Clot Management Devices Market

Clot Management Devices Market Size, Share & Trends Analysis Report by Products (Embolectomy Balloon Catheter, Catheter Directed Thrombolysis Devices, Percutaneous Thrombectomy Devices, Inferior Vena Cava Filters, Neurovascular Embolectomy Devices, and Others), and by End-User (Ambulatory Surgical Centers (ASCs), Diagnostic Centers, and Others) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

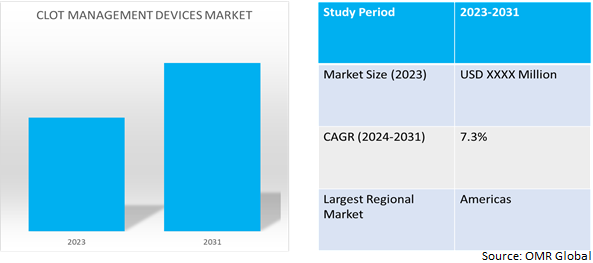

Clot management devices market is anticipated to grow at a CAGR of 7.3% during the forecast period (2024-2031). Clot management devices are essential for treating life-threatening conditions such as DVT and PE subsequently percutaneous coronary intervention, removing or dissolving clots from blood arteries, and restoring blood circulation.

Market Dynamics

Increase in the Elderly Population

Growing older raises the risk of conditions such as deep vein thrombosis (DVT), which can cause a fatal pulmonary embolism and other consequences. DVT is prevented via the use of clot management devices, such as superior vena cava filters. The growing number of older individuals can boost demand for these devices and fuel the expansion of the clot management devices market. According to the National Institute of Health ( gov.), in November 2023, as per the report, World Health Organization's Decade of Healthy Ageing report predicts a 34% increase in older adults aged above 60 globally, from 1 billion in 2019 to 1.4 billion in 2030. Furthermore, Cardiovascular diseases are the leading cause of global death, causing 32% of all deaths in 2019. In 2019, 17.9 million people died, with 85% owing to heart attacks and stroke. Preventive measures include addressing risk factors and early detection for effective management.

Increased Risk of Thrombotic Incidents in HIV/AIDS Patients

Although utilizing c-ART, HIV/AIDS patients have a higher risk of thrombotic events, such as VTE, owing to endothelial dysfunction, immunological activation, and inflammation. According to the National Institute of Health (gov.) in May 2023, despite the use of combination antiretroviral therapy (c-ART), HIV/AIDS continues to cause 1.7 million new cases and 690 thousand deaths annually, posing a significant economic and medical threat to human health. Patients with HIV are at a higher risk of non-HIV/AIDS causes of end-organ disease, including vascular complications like VTE.

Market Segmentation

Our in-depth analysis of the global Clot Management Devices market includes the following segments by product and end-user:

- Based on products, the market is sub-segmented into embolectomy balloon catheters, catheter-directed thrombolysis devices, percutaneous thrombectomy devices, inferior vena cava filters, neurovascular embolectomy devices, others (permanent, retrievable, and neurovascular embolectomy devices).

- Based on end-user, the market is augmented into hospitals and clinics, ambulatory surgical centers (ASCs), diagnostic centers, and others (research and academic institutions, and home healthcare settings)

Neurovascular Embolectomy Devices are Projected to Emerge as the Largest Segment

Based on the product, the Clot Management Devices market is sub-segmented into embolectomy balloon catheters, catheter-directed thrombolysis devices, percutaneous thrombectomy devices, inferior vena cava filters, neurovascular embolectomy devices, and others. Among these, the neurovascular embolectomy devices sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing demand for the prevalence of hypertension in low- and middle-income nations renders it necessary to implement effective management strategies, such as increasing awareness, enhancing screening, and encouraging blood pressure control. These measures additionally fuel the demand for devices for neurovascular embolectomy and clot management. According to the World Health Organisation, in March 2023, Hypertension affects 1.28 billion adults aged 30-79, primarily in low- and middle-income countries. 46% are unaware, 42% are diagnosed, and 21% have it under control. The global target is to reduce hypertension prevalence by 33% between 2010 and 2030.

Hospitals and Clinics Sub-segment to Hold a Considerable Market Share

Hospitals collaborate with industry partners, such manufacturers of clot management devices, to deploy innovative solutions such as blood clot applications, accelerating the adoption of healthcare programs. For instance, in November 2023,Oxford University Hospitals launched blood clot app. To inform individuals regarding blood clots and methods for lowering risk.The new app integrated into patients' discharge and admission documents, advising them to seek medical attention for severe blood clot symptoms.

Regional Outlook

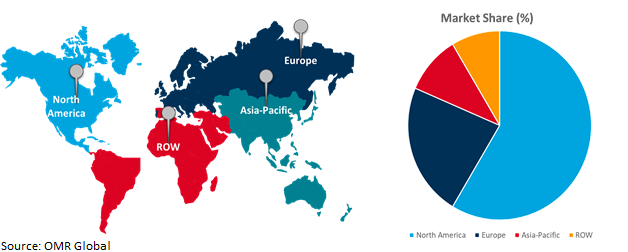

The global clot management devices market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Increased demand for Public Health Programs in Asia-Pacific

- Programs for public health that focus on obesity and abdominal obesity have the potential to significantly reduce the burden of thrombotic diseases, enhance cardiovascular health, and minimize risk factors in groups that are previously at risk.

- Furthermore, according to the National Institute of Health (gov.) in May 2023, the study aimed to assess the prevalence and factors associated with obesity and abdominal obesity in India, using data from the National Family Health Survey 2019-2021. The prevalence of obesity was found to be 13.9%, while the prevalence of abdominal obesity was 57.71%. Factors such as older age, female gender, higher education, increased wealth, marital status, and urban residence were associated with both obesity and abdominal obesity. Additionally, residing in the North zone and having current alcohol intake were associated with abdominal obesity, while residing in the South zone was associated with obesity. Programs that promote public health can achieve success by focusing on these high-risk populations.

Global Clot Management Devices Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the transportation services such as Clot Management Devices are required for the moving of coal owing to the patient advocacy groups play an essential role in promoting VTE awareness, fighting for easier access to clot management tools and therapies, and funding projects that can improve the care of individuals with VTE. According to the National Institute of Health (gov.) in March 2022, the incidence of venous thromboembolism (VTE) in the U.S. is currently estimated to be between 71 and 113 cases per 100,000 population. Deep vein thrombosis occurs in approximately 200,000 patients annually, with approximately 50,000 cases complicated by pulmonary embolism. The incidence of pulmonary embolism is 1-2 per 1,000 person-years, and more than a third of survivors experience recurrence. It is important to note that VTE-related events contribute to a higher number of deaths compared to AIDS, breast cancer, prostate cancer, and motor vehicle crashes combined in the US.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order

The major companies serving the global clot management devices market include, Boston Scientific Corp.,Edwards Lifesciences Corp.,Medtronic PLC,Penumbra, Inc.,Teleflex Inc., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2020, Philips introduced the Azurion neuro biplane system at ECR2024, enhanced minimally invasive diagnosis and treatment of neurovascular patients, providing image-guided therapy for confident diagnosis and assessment.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global clot management devices market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott Laboratories

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. AngioDynamics, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Argon Medical Devices, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Clot Management Devices Market by Product

4.1.1. Embolectomy Balloon Catheter

4.1.2. Catheter Directed Thrombolysis Devices

4.1.3. Percutaneous Thrombectomy Devices

4.1.4. Inferior Vena cava Filters

4.1.5. Neurovascular Embolectomy Devices

4.1.6. Others (Permanent, Retrievable, and Neurovascular Embolectomy Devices)

4.2. Global Clot Management Devices Market by End-User

4.2.1. Hospitals and Clinics

4.2.2. Ambulatory Surgical Centers (ASCs)

4.2.3. Diagnostic Centers

4.2.4. Others (Research and Academic Institutions, and Home Healthcare Settings)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Boston Scientific Corp.

6.2. Cardinal Health

6.3. Cook Group Inc.

6.4. Edwards Lifesciences Corp.

6.5. Integer Holdings Corp.

6.6. iVascular, S.L.U

6.7. Johnson & Johnson Services, Inc.

6.8. LeMaitre Vascular, Inc.

6.9. Medtronic PLC

6.10. Penumbra, Inc.

6.11. Strub Medical GmbH & Co. KG

6.12. Stryker Corp.

6.13. Teleflex Inc.

1. GLOBAL CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL EMBOLECTOMY BALLOON CATHETER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CATHETER DIRECTED THROMBOLYSIS DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL PERCUTANEOUS THROMBECTOMY DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL INFERIOR VENA CAVA FILTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL NEUROVASCULAR EMBOLECTOMY DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OTHER CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

9. GLOBAL CLOT MANAGEMENT DEVICES FOR HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CLOT MANAGEMENT DEVICES FOR AMBULATORY SURGICAL CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CLOT MANAGEMENT DEVICES FOR DIAGNOSTIC CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CLOT MANAGEMENT DEVICES FOR OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

16. NORTH AMERICAN CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

17. EUROPEAN CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

19. EUROPEAN CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

23. REST OF THE WORLD CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

25. REST OF THE WORLD CLOT MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL CLOT MANAGEMENT DEVICES MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL EMBOLECTOMY BALLOON CATHETER MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CATHETER DIRECTED THROMBOLYSIS DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL PERCUTANEOUS THROMBECTOMY DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL INFERIOR VENA CAVA FILTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL NEUROVASCULAR EMBOLECTOMY DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OTHERS CLOT MANAGEMENT DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CLOT MANAGEMENT DEVICES MARKET SHARE BY END-USER, 2023 VS 2031 (%)

9. GLOBAL CLOT MANAGEMENT DEVICES FOR HOSPITALS AND CLINICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CLOT MANAGEMENT DEVICES FOR AMBULATORY SURGICAL CENTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CLOT MANAGEMENT DEVICES FOR DIAGNOSTIC CENTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CLOT MANAGEMENT DEVICES FOR OTHER END-USERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CLOT MANAGEMENT DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

16. UK CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

28. THE MIDDLE EAST AND AFRICA CLOT MANAGEMENT DEVICES MARKET SIZE, 2023-2031 ($ MILLION)