CMOS Image Sensors Market

Global CMOS Image Sensors Market Research By Technology (Front Side Illumination (FSI) and Back Side Illumination (BSI)), and By End-User (Automotive, Security & Surveillance, Healthcare, Consumer Electronics, and Others) Forecast 2021-2027 Update Available - Forecast 2025-2031

The global CMOS image sensors market is growing at a CAGR of 8.5% during the forecast period. The major factors that are augmenting the growth of the CMOS image market are growing advancements in CMOS sensor technology. Furthermore, increasing use of smartphones for clicking pictures and video shooting enhances the demand for high-quality cameras in smartphones are also estimated to be the major factors that are contributing significantly towards the growth of the market. However, there are also some factors that are becoming hindrances to the growth and development of the market. These factors include the high cost of the device along with maintenance of devices, which are the major factors constraints that are hindering the growth of the global CMOS image sensors market.

Moreover, emerging demand from the medical industry along with the automotive sector in developing economies are the key factors that are creating opportunities in the market. New launches in the market are likely to drive the growth of the global CMOS image sensors market. For instance, in July 2020, one of the companies of Teledyne Technologies Inc. that is Teledyne e2v had announced Hydra3D its new Time-of-Flight (ToF) CMOS image sensors that are, tailored for 3D detection and distance measurement. This sensor supports industrial applications such as including vision-guided robotics, logistics, and automated guided vehicles.

Impact of COVID-19 Pandemic on the Global CMOS Image Sensors Market

The global CMOS image sensors market is hardly hit by the COVID-19 pandemic since December 2019. Due to the COVID-19 pandemic, the supply chain had been disturbed that had led to a decline in demand for CMOS image sensors which had adversely impacted the growth of the market. However, the CMOS image sensors market is steadily building its pace back and recovering.

Segmental Outlook

The market is segmented based on technology and end-user. By technology, the market is segmented into front side illumination (FSI) and back side illumination (BSI). Further, based on the end-user segment the market is segmented into automotive, security & surveillance, healthcare, consumer electronics, and others.

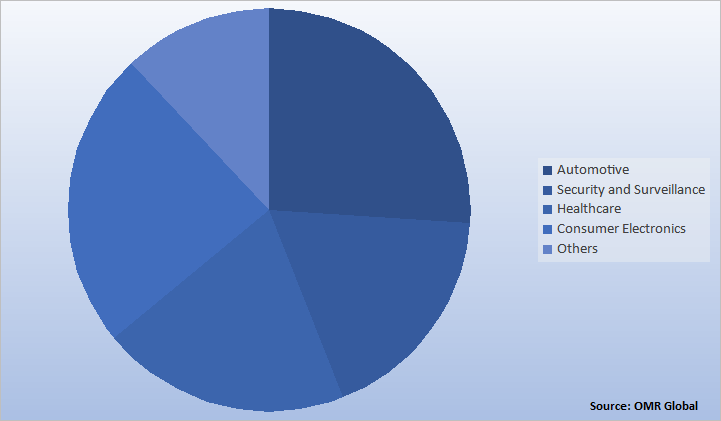

Global CMOS Image Sensors Market Share by End-User, 2020 (%)

Based on end-user, automotive holds a significant share in the market. The segment growth is driven by the increasing adaptability of cameras in augmented reality (AR), Virtual reality (VR) along driverless cars. The CMOS image sensor in the automotive application provides several benefits that include low price, improved performance at temperature when higher and lower, little or no aging under the influence of the factors related to the environment in vehicles. The company offers image sensors in automotive includes. Sony Corp., Samsung Semiconductor, Inc., Canon Inc. among others.

Regional Outlooks

Global CMOS image sensors market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is bifurcated into North America, Europe, Asia Pacific, and the Rest of the World. North America is estimated to be one of the leading regions in the global CMOS image sensors market. Increasing demand for security and scrutiny is also one of the major factors driving the growth of the market in the region. Additionally, growth due to the high use of smartphones and technological advancement of medical imaging technologies such as MRI, ultrasound, and others in the healthcare industry is also supporting the growth of the market.

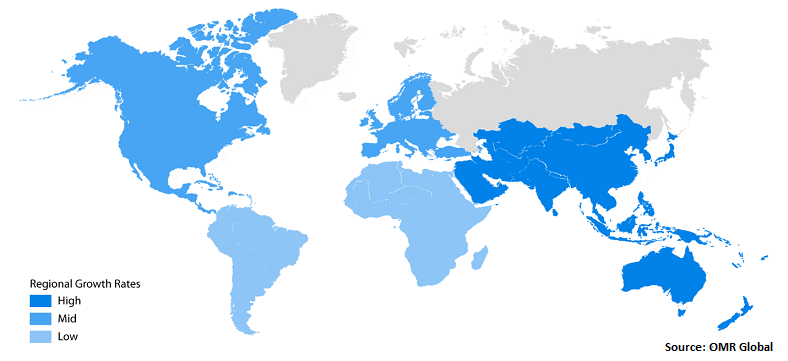

Global CMOS Image Sensors Market Growth, by Region 2021-2027

Asia-Pacific will have considerable growth in the Global CMOS Image Sensors Market

The Asia-Pacific region is regarded as the economies to grow and is expected to create an opportunity for the global CMOS image sensors market. Availability of labor at low cost and the establishment of manufacturing units by overseas companies is expected to upgrade productivity in the Asia-Pacific region. Furthermore, the automobile industry has a significant contribution to the growth CMOS image sensors market as the application of CMOS image sensors is growing in driverless cars that are also expected to drive the market in the region.

Market Players Outlook

Key players of the global CMOS image sensors market are Canon Inc., Nikon Corp., Panasonic Corp., Samsung Semiconductor, Inc., and Sony Corp. To survive in the market, these players adopt different marketing strategies such as product launches and mergers and acquisitions. For instance, in December 2021, Canon Inc. had introduced LI7060SAC, a new 1/2.3" CMOS sensor in Japan that is able to realize1 a high dynamic range of 120 decibels (dB) via double exposure2 along with an effective pixel count of 2.81 million pixels (1936 x 1456).

In October 2020, Canon Inc. had launched the new 19K 250 MP APS-H CMOS sensor. This new sensor is efficient of imaging at an ultra-high resolution of about 250 million pixels and is utilized in different shooting ranges and purposes along with solving problems as signal delay and slight discrepancies in timing.

In October 2019, Sony Corp. had launched six new types of stacked CMOS image sensors with a global shutter function that are achieved using a back-illuminated pixel structure for industrial equipment applications. Additionally, these new sensors are compact along with having the capability of high imaging performance without distortion of moving objects.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global CMOS image sensors market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global CMOS Image Sensors Market Industry

• Recovery Scenario Of Global CMOS Image Sensors Market Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global CMOS Image Sensors Market By Technology

5.1.1. Front Side Illumination (FSI)

5.1.2. Back Side Illumination (BSI)

5.2. Global CMOS Image Sensors Market By End-User

5.2.1. Automotive

5.2.2. Security and Surveillance

5.2.3. Healthcare

5.2.4. Consumer Electronics

5.2.5. Others (Aerospace & Defense)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AIRY3D

7.2. Ambarella International LP.

7.3. ams AG

7.4. Canon Inc.

7.5. CMOS Sensor Inc.

7.6. Fastree3D SA

7.7. Hamamatsu Photonics K.K.

7.8. Himax Technologies, Inc.

7.9. Nikon Corp.

7.10. OmniVision Technologies, Inc.

7.11. Panasonic Corp.

7.12. PixArt Imaging Inc.

7.13. PIXELPLUS

7.14. Samsung Electronics Co., Ltd.

7.15. Semiconductor Components Industries, LLC

7.16. Sharp Corp.

7.17. SK Hynix Inc.

7.18. Sony Corp.

7.19. STMicroelectronics

7.20. Teledyne Technologies Inc.