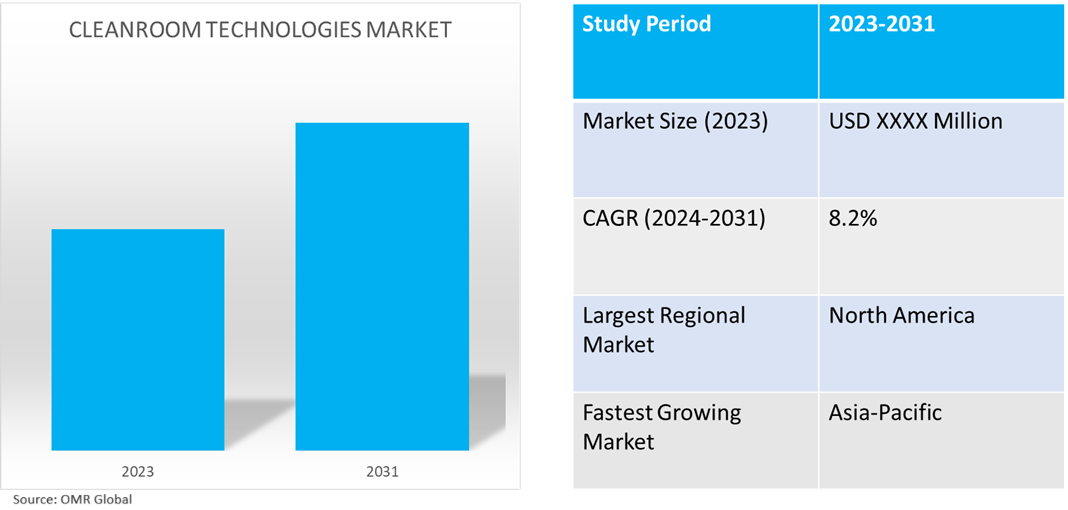

Cleanroom Technologies Market

Cleanroom Technologies Market Size, Share & Trends Analysis Report by Product (Fan Filter Units, HVAC, Vacuum Systems, and Disinfectants) and by Application (Pharmaceutical, Biotechnology, and Medical Device Manufacturers) Forecast Period (2024-2031)

Cleanroom technologies market is anticipated to grow at a significant CAGR of 8.2% during the forecast period (2024-2031). The market growth is attributed to the growing demand for cleanroom technologies in manufacturing facilities across a range of industries. It is anticipated that cleanroom technology will be more widely used to ensure the sterility of both the finished goods and the entire manufacturing process driving the growth of the market. According to the International Society for Pharmaceutical Engineering (ISPE), Pharmaceutical cleanrooms can consume up to 15 times more energy than commercial building systems, with more than 50.0% of electricity being consumed by plant HVAC cleanroom systems. This level of energy consumption is driven by the high air change rates required to ensure the air quality of pharmaceutical production.

Market Dynamics

Increasing Demand for Automated Operations

Automated cleanroom operations reduce manual intervention for smooth procedures. This technical innovation maximizes precision and efficiency by utilizing robotics, intelligent controls, and other automated systems. For the delicate handling of delicate components, robotic arms are used to ensure precision and reduce contamination hazards. Automated material handling systems facilitate the efficient transportation of commodities and minimize downtime by streamlining logistics. There are many advantages of automating cleanroom operations. Faster processes and shorter cycle times lead to increased efficiency, which improves productivity and cost-effectiveness. Moreover, automation lowers human mistakes, enhancing the caliber of the output.

Growing Adoption of Real-Time Data Monitoring

In cleanroom settings, real-time data monitoring is essential for maintaining ideal conditions and quickly spotting aberrations. Real-time monitoring of critical parameters enables prompt resolution of aberrations, reducing the risk of contamination and guaranteeing constant product quality. Cleanroom data collecting is undergoing a revolution with advanced data monitoring technology such as sensors and IoT devices.

Market Segmentation

- Based on the product, the market is segmented into fan filter units, HVAC, vacuum systems, and disinfectants.

- Based on the end-users, the market is segmented into pharmaceutical, biotechnology, and medical device manufacturers.

HVAC is Projected to Hold the Largest Segment

HVAC (heating, ventilation, and air conditioning) systems are essential for the precise control of temperature, humidity, and pressure levels that pharmaceutical and biotech companies need for manufacturing and research activities. White rooms utilize ULPA and HEPA filters in their HVAC systems, which can remove up to 99.9% of airborne particles. This system is crucial for maintaining the desired level of air purity. In June 2024, Panel Built Inc., a modular building manufacturer, announced adding white rooms to its comprehensive cleanroom solutions. This new offering aims to provide an economical yet efficient alternative for businesses requiring controlled environments for delicate operations.

Pharmaceutical Segment to Hold a Considerable Market Share

The factors supporting segment growth include the increasing demand for cleanroom technology due to the presence of cohesive laws governing the approval of pharmaceutical items. To guarantee the safe and efficient production of pharmaceutical goods during the manufacturing process, the cleanroom must be properly designed, installed, operated, and maintained. Installing cleanroom technology equipment, such as HVAC systems, air showers, and diffusers, ensures the best possible product quality with minimal waste, maximum yield, and streamlined production procedures. For instance, in April 2024, AES Clean Technology sets new standards for cleanliness and efficiency in cleanrooms with the launch of its CleanLock Module. The product addresses the critical need to maintain ultra-clean environments in industries such as pharmaceuticals, biotechnology, and medical device manufacturing.

Regional Outlook

The global cleanroom technologies market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Cleanroom Technologies in Asia-Pacific

- The regional growth is attributed to growing regulatory concerns around the production, distribution, and packaging of high-quality items. The presence of large pharmaceuticals and nutraceuticals industry in the Asia-Pacific is further aiding the regional market growth. The market is growing as a result of growing consumer awareness of pure and high-quality products as well as easier access to cleanroom technology supplies and equipment.

Global Cleanroom Technologies Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the presence of cleanroom technologies providers such as 3M Co., DuPont de Nemours, Inc., and Honeywell International Inc. in the region. The market growth is attributed to the advanced healthcare system, the presence of major pharmaceutical and medical device companies in the region, and a notable rise in the public's knowledge of cosmeceuticals and nutraceuticals. In addition, strict laws governing the approval of medical supplies, including those in the US, have led to a significant increase in the market for cleanroom technology. For instance, in May 2024, AAF International, a US-based air filtration systems and technology company, officially opened its new ISO Class 4, 6, and 7 cleanrooms for HEPA filter manufacturing. The official opening of the cleanroom and exciting new product launch highlights AAF's mission to be an air filtration solution provider, innovative technology, and supplier of choice.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the cleanroom technologies market include 3M Co., Azbil Corp., DuPont de Nemours, Inc., Honeywell International Inc., and Kimberly-Clark Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In May 2024, Cherwell introduced the new MicronView BioAerosol Monitoring System (BAMS) which enables the rapid real-time, continuous monitoring of airborne microbes to support EU GMP Annex 1 requirements. The introduction of the BAMS rapid microbial monitoring (RMM) system means Cherwell now offers a complete environmental monitoring (EM) portfolio to meet all cleanroom microbiology needs.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the cleanroom technologies market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industrial Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Azbil Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. DuPont de Nemours, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Honeywell International Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Kimberly-Clark Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cleanroom Technologies Market by Product

4.1.1. Fan Filter Units

4.1.2. HVAC

4.1.3. Vacuum Systems

4.1.4. Disinfectants

4.2. Global Cleanroom Technologies Market by End-Users

4.2.1. Pharmaceutical

4.2.2. Biotechnology

4.2.3. Medical Device Manufacturers

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AIRPLAN

6.2. AIRTECH JAPAN, Ltd.

6.3. Ansell Ltd.

6.4. Ardmac

6.5. Berkshire Corp.

6.6. Bouygues

6.7. Camfil AB

6.8. Clean Air Technology, Inc.

6.9. Colandis GmbH

6.10. Contec, Inc.

6.11. Dynarex Corp.

6.12. Exyte GmbH

6.13. Illinois Tool Works Inc.

6.14. Labconco Corp.

6.15. Micronclean

6.16. OCTANORM-Vertriebs-GmbH

6.17. Parteco S.r.l.

6.18. Taikisha Ltd.

6.19. Texwipe

6.20. Valutek Inc.

1. Global Cleanroom Technologies Market Research And Analysis By Product, 2023-2031 ($ Million)

2. Global Fan Filter Units In Cleanroom Technologies Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global HVAC In Cleanroom Technologies Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Vacuum Systems In Cleanroom Technologies Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Disinfectants In Cleanroom Technologies Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Cleanroom Technologies Market Research And Analysis By End-User, 2023-2031 ($ Million)

7. Global Cleanroom Technologies For Pharmaceutical Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Cleanroom Technologies For Biotechnology Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Cleanroom Technologies For Medical Device Manufacturers Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Cleanroom Technologies Market Research And Analysis By Region, 2023-2031 ($ Million)

11. North American Cleanroom Technologies Market Research And Analysis By Country, 2023-2031 ($ Million)

12. North American Cleanroom Technologies Market Research And Analysis By Product, 2023-2031 ($ Million)

13. North American Cleanroom Technologies Market Research And Analysis By End-Users, 2023-2031 ($ Million)

14. European Cleanroom Technologies Market Research And Analysis By Country, 2023-2031 ($ Million)

15. European Cleanroom Technologies Market Research And Analysis By Product, 2023-2031 ($ Million)

16. European Cleanroom Technologies Market Research And Analysis By End-Users, 2023-2031 ($ Million)

17. Asia-Pacific Cleanroom Technologies Market Research And Analysis By Country, 2023-2031 ($ Million)

18. Asia-Pacific Cleanroom Technologies Market Research And Analysis By Product, 2023-2031 ($ Million)

19. Asia-Pacific Cleanroom Technologies Market Research And Analysis By End-Users, 2023-2031 ($ Million)

20. Rest Of The World Cleanroom Technologies Market Research And Analysis By Region, 2023-2031 ($ Million)

21. Rest Of The World Cleanroom Technologies Market Research And Analysis By Product, 2023-2031 ($ Million)

22. Rest Of The World Cleanroom Technologies Market Research And Analysis By End-Users, 2023-2031 ($ Million)

1. Global Cleanroom Technologies Market Share By Product, 2023 Vs 2031 (%)

2. Global Fan Filter Units In Cleanroom Technologies Market Share By Region, 2023 Vs 2031 (%)

3. Global HVAC Units In Cleanroom Technologies Market Share By Region, 2023 Vs 2031 (%)

4. Global Vacuum Systems In Cleanroom Technologies Market Share By Region, 2023 Vs 2031 (%)

5. Global Disinfectants In Cleanroom Technologies Market Share By Region, 2023 Vs 2031 (%)

6. Global Cleanroom Technologies Market Share By End-User, 2023 Vs 2031 (%)

7. Global Cleanroom Technologies For Pharmaceutical Market Share By Region, 2023 Vs 2031 (%)

8. Global Cleanroom Technologies For Biotechnology Market Share By Region, 2023 Vs 2031 (%)

9. Global Cleanroom Technologies For Medical Device Manufacturers Market Share By Region, 2023 Vs 2031 (%)

10. Global Cleanroom Technologies Market Share By Region, 2023 Vs 2031 (%)

11. US Cleanroom Technologies Market Size, 2023-2031 ($ Million)

12. Canada Cleanroom Technologies Market Size, 2023-2031 ($ Million)

13. UK Cleanroom Technologies Market Size, 2023-2031 ($ Million)

14. France Cleanroom Technologies Market Size, 2023-2031 ($ Million)

15. Germany Cleanroom Technologies Market Size, 2023-2031 ($ Million)

16. Italy Cleanroom Technologies Market Size, 2023-2031 ($ Million)

17. Spain Cleanroom Technologies Market Size, 2023-2031 ($ Million)

18. Rest Of Europe Cleanroom Technologies Market Size, 2023-2031 ($ Million)

19. India Cleanroom Technologies Market Size, 2023-2031 ($ Million)

20. China Cleanroom Technologies Market Size, 2023-2031 ($ Million)

21. Japan Cleanroom Technologies Market Size, 2023-2031 ($ Million)

22. South Korea Cleanroom Technologies Market Size, 2023-2031 ($ Million)

23. Rest Of Asia-Pacific Cleanroom Technologies Market Size, 2023-2031 ($ Million)

24. Rest Of The World Cleanroom Technologies Market Size, 2023-2031 ($ Million)

25. Latin America Cleanroom Technologies Market Size, 2023-2031 ($ Million)

26. Middle East And Africa Cleanroom Technologies Market Size, 2023-2031 ($ Million)