Cider Market

Global Cider Market Size, Share & Trends Analysis Report, By Flavor (Apple Flavored, Fruit Flavored, Pear, Lemon, and Others), By Type (Hard Cider and sweet Cider), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Stores, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global cider market is estimated to grow at a CAGR of nearly 5.7% during the forecast period. Rising demand for premium alcoholic beverages and significant youth population is driving the demand for cider. Rising adoption of premium alcoholic beverages is encouraging the market growth. The adoption of apple wine and fruit flavored wine are being primarily led by the increasing disposable income of consumers and a major shift towards beverages with natural flavors. Millennials are primarily buying innovative alcoholic beverages products and therefore, the manufacturers are using natural flavors that enables to enhance the taste and fragrance of their alcoholic beverages. The comprehensive range of cider with innovative natural flavors is providing multiple options for consumers which allows them to select the cider product of their choice.

There is an increasing trend towards celerity-owned brands available in the market that is bound to attract a large number of the customer base. Most people prefer to consume premium alcohol beverage of their favorite celebrities. Therefore, it is expected that more new launches of celebrities-owned premium alcohol brands will occur in near future, which in turn, will likely propel the market growth. Further, the companies are expanding the range of their premium beverages owing to its increasing popularity in millennials. For instance, in May 2019, Asahi group Holding, Ltd, announce that Asahi Europe, Ltd. a subsidiary of Asahi, completed the acquisition of the premium beer and cider business of Fuller, Smith and Turner PLC that operates pubs, hotel, and premium beer and cider business. This will enable Asahi to expand the range of their premium alcoholic beverages and gain a significant market share.

Market Segmentation

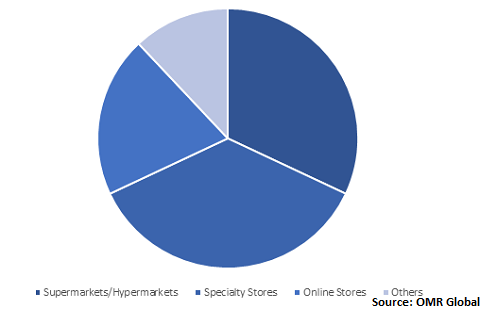

The global cider market is segmented based on flavor, type, and distribution channel. Based on flavor, the market is classified into apple flavored, fruit flavored, pear, lemon, and others. Based on type, the market is classified into hard cider and sweet cider. Based on the distribution channel, the market is classified into supermarkets and hypermarkets, specialty stores, online stores, and others.

Online stores are anticipated to hold significant share in the market during the forecast period

Online retail stores are expected to have significantly used distribution channel for cider products during the forecast period. The rising e-commerce industry has made the lives easier for internet users to shop online. Owing to the benefits such as 24/7 accessibility, with no downtime for public holidays, bad weather conditions, and closing times, e-commerce platforms have been gaining foremost importance among the digital population. Ecommerce allows buying products quickly and easily without the hassle of awkward social interactions, crowds, and traffic. Improved infrastructure, lower selling price and reduced costs associated with marketing and outreach of products over a digital platform contribute to promoting online sales across the globe. Therefore, the manufacturers of cider have been focusing on increasing its sell of products through online stores, which in turn, can increase their revenue generation.

Global Cider Market Share by Distribution Channel, 2019 (%)

Regional Outlook

Geographically, the market is segmented into North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2019, Europe has witnessed significant growth in the market owing to the increasing demand for low alcoholic beverages and significant disposable income. There is an increasing shift of adults towards premium cider brands in the region, which is driving the market growth in the region. In addition, a significant availability of millennial consumers is further accelerating market growth. Asia-Pacific is estimated to witness potential growth during the forecast period owing to the rising per-capita income and rising demand for apple flavored wine coupled with nutritional benefits and availability of a wide range of apple wine products.

Global Cider Market Growth, by Region 2020-2026

Market Players Outlook

The major players operating in the market include C&C Group plc, Agrial Group, Anheuser-Busch InBev, Asahi Group Holdings Ltd., and Heineken N.V. The market players are constantly focusing on gaining major market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance, in March 2020, C&C Group plc and Budweiser Brewing Group UK&I, a part of AB InBev, declared the expansion of their current multi-year collaboration, which includes exclusive distribution of Bud Light and Budweiser on the island of Ireland.

Owing to the addition of Bud Light and Budweiser, from July 2020, C&C will sale and distribute complete beer brand portfolio of Budweiser Brewing Group across Ireland. Budweiser Brewing Group and C&C Group will partner on the marketing of the portfolio which also comprises both cider and beer brands including Stella Artois, Beck’s, Hoegaarden, Corona, and Leffe. This signifies an end to the relationship of Budweiser Brewing Group with Diageo in Ireland.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cider market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. C&C Group plc

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Agrial Group

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Anheuser-Busch InBev

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Asahi Group Holdings, Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Heineken N.V.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Cider Market by Flavor

5.1.1. Apple Flavored

5.1.2. Fruit Flavored

5.1.3. Pear

5.1.4. Lemon

5.1.5. Others

5.2. Global Cider Market by Type

5.2.1. Hard Cider

5.2.2. Sweet Cider

5.3. Global Cider Market by Distribution Channel

5.3.1. Supermarkets and Hypermarkets

5.3.2. Specialty Stores

5.3.3. Online Stores

5.3.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Agrial Group

7.2. Anheuser-Busch InBev

7.3. Asahi Group Holdings, Ltd.

7.4. C&C Group plc

7.5. Carlsberg Breweries A/S

7.6. Crispin Cider Co.

7.7. Diageo plc

7.8. Distell Group Ltd.

7.9. Halewood International Ltd.

7.10. Heineken N.V.

7.11. Kopparberg UK

7.12. Molson Coors Beverage Co.

7.13. Thatchers Cider Co. Ltd.

7.14. The Boston Beer Co.

7.15. Vander Mill

7.16. Woodchuck Cidery

LIST OF TABLES

1. GLOBAL CIDER MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

2. GLOBAL APPLE FLAVORED CIDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL FRUIT FLAVORED CIDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL PEAR CIDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL LEMON CIDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER CIDER PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL CIDER MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

8. GLOBAL HARD CIDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL SWEET CIDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL CIDER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

11. GLOBAL CIDER IN SUPERMARKETS AND HYPERMARKETS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL CIDER IN SPECIALTY STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL CIDER IN ONLINE STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL CIDER IN OTHER DISTRIBUTION CHANNELS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL CIDER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN CIDER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN CIDER MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

18. NORTH AMERICAN CIDER MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. NORTH AMERICAN CIDER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

20. EUROPEAN CIDER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN CIDER MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

22. EUROPEAN CIDER MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

23. EUROPEAN CIDER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC CIDER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC CIDER MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC CIDER MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC CIDER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

28. REST OF THE WORLD CIDER MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2019-2026 ($ MILLION)

29. REST OF THE WORLD CIDER MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

30. REST OF THE WORLD CIDER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL CIDER MARKET SHARE BY FLAVOR, 2019 VS 2026 (%)

2. GLOBAL CIDER MARKET SHARE BY TYPE, 2019 VS 2026 (%)

3. GLOBAL CIDER MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

4. GLOBAL CIDER MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US CIDER MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA CIDER MARKET SIZE, 2019-2026 ($ MILLION)

7. UK CIDER MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE CIDER MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY CIDER MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY CIDER MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN CIDER MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE CIDER MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA CIDER MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA CIDER MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN CIDER MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC CIDER MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD CIDER MARKET SIZE, 2019-2026 ($ MILLION)