Cleanroom Technology Market

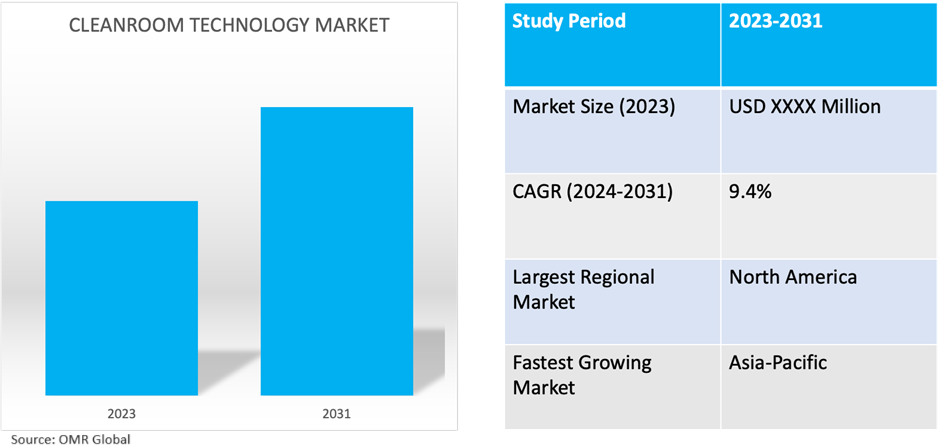

Cleanroom Technology Market Size, Share & Trends Analysis Report by Type (Standard Cleanrooms, Modular Cleanrooms (Hardwall Cleanrooms, and Softwall Cleanrooms), and Mobile Cleanrooms), and by End-User (Pharmaceutical Industry, Biotechnology Industry, Medical Device Manufacturers, and Hospitals), Forecast Period (2024-2031)

Cleanroom technology market is anticipated to grow at a CAGR of 9.4% during the forecast period (2024-2031). A major factor supporting the market growth is the increasing demand for contamination-free environments across various industries. Industries such as pharmaceuticals, biotechnology, and healthcare require controlled environments to prevent contamination during the production process. As technological advancements continue to drive innovation in these sectors, the need for cleanroom technology to maintain stringent cleanliness standards becomes imperative.

Market Dynamics

The Growing Demand for Cleanroom Technology Across Various Industries

Industries such as pharmaceuticals, biotechnology, electronics, and semiconductor manufacturing are witnessing a surge in demand for cleanroom technology. As these sectors advance technologically and expand globally, the need for controlled environments to mitigate contamination risks becomes increasingly critical. Cleanrooms ensure product quality, safety, and compliance with stringent industry regulations. The proliferation of sensitive processes, such as semiconductor fabrication and biopharmaceutical manufacturing, underscores the indispensable role of cleanroom technology in maintaining cleanliness standards and optimizing operational efficiency. For instance, in June 2022, ABN Cleanroom Technology introduced INTEGRA, the industry's pioneering off-the-shelf cleanroom solution capable of meeting cleanliness classifications up to ISO Class 4 and CGMP grade B.

The Role of Cleanroom Technology in Ensuring Patient Safety and Product Quality

Globally, healthcare expenditure is on the rise, driven by factors such as aging populations, increasing prevalence of chronic diseases, and advancements in medical technology. Cleanroom technology plays a vital role in healthcare, particularly in the manufacturing of sterile pharmaceuticals, medical devices, and biotechnology products. With healthcare facilities striving to uphold the highest standards of patient care and safety, investment in cleanroom infrastructure is prioritized to ensure the production of high-quality, contamination-free medical products. The growing emphasis on infection control and regulatory compliance further propels the adoption of cleanroom technology in healthcare settings. For instance, in April 2023, ABN Cleanroom Technology debuted Europe's inaugural readily deployable low dewpoint cleanroom solution, marking a significant advancement in the region's cleanroom technology sector.

Market Segmentation

- Based on type, the market is segmented into standard cleanrooms, modular cleanrooms (Hardwall Cleanrooms, and Softwall Cleanrooms), and mobile cleanrooms.

- Based on end-user, the market is segmented into the pharmaceutical industry, biotechnology industry, medical device manufacturers, and hospitals.

Hardwall Cleanrooms is Projected to Emerge as the Largest Segment

The hardwall cleanrooms segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes superior structural integrity and durability compared to softwall cleanrooms. Hardwall cleanrooms feature rigid walls made of materials such as steel, aluminum, or composite panels, providing a robust and stable environment for sensitive manufacturing processes. This structural stability allows hardwall cleanrooms to maintain precise environmental control, such as temperature, humidity, and air pressure, essential for industries with stringent cleanliness requirements, such as pharmaceuticals, electronics, and biotechnology.

Biotechnology Segment to Hold a Considerable Market Share

The biotechnology segment is set to claim a substantial market due to stringent regulatory standards and the critical nature of biotechnological processes. Cleanroom technology is essential for ensuring compliance with regulations and maintaining the integrity of sensitive biological materials during biopharmaceutical production and genetic research. With increasing investments in biotechnology R&D and the expansion of biopharmaceutical manufacturing, cleanrooms play a pivotal role in facilitating innovation and meeting growing market demands. Moreover, advancements in biotechnology, such as genome editing and gene therapy, require sterile and controlled environments for experimentation and development, further driving the adoption of cleanroom technology.

Regional Outlook

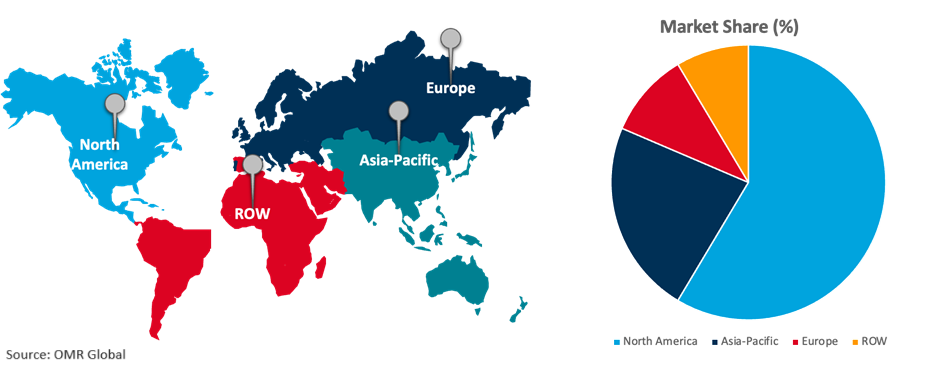

The global cleanroom technology market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Drives Surge in Cleanroom Technology Adoption Amid Industrial Expansion and Healthcare Demand

Asia-Pacific is the fastest-growing market in the global cleanroom technology market due to rapid industrialization and urbanization in countries like China, India, and Southeast Asian nations led to the expansion of industries such as pharmaceuticals, biotechnology, electronics, and semiconductor manufacturing. As these industries flourish, the demand for cleanroom technology to maintain stringent cleanliness standards increases substantially. Additionally, the region's large population base and rising disposable incomes drive the demand for healthcare services, pharmaceuticals, and medical devices, further boosting the adoption of cleanroom technology in healthcare facilities and manufacturing plants. For instance, in June 2023, Micron Technology Inc., a prominent global semiconductor corporation, unveiled intentions to construct a distinctive assembly and testing facility in Gujarat, India. This state-of-the-art facility by Micron will facilitate assembly and testing manufacturing for Dynamic Random-Access Memory (DRAM) and Negative-AND (NAND) products, catering to the increasing demand from both domestic and international markets.

Global Cleanroom Technology Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to a robust healthcare and pharmaceutical industry with significant investments in research and development. The stringent regulatory environment in North America necessitates compliance with strict cleanliness standards, driving the demand for cleanroom technology across various sectors, including pharmaceuticals, biotechnology, and healthcare. Additionally, North America is home to several prominent players in the cleanroom technology market, contributing to the region's dominance. For instance, in 2021, Wynnchurch Capital, based in the US, and Exyte Group, headquartered in Germany, finalized an agreement for the acquisition of the Critical Process Systems Group (CPS) by Exyte. This strategic acquisition enhances Exyte's portfolio, enabling the company to enhance its services for existing and prospective clients in the semiconductor, biopharmaceutical, and life sciences sectors.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global cleanroom technology market include Abtech Inc., Kimberley-Clark Worldwide Inc., Ansell Ltd., Clean Air Products, and DuPont de Nemours, Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in October 2022, Bouygues Energies & Services, a subsidiary of Bouygues Construction, achieved the successful installation of a state-of-the-art manufacturing cleanroom facility for Novanta (US) in Taunton.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cleanroom technology market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abtech, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. DuPont de Nemours, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Kimberley-Clark Worldwide Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cleanroom Technology Market by Type

4.1.1. Standard Cleanrooms

4.1.2. Modular Cleanrooms

4.1.2.1. Hardwall Cleanrooms

4.1.2.2. Softwall Cleanrooms

4.1.3. Mobile Cleanrooms

4.2. Global Cleanroom Technology Market by End-User

4.2.1. Pharmaceutical Industry

4.2.2. Biotechnology Industry

4.2.3. Medical Device Manufacturers

4.2.4. Hospitals

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. ABN Cleanroom Technology NV

6.2. Airex Filter Corp.

6.3. Airplan S.A.

6.4. Alpiq Group

6.5. Angstrom Technology

6.6. Ansell Ltd.

6.7. Ardmac

6.8. ATLAS ENVIRONMENTS, LTD.

6.9. Azbil Corp.

6.10. Bouygues E&S InTec Schweiz AG

6.11. Clean Air Technology, Inc.

6.12. Clean Rooms International, Inc

6.13. COLANDIS GmbH

6.14. Dynarex Corporation

6.15. Exyte Technology

6.16. HPCi Media Limited

6.17. ITW Contamination Control BV

6.18. KIMBERLY-CLARK CORP.

6.19. Labconco Corporation

6.20. OCTANORM-VERTRIEBS-GMBH

6.21. Parteco SRL

6.22. Suzhou Antai Airtech Co., Ltd.

6.23. Taikisha Ltd.

6.24. Terra Universal. Inc.

6.25. Weiss Technik

1. GLOBAL CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL STANDARD CLEANROOMS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MODULAR CLEANROOMS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL HARDWALL CLEANROOMS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SOFTWALL CLEANROOMS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL MOBILE CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

8. GLOBAL CLEANROOM TECHNOLOGY FOR PHARMACEUTICAL INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CLEANROOM TECHNOLOGY FOR BIOTECHNOLOGY INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CLEANROOM TECHNOLOGY FOR MEDICAL DEVICE MANUFACTURERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CLEANROOM TECHNOLOGY FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. EUROPEAN CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. REST OF THE WORLD CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD CLEANROOM TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL CLEANROOM TECHNOLOGY MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL STANDARD CLEANROOM TECHNOLOGY MARKET SHARE BY REGION, 2023-2031 (%)

3. GLOBAL MODULAR CLEANROOM TECHNOLOGY MARKET SHARE BY REGION, 2023-2031 (%)

4. GLOBAL HARDWALL CLEANROOMS TECHNOLOGY MARKET SHARE BY REGION, 2023-2031 (%)

5. GLOBAL SOFTWALL CLEANROOMS TECHNOLOGY MARKET SHARE BY REGION, 2023-2031 (%)

6. GLOBAL MOBILE CLEANROOMS IN CLEANROOM TECHNOLOGY MARKET SHARE BY REGION, 2023-2031 (%)

7. GLOBAL CLEANROOM TECHNOLOGY MARKET SHARE BY END-USER, 2023 VS 2031 (%)

8. GLOBAL CLEANROOM TECHNOLOGY FOR PHARMACEUTICAL INDUSTRY MARKET SHARE BY REGION, 2023-2031 (%)

9. GLOBAL CLEANROOM TECHNOLOGY FOR BIOTECHNOLOGY INDUSTRY MARKET SHARE BY REGION, 2023-2031 (%)

10. GLOBAL CLEANROOM TECHNOLOGY FOR MEDICAL DEVICE MANUFACTURERS MARKET SHARE BY REGION, 2023-2031 (%)

11. GLOBAL CLEANROOM TECHNOLOGY FOR HOSPITALS MARKET SHARE BY REGION, 2023-2031 (%)

12. GLOBAL CLEANROOM TECHNOLOGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

15. UK CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA CLEANROOM TECHNOLOGY MARKET SIZE, 2023-2031 ($ MILLION)