Circuit Breaker and Fuses Market

Global Circuit Breaker and Fuses Market Size, Share & Trends Analysis Report, By Product Type (Circuit Breaker and Fuse), By Arc Quenching Media Type (Vacuum Circuit Breakers, Oil Circuit Breakers, Air Circuit Breakers, and Others), By Application (Consumer Electronics, Industrial, Transport, Construction, Energy, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The global circuit breaker and fuses market is estimated to grow at a CAGR of nearly 6.0% during the forecast period. The major factors contributing to the growth of the market include the rising demand for renewable energy sources and the growing construction industry. As per the International Renewable Energy Agency (IRENA), the global solar energy capacity increased from 488.7 gigawatts (GW) in 2018 to 586.4 GW in 2019. Solar energy and wind energy is constantly leading renewable capacity expansion. These combinedly accounted for 90% of total net renewable additions in 2019. Growing environmental concerns such as rising carbon emission, air pollution, and global warming are the major factors encouraging the adoption of solar panels.

Another major factor for the growth of the solar industry is the reduction in the price of the solar panels. A significant decline in the cost of rooftop solar panels has been observed over the years. Solar panels are penetrating significantly from various commercial to household applications across the globe. Due to these benefits, the installations of solar photovoltaic (PV) systems has been accelerating, which in turn, is leading the adoption of circuit breakers and fuses. Circuit breakers and fuses are primarily used for the protection of the PV wiring from getting too hot and catching fire.

They are used for the protection of devices from catching fire and severe damage if the short circuit occurs. For instance, if a short circuit develops in the AC/DC inverter, a fuse between the inverter and the battery acts to prevent a possible battery explosion. Additionally, the fuse will cut the circuit quickly to prevent wires from catching fire. Therefore, the wires, battery, and AC/DC inverter will be safely disabled by the fuse. Thus, the increasing solar energy capacity installation is primarily contributing to the growth of the market.

Market Segmentation

The global circuit breaker and fuses market is segmented based on product type, arc quenching media type, and application. Based on product type, the market is classified into a circuit breaker and fuse. Based on the arc quenching media type, the market is segmented into vacuum circuit breakers, oil circuit breakers, air circuit breakers, and others. Based on application, the market is classified into consumer electronics, industrial, transport, construction, energy, and others.

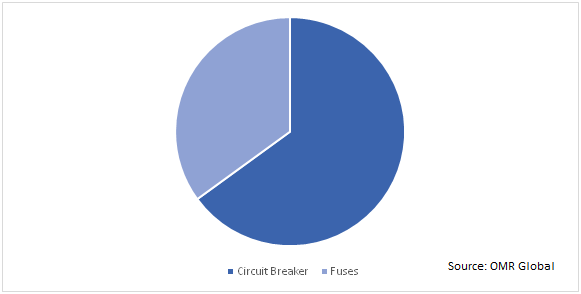

Circuit breaker held the largest share in the product type

In 2019, circuit breakers have witnessed considerable demand across several applications, including energy, automotive, and other industries. Circuit breakers are significantly installed for protection of any system from short circuits, high voltages, and high currents. Therefore, it has immense popularity in renewable resources as the power generated by renewable resources are not as stable. This increases the need for circuit breakers during the installation of the renewable energy system. Further, there is an emerging application of air circuit breakers (ACB) as it mostly used in high current applications. ACB can offer protection against overload and short circuit up to 6,300 A. ACBs comes with two pairs of contacts; the main pair carries the current at a steady load rate and is made of copper. The other pair is the arcing contact and usually made up of carbon. ACB is used mostly for the protection of plants, electrical machines, transformers, capacitors and generators. ACB is also used in low as well as high currents and voltage equipment.

Global Circuit Breaker and Fuses Market Share by Product Type, 2019 (%)

Regional Outlook

Geographically, the market is classified into four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2019, Asia-Pacific is anticipated to hold the largest share in the market owing to the rapid industrialization, rising demand for renewable energy sources, and increasing demand for electric vehicles in the region. As per the International Renewable Energy Agency (IRENA), China’s total operating solar PV capacity reached 205.5 GW in 2019, increased from 175.2 GW in 2018. This results in the demand for circuit breaker and fuses for use in solar panels as a protection against short circuits. Further, the rapidly growing transmission & distribution sector in the Asia-Pacific will give a boost to the regional growth of the market during the forecast period.

Global Circuit Breaker and Fuses Market Growth, by Region 2020-2026

Market Players Outlook

The major players in the market include Eaton Corp. plc, Schneider Electric SE, Hitachi, Ltd., Mitsubishi Electric Corp., and Atom Power, Inc. These companies are adopting various strategies such as partnership and collaboration, geographical expansion, and product launch for increasing their market share. For instance, in February 2019, in Hyderabad, Schneider Electric SE declared the launch of Masterpact MTZ; it is a high-power low voltage circuit breaker that combines the performance and reliability with new digital capabilities of the system. It combines and manages with smart panel architecture and is controlled by the supervision system to carry out preventive maintenance and energy management. This launch will facilitate smart water management conveniently.

Further, in December 2018, Hitachi declared to acquire ABB’s power grids business, which is expected to complete in the first half of 2020. ABB power grids business operates in four segments, including high voltage products, transformers, grid automation, and grid integration. With this acquisition, Hitachi will expand in the areas of power and energy area, life (smart-city and buildings), mobility (railways and EVs), and industry (manufacturing facilities). This will enable the company to offer innovative energy solutions to a wide range of customers.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global circuit breaker and fuses market. Based on the availability of data and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Eaton Corp. plc

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Schneider Electric SE

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Hitachi, Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Mitsubishi Electric Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Atom Power, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Circuit Breaker and Fuses Market by Product Type

5.1.1. Circuit Breaker

5.1.1.1. High Voltage

5.1.1.2. Medium Voltage

5.1.1.3. Low Voltage

5.1.2. Fuse

5.1.2.1. High Voltage

5.1.2.2. Medium Voltage

5.1.2.3. Low Voltage

5.2. Global Circuit Breaker and Fuses Market by Arc Quenching Media Type

5.2.1. Vacuum Circuit Breakers

5.2.2. Oil Circuit Breakers

5.2.3. Air Circuit Breakers

5.2.4. Others

5.3. Global Circuit Breaker and Fuses Market by Application

5.3.1. Consumer Electronics

5.3.2. Industrial

5.3.3. Transport

5.3.4. Construction

5.3.5. Energy

5.3.6. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Atom Power, Inc.

7.2. Bourns, Inc.

7.3. Camsco Electric Co., Ltd.

7.4. Changan Group Co.,Ltd.

7.5. Eaton Corp. plc

7.6. EFACEC

7.7. Fuji Electric Co., Ltd.

7.8. G&W Electric Co.

7.9. Havells India Ltd.

7.10. Hitachi, Ltd.

7.11. Honeywell International Inc.

7.12. Larsen & Toubro Ltd.

7.13. Legrand

7.14. Maxwell Technologies, Inc.

7.15. Mitsubishi Electric Corp.

7.16. Pennsylvania Breaker LLC

7.17. Schneider Electric SE

7.18. Siemens AG

7.19. Tavrida Electric

7.20. TE Connectivity Ltd.

7.21. Toshiba International Corp.

1. GLOBAL CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL CIRCUIT BREAKER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL FUSE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY ARC QUENCHING MEDIA TYPE, 2019-2026 ($ MILLION)

5. GLOBAL VACUUM CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OIL CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL AIR CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL OTHER CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

10. GLOBAL CIRCUIT BREAKER AND FUSES IN CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL CIRCUIT BREAKER AND FUSES IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL CIRCUIT BREAKER AND FUSES IN TRANSPORT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL CIRCUIT BREAKER AND FUSES IN CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL CIRCUIT BREAKER AND FUSES IN ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL CIRCUIT BREAKER AND FUSES IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. NORTH AMERICAN CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

19. NORTH AMERICAN CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY ARC QUENCHING MEDIA TYPE, 2019-2026 ($ MILLION)

20. NORTH AMERICAN CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

21. EUROPEAN CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. EUROPEAN CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

23. EUROPEAN CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY ARC QUENCHING MEDIA TYPE, 2019-2026 ($ MILLION)

24. EUROPEAN CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY ARC QUENCHING MEDIA TYPE, 2019-2026 ($ MILLION)

28. ASIA-PACIFIC CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

29. REST OF THE WORLD CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

30. REST OF THE WORLD CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY ARC QUENCHING MEDIA TYPE, 2019-2026 ($ MILLION)

31. REST OF THE WORLD CIRCUIT BREAKER AND FUSES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL CIRCUIT BREAKER AND FUSES MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL CIRCUIT BREAKER AND FUSES MARKET SHARE BY ARC QUENCHING MEDIA TYPE, 2019 VS 2026 (%)

3. GLOBAL CIRCUIT BREAKER AND FUSES MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

4. GLOBAL CIRCUIT BREAKER AND FUSES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)

7. UK CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD CIRCUIT BREAKER AND FUSES MARKET SIZE, 2019-2026 ($ MILLION)