Cloud Seeding Market

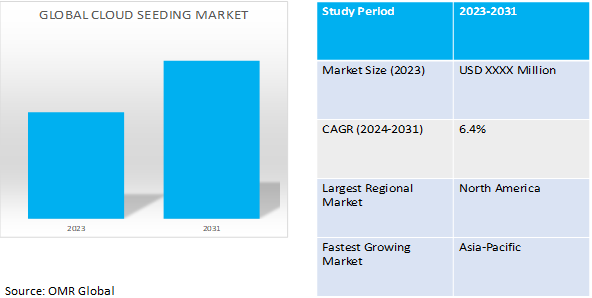

Cloud Seeding Market Size, Share & Trends Analysis Report by Type (Aerial Cloud Seeding and Ground Based Cloud Seeding), by Seeding Technique (Hygroscopic and Glaciogenic), and by Application (Increasing Precipitation, Mitigating Hail Damage and Dispersing Fog) and by Flare (End Burning Flares, Ejection Flares, Automatic and Remote Based Generator, Manual Generator and Flare Trees) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Cloud seeding market is anticipated to grow at a CAGR of 6.4% during the forecast period (2024-2031). Cloud seeding can be identified as weather modification technique that improves a cloud’s ability to produce rain or snow. This technique is also used to control weather events such as suppressing storms or causing rain in draught effected areas.

Market Dynamics

The increasing demand for water resources

The increasing demand for water resources is a significant driver for the cloud seeding market. In regions facing water scarcity or drought conditions, cloud seeding offers a potential solution to enhance precipitation and manage water supplies. Increase in the use of cloud seeding technologies to create artificial rain and keep the level of water in drought-stricken areas, is the key driver of the cloud seeding system market. In the US, the main uses of fresh water are aquaculture (3%), public supply (12%), self-supplied industry (5%), irrigation (32%), and thermoelectric power (45%). It is anticipated that as temperatures rise and precipitation patterns alter, so will these water needs. India is among the most water-stressed countries in the across the globe, with only 4% of the world's water supply and 18% of its people living there. And India’s rapid economic ascent in recent years has only increased demand for both energy and water, putting these interconnected resources under increasing pressure.

Increasing Cloud Seeding Use to Reduce the Impact of Natural Disasters

With cloud seeding technology, the disastrous effects of climate change can be considerably mitigated. Chemicals such as sodium chloride and silver iodide can be applied to cloud seedlings to accelerate rain cloud precipitation and reduce total damage estimates. A cloud containing extremely heavy snow or rain particles that is headed toward populated areas may be seeded in a forest environment. Cloud seeding make sure that calamities and cloud precipitation can be reduced.

Market Segmentation

Our in-depth analysis of the global cloud seeding market includes the following segments by type, product, and technology:

- Based on type, the market is sub-segmented into aerial cloud seeding and ground based cloud seeding.

- Based on seeding technique, the market is bifurcated into hygroscopic and glaciogenic.

- Based on technology, the market is augmented into increasing precipitation, mitigating hail damage and dispersing fog

- Based on flare, the market is augmented into end burning flares, ejection flares, automatic and remote based generator, manual generator and flare trees

Hygroscopic Seeding is Projected to Emerge as the Largest Segment

Based on the seeding technique, the global cloud seeding market is sub-segmented into into hygroscopic and glaciogenic. Among these, the hygroscopic sub-segment is expected to hold the largest share of the market. Through the use of this technique, substances such as calcium chloride or salt are released into the atmosphere. Cloud formation and rainfall are ultimately caused by these materials' ability to draw moisture from the surrounding air. This method is more effective in areas with high humidity. In order to offset its average yearly rainfall of less than 120 mm, the UAE has been operating an aircraft-based hygroscopic seeding programme for the past two decades.

Ariel Cloud Seeding Sub-segment to Hold a Considerable Market Share

Cloud seeding is primarily carried out using aircraft that release substances, such as potassium or silver iodide into the atmosphere at particular altitudes where clouds can be observed. Nations all over the globe have been using aerial cloud seeding for various reasons, but it's a growing practice in many of the hardest-hit drought regions globally. Since March 2021, the UAE has been experimenting with the use of aerial drones which fire electric charges into clouds. With almost 200 trials in 2020 alone, they had already used salt extensively in cloud seeding research. However, they started a new, less invasive, and intensive approach in 2021 with drones targeting particular clouds and "zap" them with laser beams, using the electric charges in the same way as cloud seeding substances. Some common types of aircraft used for cloud seeding includes fixed-wing aircraft, unmanned aerial vehicles (drones), turboprop aircraft, helicopters among others.

Regional Outlook

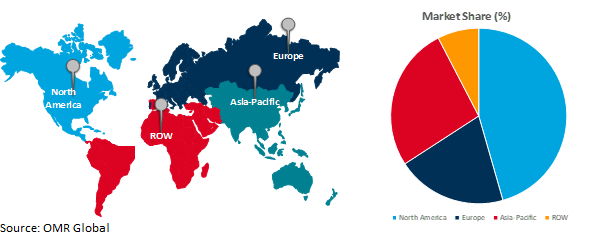

The global cloud seeding market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific to expand at the quickest rate

Asia Pacific area to expand at the quickest rate owing to the rising cloud seeding programs from countries such as China, India, and Thailand and increasing demand for commercial applications drive the growth of the market. For instance, in June 2023, The Indian Institute of Technology-Kanpur (IIT-K) successfully conducted a test for artificial rain via cloud-seeding over a limited area on the sprawling campus. Thick clouds caused heavy rain as the jet, taking off from the institute's airfield, shot powder spray at 5,000 feet in the air. The Uttar Pradesh (UP) government had turned to the premier institute for this technology to help UP’s parched Bundelkhand region with artificial rains.

Global Cloud Seeding Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the an increasing focus on weather modification, introduction of latest technologies, increasing expenditure on R&D, and use of cloud seeding for communication and surveillance purpose. For instance, in March 2023, The Southern Nevada Water Authority accepted a $2.4 million grant from the US Bureau of Reclamation to fund cloud seeding in other Western states whose rivers feed the parched desert region. The financing comes at a time when Colorado River reservoirs have reached record lows and growing Western towns and industry are unable to reduce their water demand in response to dwindling supplies.

Technologies such as cloud seeding can significantly lessen the disastrous effects. When . Chemicals such as sodium chloride and silver iodide used in cloud seeding can speed up the formation of catastrophic clouds and reduce the overall projected damage. There were 28 confirmed climate disaster incidents in 2023 with losses exceeding $1 billion each to affect the US. These events included 1 drought, 4 flooding and other natural disasters. Climate disaster events such as Hail storm can cause damage, especially when accompanied by strong winds or when striking roofing materials that were not engineered to withstand hail impact. Cloud seeding, process turns bigger size hail that could reach ground into smaller hailstones or rain as it warms before reaching the ground. This small hail or rain does not damage property, and significant losses are averted. According to NOAA’s National Weather Service Storm Prediction Center 6,962 hail events occured in 2023 compared to 4,436 in 2022. Texas, and Nebraska had the largest number of hail events in 2023.

Top Five States By Number Of Major Hail Events, 2023

| State | Number of Hail Events |

| Texas | 1,123 |

| Nebraska | 486 |

| Kansas | 459 |

| Colorado | 400 |

| Missouri | 400 |

Source: U.S. Department of Commerce, Storm Prediction Center, National Weather Service.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global cloud seeding market includeSeeding Operations & Atmospheric Research, Ice Crystal Engineering LLC., Cloud Seeding Technologies, DRI, Santa Barbara County Water Agency (SBCWA), National Center of Meteorology, NASA, Weather Modification, Inc., NAWC Inc., Snowy Hydro Ltd, 3D SA, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in July 2020, The UAE’s National Center of Meteorology (NCM) revealed that it has carried out 219 cloud seeding operations across the nation in the first half of 2020, using a total of 4,841 flares produced by NCM’s Emirates Weather Enhancement Factory as well as 419 ground generator flares.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cloud seeding market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Market Segmentation

3.1. Global Cloud seeding Market by Type

3.1.1. Aerial Cloud Seeding

3.1.2. Ground Based Cloud Seeding

3.2. Global Cloud seeding Market by Seeding Technique

3.2.1. Hygroscopic

3.2.2. Glaciogenic

3.3. Global Cloud seeding Market by Application

3.3.1. Increasing Precipitation

3.3.2. Mitigating Hail Damage

3.3.3. Dispersing Fog

3.4. Global Cloud seeding Market by Application

3.4.1. End Burning Flares

3.4.2. Ejection Flares

3.4.3. Automatic and Remote Based Generator

3.4.4. Manual Generator

3.4.5. Flare Trees

4. Regional Analysis

4.1. North America

4.1.1. United States

4.1.2. Canada

4.2. Europe

4.2.1. UK

4.2.2. Germany

4.2.3. Italy

4.2.4. Spain

4.2.5. France

4.2.6. Rest of Europe

4.3. Asia-Pacific

4.3.1. China

4.3.2. India

4.3.3. Japan

4.3.4. South Korea

4.3.5. Rest of Asia-Pacific

4.4. Rest of the World

5. Company Profiles

5.1. 3D SA

5.2. Cloud Seeding Technologies

5.3. DRI

5.4. Ice Crystal Engineering LLC.

5.5. NASA

5.6. National Center of Meteorology

5.7. NAWC Inc.

5.8. Santa Barbara County Water Agency (SBCWA)

5.9. Seeding Operations & Atmospheric Research

5.10. Snowy Hydro Ltd

5.11. Weather Modification, Inc.

1. GLOBAL CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL AERIAL CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL GROUND CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY SEEDING TECHNIQUE, 2023-2031 ($ MILLION)

5. GLOBAL HYGROSCOPIC CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL GLACIOGENIC SEEDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL CLOUD SEEDING FOR INCREASING PRECIPITATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CLOUD SEEDING FOR MITIGATING HAIL DAMAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CLOUD SEEDING FOR DISPERSING FOG MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY FLARE, 2023-2031 ($ MILLION)

12. GLOBAL END BURNING FLARES CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL EJECTION FLARES CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL AUTOMATIC AND REMOTE BASED GENERATOR CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL MANUAL GENERATOR CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL FLARE TREES CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. NORTH AMERICAN CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY SEEDING TECHNIQUE, 2023-2031 ($ MILLION)

21. NORTH AMERICAN CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. NORTH AMERICAN CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY FLARE, 2023-2031 ($ MILLION)

23. EUROPEAN CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. EUROPEAN CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY SEEDING TECHNIQUE, 2023-2031 ($ MILLION)

26. EUROPEAN CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. EUROPEAN CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY FLARE, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY SEEDING TECHNIQUE, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY FLARE , 2023-2031 ($ MILLION)

33. REST OF THE WORLD CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

34. REST OF THE WORLD CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

35. REST OF THE WORLD CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY SEEDING TECHNIQUE, 2023-2031 ($ MILLION)

36. REST OF THE WORLD CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

37. REST OF THE WORLD CLOUD SEEDING MARKET RESEARCH AND ANALYSIS BY FLARE , 2023-2031 ($ MILLION)

1. GLOBAL CLOUD SEEDING MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL AERIAL CLOUD SEEDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL GROUND CLOUD SEEDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CLOUD SEEDING MARKET SHARE BY SEEDING TECHNIQUE, 2023 VS 2031 (%)

5. GLOBAL HYGROSCOPIC CLOUD SEEDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL GLACIOGENIC CLOUD SEEDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CLOUD SEEDING MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL CLOUD SEEDING FOR INCREASING PRECIPITATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CLOUD SEEDING FOR MITIGATING HAIL DAMAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CLOUD SEEDING FOR DISPERSING FOG MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CLOUD SEEDING MARKET SHARE BY FLAREs, 2023 VS 2031 (%)

12. GLOBAL CLOUD SEEDING BY END BURNING FLARES MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CLOUD SEEDING BY EJECTION FLARES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL CLOUD SEEDING BY AUTOMATIC AND REMOTE BASED GENERATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL CLOUD SEEDING BY MANUAL GENERATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL CLOUD SEEDING BY FLARE TREES MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL CLOUD SEEDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

20. UK CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICA CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)

32. MIDDLE EAST AND AFRICA CLOUD SEEDING MARKET SIZE, 2023-2031 ($ MILLION)