Cloud Project Portfolio Management Market

Cloud Project Portfolio Management Market Size, Share & Trends Analysis Report by Deployment Mode (Private, Public, and Hybrid), by Enterprise Size (Small and Medium Enterprises, and Large Enterprises), and by End User Industry (BFSI, Healthcare, and Life Sciences, IT and Telecommunication, Manufacturing, Government and Public Sectors, and Others ) Forecast Period (2023-2029) Update Available - Forecast 2025-2031

Cloud project portfolio management market is anticipated to grow at a significant CAGR of 14.7% during the forecast period. High adoption of cloud project portfolio management among numerous end-user industries, along with the advent of technological advances such as the Internet of things (IoT), big data, and machine learning (ML), is projected to drive market growth. The companies are providing private, public, and hybrid-based cloud solutions to regulatory, and public bodies, further boosting the market growth. For instance, in 2020, NOAA developed a cloud strategy to better coordinate data across the organization. The agency adopted a multi-cloud solution combining commercial cloud with government cloud and on-premise private data systems for a hybrid cloud configuration enabling the government agency to manage sophisticated information.

Segmental Outlook

The global cloud project portfolio management market is segmented based on the deployment mode, enterprise size, and end-user industry. Based on deployment mode, the market is categorized into private, public, and hybrid. Based on enterprise size the market is segmented into small and medium enterprises, and large enterprises. Based on the end-user industry the market is divided into BFSI, healthcare and life sciences, IT and telecommunication, manufacturing, government, and public sectors, and others. Based on the end-user industry, the government and public sector segment holds a significant market share. The cloud project portfolio offers capabilities such as time tracking, data analytics, and cost management which are required in the public sector to manage a large amount of sensitive data.

Based on deployment mode, the public segment is anticipated to grow at a favorable rate. The ease of use and fast deployment of the public cloud are the primary reasons for its widespread adoption. Enterprises benefit from the public cloud application model owing to its scalability, stability, availability, and remote access. According to the Flexera 2021 State of the Cloud Report survey, 36% of enterprises spend more than $12 million per year on public clouds, and 55% of enterprise workloads are expected to be in a public cloud within twelve months.

Regional Outlooks

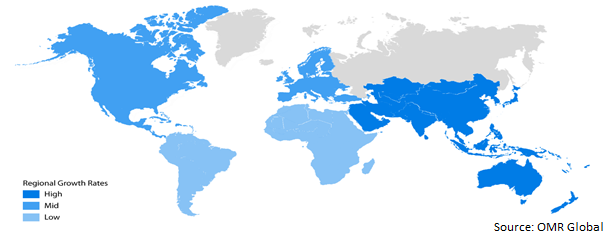

The global cloud project portfolio management market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. The North American region is anticipated to witness considerable growth in the market. The surge in activities such as automation and digitalization across industries including healthcare, government, BFSI, and construction has stimulated the need for cloud project portfolio management software for monitoring and analytical solutions that increase the productivity and efficiency of businesses.

Global Cloud Project Portfolio Management Market Growth, by Region 2023-2029

The North America Region Dominates the Global Cloud Project Portfolio Management Market

The North American region has registered favorable growth in the cloud project portfolio market. The rising integration of cloud-based solutions owing to its various benefits, such as improved productivity and collaboration, easy accessibility, and low maintenance, has created positive demand in the market in the region. Various market players such as IBM, SalesForce, DigitalOcean Holdings, Inc., and Microsoft, are expanding their reach by adopting proactive strategies such as partnership, collaboration, and new product launches. For instance, in May 2022, DigitalOcean Holdings, Inc. launched serverless cloud-based project management solutions enabling scalable, cost-effective, and fast computing solutions for startups and small businesses.

Market Players Outlook

The major companies serving the global cloud project portfolio management market include Broadcom Inc., Microsoft Corp., Oracle corp., Salesforce Corp, SAP SE, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, geographical expansions, partnerships, product launches, and collaborations, to stay competitive in the market. For instance, in March 2021, Symphony Technology Group acquired Sciforma. Through this acquisition, Symphony Technology Group is focused on improving its premier cloud service, while Sciforma's laser focuses on providing the finest possible customer service combined with extra financial support to speed up innovation even further.

The Report Covers

- Market value data analysis of 2023 and forecast to 2029.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cloud project portfolio management market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

1.1. Key Company Analysis

3.1. Broadcom, Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Microsoft Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Oracle Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Salesforce, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. SAP SE

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cloud Project Portfolio Management Market by Deployment Mode

4.1.1. Private

4.1.2. Public

4.1.3. Hybrid

4.2. Global Cloud Project Portfolio Management Market by Enterprise Size

4.2.1. Small and Medium Enterprises

4.2.2. Large Enterprises

4.3. Global Cloud Project Portfolio Management Market by End User Industry

4.3.1. BFSI

4.3.2. Healthcare and Life Sciences

4.3.3. IT and Telecommunication

4.3.4. Manufacturing

4.3.5. Government and Public Sectors

4.3.6. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Adobe, Inc.

6.2. Changepoint Corp.

6.3. Clarizen, Inc.

6.4. Cloud Coach

6.5. Hewlett Packard Enterprise Development lP

6.6. KeyedIn Projects.

6.7. Mavenlink

6.8. Micro Focus

6.9. Onepoint Projects

6.10. Plainsware, Inc.

6.11. Planview, Inc.

6.12. Servicenow, Inc.

6.13. Upland Software, Inc.

6.14. Workfront, Inc.

1. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2021-2029 ($ MILLION)

2. GLOBAL PRIVATE CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

3. GLOBAL PUBLIC CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

4. GLOBAL HYBRID CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

5. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2029 ($ MILLION)

6. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR SMALL AND MEDIUM ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

7. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR LARGE ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

8. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2029 ($ MILLION)

9. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

10. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR HEALTHCARE AND LIFE SCIENCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

11. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR IT AND TELECOMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

12. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

13. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR GOVERNMENT AND PUBLIC SECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

14. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

15. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

16. NORTH AMERICAN CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

17. NORTH AMERICAN CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2021-2029 ($ MILLION)

18. NORTH AMERICAN CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2029 ($ MILLION)

19. NORTH AMERICAN CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2029 ($ MILLION)

20. EUROPEAN CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

21. EUROPEAN CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2021-2029 ($ MILLION)

22. EUROPEAN CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2029 ($ MILLION)

23. EUROPEAN CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2029 ($ MILLION)

24. ASIA-PACIFIC CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

25. ASIA-PACIFIC CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2021-2029 ($ MILLION)

26. ASIA-PACIFIC CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2029 ($ MILLION)

27. ASIA-PACIFIC CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2029 ($ MILLION)

28. REST OF THE WORLD CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

29. REST OF THE WORLD CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2021-2029 ($ MILLION)

30. REST OF THE WORLD CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2029 ($ MILLION)

31. REST OF THE WORLD CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2029 ($ MILLION)

1. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SHARE BY DEPLOYMENT MODE, 2021 VS 2029 (%)

2. GLOBAL PRIVATE CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SHARE BY REGION, 2021 VS 2029 (%)

3. GLOBAL PUBLIC CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SHARE BY REGION, 2021 VS 2029 (%)

4. GLOBAL HYBRID CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SHARE BY REGION, 2021 VS 2029 (%)

5. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SHARE BY ENTERPRISE SIZE, 2021 VS 2029 (%)

6. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR SMALL AND MEDIUM ENTERPRISES MARKET SHARE BY REGION, 2021 VS 2029 (%)

7. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR LARGE ENTERPRISES MARKET SHARE BY REGION, 2021 VS 2029 (%)

8. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SHARE BY END-USER INDUSTRY, 2021 VS 2029 (%)

9. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR BFSI MARKET SHARE BY REGION, 2021 VS 2029 (%)

10. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR HEALTHCARE AND LIFE SCIENCE MARKET SHARE BY REGION, 2021 VS 2029 (%)

11. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR IT AND TELECOMMUNICATION MARKET SHARE BY REGION, 2021 VS 2029 (%)

12. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR MANUFACTURING MARKET SHARE BY REGION, 2021 VS 2029 (%)

13. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR GOVERNMENT AND PUBLIC SECTORS MARKET SHARE BY REGION, 2021 VS 2029 (%)

14. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2029 (%)

15. GLOBAL CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SHARE BY REGION, 2021 VS 2029 (%)

16. US CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SIZE, 2021-2029 ($ MILLION)

17. CANADA CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SIZE, 2021-2029 ($ MILLION)

18. UK CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SIZE, 2021-2029 ($ MILLION)

19. FRANCE CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SIZE, 2021-2029 ($ MILLION)

20. GERMANY CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SIZE, 2021-2029 ($ MILLION)

21. ITALY CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SIZE, 2021-2029 ($ MILLION)

22. SPAIN CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SIZE, 2021-2029 ($ MILLION)

23. REST OF EUROPE CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SIZE, 2021-2029 ($ MILLION)

24. INDIA CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SIZE, 2021-2029 ($ MILLION)

25. CHINA CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SIZE, 2021-2029 ($ MILLION)

26. JAPAN CLOUD PROJECT PORTFOLIO MANAGEMENT MARKET SIZE, 2021-2029 ($ MILLION)

27. SOUTH KOREA Cloud Project Portfolio Management MARKET SIZE, 2021-2029 ($ MILLION)

28. REST OF ASIA-PACIFIC Cloud Project Portfolio Management MARKET SIZE, 2021-2029 ($ MILLION)

29. REST OF THE WORLD Cloud Project Portfolio Management MARKET SIZE, 2021-2029 ($ MILLION)