Coconut Oil Market

Coconut Oil Market Size, Share & Trends Analysis Report by Type (RBD, Virgin, and Crude), by Source (Dry Coconut and Wet Coconut), by Application (Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals and Other) Forecast Period (2024-2031)

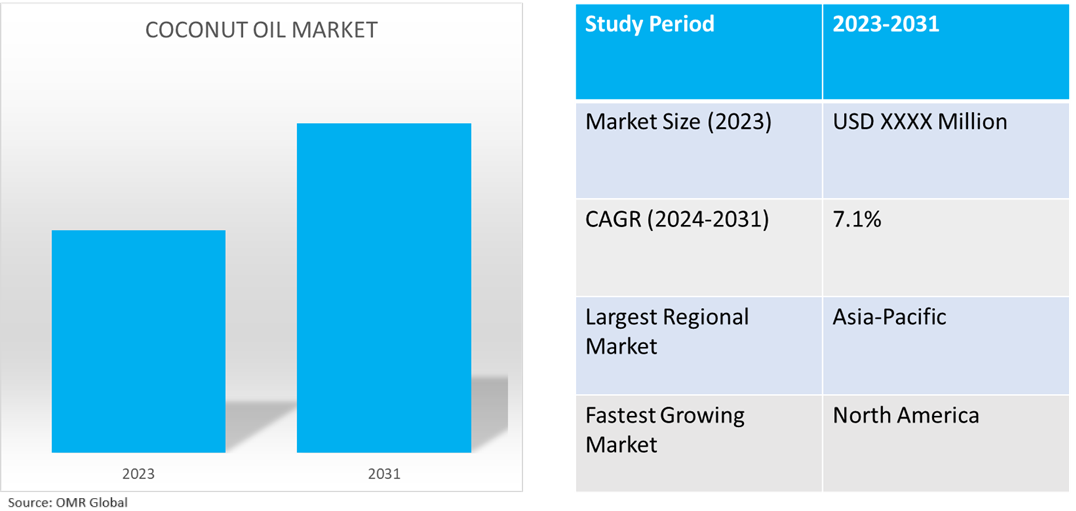

Coconut oil market is anticipated to grow at a significant CAGR of 7.1% during the forecast period (2024-2031). The coconut oil market growth is attributed to the increasing importance of its medicinal and nutraceutical properties contributing to human health, nutrition, and wellness. With the new development in the health sector with skin and hair treatment benefits, the CNO and VCO demand personal care applications. Additionally, there is enormous scope for value addition for every part of the coconut and coconut palm in various sectors such as food & beverages, dairy sector, health and beauty (nutraceutical and cosmeceutical products), art and handicrafts, and others. According to the International Coconut Community, the global production of coconut oil is forecasted to be over 240 thousand tons in 2023. Coconut oil prices are projected to be at $1,060/MT.

Market Dynamics

Increasing Demand for Versatile Products from Coconut

The coconut is well-known for its meat, milk, water, and oil. In daily life, coconuts and their products are utilized for a variety of things, including food ingredients, cooking, hair and skin care, and medicinal purposes. Because it includes dietary fat and fiber, protein, carbs, minerals such as phosphorous and potassium, and vitamins such as riboflavin and niacin, the coconut flesh is incredibly nutrient-dense. The primary coconut product, coconut oil, is well-known for its many advantageous applications. Instead of utilizing other vegetable oils as a cooking medium, doctors advise using coconut oil. Different countries use coconuts and trees in different ways. For instance, coconut palm is used to prepare more than fifty goods.

Growing Coconut Oil Use in Personal Care Products

Communities globally, particularly those in tropical and coastal areas, view coconut oil and other coconut-based products as healthy ingredients that can enhance one's appearance. This perception has led manufacturers to incorporate coconut oil as a basic ingredient in cosmetic and personal care products. In addition, as consumers are highly interested in organic and vegan skincare and hair care products, cosmetics containing virgin coconut oil are highly accepted. Consequently, in their range of cosmetics and personal care products, many personal care brands are substituting coconut oil for mineral oil as it contains triglycerides along with stable saturated medium-chain fatty acids (lauric acid, C10 capric acid, and C8 caprylic acid) that share the same occlusive and hydrophobic properties as mineral oil.

Market Segmentation

• Based on the type, the market is segmented into refined, bleached, and deodorized (RBD), virgin, and crude.

• Based on the source, the market is segmented into dry coconut and wet coconut.

• Based on the application, the market is segmented into food & beverages, cosmetics & personal care, pharmaceuticals, and other (nutritional products).

Virgin is Projected to Hold the Largest Share

The primary factors supporting the growth include the increasing demand for virgin coconut oil (VCO) products for health and beauty. VCO does not undergo chemical refining, bleaching, or deodorizing. VCO is colorless, free of sediment, and has a natural fresh coconut scent. It is free from rancid odor or taste. Virgin coconut oil consists mainly of medium-chain fatty acids, lauric acid, which constitutes 48.0% of VCO and possesses potent antimicrobial properties capable of destroying disease-causing bacteria, fungi, viruses, and parasites. According to the National Cooperative Development Corporation (NCDC), in October 2021, the Philippines was the largest producer and exporter of virgin coconut oil (VCO). Export reached over 42 export destinations the US (59.7%), the Netherlands (10.1%), Canada (8.5%), and the rest to Europe, China, Japan, Singapore, Australia, and Southeast Asia. The compound annual growth rate of global demand for VCO projected from 2019 to 2024 is 11.0%, and the VCO market is projected to reach $5.0 billion by 2024. In India, the demand for VCO for domestic and export is increasing owing to the increased awareness of the health benefits of this product.

Food & Beverages Segment to Hold a Considerable Market Share

The factors supporting segment growth include coconut meat contains dietary fat and fiber, protein, carbohydrates, micro minerals such as potassium and phosphorous, and vitamins such as niacin and riboflavin. Coconut oil (CNO), the main economic value-added product made from coconuts, has been traded all over the globe. In the global oilseed, oils, and fats market, copra is a highly prized product. One of the richest sources of fat is copra, which has an oil concentration ranging from 65.0% to 70.0%. The meat known as "copra" is dried endosperm, which has had its moisture content lowered from 50.0% to 55.0% while it was still wet. Less than 5.0% of the oils and fats sold globally are made from coconut oil.

Regional Outlook

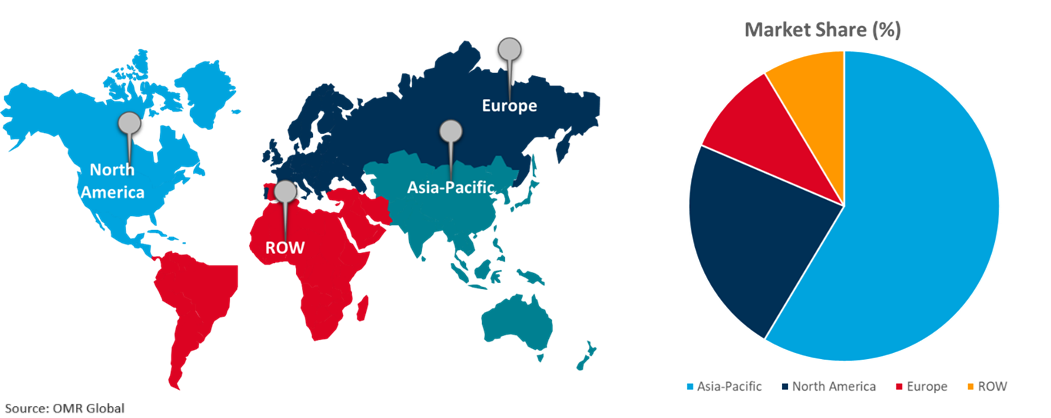

Global coconut oil market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Coconut Oil in North America

- The regional growth is attributed to increasing organic and antioxidant qualities have led to a rise in demand. Customers are using coconut oil for digestion, hair care, and skincare. With growing trends toward health consciousness and flexible usage, the industry is expanding rapidly in the US. According to the US Department of Agriculture, in June 2024, coconut oil production reached 3.8 million metric tons (MMT) in 2023-24. Domestic coconut oil Consumption reached 3.6 million metric tons (MMT) in 2023-24.

Global Coconut Oil Market Growth by Region 2024-2031

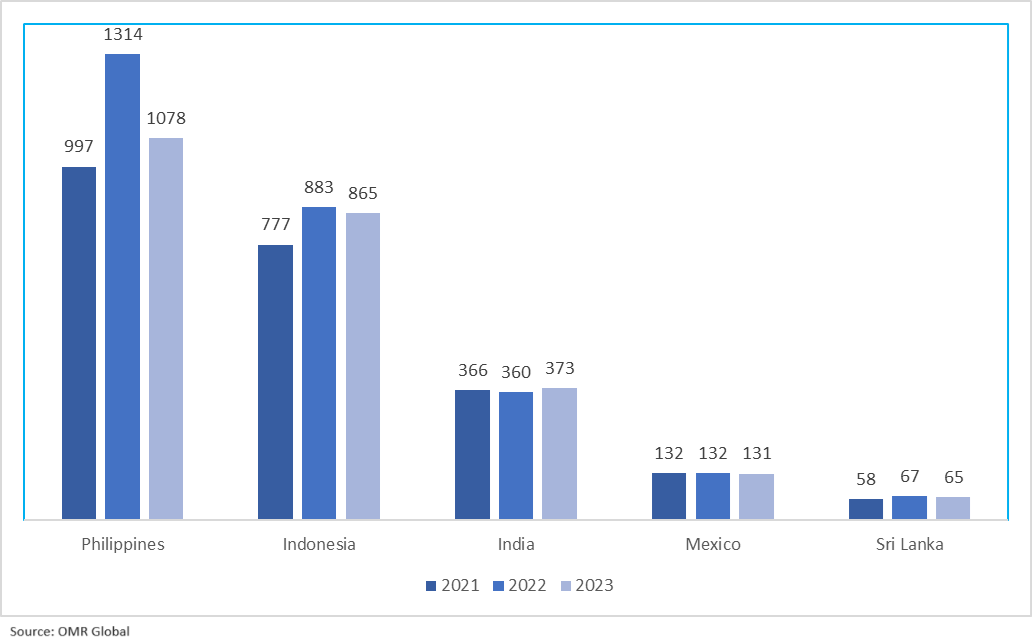

Coconut Oil Production By Country, 2021-2023 (000’Metric Tons (MT))

Source: International Coconut Community

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the presence of coconut oil offering companies such as Adani Group, Marico Ltd., Sun Bionaturals Pvt. Ltd., and others. The market growth is attributed to growing awareness of the health benefits of coconut oil and the increasing medicinal benefits of coconut oil in various pharmaceutical & beauty products. Coconut oil (CNO), especially virgin coconut oil (VCO), is gaining importance for its known medicinal and nutraceutical properties that contribute to human health, nutrition, and wellness. With this new development in the health sector with skin and hair treatment benefits, the CNO and VCO find great demand for personal care and beauty care applications. According to the National Cooperative Development Corporation (NCDC), in October 2021, the Asia-Pacific region produced about 85.0% of the global coconut products, such as coconut oil, water and milk, virgin coconut oil, and raw materials such as fibrous materials and timbers used in construction. The coconut industry makes significant contributions to the agri-food sectors of countries in the Asian-Pacific region. It is also a socioeconomic pillar in rural areas, where small-scale holders account for 80.0-90.0% of primary coconut production.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global coconut oil market include Adani Group, Cargill, Inc., Greenville Agro Corp., Marico Ltd., and The Vita Coco Co. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In February 2022, Dabur Ltd. introduced “Virgin Coconut Oil’, further strengthening its presence in the coconut oil market. Dabur Virgin Coconut Oil can be used for cooking and is traditionally also used for Skin & Hair Health and as massage oil. It is extracted through Cold Press Technology that preserves the natural goodness, vital nutrients, rich aroma, and true flavor of coconuts. It contains MCT (Medium Chain Triglycerides) which gets digested easily and helps in energy release and hence is not stored in the body.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the coconut oil market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Adani Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cargill, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Greenville Agro Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Marico Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. The Vita Coco Co.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Coconut Oil Market by Type

4.1.1. Refined, Bleached and Deodorised (RBD)

4.1.2. Virgin

4.1.3. Crude

4.2. Global Coconut Oil Market by Source

4.2.1. Dry Coconut

4.2.2. Wet Coconut

4.3. Global Coconut Oil Market by Application

4.3.1. Food & Beverages

4.3.2. Cosmetics & Personal Care

4.3.3. Pharmaceuticals

4.3.4. Other (Nutritional Products)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Barlean's Organic Oils, LLC

6.2. COCO & CO.

6.3. ConnOils LLC

6.4. Dr. Bronner's

6.5. Healthy Traditions, Inc.

6.6. Jarrow Formulas, Inc.

6.7. La Tourangelle, Inc.

6.8. Majestic Pure (Volans Epic LLC)

6.9. Nature’s Way Brands, LLC

6.10. NOW Health Group, Inc.

6.11. Nucoconut

6.12. Nutiva Inc.

6.13. Peter Paul Philippines Corp.

6.14. Primex Coco Products, Inc.

6.15. Radha Beauty

6.16. SPECTRUM ORGANIC PRODUCTS, LLC

6.17. The Carrington Tea Company, LLC

6.18. The Hain Celestial Group, Inc.

6.19. Tropical Traditions, Inc

6.20. Viva Naturals

1. Global Coconut Oil Market Research And Analysis By Type, 2023 Vs 2031 (%)

2. Global RBD Coconut Oil Market Share By Region, 2023 Vs 2031 (%)

3. Global Virgin Coconut Oil Market Share By Region, 2023 Vs 2031 (%)

4. Global Crude Coconut Oil Market Share By Region, 2023 Vs 2031 (%)

5. Global Coconut Oil Market Share By Source, 2023 Vs 2031 (%)

6. Global Dry Coconut Oil Market Share By Region, 2023 Vs 2031 (%)

7. Global Wet Coconut Oil Market Share By Region, 2023 Vs 2031 (%)

8. Global Coconut Oil Market Share By Application, 2023 Vs 2031 (%)

9. Global Coconut Oil In Food & Beverages Market Share By Region, 2023 Vs 2031 (%)

10. Global Coconut Oil In Cosmetics & Personal Care Market Share By Region, 2023 Vs 2031 (%)

11. Global Coconut Oil In Pharmaceuticals Market Share By Region, 2023 Vs 2031 (%)

12. Global Other Coconut Oil Application Market Share By Region, 2023 Vs 2031 (%)

13. Global Coconut Oil Market Share By Region, 2023 Vs 2031 (%)

14. US Coconut Oil Market Size, 2023-2031 ($ Million)

15. Canada Coconut Oil Market Size, 2023-2031 ($ Million)

16. UK Coconut Oil Market Size, 2023-2031 ($ Million)

17. France Coconut Oil Market Size, 2023-2031 ($ Million)

18. Germany Coconut Oil Market Size, 2023-2031 ($ Million)

19. Italy Coconut Oil Market Size, 2023-2031 ($ Million)

20. Spain Coconut Oil Market Size, 2023-2031 ($ Million)

21. Rest Of Europe Coconut Oil Market Size, 2023-2031 ($ Million)

22. India Coconut Oil Market Size, 2023-2031 ($ Million)

23. China Coconut Oil Market Size, 2023-2031 ($ Million)

24. Japan Coconut Oil Market Size, 2023-2031 ($ Million)

25. South Korea Coconut Oil Market Size, 2023-2031 ($ Million)

26. Rest Of Asia-Pacific Coconut Oil Market Size, 2023-2031 ($ Million)

27. Rest Of The World Coconut Oil Market Size, 2023-2031 ($ Million)

28. Latin America Coconut Oil Market Size, 2023-2031 ($ Million)

29. Middle East And Africa Coconut Oil Market Size, 2023-2031 ($ Million)