Cloud Analytics Market

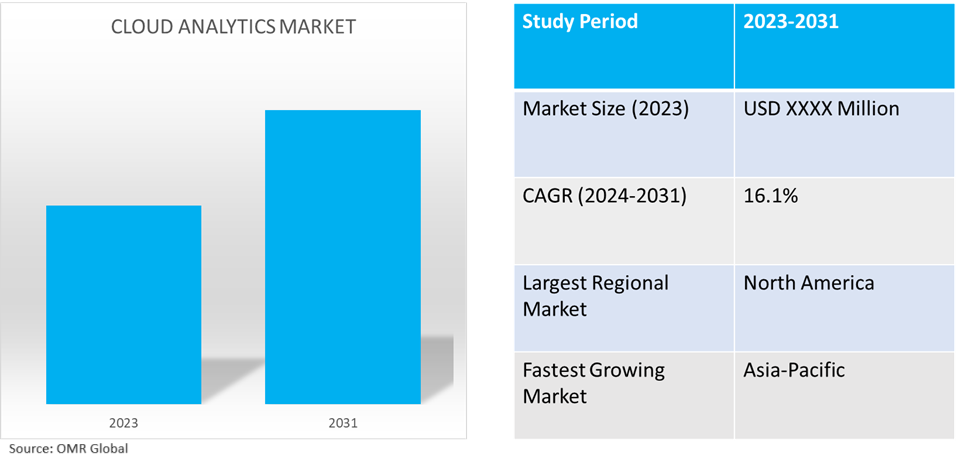

Cloud Analytics Market Size, Share & Trends Analysis Report by Component (Solutions and Services), by Deployment (Public, Private, and Hybrid), by Application (Sales and Marketing, Customer Service, Accounting & Finance, Human Resources, and Others), and by Industry Vertical (BFSI, Retail & Consumer goods, Healthcare & Life sciences, IT & Telecommunication, Education, Automotive, Manufacturing, Transportation & Logistics, Government & Defense, and Other), Forecast Period (2024-2031)

Cloud analytics market is anticipated to grow at a significant CAGR of 16.1% during the forecast period (2024-2031). The market growth is attributed to increasing cloud-based analytics solutions that enable businesses to accelerate digital transformation projects, improve customer experiences, maximize operational efficiency, and strengthen network security protocols globally. According to the World Bank, in June 2022, cloud services advanced digital transformation for governments. Cloud services offer governments cost savings, capacity to rapidly scale, advanced cybersecurity features, and access to powerful analytical tools for processing big data.

Market Dynamics

Transformative Impact on Businesses

AI cloud analytics enables completely new business models and services in addition to improving existing ones. By processing massive volumes of sensor and environmental data in real-time, it can propel the development of connected vehicles and autonomous driving in the automobile industry. It can enhance client satisfaction and retention in the entertainment industry by personalizing content on streaming platforms. Numerous cloud analytics platforms provide real-time data processing and analysis tools, enabling companies to act quickly and decisively. Businesses will be able to obtain valuable insights more quickly and precisely than ever before owing to this synergy, which opens up previously unattainable possibilities in data processing, analysis, and interpretation.

Increasing Adoption of AI-Centric Cloud Platform

An artificial intelligence (AI) and machine learning (ML) focused cloud platform is a cloud computing environment that is specifically tailored and built to host, develop, and run AI and ML applications. From data preprocessing and model training to deployment and monitoring, these platforms offer the computational capacity, resources, and services required to support the full AI development lifecycle. For instance, in September 2023, Amdocs a provider of software and services to communications and media companies announced the introduction of its Generative AI-powered cloud management platform. The solutions are designed to hyper-automate service development and operations and manage and streamline a service provider’s entire IT and business operations lifecycle.

Market Segmentation

- Based on the component, the market is segmented into solutions and services.

- Based on the deployment, the market is segmented into public, private, and hybrid.

- Based on the application, the market is segmented into sales and marketing, customer service, accounting & finance, human resources, and others (research & development).

- Based on the industry vertical, the market is segmented into BFSI, retail & consumer goods, healthcare & life sciences, IT & telecommunication, education, automotive, manufacturing, transportation & logistics, government & defense, and other (energy & utilities).

Solutions are Projected to Hold the Largest Segment

The solutions segment is expected to hold the largest share of the market. The primary factors supporting the growth include the growing number of organizations in need of cloud analytics solutions, including cloud BI tools, enterprise information management, governance, risk, and compliance, enterprise performance management, and analytics solutions. The latter helps organizations plan more effectively and efficiently in the areas of HR, finance, sales, and supply chain, gain better insights, and make easier financial decisions. For instance, in September 2021, Snowflake Inc., the data cloud company, announced the financial services data cloud, which unites Snowflake’s industry-tailored platform governance capabilities, Snowflake- and partner-delivered solutions, and industry-critical datasets, to help financial services organizations revolutionize data use to drive business growth and deliver better customer experiences.

BFSI Segment to Hold a Considerable Market Share

The BFSI segment is expected to hold a considerable share of the market. The factors supporting segment growth include businesses using cloud analytics to enhance user experience as a result of the increasing competition in the BFSI industry. Businesses are utilizing cloud analytics to improve client acquisition, engagement, and targeting. Among the cloud analytics solutions the BFSI sector is implementing to enhance user experience and achieve a competitive edge are sales, website, performance, and financial analytics. For instance, in February 2023, Oracle introduced Oracle Banking Cloud Services, a new suite of componentized, composable cloud-native services. The six new services provide banks with highly scalable corporate demand deposit account processing; enterprise-wide limits and collateral management, real-time ISO20022 global payment processing, API management, retail onboarding and originations, and new self-service digital experience capabilities

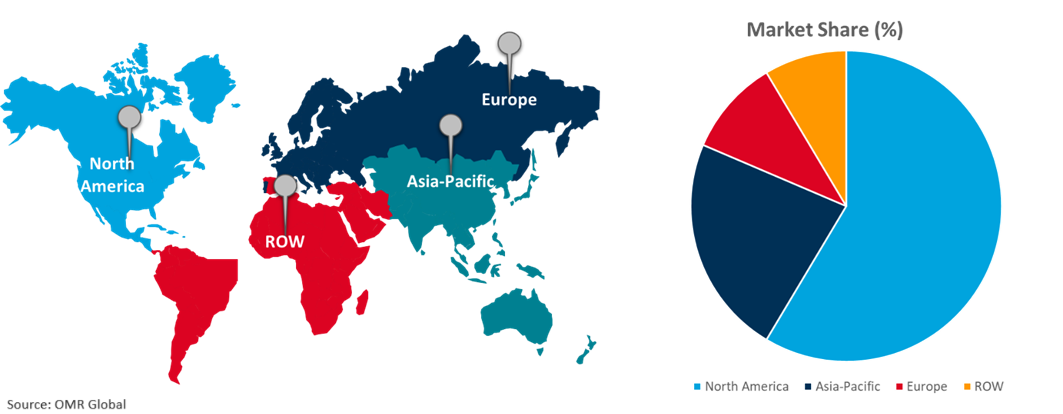

Regional Outlook

Global cloud analytics market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Adoption of Cloud Analytics in Asia-Pacific

- The regional growth is attributed to the rapid expansion of the e-commerce sector in countries like China, India, and Japan. Postal automation systems in the Asia Pacific area are also seeing a lot of growth potential owing to the growing demand from the BFSI sector.

- According to the India Brand Equity Foundation (IBEF), in January 2024, the cloud computing scope in India has evolved from a facilitator to a catalyst that promotes creativity, adaptability, and corporate expansion. Cloud technology will account for 8.0% of India’s GDP by 2026. It has the potential to boost the country's GDP by $310.0-$380.0 billion by 2026, while also producing 14 million employment. A concentrated all-around effort can result in a continuous 25.0%-30.0% increase in cloud investment over the next five years (2022 onwards) to reach $18.5 billion, assisting India in realizing the full potential of the cloud market.

Global Cloud Analytics Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to numerous prominent cloud analytics companies and providers such as Google LLC, IBM Corp., Microsoft Corp., Oracle Corp., and Salesforce, Inc., in the region. The expansion of the market in the region is driven by the growing adoption of the latest technologies in postal services and the presence of significant players in the region. Moreover, growing labor prices and labor shortages are forcing enterprises to implement automation resulting in the market's growth. The demand for postal automation services is expanding in government, BFSI, and other industries fueling the industry growth in the region. Governments meet stringent security, digital sovereignty, and compliance requirements when developing, deploying, and operating their enterprise AI stack. The market players in the region offer software and Cloud AI infrastructure in a unified solution. For instance, in April 2024, Oracle US government cloud customers accelerate sovereign AI with NVIDIA AI enterprise. NVIDIA AI Enterprise on Oracle Cloud Infrastructure Supercluster enables government organizations to quickly build and deploy scalable and secure deep learning workloads.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the cloud analytics market include Amazon Web Services, Inc., Google LLC, IBM Corp., Microsoft Corp., and Salesforce, Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Developments

- In February 2023, Akamai Technologies, Inc., the cloud company that powers and protects life online, introduced Akamai Connected Cloud, a massively distributed edge and cloud platform for cloud computing, security, and content delivery that keeps applications and experiences closer and threats farther away. The new strategic cloud computing services for developers to build, run, and secure highly performant workloads closer to wherever businesses and users connect online.

- In June 2023, global integrated energy company OQ led the market to SAP’s first private cloud customer in Oman. Oman has reached a major milestone in its digital transformation with the announcement of the Sultanate’s first private cloud data center, launched by global technology company SAP SE in alignment with Oman’s Ministry of Transport, Communications, and Information Technology (MTCIT).

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the cloud analytics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Amazon Web Services, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Google, LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IBM Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Microsoft Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Salesforce, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cloud Analytics Market by Component

4.1.1. Solutions

4.1.2. Services

4.2. Global Cloud Analytics Market by Deployment

4.2.1. Public

4.2.2. Private

4.2.3. Hybrid

4.3. Global Cloud Analytics Market by Application

4.3.1. Sales And Marketing

4.3.2. Customer Service

4.3.3. Accounting & Finance

4.3.4. Human Resource

4.3.5. Others (Research & Development)

4.4. Global Cloud Analytics Market by Industry Vertical

4.4.1. BFSI

4.4.2. Retail & Consumer goods

4.4.3. Healthcare & Life sciences

4.4.4. IT & Telecommunication

4.4.5. Education

4.4.6. Automotive

4.4.7. Manufacturing

4.4.8. Transportation & Logistics

4.4.9. Government & Defense

4.4.10. Other (Energy & Utilities)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Adobe Inc.

6.2. Alteryx

6.3. Board International SA

6.4. Cloud Software Group, Inc.

6.5. Cloudera, Inc.

6.6. Domo, Inc.

6.7. GoodData Corp.

6.8. Kyndryl Inc.

6.9. MicroStrategy Inc.

6.10. Mode Analytics, Inc.

6.11. Oracle Corp.

6.12. Pivotal BI Ltd.

6.13. QlikTech International AB

6.14. SAP SE

6.15. SAS Institute Inc.

6.16. Sisense Ltd.

6.17. Snowflake Inc.

6.18. ThoughtSpot Inc.

6.19. Yellowfin, Inc.

6.20. Zoho Corp. Pvt. Ltd.

1. GLOBAL CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL CLOUD ANALYTICS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CLOUD ANALYTICS SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

5. GLOBAL PUBLIC CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL PRIVATE CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL HYBRID CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL CLOUD ANALYTICS IN SALES AND MARKETING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CLOUD ANALYTICS IN CUSTOMER SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CLOUD ANALYTICS IN ACCOUNTING & FINANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CLOUD ANALYTICS IN HUMAN RESOURCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CLOUD ANALYTICS IN OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

15. GLOBAL CLOUD ANALYTICS FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL CLOUD ANALYTICS FOR RETAIL & CONSUMER GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL CLOUD ANALYTICS FOR HEALTHCARE & LIFE SCIENCES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL CLOUD ANALYTICS FOR IT & TELECOMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL CLOUD ANALYTICS FOR EDUCATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL CLOUD ANALYTICS FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL CLOUD ANALYTICS FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. GLOBAL CLOUD ANALYTICS FOR TRANSPORTATION & LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. GLOBAL CLOUD ANALYTICS FOR GOVERNMENT & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. GLOBAL CLOUD ANALYTICS FOR OTHER INDUSTRY VERTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. GLOBAL CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. NORTH AMERICAN CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. NORTH AMERICAN CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

28. NORTH AMERICAN CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

29. NORTH AMERICAN CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. NORTH AMERICAN CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

31. EUROPEAN CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

32. EUROPEAN CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

33. EUROPEAN CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

34. EUROPEAN CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

35. EUROPEAN CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

36. ASIA-PACIFIC CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

37. ASIA-PACIFIC CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

38. ASIA-PACIFIC CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

39. ASIA-PACIFIC CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

40. ASIA-PACIFIC CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

41. REST OF THE WORLD CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

42. REST OF THE WORLD CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

43. REST OF THE WORLD CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

44. REST OF THE WORLD CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

45. REST OF THE WORLD CLOUD ANALYTICS MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

1. GLOBAL CLOUD ANALYTICS MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL CLOUD ANALYTICS SOLUTIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CLOUD ANALYTICS SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CLOUD ANALYTICS MARKET SHARE BY DEPLOYMENT, 2023 VS 2031 (%)

5. GLOBAL PUBLIC CLOUD ANALYTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL PRIVATE CLOUD ANALYTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL HYBRID CLOUD ANALYTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CLOUD ANALYTICS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

9. GLOBAL CLOUD ANALYTICS IN SALES AND MARKETING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CLOUD ANALYTICS IN CUSTOMER SERVICE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CLOUD ANALYTICS IN ACCOUNTING & FINANCE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CLOUD ANALYTICS IN HUMAN RESOURCE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CLOUD ANALYTICS IN OTHER APPLICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL CLOUD ANALYTICS MARKET SHARE BY INDUSTRY VERTICAL, 2023 VS 2031 (%)

15. GLOBAL CLOUD ANALYTICS FOR BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL CLOUD ANALYTICS FOR RETAIL & CONSUMER GOODS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL CLOUD ANALYTICS FOR HEALTHCARE & LIFE SCIENCES MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL CLOUD ANALYTICS FOR IT & TELECOMMUNICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL CLOUD ANALYTICS FOR EDUCATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL CLOUD ANALYTICS FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL CLOUD ANALYTICS FOR MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. GLOBAL CLOUD ANALYTICS FOR TRANSPORTATION & LOGISTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

23. GLOBAL CLOUD ANALYTICS FOR GOVERNMENT & DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

24. GLOBAL CLOUD ANALYTICS FOR OTHER INDUSTRY VERTICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

25. GLOBAL CLOUD ANALYTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

26. US CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

27. CANADA CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

28. UK CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

29. FRANCE CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

30. GERMANY CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

31. ITALY CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

32. SPAIN CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

33. REST OF EUROPE CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

34. INDIA CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

35. CHINA CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

36. JAPAN CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

37. SOUTH KOREA CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

38. REST OF ASIA-PACIFIC CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

39. REST OF THE WORLD CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

40. LATIN AMERICA CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)

41. MIDDLE EAST AND AFRICA CLOUD ANALYTICS MARKET SIZE, 2023-2031 ($ MILLION)