Cobalt Market

Cobalt Market Size, Share & Trends Analysis Report by Source (Primary Cobalt Sources and Secondary Cobalt Sources), by Form (Cobalt Metal, Cobalt Oxide, Cobalt Powder, Cobalt Alloys, and Cobalt Salts), and by End-User (Automotive, Energy and Power, Aerospace and Defense, Electronics, Industrial, Healthcare and Other) Forecast Period (2025-2035)

Industry Overview

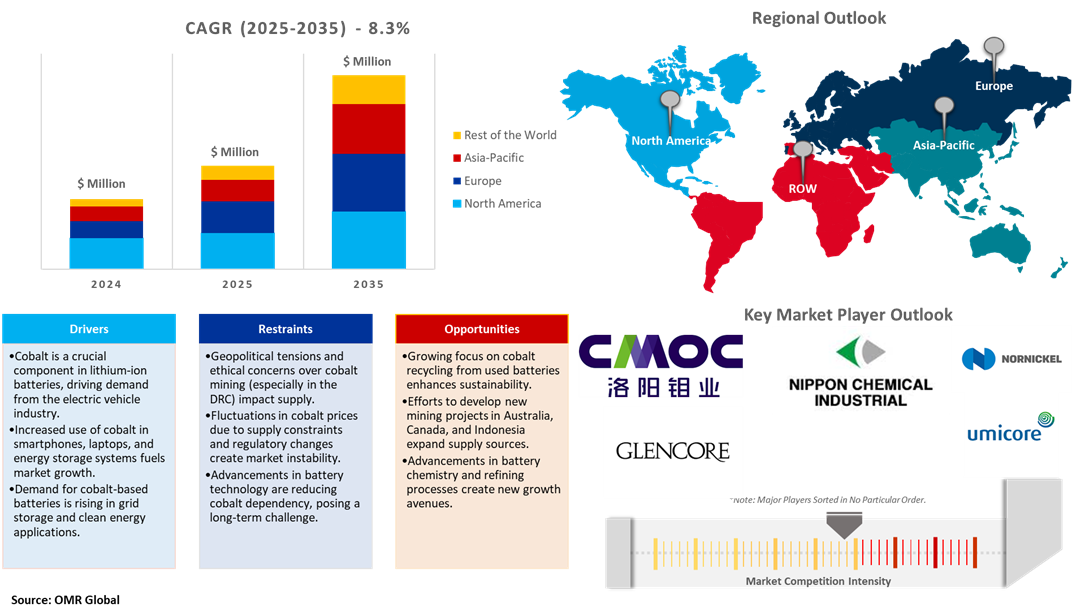

Cobalt market reached 220 kt in 2024 and is anticipated to grow at a CAGR of 8.3% during the forecast period (2025-2035). According to the Cobalt Institute, cobalt demand reached approximately 200 kt in 2023, doubling since 2016 with 10% yoy growth. Batteries now dominate 73% of the market, driving 93% of total demand growth. EVs alone account for 45% (90 kt), growing 23% yoy. Portable electronics, the second-largest sector (26%), saw demand drop 2.4% yoy to just under 52 kt. Increased cobalt metal adoption for electric vehicle batteries, renewable energy storage, and other new industrial and aerospace applications are propelling the growth of the market.

- Battery applications consume 73% of cobalt demand and are the leading cause of market expansion. Cobalt is still a significant element in several of the leading cathode chemistries utilized in lithium-ion batteries in EVs, portable electronics and emerging demand from energy storage systems (ESS).

- 24% of cobalt demand is still supported by non-battery uses with super alloys, mostly for aerospace usage, representing 9% of this proportion. The aerospace industry maintained a quicker-than-anticipated post-Covid recuperation in 2023, underpinning demand for cobalt's biggest non-battery usage.

Market Dynamics

Growing Adoption of Cobalt Recycling

Companies are making significant investments in cobalt recycling technologies owing to growing environmental and societal pressure. More advanced recycling techniques are being developed for the extraction of cobalt from spent batteries to lessen reliance on main supplies. Investing in firms involved in cobalt mining and exploration offers a direct link to cobalt production. Governments and business executives are working on circular economy initiatives to guarantee that cobalt remains sufficiently available for industrial use in the future.

Increasing Developments in Technologies for Cobalt Extraction

With the enhanced cobalt extraction efficiency from the mining and refining process with the minimum impact on the environment, more firms are embracing the principles of sustainable mining such as incorporating environmentally friendly leaching, and methods that reduce waste. Deep-sea cobalt is gaining even more studies where pilot seabed mining operations complement the extraction sources on the terrestrial body. The innovative techniques in separating cobalt from ores and concentrates owing to the application of new dissolution processes, such as sulfur dioxide (SO2) gas leaching, have changed cobalt extraction. Leaching is the key phase in cobalt extraction that involves the dissolution of valuable metals from ores or concentrates using chemical agents.

Market Segmentation

- Based on the source, the market is segmented into primary cobalt sources and secondary cobalt sources.

- Based on the form, the market is segmented into cobalt metal, cobalt oxide, cobalt powder, cobalt alloys, and cobalt salts (cobalt sulfate, cobalt chloride).

- Based on the end-user, the market is segmented into automotive, energy and power, aerospace and defense, electronics, industrial, healthcare and other (medical).

Cobalt Metal Segment to Lead the Market with the Largest Share

The cobalt market is rapidly growing owing to increasing demand for the metal. Industries are discovering the importance of using cobalt metal offers the durability and performance of the key components that can be maintained through innovative development. Cobalt is also increasingly being used to make premium magnets for renewable energy applications. Its requirement for energy storage products has increased sharply owing to the focus on creating cleaner energy alternatives. Furthermore, cobalt's role in electronic and precision instrument manufacturing also contributed to the growth of this industry.

Energy and Power: A Key Segment in Market Growth

The cobalt market is rising owing to the increased dependence on it by the energy and power sectors in a wide array of applications. The demand for efficient and long-lasting sustainable energy solutions with advanced energy storage technologies has also increased, wherein cobalt finds its application. It improves efficiency and the lifespan of battery chemistry in a large-scale power storage system, making it important. Other drivers include ongoing research to improve energy density and battery performance. The investment of governments and industries in renewable energy projects has further movements in cobalt market growth.

Regional Outlook

The global cobalt market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Cobalt in Europe Key Industries

The demand for cobalt is rising primarily result of Europe's push toward electric vehicles and renewable energy. Cobalt inventories continue to be ordered by stable high-performance alloy applications in the defense and aerospace industries. Demand for cobalt rises mostly as a result of the European Union's strict emission regulations, that boost sales of battery-powered electric cars. Constant investment in domestic battery production aims to reduce imports. Innovation in cobalt consumption is also being driven by advanced battery technology development. The supply chain is also getting stronger owing to strategic alliances between manufacturers and mining companies.

Asia-Pacific Region Dominates the Market with Major Share

The Asia-Pacific market for cobalt is increasing based on the enhanced demand for electric automobiles and lithium-ion batteries. Top battery manufacturers in China, Japan, and South Korea have led to higher demand for it. Efforts by the Government to achieve the sustainability and usage of clean sources of energy to enhance the requirements. The market's expansion can also be attributed to the growing electronics manufacturing base and rapid industrialization. The regional supply chain is being further strengthened by the investments made in cobalt refinement and battery recycling. The market is stabilized by the substantial presence of main battery producers. Through local mining operations, the pace of reducing reliance on imports is accelerating. Therefore, it remains a vital center for cobalt as a source of innovation and consumption. According to the Cobalt Institute, Cobalt Market Report 2023, China, the largest refiner of cobalt, produced 140 kt of refined cobalt in 2023, increasing its global share to 78.0%.

Market Players Outlook

The major companies operating in the global cobalt market include CMOC Group Ltd., Glencore plc, Nippon Chemical Industrial CO., LTD., PJSC MMC Norilsk Nickel, and Umicore N.V., among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In April 2024, Electra Battery Materials Corp. announced that they had signed a binding letter of intent for a long-term supply of ERG’s cobalt hydroxide to North America’s first battery-grade cobalt sulfate refinery. The agreement effectively supports efforts to onshore the battery supply chain and reduce reliance on foreign refiners.

- In January 2022, Glencore and Managem announced that they had entered into a partnership to produce Cobalt from recycled cobalt, nickel, and lithium at managem's CTT Hydrometallurgical Refinery. Glencore leverages its long-established ability in sourcing and recycling cobalt and nickel-bearing products at its Canadian (Sudbury) and Norwegian (Nikkelverk) operations to supply cobalt-containing black mass to the CTT refinery.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cobalt market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Cobalt Market Sales Analysis – Source | Form| End-User ($ Million)

• Cobalt Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Cobalt Industry Trends

2.2.2. Market Recommendations

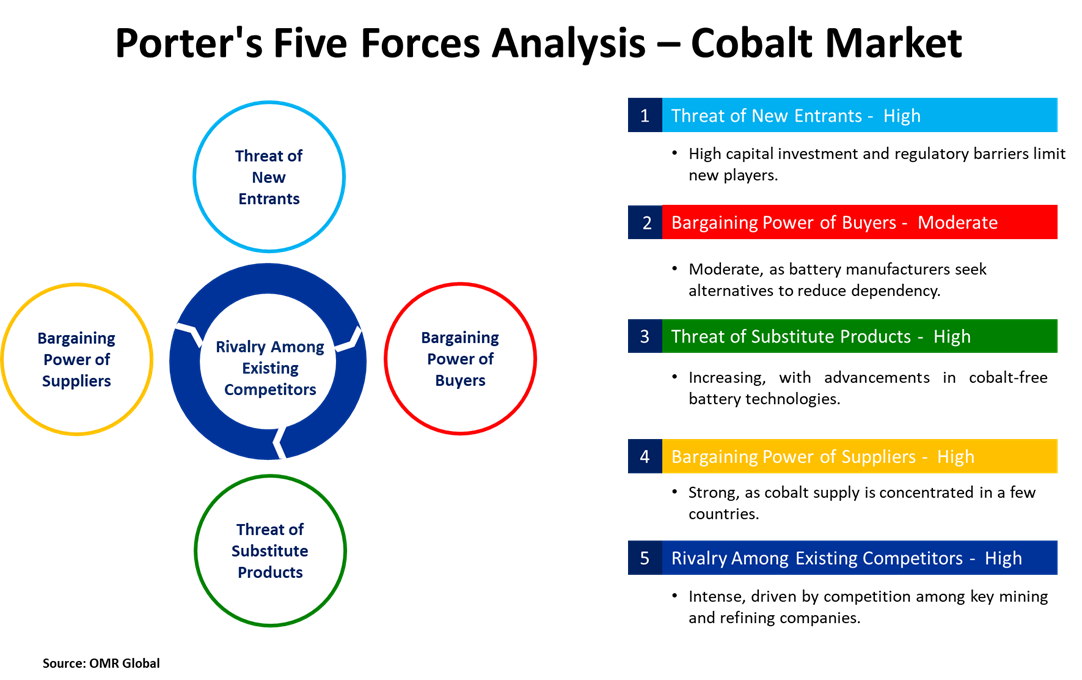

2.3. Porter's Five Forces Analysis for the Cobalt Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Cobalt Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Cobalt Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Cobalt Market Revenue and Share by Manufacturers

• Cobalt Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. CMOC Group Ltd.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Glencore plc

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Nippon Chemical Industrial Co., Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. PJSC MMC Norilsk Nickel

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Umicore N.V.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Cobalt Market Sales Analysis by Source ($ Million)

5.1. Primary Cobalt Sources

5.2. Secondary Cobalt Sources

6. Global Cobalt Market Sales Analysis by Form ($ Million)

6.1. Cobalt Metal

6.2. Cobalt Oxide

6.3. Cobalt Powder

6.4. Cobalt Alloys

6.5. Cobalt Salts (cobalt sulfate, cobalt chloride)

7. Global Cobalt Market Sales Analysis by End-User ($ Million)

7.1. Automotive

7.2. Energy and Power

7.3. Aerospace and Defense

7.4. Electronics

7.5. Industrial

7.6. Healthcare

7.7. Other (Medical)

8. Regional Analysis

8.1. North American Cobalt Market Sales Analysis – Source| Form| End-User |Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Cobalt Market Sales Analysis – Source| Form| End-User |Country ($ Million)

• Macroeconomic Factors for North America

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Cobalt Market Sales Analysis – Source| Form| End-User |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Cobalt Market Sales Analysis – Source| Form| End-User |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. AMPERE INDUSTRIE SASU

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Anglo American (AAL.L)

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. ATI, Inc.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Belmont Metals

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Bluestone Metals and Chemicals

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Chengdu Huarui Industrial Co., Ltd.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. CMOC Group Ltd.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Fengchen Group Co., Ltd.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Ganfeng Lithium Group Co., Ltd.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Glencore plc

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Höganäs AB

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. International Isotopes Inc.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Managem Group

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. NeoNickel

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Nippon Chemical Industrial CO., LTD.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. PJSC MMC Norilsk Nickel

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Reade International Corp.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Sherritt International Corp.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Special Metals Corp.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Stanford Advanced Materials

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. The Shepherd Chemical Co.

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Three Cobalt Pte. Ltd.

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. TOKUSHU KINZOKU EXCEL CO.,LTD.

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. Umicore N.V.

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

9.25. United Performance Metals (UPM)

9.25.1. Quick Facts

9.25.2. Company Overview

9.25.3. Product Portfolio

9.25.4. Business Strategies

9.26. Vale S.A.

9.26.1. Quick Facts

9.26.2. Company Overview

9.26.3. Product Portfolio

9.26.4. Business Strategies

9.27. VDM Metals International GmbH

9.27.1. Quick Facts

9.27.2. Company Overview

9.27.3. Product Portfolio

9.27.4. Business Strategies

1. Global Cobalt Market Research And Analysis By Source, 2024-2035 ($ Million)

2. Global Primary Cobalt Sources Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Secondary Cobalt Sources Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Cobalt Market Research And Analysis By Form, 2024-2035 ($ Million)

5. Global Cobalt Metal Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Cobalt Oxide Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Cobalt Powder Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Cobalt Alloys Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Cobalt Salts Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Cobalt Market Research And Analysis By End-User, 2024-2035 ($ Million)

11. Global Cobalt For Automotive Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Cobalt For Energy & Power Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Cobalt For Aerospace and Defense Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Cobalt For Electronics Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Cobalt For Industrial Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Cobalt For Healthcare Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Cobalt For Other End-User Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Cobalt Market Research And Analysis By Region, 2024-2035 ($ Million)

19. North American Cobalt Market Research And Analysis By Country, 2024-2035 ($ Million)

20. North American Cobalt Market Research And Analysis By Source, 2024-2035 ($ Million)

21. North American Cobalt Market Research And Analysis By Form, 2024-2035 ($ Million)

22. North American Cobalt Market Research And Analysis By End-User, 2024-2035 ($ Million)

23. European Cobalt Market Research And Analysis By Country, 2024-2035 ($ Million)

24. European Cobalt Market Research And Analysis By Source, 2024-2035 ($ Million)

25. European Cobalt Market Research And Analysis By Form, 2024-2035 ($ Million)

26. European Cobalt Market Research And Analysis By End-User, 2024-2035 ($ Million)

27. Asia-Pacific Cobalt Market Research And Analysis By Country, 2024-2035 ($ Million)

28. Asia-Pacific Cobalt Market Research And Analysis By Source, 2024-2035 ($ Million)

29. Asia-Pacific Cobalt Market Research And Analysis By Form, 2024-2035 ($ Million)

30. Asia-Pacific Cobalt Market Research And Analysis By End-User, 2024-2035 ($ Million)

31. Rest Of The World Cobalt Market Research And Analysis By Region, 2024-2035 ($ Million)

32. Rest Of The World Cobalt Market Research And Analysis By Source, 2024-2035 ($ Million)

33. Rest Of The World Cobalt Market Research And Analysis By Form, 2024-2035 ($ Million)

34. Rest Of The World Cobalt Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Cobalt Market Share By Source, 2024 Vs 2035 (%)

2. Global Primary Cobalt Sources Market Share By Region, 2024 Vs 2035 (%)

3. Global Secondary Cobalt Sources Market Share By Region, 2024 Vs 2035 (%)

4. Global Cobalt Market Share By Form, 2024 Vs 2035 (%)

5. Global Cobalt Metal Market Share By Region, 2024 Vs 2035 (%)

6. Global Cobalt Oxide Market Share By Region, 2024 Vs 2035 (%)

7. Global Cobalt Powder Market Share By Region, 2024 Vs 2035 (%)

8. Global Cobalt Alloys Market Share By Region, 2024 Vs 2035 (%)

9. Global Cobalt Salts Market Share By Region, 2024 Vs 2035 (%)

10. Global Cobalt Market Share By End-User, 2024 Vs 2035 (%)

11. Global Cobalt For Automotive Market Share By Region, 2024 Vs 2035 (%)

12. Global Cobalt For Energy & Power Market Share By Region, 2024 Vs 2035 (%)

13. Global Cobalt For Aerospace and Defense Market Share By Region, 2024 Vs 2035 (%)

14. Global Cobalt For Electronics Market Share By Region, 2024 Vs 2035 (%)

15. Global Cobalt For Industrial Market Share By Region, 2024 Vs 2035 (%)

16. Global Cobalt For Healthcare Market Share By Region, 2024 Vs 2035 (%)

17. Global Cobalt For Other End-User Market Share By Region, 2024 Vs 2035 (%)

18. Global Cobalt Market Share By Region, 2024 Vs 2035 (%)

19. US Cobalt Market Size, 2024-2035 ($ Million)

20. Canada Cobalt Market Size, 2024-2035 ($ Million)

21. UK Cobalt Market Size, 2024-2035 ($ Million)

22. France Cobalt Market Size, 2024-2035 ($ Million)

23. Germany Cobalt Market Size, 2024-2035 ($ Million)

24. Italy Cobalt Market Size, 2024-2035 ($ Million)

25. Spain Cobalt Market Size, 2024-2035 ($ Million)

26. Russia Cobalt Market Size, 2024-2035 ($ Million)

27. Rest Of Europe Cobalt Market Size, 2024-2035 ($ Million)

28. India Cobalt Market Size, 2024-2035 ($ Million)

29. China Cobalt Market Size, 2024-2035 ($ Million)

30. Japan Cobalt Market Size, 2024-2035 ($ Million)

31. South Korea Cobalt Market Size, 2024-2035 ($ Million)

32. Australia and New Zealand Cobalt Market Size, 2024-2035 ($ Million)

33. ASEAN Countries Cobalt Market Size, 2024-2035 ($ Million)

34. Rest Of Asia-Pacific Cobalt Market Size, 2024-2035 ($ Million)

35. Latin America Cobalt Market Size, 2024-2035 ($ Million)

36. Middle East And Africa Cobalt Market Size, 2024-2035 ($ Million)

FAQS

The size of the Cobalt market in 2024 is estimated to be around 220 kt.

Asia-Pacific holds the largest share in the Cobalt market.

Leading players in the Cobalt market include CMOC Group Ltd., Glencore plc, Nippon Chemical Industrial CO., LTD., PJSC MMC Norilsk Nickel, and Umicore N.V., among others.

Cobalt market is expected to grow at a CAGR of 8.3% from 2025 to 2035.

The Cobalt Market is growing due to rising demand for lithium-ion batteries in electric vehicles (EVs) and consumer electronics. Additionally, increasing use in superalloys, aerospace, and renewable energy storage.