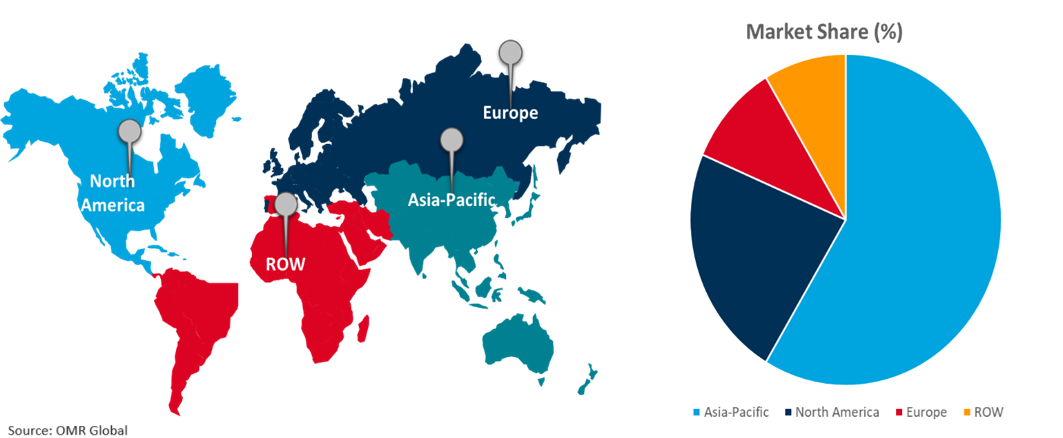

Regional Outlook

Global chlor-alkali market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Chlor-Alkali in North America

The regional growth is attributed to the growing PVC demand, water treatment, and chemical sector expansion. The rising demand for caustic soda is widely used in the manufacturing of alumina, pulp and paper, and textiles. Another important application, chlorine, is necessary to produce chemicals, disinfectants, and PVC, all of which significantly fuel the market's expansion. According to the US Environmental Protection Agency (EPA), in March 2023, it is estimated that construction applications such as polyvinyl chloride and epoxies accounted for the largest single demand for chlorine in 2021. Presently, chlorine is used widely by chlor-alkali manufacturing facilities for derivative chemical production, a process referred to as captive consumption. A fraction of overall production (estimated to be 3,600 million (M) kg or 32.0% in 2022) is destined for sale on the merchant market. Of the anticipated 628 M kg of demand for water treatment applications, municipal wastewater and drinking water are estimated to account for 67.0% and 33.0%, respectively.

Global Chlor-Alkali Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the presence of chlor-alkali offering companies such as Reliance Industries Ltd., Shin-Etsu Chemical Co., Ltd., Tata Chemicals The Dow Chemical Co., and others. The market growth is attributed to the growing demand for chlor-alkali in industries such as electronics, cars, and construction. Growth in building activity has increased demand for PVC, which has an impact on chlorine production, especially in emerging economies such as India, China, Japan, and South Korea. Additionally, the manufacture of chlor-alkali has lessened its environmental effect and improved energy efficiency owing to ongoing developments in membrane cell technology. With these advancements, manufacturers may increase production capacity while lowering operating expenses and their carbon footprint. The growing chemicals production hub and industrial ecosystem attracted significant foreign direct investment from international partners in the downstream business including refining, fertilizers, and gas pipelines. For instance, in June 2021, Abu Dhabi National Oil Company (ADNOC) announced that Reliance Industries Ltd. has signed an agreement to join a new global-scale chlor-alkali, ethylene dichloride, and polyvinyl chloride (PVC) production facility at TA’ZIZ in Ruwais, Abu Dhabi. Under the terms of the agreement, TA’ZIZ and Reliance construct an integrated plant, that can produce 940 thousand tons of chlor-alkali, 1.1 million tons of ethylene dichloride, and 360 thousand tons of PVC annually.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global chlor-alkali market include Occidental Petroleum Corp., Olin Corp., Solvay S.A., Tosoh Corp., and Westlake Chemical Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In February 2024, INEOS Inovyn introduced the Ultra-Low Carbon Chlor-Alkali range – significantly reducing CO2 footprint by up to 70.0%. New Ultra Low Carbon (ULC) range of Chlor-Alkali products, including Caustic Soda, Caustic potash, and Chlorine a major carbon footprint reduction. The new range uses renewable energy sources to power INEOS Inovyn manufacturing sites. The first production sites include Rafnes in Norway, which uses local hydroelectric power, and Antwerp in Belgium, where electricity comes directly from North Sea wind turbines.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global chlor-alkali market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Occidental Petroleum Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Olin Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Solvay S.A.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Tosoh Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Westlake Chemical Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Chlor-Alkali Market by Product

4.1.1. Chlorine

4.1.2. Caustic Soda

4.1.3. Soda Ash

4.2. Global Chlor-Alkali Market by Application

4.2.1. PVC

4.2.2. Paper & Pulp

4.2.3. Gas

4.2.4. Chemical

4.2.5. Textiles

4.2.6. Others (Water Treatment, Food Processing, Glass Manufacture)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AGC Inc. (Asahi Glass Co.)

6.2. China National Chemical Corp. (ChemChina)

6.3. Ercros S.A.

6.4. Formosa Plastics Corp.

6.5. Grasim Industries (Aditya Birla Group)

6.6. Hanwha Solutions Corp.

6.7. INOVYN (INEOS Group)

6.8. Kem One

6.9. LG Chem Ltd.

6.10. Nouryon (AkzoNobel Specialty Chemicals)

6.11. PPG Industries, Inc.

6.12. SABIC (Saudi Basic Industries Corp.)

6.13. Sanmar Group

6.14. Shin-Etsu Chemical Co., Ltd.

6.15. Tata Chemicals Ltd.

6.16. The Dow Chemical Co.

6.17. Vynova Group

1. Global Chlor-Alkali Market Research And Analysis By Product, 2023-2031 ($ Million)

2. Global Chlorine Chlor-Alkali Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Caustic Soda Chlor-Alkali Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Caustic Soda Chlor-Alkali Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Chlor-Alkali Market Research And Analysis By Application, 2023-2031 ($ Million)

6. Global Chlor-Alkali For Paper & Pulp Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Chlor-Alkali For Gas Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Chlor-Alkali For Chemical Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Chlor-Alkali For Textiles Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Chlor-Alkali For Others Application Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Chlor-Alkali Market Research And Analysis By Region, 2023-2031 ($ Million)

12. North American Chlor-Alkali Market Research And Analysis By Country, 2023-2031 ($ Million)

13. North American Chlor-Alkali Market Research And Analysis By Product, 2023-2031 ($ Million)

14. North American Chlor-Alkali Market Research And Analysis By Application, 2023-2031 ($ Million)

15. European Chlor-Alkali Market Research And Analysis By Country, 2023-2031 ($ Million)

16. European Chlor-Alkali Market Research And Analysis By Product, 2023-2031 ($ Million)

17. European Chlor-Alkali Market Research And Analysis By Application, 2023-2031 ($ Million)

18. Asia-Pacific Chlor-Alkali Market Research And Analysis By Country, 2023-2031 ($ Million)

19. Asia-Pacific Chlor-Alkali Market Research And Analysis By Product, 2023-2031 ($ Million)

20. Asia-Pacific Chlor-Alkali Market Research And Analysis By Application, 2023-2031 ($ Million)

21. Rest Of The World Chlor-Alkali Market Research And Analysis By Region, 2023-2031 ($ Million)

22. Rest Of The World Chlor-Alkali Market Research And Analysis By Product, 2023-2031 ($ Million)

23. Rest Of The World Chlor-Alkali Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Chlor-Alkali Market Research And Analysis By Product, 2023 Vs 2031 (%)

2. Global Chlorine Chlor-Alkali Market Share By Region, 2023 Vs 2031 (%)

3. Global Caustic Soda Chlor-Alkali Market Share By Region, 2023 Vs 2031 (%)

4. Global Soda Ash Chlor-Alkali Market Share By Region, 2023 Vs 2031 (%)

5. Global Chlor-Alkali Market Research And Analysis By Application, 2023 Vs 2031 (%)

6. Global Chlor-Alkali For Paper & Pulp Market Share By Region, 2023 Vs 2031 (%)

7. Global Chlor-Alkali For Gas Market Share By Region, 2023 Vs 2031 (%)

8. Global Chlor-Alkali For Chemical Market Share By Region, 2023 Vs 2031 (%)

9. Global Chlor-Alkali For Textiles Market Share By Region, 2023 Vs 2031 (%)

10. Global Chlor-Alkali For Others Application Market Share By Region, 2023 Vs 2031 (%)

11. Global Chlor-Alkali Market Share By Region, 2023 Vs 2031 (%)

12. US Chlor-Alkali Market Size, 2023-2031 ($ Million)

13. Canada Chlor-Alkali Market Size, 2023-2031 ($ Million)

14. UK Chlor-Alkali Market Size, 2023-2031 ($ Million)

15. France Chlor-Alkali Market Size, 2023-2031 ($ Million)

16. Germany Chlor-Alkali Market Size, 2023-2031 ($ Million)

17. Italy Chlor-Alkali Market Size, 2023-2031 ($ Million)

18. Spain Chlor-Alkali Market Size, 2023-2031 ($ Million)

19. Rest Of Europe Chlor-Alkali Market Size, 2023-2031 ($ Million)

20. India Chlor-Alkali Market Size, 2023-2031 ($ Million)

21. China Chlor-Alkali Market Size, 2023-2031 ($ Million)

22. Japan Chlor-Alkali Market Size, 2023-2031 ($ Million)

23. South Korea Chlor-Alkali Market Size, 2023-2031 ($ Million)

24. Rest Of Asia-Pacific Chlor-Alkali Market Size, 2023-2031 ($ Million)

25. Rest Of The World Chlor-Alkali Market Size, 2023-2031 ($ Million)

26. Latin America Chlor-Alkali Market Size, 2023-2031 ($ Million)

27. Middle East And Africa Chlor-Alkali Market Size, 2023-2031 ($ Million)