Cold Chain Equipment Market

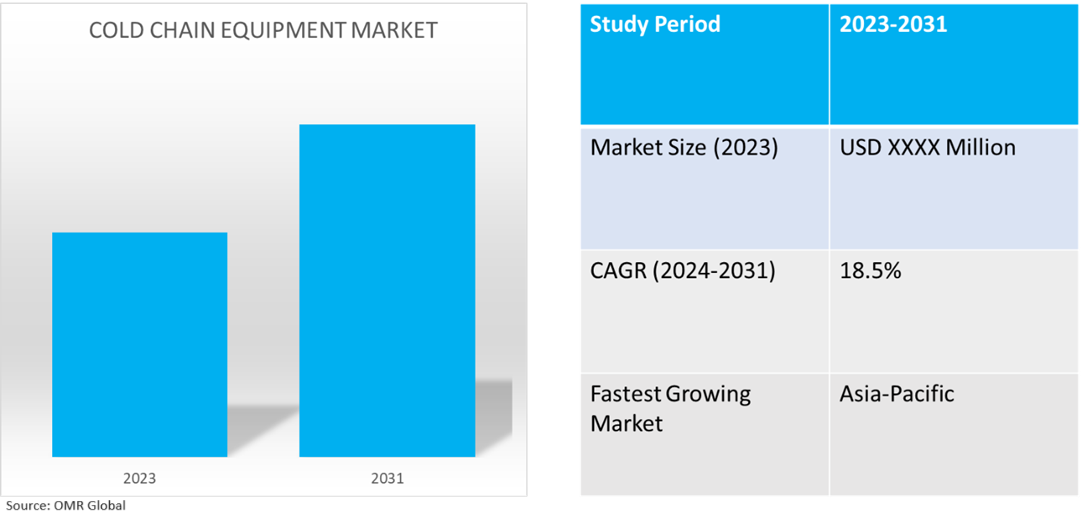

Cold Chain Equipment Market Size, Share & Trends Analysis Report by Type (Refrigerated Storage, and Transportation), and by Industry Vertical (Pharmaceuticals, Food and Beverage, Chemicals, and Others) Forecast Period (2024-2031)

Cold chain equipment market is anticipated to grow at a CAGR of 18.5% during the forecast period (2024-2031). The cold chain equipment includes refrigerators, vaccine carriers, insulated vans, stabilizers, and real-time temperature monitoring devices among others. The market's growth is driven by the increasing adoption of cold chain infrastructure, and growing demand from the pharmaceutical and food and beverage industries. The growing industrialization, changes in consumer preferences, and government support are the major promoters of the global market. Further, the market is expected to be positively influenced by technological advancements such as IoT-enabled sensors, RFID tracking, and real-time monitoring.

Market Dynamics

Increasing Adoption of Cold Chain Infrastructure

The growth in the cold chain equipment market is instigated by the rising adoption of cold chain infrastructure, especially in the pharmaceutical, agriculture, and food and beverage industries, to sustain food, vaccines, and crops for a longer duration while reducing preservatives and processing. Further, growing international trade and logistics have stimulated the adoption of cold chain infrastructure such as multi-modal transportation and cross-border cold storage to facilitate the smooth exchange of goods by complying with regulatory standards. For instance, India's Integrated Cold Chain and Value Addition Infrastructure scheme promotes integrated and complete cold chain facilities without any break from the farm gate to the consumer, to reduce losses by improving efficiency in farmers' produce, storage, transportation, and minimal processing. Both horticultural and non-horticultural produce are eligible for support under this scheme. Under this scheme, as of December 2022, a cold storage capacity of 8.38 lakh MT has been created.

Integration of IoT and Smart Technology in Cold Chain Equipment

The rising trend of integrating IoT devices and smart technology such as real-time monitoring sensors, temperature sensors, and RFID tracking into cold chain equipment is expected to positively influence market growth, as cold chain logistics require such technology for data collection, shipment tracking, and monitoring, and supply chain efficiency. The advancement in IoT devices and smart technologies using artificial intelligence (AI) and machine learning (ML) is expected to enhance current cold chain equipment capabilities while paving the way for automation in cold chain warehousing and transport. For instance, in February 2021, Sensitech (Carrier Corp, Company, a leading supply chain visibility supplier, expanded its range of IoT devices to include air-carrier authorized and non-lithium battery variants for real-time shipment tracking while goods travel by plane. TempTale GEO and VizComm View products provide validated data for shipments of vaccines, pharmaceuticals, and test kits, allowing for essential accept/reject decisions across all modes of transportation (air, land, or sea).

Segmental Outlook

- Based on type, the market is segmented into refrigerated storage and transportation.

- Based on industry vertical, the market is segmented into pharmaceuticals, food and beverage, chemicals, and others (brewery, healthcare).

Transportation Equipment Holds Major Share Based on Type

The transportation equipment segment is the most prominent type of equipment owing to factors such as growth in cold chain logistics and increasing consumption of perishable products such as frozen foods. The rising investment by the government to strengthen cross-border cold chain logistics, growing international trade, and advancements in transportation equipment such as the integration of tracking devices in vaccine carriers to monitor real-time conditions are other contributors to the high share of this market segment. For instance, Tower Cold Chain introduced the KTEvolution container for pharma transport, which adds to the company's existing product portfolio and provides a solution for the easy, cost-effective, and compliant transport of pharmaceutical products between suppliers, manufacturers, distributors, and end-users across the global supply chain.

Pharmaceuticals are Expected to Hold a Considerable Market Share

The demand for cold chain equipment has exponentially increased in the pharmaceutical industry, attributed to the increasing demand for vaccine carriers, growth in the pharmaceutical export industry, the introduction of medicines requiring constant temperature control, and regulatory developments. For instance, as per IBEF India, drug and pharmaceutical exports totaled $25.0 billion in FY24 (ending February 2024). In FY23, drug and pharmaceutical exports totaled $25.4 billion. In 2021-22, the country exported pharmaceutical products worth $24.6 billion, whereas in 2020-21, exports increased by 18.0% YoY to $24.4 billion.

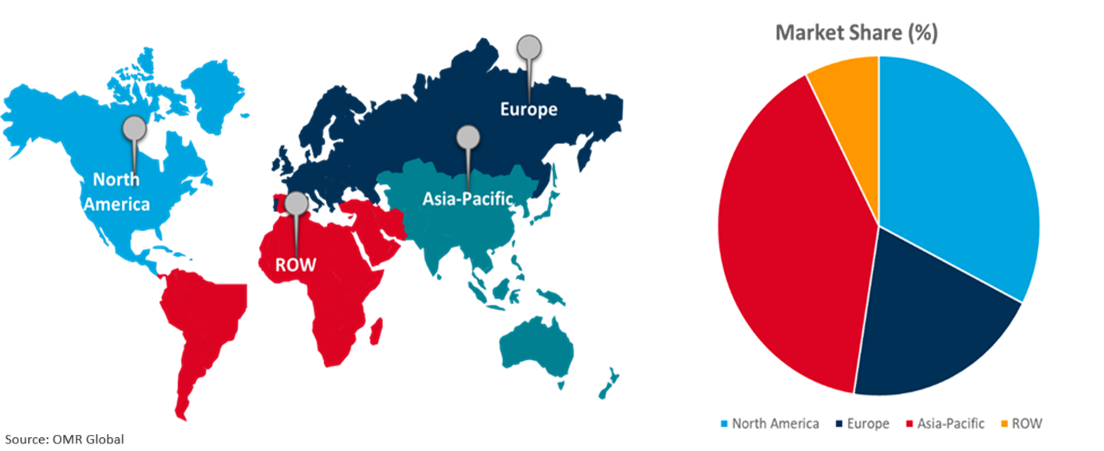

Regional Outlook

The global cold chain equipment market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Cold Chain Equipment Market Growth by Region 2024-2031

Asia-pacific is anticipated to Exhibit Highest CAGR

Asia-Pacific is anticipated to exhibit the highest CAGR during the forecast period. The ongoing increase in expenditure made by regional companies to improve production capacity, and rising consumption of cold chain equipment in the manufacturing sector are key contributors to the regional market growth. The growth in regional cold chain infrastructure, and constant efforts by regional government to aid and develop cold chain logistics are also fueling the regional market growth. For instance, China's State Council approved a five-year expansion plan for cold chain logistics. The plan's key objective is to make China's cold chains greener and smarter. It recognizes the need for cold-chain logistics providers to "shore up weak links in infrastructure, ease delivery routes, improve cold-chain technologies and equipment, and enhance oversight mechanisms." China intends to invest in infrastructure such as smart sorting equipment, logistics robots, and temperature monitors, as well as 5G and smart technology like AI. Further, as part of the strategy, China aims to have an effective cold-chain network in place by 2025, serving both urban and rural locations. In addition, it wishes to connect the network to the international market during this timeframe.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global cold chain equipment market include Honeywell International Inc. Carrier Corp., Linde plc, Daikin Industries Ltd., and Blue Star Ltd. among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in October 2023, Cold Chain Technologies, LLC, a provider of thermal packaging solutions for the transportation of temperature-sensitive products in the life sciences industry, announced the acquisition of Exeltainer, a global provider of life sciences thermal packaging solutions with manufacturing hubs in Spain and Brazil. The purchase of Exeltainer broadens CCT's global network and line of highly designed solutions that address customers' most difficult challenges.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cold chain equipment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Carrier Global Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Daikin Industries Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Honeywell International Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Linde plc

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cold Chain Equipment Market by Type

4.1.1. Refrigerated Storage

4.1.2. Transportation

4.2. Global Cold Chain Equipment Market by Industry Vertical

4.2.1. Pharmaceuticals

4.2.2. Food and Beverage

4.2.3. Chemicals

4.2.4. Others (Brewery, Healthcare)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Air Liquide Advanced Technologies

6.2. Arctic Chiller Group

6.3. BITZER Kühlmaschinenbau GmbH

6.4. Blue Star Ltd.

6.5. CAREL INDUSTRIES S.p.A.

6.6. Cold Chain Technologies

6.7. CSafe Group

6.8. Kelvion Holding GmbH

6.9. Piovan S.p.A.

6.10. Peli BioThermal, Ltd.

6.11. Sonoco Products Co.

6.12. Temperatsure, LLC (Nordic Cold Chain Solutions)

6.13. The Chemours Company

6.14. Trane Technologies Company, LLC

6.15. Vestfrost Solutions

6.16. Viessmann Kühlsysteme GmbH

1. Global Cold Chain Equipment Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Cold Chain Refrigerated Storage Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Cold Chain Transportation Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Cold Chain Equipment Market Research And Analysis By Industry Vertical, 2023-2031 ($ Million)

5. Global Cold Chain Equipment Analysis For Pharmaceuticals Market Research And By Region, 2023-2031 ($ Million)

6. Global Cold Chain Equipment For Food And Beverages Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Cold Chain Equipment For Chemical Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Cold Chain Equipment For Other Industry Verticals Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Cold Chain Equipment Market Research And Analysis By Region, 2023-2031 ($ Million)

10. North American Cold Chain Equipment Market Research And Analysis By Country, 2023-2031 ($ Million)

11. North American Cold Chain Equipment Market Research And Analysis By Type, 2023-2031 ($ Million)

12. North American Cold Chain Equipment Market Research And Analysis By Industry Vertical, 2023-2031 ($ Million)

13. European Cold Chain Equipment Market Research And Analysis By Country, 2023-2031 ($ Million)

14. European Cold Chain Equipment Market Research And Analysis By Type, 2023-2031 ($ Million)

15. European Cold Chain Equipment Market Research And Analysis By Industry Vertical, 2023-2031 ($ Million)

16. Asia-Pacific Cold Chain Equipment Market Research And Analysis By Country, 2023-2031 ($ Million)

17. Asia-Pacific Cold Chain Equipment Market Research And Analysis By Type, 2023-2031 ($ Million)

18. Asia-Pacific Cold Chain Equipment Market Research And Analysis By Industry Vertical, 2023-2031 ($ Million)

19. Rest Of The World Cold Chain Equipment Market Research And Analysis By Region, 2023-2031 ($ Million)

20. Rest Of The World Cold Chain Equipment Market Research And Analysis By Type, 2023-2031 ($ Million)

21. Rest Of The World Cold Chain Equipment Market Research And Analysis By Industry Vertical, 2023-2031 ($ Million)

1. Global Cold Chain Equipment Market Share By Type, 2023 Vs 2031 (%)

2. Global Cold Chain Refrigerated Storage Market Share By Region, 2023 Vs 2031 (%)

3. Global Cold Chain Transportation Market Share By Region, 2023 Vs 2031 (%)

4. Global Cold Chain Equipment Market Share By Industry Vertical, 2023 Vs 2031 (%)

5. Global Cold Chain Equipment For Pharmaceutical Market Share By Region, 2023 Vs 2031 (%)

6. Global Cold Chain Equipment For Food And Beverages Market Share By Region, 2023 Vs 2031 (%)

7. Global Cold Chain Equipment For Chemical Market Share By Region, 2023 Vs 2031 (%)

8. Global Cold Chain Equipment For Other Industry Vertical Market Share By Region, 2023 Vs 2031 (%)

9. Global Cold Chain Equipment Market Share By Region, 2023 Vs 2031 (%)

10. US Cold Chain Equipment Market Size, 2023-2031 ($ Million)

11. Canada Cold Chain Equipment Market Size, 2023-2031 ($ Million)

12. UK Cold Chain Equipment Market Size, 2023-2031 ($ Million)

13. France Cold Chain Equipment Market Size, 2023-2031 ($ Million)

14. Germany Cold Chain Equipment Market Size, 2023-2031 ($ Million)

15. Italy Cold Chain Equipment Market Size, 2023-2031 ($ Million)

16. Spain Cold Chain Equipment Market Size, 2023-2031 ($ Million)

17. Rest Of Europe Cold Chain Equipment Market Size, 2023-2031 ($ Million)

18. India Cold Chain Equipment Market Size, 2023-2031 ($ Million)

19. China Cold Chain Equipment Market Size, 2023-2031 ($ Million)

20. Japan Cold Chain Equipment Market Size, 2023-2031 ($ Million)

21. South Korea Cold Chain Equipment Market Size, 2023-2031 ($ Million)

22. Rest Of Asia-Pacific Cold Chain Equipment Market Size, 2023-2031 ($ Million)

23. Latin America Cold Chain Equipment Market Size, 2023-2031 ($ Million)

24. Middle East And Africa Cold Chain Equipment Market Size, 2023-2031 ($ Million)