Coiled Tubing Market

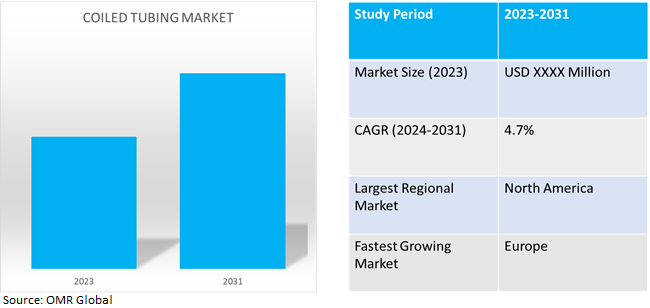

Coiled Tubing Market Size, Share & Trends Analysis Report by Operation (Pumping, Circulation, Logging, and Perforation), by Application (Onshore and Offshore), and by Service (Well Intervention, Drilling, and Completion), Forecast Period (2024-2031)

Coiled tubing market is anticipated to grow at a CAGR of 4.7% during the forecast period (2024-2031). Coiled tubing is a long material pipe and surface equipment that was originally intended to be used in the producing of (live) wells. The use of coiled tubing has expanded beyond traditional applications such as well cleaning and acid stimulation.

Market Dynamics

Expansion of Offshore Exploration and Production Activities Increases Market Demand

The offshore oil and gas sector’s expansion, particularly into deep and ultra-deepwater regions, is a significant growth driver for the coiled tubing market. Coiled tubing units, known for their versatility in well interventions, drilling operations, and production enhancement techniques, are increasingly utilized in offshore environments. This trend is fueled by the ongoing exploration and development of offshore fields, where coiled tubing’s capabilities are critical for the success of such ventures. The demand for coiled tubing services in offshore settings is poised for growth, reflecting the industry’s push toward exploring new frontiers and maximizing the yield from these challenging environments. As offshore exploration and production activities continue to advance, the reliance on coiled tubing services is expected to rise, further stimulating market growth.

Growth of Enhanced Oil Recovery (EOR) Methodologies

Globally, manufacturers of coiled tubing have a lot of opportunities because of the increased focus on optimizing hydrocarbon recovery from current reservoirs. Moreover, enhanced oil recovery (EOR) methods like chemical treatments, gas injection, and water flooding are being used to extract more oil and gas from developed fields. Because it offers a versatile and affordable way to transfer fluids and treatments into the reservoir, coiled tubing technology is essential to the implementation of EOR techniques.

Market Segmentation

Our in-depth analysis of the global coiled tubing market includes the following segments by operation, application, and service:

- Based on operation, the market is segmented into pumping, circulation, logging, and perforation.

- Based on application, the market is segmented into onshore and offshore.

- Based on service, the market is segmented into well intervention, drilling, and completion.

Well Intervention is Projected to Emerge as the Largest Segment

The well-intervention segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing demand for enhanced oil recovery techniques and the need to maintain the productivity of aging oil wells. Well, intervention and production services are critical in extending the life of oil wells, optimizing their output, and ensuring operational efficiency. These services include a range of operations such as well stimulation, sand control, zonal isolation, and scale removal, which are vital for sustaining production levels and mitigating the decline in mature fields.

Onshore Segment to Hold a Considerable Market Share

The onshore segment of the coiled tubing market, with a considerable market share, reflects the significant role of terrestrial oil and gas operations in the industry. Its growth is driven by the extensive infrastructure, technological advancements, and relatively lower operational complexities associated with onshore activities compared to offshore operations. Onshore applications of coiled tubing include a wide range of services from drilling to well intervention, completion, and maintenance, highlighting the versatility and efficiency of coiled tubing in enhancing production and recovery rates in terrestrial settings.

Regional Outlook

The global coiled tubing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

The European region is likely to witness a growth in terms of volume, over the forecast period. The region is focusing on making a transition of its energy mix from fossil fuel to renewable energy. Moreover, the Russia-Ukraine conflict has created a negative impact on the gas supply of the region. Such factors are expected to restrain demand for coiled tubing in Europe during the forecast period.

Global Coiled Tubing Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share among all regions due to increasing gas production and exploration activities. There is rising awareness related to the benefits of using coiled tubing for upstream industries. The United States market is witnessing a drastic increase in capital expenditure for exploration, development, and tight oil production. Moreover, there is an increase in shale gas developments in the US. Developed countries such as the United States and Canada are the major coiled tubing consumers for upstream activities. The dynamics within North America are characterized by innovative drilling techniques and a strong focus on maximizing oil and gas extraction efficiency. The region’s swift adoption of advanced technologies for well interventions, alongside a growing number of mature wells requiring maintenance, positions coiled tubing as an essential service. Furthermore, the commitment to environmental standards and the development of unconventional resources propel the demand for coiled tubing services.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global coiled tubing market include Baker Hughes Company, Calfrac Well Services Ltd., Schlumberger Ltd, and Weatherford International PLC, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in August 2022, NexTier Oilfield Solutions Inc. and its wholly-owned subsidiary, NexTier Completion Solutions Inc., finalized a definitive agreement to acquire the assets of the sand hauling, well-site storage, and last-mile logistics businesses of Continental Intermodal Group LP and its subsidiaries.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global coiled tubing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Baker Hughes Company

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Calfrac Well Services Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Schlumberger Limited

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Weatherford International PLC

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Coiled Tubing Market by Operation

4.1.1. Pumping

4.1.2. Circulation

4.1.3. Logging

4.1.4. Perforation

4.2. Global Coiled Tubing Market by Application

4.2.1. Onshore

4.2.2. Offshore

4.3. Global Coiled Tubing Market by Service

4.3.1. Well Intervention

4.3.2. Drilling

4.3.3. Completion

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Altus Intervention

6.2. Basic Energy Services Inc.

6.3. Forum Energy Technologies Inc.

6.4. Halliburton Company

6.5. HandyTube Corp.

6.6. Key Energy Services, LLC,

6.7. NexTier Oilfield Solutions Inc.

6.8. Oceaneering International, Inc.

6.9. RPC Inc.

6.10. Sandvik AB

6.11. STEP ENERGY SERVICES

6.12. Superior Energy Services Inc.

6.13. Tenaris SA

6.14. Trican Well Service Ltd

6.15. Trident Steel Corp.

6.16. Webco Industries

6.17. Yantai Jereh Petroleum Equipment and Technologies Co. Ltd.

1. GLOBAL COILED TUBING MARKET RESEARCH AND ANALYSIS BY OPERATION, 2023-2031 ($ MILLION)

2. GLOBAL COILED TUBING PUMPING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL COILED TUBING CIRCULATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL COILED TUBING LOGGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL COILED TUBING PERFORATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL COILED TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

7. GLOBAL ONSHORE COILED TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL OFFSHORE COILED TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL COILED TUBING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

10. GLOBAL COILED TUBING WELL INTERVENTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL COILED TUBING DRILLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL COILED TUBING COMPLETION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL COILED TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN COILED TUBING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN COILED TUBING MARKET RESEARCH AND ANALYSIS BY OPERATION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN COILED TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN COILED TUBING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

18. EUROPEAN COILED TUBING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN COILED TUBING MARKET RESEARCH AND ANALYSIS BY OPERATION, 2023-2031 ($ MILLION)

20. EUROPEAN COILED TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. EUROPEAN COILED TUBING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC COILED TUBING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC COILED TUBING MARKET RESEARCH AND ANALYSIS BY OPERATION, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC COILED TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC COILED TUBING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD COILED TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD COILED TUBING MARKET RESEARCH AND ANALYSIS BY OPERATION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD COILED TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD COILED TUBING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

1. GLOBAL COILED TUBING MARKET SHARE BY OPERATION, 2023 VS 2031 (%)

2. GLOBAL COILED TUBING PUMPING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL COILED TUBING CIRCULATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL COILED TUBING LOGGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL COILED TUBING PERFORATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL COILED TUBING MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

7. GLOBAL ONSHORE COILED TUBING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL OFFSHORE COILED TUBING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL COILED TUBING MARKET SHARE BY SERVICE, 2023 VS 2031 (%)

10. GLOBAL COILED TUBING WELL INTERVENTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL COILED TUBING DRILLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL COILED TUBING COMPLETION MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL COILED TUBING MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

16. UK COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA COILED TUBING MARKET SIZE, 2023-2031 ($ MILLION)