Coated Glass Market

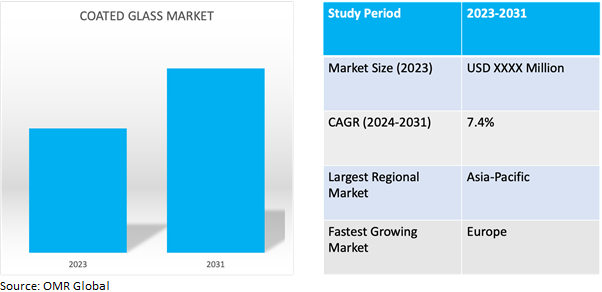

Coated Glass Market Size, Share & Trends Analysis Report by Coating (Hard Coating and Soft Coating). and by Application (Architectural, Automotive, Optical, and Others). Forecast Period (2024-2031).

Coated glass market is anticipated to grow at a CAGR of 7.4% during the forecast period (2024-2031). Coated glass is a type of glass that has been treated with a thin, transparent coating to improve its performance characteristics. This coating is typically applied to one or more surfaces of the glass during the manufacturing process. A major factor supporting the market growth is the increasing demand for energy-efficient and sustainable building materials.

Market Dynamics

Elevated Emphasis on Energy Efficiency: Driving the Coated Glass Market

Awareness and concern regarding energy efficiency and sustainability are pivotal drivers shaping the global coated glass market. As environmental consciousness grows, there's a heightened emphasis on adopting green building practices. Coated glass, renowned for its energy-saving properties and contribution to reducing carbon emissions, emerges as a favored choice in modern construction projects. This heightened awareness prompts architects, developers, and consumers to prioritize energy-efficient materials, propelling the demand for coated glass in the market.

Rapid Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development in emerging economies significantly impact the dynamics of the coated glass market. As urban populations swell and cities expand, there's an urgent need for modern infrastructure and buildings to accommodate this growth. Coated glass finds extensive application in skyscrapers, commercial complexes, and urban developments, driven by its ability to enhance aesthetics, energy efficiency, and overall building performance. The surge in construction activities in urban areas fuels the demand for coated glass products, propelling the market growth. For instance, in December 2023, Emirates Glass LLC, a prominent player in the glass industry, reaffirmed its commitment to innovation and quality by investing in new machinery and equipment. The company introduced a state-of-the-art Jumbo Series production line featuring Vortex Pro Convection technology. This cutting-edge production line is capable of manufacturing coated glass with superior emissivity levels, offering both high and low values of 8cm and 0.02cm, respectively.

Market Segmentation

Our in-depth analysis of the global coated glass market includes the following segments by coating, and application:

- Based on coating, the market is segmented into hard coating and soft coating.

- Based on application, the market is segmented into architectural, automotive, optical, and others.

Automotive is Projected to Emerge as the Largest Segment

The automotive segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing demand for advanced safety, comfort, and aesthetic features in vehicles. Coated glass offers several benefits that cater to these requirements, including enhanced durability, UV protection, thermal insulation, and glare reduction. These properties not only improve the overall driving experience by providing a more comfortable and visually appealing environment but also contribute to occupant safety by offering better impact resistance and shatterproof qualities.

Soft Coating Segment to Hold a Considerable Market Share

The soft coating segment holds a considerable market share in the global coated glass market due to its versatile applications and superior performance characteristics. Soft coatings, also known as low-emissivity (Low-E) coatings, are applied to glass surfaces using specialized techniques, resulting in enhanced thermal insulation and solar control properties. This enables soft-coated glass to regulate indoor temperature effectively, minimize heat loss in cold climates, and reduce solar heat gain during hot weather, thereby improving energy efficiency in buildings and vehicles.

Regional Outlook

The global coated glass market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Europe's Accelerated Growth in Coated Glass Market Amidst Environmental Imperatives

Europe is emerging as the fastest-growing market in the global coated glass market due to stringent regulations and standards regarding energy efficiency and environmental sustainability that are driving the adoption of coated glass in the region. European countries are increasingly focused on reducing carbon emissions and improving building energy performance, leading to a surge in demand for energy-efficient building materials such as coated glass, also the renovation and modernization of existing infrastructure, particularly in urban areas, are fueling the demand for coated glass products that offer improved thermal insulation, solar control, and soundproofing properties. For instance, in August 2023, Eurostat, the statistical office of the European Union (EU) based in Luxembourg, reported a 0.5% increase in industrial production in the euro area and a 0.4% rise in the EU in June 2023 compared to the previous month of May 2023.

Global Coated Glass Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share due to rapid urbanization, infrastructural development, and growing construction activities in the region. Countries like China, India, and Japan are experiencing significant economic growth, leading to increased investments in residential, commercial, and industrial infrastructure. As a result, there is a soaring demand for coated glass in building facades, windows, and other architectural applications to enhance energy efficiency, thermal insulation, and aesthetic appeal. Additionally, the automotive sector in Asia-Pacific is witnessing robust growth, driving the adoption of coated glass for vehicle windows and windshields to improve safety, comfort, and sustainability. For instance, in November 2023, Nippon Sheet Glass Co., Ltd. unveiled the commencement of operations for a fresh solar glass production line in Malaysia. Simultaneously, the company repurposed an existing production line to cater specifically to transparent conductive oxide (TCO) glass manufacturing. This strategic initiative reflects the company's commitment to advancing renewable energy solutions and addressing pressing global environmental challenges.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global coated glass market include AGC Inc., Central Glass Co. Ltd., Fuyao Glass Industry Group Co., Ltd., Corning Incorporated, and SYP Glass Group Co., Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2023, Guardian Glass, a prominent manufacturer specializing in coated and fabricated glass, revealed its acquisition of Vortex Glass through a signed agreement. As part of the acquisition, Guardian Glass will obtain the fabrication business assets of Vortex Glass across key locations in California, Miami, and Florida. This strategic move aims to bolster Guardian Glass's operational footprint and enable it to meet the increasing demand for coated glass within the US.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global coated glass market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AGC Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Central Glass Co. Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Fuyao Glass Industry Group Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Coated Glass Market by Coating

4.1.1. Hard Coating

4.1.2. Soft Coating

4.2. Global Coated Glass Market by Application

4.2.1. Architectural

4.2.2. Automotive

4.2.3. Optical

4.2.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. AVIC SANXIN Co. Ltd.

6.2. Blue Star Glass

6.3. Cardinal Glass Industries.

6.4. CSG Holding Co. Ltd.

6.5. Euroglas GmbH

6.6. Fuyao Group

6.7. Guardian Industries

6.8. Huadong Coating Glass

6.9. Jinjing Group Co. Ltd.

6.10. Nippon Sheet Glass Co., Ltd

6.11. Saint-Gobain

6.12. Schott Envases Argentina S.A.

6.13. Sisecam Group

6.14. Taiwan Glass Ind. Corp.

6.15. Vitro

6.16. Xinyi Glass Holdings Co. Ltd.

6.17. Zhongli Holding

1. GLOBAL COATED GLASS MARKET RESEARCH AND ANALYSIS BY COATING, 2023-2031 ($ MILLION)

2. GLOBAL HARD COATING COATED GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SOFT COATING COATED GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL COATED GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL COATED GLASS FOR ARCHITECTURAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL COATED GLASS FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL COATED GLASS FOR OPTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL COATED GLASS FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL COATED GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN COATED GLASS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN COATED GLASS MARKET RESEARCH AND ANALYSIS BY COATING, 2023-2031 ($ MILLION)

12. NORTH AMERICAN COATED GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. EUROPEAN COATED GLASS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN COATED GLASS MARKET RESEARCH AND ANALYSIS BY COATING, 2023-2031 ($ MILLION)

15. EUROPEAN COATED GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC COATED GLASS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC COATED GLASS MARKET RESEARCH AND ANALYSIS BY COATING, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC COATED GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. REST OF THE WORLD COATED GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD COATED GLASS MARKET RESEARCH AND ANALYSIS BY COATING, 2023-2031 ($ MILLION)

21. REST OF THE WORLD COATED GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL COATED GLASS MARKET SHARE BY COATING, 2023 VS 2031 (%)

2. GLOBAL HARD COATING COATED GLASS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SOFT COATING COATED GLASS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL COATED GLASS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL COATED GLASS FOR ARCHITECTURAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL COATED GLASS FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL COATED GLASS FOR OPTICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL COATED GLASS FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL COATED GLASS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. US COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

11. CANADA COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

12. UK COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

13. FRANCE COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

14. GERMANY COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

15. ITALY COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

18. INDIA COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

19. CHINA COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

20. JAPAN COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

23. LATIN AMERICA COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)

24. MIDDLE EAST AND AFRICA COATED GLASS MARKET SIZE, 2023-2031 ($ MILLION)