Closet Organizer Market

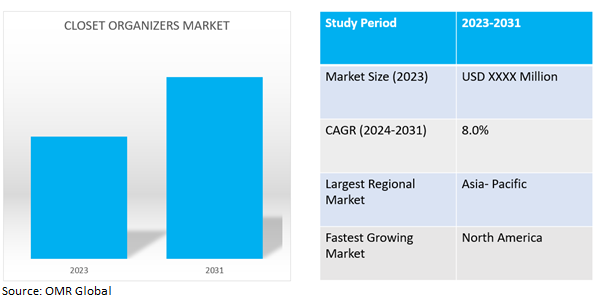

Closet Organizer Market Size, Share & Trends Analysis Report by Material (Wood, Metal, Medium Density Fiberboard (MDF), Fabric, Plywood), by Distribution Channel (Offline Channel, Online Channel), and by End- User (Residential and Commercial) Forecast Period (2024-2031)

Closet organizer market is anticipated to grow at a CAGR of 8.0% during the forecast period (2024-2031). Closet organizers provide additional partitions, shelves, bins, and hangers for user to maximize the space within its closet. The growing urbanization acrossthe emerging economies globally has driven the demand for closet organizers, there by driving the global market.

Market Dynamics

Urban Living Boosts Demand for Closet Organizer

The growing urbanization has significantly impacted living spaces worldwide. As urban populations grow, housing options often become smaller due to limited space. In crowded city areas, apartments, condos, and even houses have less square footage. This presents a challenge for individuals to make the most of their living spaces efficiently. Closet organizers play a key role in addressing this issue. By providing smart storage solutions, they allow residents to maximize the use of available space. These organizers optimize vertical storage, utilize corners effectively, and create compartments for various items. Whether it's a walk-in closet, a reach-in wardrobe, or a compact cupboard, well-designed organizers help keep belongings organized, accessible, and clutter-free. As the global population continues moving to cities, the demand for practical and space-saving closet organizers is expected to steadily increase.

Rise in Disposible Income

The demand for specialty closet organizers, particularly designer closets, is on the rise due to increasing disposable incomes and changing consumer lifestyles. As customers invest more in their wardrobe and seek customized storage solutions for their expanding collections, the market for stylish and functional options is growing. This trend reflects a shift towards consumers purchasing more clothing and wanting sophisticated storage solutions to showcase their belongings. The demand for specialty closet organizers that offer both utility and elegance is increasing in response to this evolution in consumer behavior.

Market Segmentation

Our in-depth analysis of the global closet organizer market includes the following segments by material, distribution channel, and end- user:

- Based on material, the market is sub-segmented into wood, metal, and medium density fiberboard (MDF), fabric, plywood.

- Based on distribution channel, the market is bifurcated into offline channel and online channel.

- Based on end- user, the market is bifurcated into residential and commercial

Online Channel to Exhibit the Highest CAGR

The online channel has given closet organizers a big boost. The huge customer base and easy to explore options of internet shopping has benefitted the growth of this market channel. Closet organizers are right there on the sites, open to shoppers worldwide. Ecommerce websites offer many closet organizer choices. Shoppers can check out all the designs, sizes, materials, and prices. Customers can also compare products, read reviews, and pick what works best for them. The simple access, detailed info, and special deals make online the goto for closet organizers nowadays.

Residential Segment Hold a Considerable Market Share

The rise of urbanization has significantly influenced the demand for storage solutions in residential area. As people flock to cities, living spaces become more limited, necessitating innovative approaches to maximizing space utilization. In small homes, creative thinking is crucial to balance functionality and comfort when it comes to storage. The market has responded to this trend with a wide range of adaptable storage solutions tailored for urban living, from versatile furniture to space-saving shelving systems.

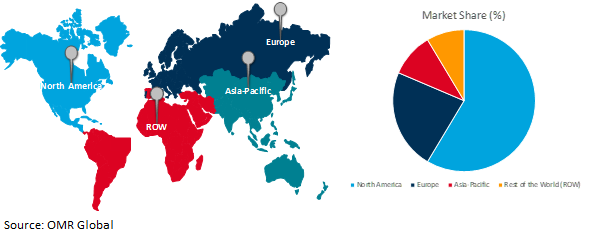

Regional Outlook

The global closet organizer market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Closet Organizer Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to strong culture of home improvement and organization, with consumers placing high importance on optimizing living spaces. Additionally, the country has a significant number of households with ample closet space, necessitating the need for organizational solutions. Additionally, the presence of well-established retail infrastructure and widespread availability of closet organizer products and higher disposable incomes in North America enable consumers to invest in premium closet organizer solutions, driving the regional market growth. For instance, In December 2022, the Container Store completed the acquisition of Closet Works for a sum of $21.5 million. This strategic move by The Container Store is aimed at bolstering its custom closet offerings. The company also announced its intention to expand customization options not only for closets but also for other areas of the home such as garages, home offices, pantries, laundry rooms, and murphy beds. This acquisition aligns with The Container Store's commitment to providing tailored organizational solutions to its customers, further solidifying its position in the market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global closet organizer market includeI KEA, The Home Depot, Rubbermaid Inc., Closet Factory, and California Closets,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global closet organizer market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. IKEA

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. The Home Depot

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Rubbermaid Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Closet Factory

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. California Closets

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Closet Organizer Market by Material

4.1.1. Wood

4.1.2. Metal

4.1.3. Medium Density Fiberboard (MDF)

4.1.4. Fabric

4.1.5. Plywood

4.2. Global Closet Organizer Market by Distribution Channel

4.2.1. Offline Channel

4.2.2. Online Channel

4.3. Global Closet Organizer Market by End- User

4.3.1. Residential

4.3.2. Commercial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Ashley HomeStore

6.2. California Wardrobes

6.3. Elfa

6.4. Ethan Allen

6.5. Holike Corporation

6.6. Kartell

6.7. Lowe's

6.8. Menards

6.9. Molteni& C

6.10. OXO

6.11. Raymour& Flanigan

6.12. Sauder Woodworking Company

6.13. Sherwood Shelving

6.14. Simply Wardrobes

6.15. Target Corp.

6.16. The Wardrobe Company

6.17. Williams-Sonoma

1. GLOBAL CLOSET ORGANIZERMARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

2. GLOBAL WOOD CLOSET ORGANIZERMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL METALCLOSET ORGANIZERMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) CLOSET ORGANIZERMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FIBER CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL PLYWOOD CLOSET ORGANIZERMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

8. GLOBAL CLOSET ORGANIZER VIA OFFLINE CHANNELMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBALCLOSET ORGANIZER VIA ONLINE CHANNELMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY END- USER, 2023-2031 ($ MILLION)

11. GLOBAL CLOSET ORGANIZER IN RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CLOSET ORGANIZER IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

16. NORTH AMERICAN CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

17. NORTH AMERICAN CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY END- USER, 2023-2031 ($ MILLION)

18. EUROPEAN CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

20. EUROPEAN CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

21. EUROPEAN CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY END- USER, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFICCLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY END- USER, 2023-2031 ($ MILLION)

26. REST OF THE WORLD CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

28. REST OF THE WORLD CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

29. REST OF THE WORLD CLOSET ORGANIZER MARKET RESEARCH AND ANALYSIS BY END- USER, 2023-2031 ($ MILLION)

1. GLOBAL CLOSET ORGANIZER MARKETSHARE BY MATERIAL, 2023 VS 2031 (%)

2. GLOBAL WOOD CLOSET ORGANIZERMARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL METALCLOSET ORGANIZERMARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) CLOSET ORGANIZER MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FIBER CLOSET ORGANIZER MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL PLYWOOD CLOSET ORGANIZER MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CLOSET ORGANIZER MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

8. GLOBAL CLOSET ORGANIZER VIA OFFLINE CHANNEL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CLOSET ORGANIZER VIA ONLINE CHANNELMARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CLOSET ORGANIZER MARKET SHARE BY END- USER, 2023 VS 2031 (%)

11. GLOBAL CLOSET ORGANIZER IN RESIDENTIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CLOSET ORGANIZER IN COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL HOTELS IN CLOSET ORGANIZER MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL APARTMENTS IN CLOSET ORGANIZER MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL RETAIL STORES IN CLOSET ORGANIZER MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL CLOSET ORGANIZER MARKETSHARE BY REGION, 2023 VS 2031 (%)

17. US CLOSET ORGANIZER MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA CLOSET ORGANIZER MARKET SIZE, 2023-2031 ($ MILLION)

19. UK CLOSET ORGANIZER MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE CLOSET ORGANIZER MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY CLOSET ORGANIZER MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY CLOSET ORGANIZER MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN CLOSET ORGANIZER MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE CLOSET ORGANIZERMARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA CLOSET ORGANIZERMARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA CLOSET ORGANIZERMARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN CLOSET ORGANIZERMARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA CLOSET ORGANIZER MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC CLOSET ORGANIZER MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICACLOSET ORGANIZER MARKET SIZE, 2023-2031 ($ MILLION)

31. MIDDLE EAST AND AFRICACLOSET ORGANIZER MARKET SIZE, 2023-2031 ($ MILLION)